New Mexico State Tax

Welcome to a comprehensive guide on New Mexico's state tax system. In this expert-driven article, we delve into the intricacies of the tax landscape in the Land of Enchantment, offering valuable insights and a deep understanding of the state's tax structure, regulations, and implications for residents and businesses alike.

Understanding New Mexico’s Tax System

New Mexico, with its diverse economy and rich cultural heritage, has a tax system that reflects its unique characteristics. The state’s tax laws are designed to support various sectors, from the thriving energy industry to the vibrant tourism and cultural sectors.

Income Tax: A Key Component

Income tax forms a significant portion of New Mexico’s tax revenue. The state follows a progressive tax structure, meaning the tax rate increases as your income rises. As of 2023, New Mexico has four tax brackets, ranging from 1.7% to 4.9%.

| Tax Bracket | Income Range | Tax Rate |

|---|---|---|

| 1 | 0 - 5,000 | 1.7% |

| 2 | 5,001 - 10,000 | 2.5% |

| 3 | 10,001 - 25,000 | 3.2% |

| 4 | Over $25,000 | 4.9% |

New Mexico offers a variety of tax credits and deductions to help alleviate the tax burden on its residents. These include credits for low-income individuals, dependent care expenses, and property taxes. The state also provides tax incentives for specific industries, such as film production and renewable energy projects.

Sales and Use Tax

New Mexico imposes a sales tax on the retail sale of goods and certain services. The base state sales tax rate is 5.125%, with additional local taxes varying by jurisdiction. These local taxes can add up to a maximum of 8.88125%, making the combined sales tax rate one of the highest in the nation.

The state also levies a use tax on purchases made outside of New Mexico that are brought into the state for use, storage, or consumption. This tax ensures that all purchases, regardless of their origin, are taxed fairly.

Property Tax: A Local Affair

Property tax in New Mexico is primarily a local tax, with rates and assessment methods varying across counties and municipalities. The state’s role is limited to setting minimum standards and guidelines for property assessment and taxation.

The property tax rate in New Mexico is generally lower compared to many other states, with an average effective rate of around 0.62%. However, it’s important to note that specific localities may have higher rates to fund local services and infrastructure projects.

Tax Incentives and Economic Development

New Mexico has a range of tax incentives aimed at stimulating economic growth and attracting new businesses. These incentives are particularly attractive to sectors such as manufacturing, renewable energy, and technology.

Job Creation Tax Credits

The state offers tax credits to businesses that create new jobs, with a focus on high-wage and high-skill positions. These credits can offset a significant portion of the employer’s tax liability, making New Mexico an attractive location for businesses looking to expand their workforce.

Film and Media Production Incentives

New Mexico’s stunning landscapes and unique cultural heritage have made it a popular location for film and media production. To encourage this industry, the state provides a generous film production tax credit, which can cover up to 30% of qualifying production expenditures.

Renewable Energy Initiatives

With its abundant natural resources, New Mexico has become a leader in renewable energy development. The state offers tax incentives for renewable energy projects, including solar, wind, and geothermal, to encourage investment in these sectors.

Tax Compliance and Resources

Ensuring tax compliance is crucial for both residents and businesses in New Mexico. The state provides various resources to help taxpayers understand their obligations and navigate the tax system effectively.

Taxpayer Assistance

The New Mexico Taxation and Revenue Department offers a range of services to assist taxpayers. This includes online tools for filing tax returns, payment options, and a dedicated taxpayer assistance hotline for personalized guidance.

Tax Calendars and Deadlines

Staying on top of tax deadlines is essential to avoid penalties and interest. New Mexico provides tax calendars and reminders to help taxpayers plan their tax obligations throughout the year. These resources are available on the state’s official website and are regularly updated.

Tax Forms and Publications

The state offers a comprehensive library of tax forms and publications to guide taxpayers through the filing process. These resources cover a wide range of tax scenarios, from individual income tax returns to business tax obligations.

Future Implications and Tax Policy

New Mexico’s tax system is constantly evolving to meet the changing needs of its residents and businesses. The state’s tax policies play a crucial role in shaping its economic landscape and attracting investment.

Economic Impact of Tax Changes

Any changes to the state’s tax structure can have significant economic implications. For instance, reducing tax rates can stimulate economic growth by increasing disposable income and encouraging business investment. On the other hand, increasing tax rates can generate additional revenue for the state, which can be used to fund vital public services.

Tax Policy and Economic Development

New Mexico’s tax policy is closely tied to its economic development goals. The state’s tax incentives and programs are designed to attract and retain businesses, particularly in sectors that align with its strategic economic priorities. By offering a competitive tax environment, New Mexico aims to foster economic growth and create job opportunities for its residents.

Looking Ahead: Potential Tax Reforms

As the state’s economy continues to evolve, so too will its tax system. Potential tax reforms may include simplifying the tax code, modernizing tax administration, and exploring new revenue streams to fund critical public services. These reforms aim to create a tax system that is fair, efficient, and supportive of New Mexico’s economic aspirations.

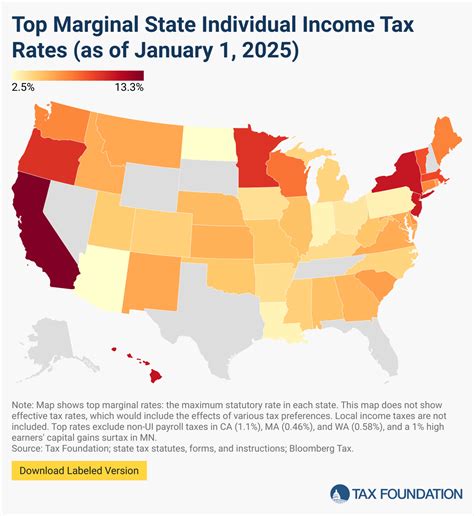

How does New Mexico’s tax system compare to other states?

+

New Mexico’s tax system has some unique features. Its income tax rates are relatively low compared to some states, but its sales tax rates are among the highest. The state’s property tax rates are generally lower, but they can vary significantly across localities.

What tax incentives are available for businesses in New Mexico?

+

New Mexico offers a range of tax incentives for businesses, including job creation tax credits, film production tax credits, and renewable energy tax incentives. These incentives are designed to attract new businesses and support existing ones.

How can I stay informed about tax deadlines and changes in New Mexico?

+

The New Mexico Taxation and Revenue Department provides tax calendars, reminders, and updates on its website. Additionally, subscribing to their newsletter or following their social media accounts can keep you informed about tax-related news and changes.

Are there any tax exemptions or reductions for senior citizens in New Mexico?

+

Yes, New Mexico offers a property tax exemption for qualifying senior citizens. This exemption reduces the taxable value of their primary residence, providing some relief from property taxes. Eligibility criteria and application processes are outlined on the state’s official website.

How does New Mexico support renewable energy development through its tax system?

