What Are Sales Tax In California

Sales tax in California is a crucial aspect of the state's revenue system, playing a significant role in funding various public services and infrastructure projects. Understanding the sales tax laws and regulations is essential for both businesses and consumers alike. This comprehensive guide aims to provide an in-depth analysis of California's sales tax system, offering valuable insights into its structure, rates, exemptions, and implications.

The Structure of California’s Sales Tax

California’s sales tax is a combined state and local tax, which means that the total sales tax rate is made up of both the state-level rate and additional local rates imposed by counties and cities. This structure ensures that the tax burden is distributed fairly across different regions, taking into account the varying needs and costs of public services in each area.

At the state level, California imposes a 6% sales and use tax on most retail transactions. This base rate is uniform across the state, providing a consistent foundation for the sales tax system. However, it is important to note that the state tax rate is not the only factor in determining the total sales tax an individual pays.

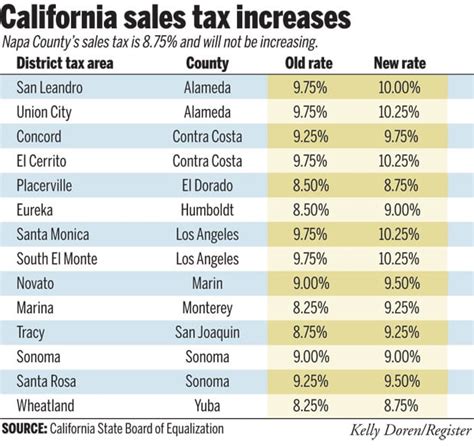

Local jurisdictions, including counties and cities, have the authority to levy additional sales taxes to fund specific projects or cover operational costs. These local sales tax rates can vary significantly, resulting in a diverse range of total sales tax rates across the state. For instance, while some counties may have a local sales tax rate of 0%, others can impose rates as high as 2.25%, leading to a combined state and local rate of 8.25% in certain areas.

Examples of Local Sales Tax Rates

To illustrate the variability of local sales tax rates, let’s consider a few examples:

| County | City | Total Sales Tax Rate |

|---|---|---|

| Los Angeles County | Los Angeles | 9.5% |

| Orange County | Anaheim | 8.75% |

| San Francisco County | San Francisco | 8.75% |

| Riverside County | Palm Springs | 8.75% |

| Santa Clara County | San Jose | 8.75% |

These examples showcase how local sales tax rates can influence the overall tax burden for consumers and businesses operating in different parts of California.

Sales Tax Exemptions in California

While sales tax is applicable to a wide range of goods and services, California does provide certain exemptions to alleviate the tax burden on specific items or transactions. These exemptions are designed to promote economic growth, support essential industries, and assist vulnerable populations.

Essential Goods and Services

One of the most notable sales tax exemptions in California is for groceries, which includes most food items intended for home consumption. This exemption aims to ensure that essential food items remain affordable for all residents, regardless of their financial situation.

Additionally, certain prescription medications and medical devices are exempt from sales tax to reduce the financial burden on individuals requiring medical treatment. This exemption extends to durable medical equipment, making it more accessible to those in need.

Educational Resources

California also exempts a range of educational resources from sales tax to encourage learning and development. This includes textbooks, school supplies, and certain computer software used for educational purposes. By removing the sales tax on these items, the state aims to make education more affordable and accessible.

Environmental Initiatives

In support of environmental sustainability, California exempts the sale of solar energy equipment and certain energy-efficient appliances from sales tax. This initiative encourages residents and businesses to adopt eco-friendly practices and technologies, contributing to a greener future.

Compliance and Enforcement

Ensuring compliance with California’s sales tax laws is a critical responsibility for businesses operating within the state. The California Department of Tax and Fee Administration (CDTFA) is responsible for overseeing sales tax collection, reporting, and enforcement.

Businesses are required to register with the CDTFA and obtain a Seller's Permit, which authorizes them to collect and remit sales tax on behalf of the state. This permit ensures that businesses understand their obligations and have the necessary tools to comply with sales tax regulations.

The CDTFA employs various strategies to enforce sales tax compliance, including audits, investigations, and educational initiatives. Audits may be conducted at any time to ensure businesses are accurately reporting and remitting sales tax. Non-compliance can result in penalties, fines, and legal consequences.

Audit and Penalty Process

If a business is selected for an audit, the CDTFA will review its sales tax records, including sales receipts, purchase orders, and financial reports. The audit process aims to identify any discrepancies or instances of non-compliance.

Penalties for non-compliance can be substantial and may include late payment penalties, interest on unpaid taxes, and additional fines for intentional evasion. In severe cases, business licenses may be revoked, and legal action may be taken.

The Impact of Sales Tax on California’s Economy

Sales tax is a significant source of revenue for California, contributing billions of dollars to the state’s budget annually. This revenue is essential for funding critical public services, such as education, healthcare, transportation, and public safety.

The sales tax system also plays a role in shaping consumer behavior and business operations. For consumers, the sales tax can influence purchasing decisions, particularly for large-ticket items. Businesses, on the other hand, must consider sales tax implications when pricing their goods and services, as well as when deciding on their location within the state.

Economic Growth and Investment

California’s diverse sales tax rates can impact economic growth and investment patterns across the state. Areas with lower sales tax rates may attract more businesses and consumers, leading to increased economic activity and job creation. Conversely, regions with higher sales tax rates may face challenges in attracting new businesses and retaining existing ones.

To mitigate these effects, the state and local governments often collaborate on economic development initiatives, providing incentives and support to businesses operating in high-tax areas. These initiatives aim to promote economic growth and ensure a fair distribution of resources across California.

Future Implications and Potential Reforms

As California’s economy and population continue to evolve, the state’s sales tax system may undergo reforms to address emerging challenges and opportunities.

Online Sales Tax Collection

With the growth of e-commerce, the collection of sales tax on online transactions has become a critical issue. California has implemented measures to ensure that online retailers collect and remit sales tax on purchases made by California residents. This initiative aims to level the playing field for brick-and-mortar stores and promote fair competition.

Simplification and Harmonization

The complex nature of California’s sales tax system, with its diverse local rates, has led to calls for simplification and harmonization. Some proposals suggest a uniform sales tax rate across the state, eliminating the variability between different regions. Such a reform could streamline tax administration and reduce compliance burdens for businesses.

Exemptions and Economic Development

California’s sales tax exemptions are subject to periodic review to ensure they align with the state’s economic development goals. As the state’s priorities evolve, certain exemptions may be expanded or eliminated to encourage growth in specific sectors or support vulnerable populations.

Conclusion

California’s sales tax system is a vital component of the state’s revenue structure, funding essential public services and infrastructure projects. With its combined state and local tax rates, the system ensures a fair distribution of tax burdens across different regions. Understanding the sales tax landscape is crucial for both businesses and consumers, as it impacts pricing, purchasing decisions, and compliance obligations.

As California's economy continues to evolve, the sales tax system will likely undergo reforms to address emerging challenges and opportunities. By staying informed about sales tax regulations and exemptions, businesses and consumers can make informed decisions and contribute to the state's economic growth and prosperity.

How often do sales tax rates change in California?

+

Sales tax rates can change periodically, typically as a result of voter-approved initiatives or legislative actions. However, major changes to the state sales tax rate are relatively rare, with the last significant increase occurring in 2012. Local sales tax rates may change more frequently, often to fund specific projects or cover operational costs.

Are there any special sales tax holidays in California?

+

California does not currently observe any official sales tax holidays. However, certain cities or counties may offer temporary sales tax exemptions or discounts on specific items during promotional events or festivals.

How can businesses stay updated on sales tax rates and regulations?

+

Businesses can stay informed by regularly checking the California Department of Tax and Fee Administration’s website, which provides up-to-date information on sales tax rates, regulations, and any changes or updates. Additionally, businesses can subscribe to the CDTFA’s newsletter or follow their social media channels for timely notifications.

What happens if a business accidentally overcharges sales tax to a customer?

+

If a business overcharges sales tax to a customer, it is important to promptly issue a refund or credit for the overpayment. Businesses should maintain accurate records of such transactions and ensure that the correct sales tax rate is applied in the future. Accurate tax collection and reporting are crucial to maintaining compliance with sales tax regulations.

Are there any sales tax exemptions for businesses in California?

+

Yes, California provides certain sales tax exemptions for businesses, primarily aimed at promoting economic development and supporting specific industries. These exemptions can vary depending on the nature of the business and the goods or services it provides. Businesses should consult with tax professionals or refer to the CDTFA’s guidelines to understand their eligibility for any applicable exemptions.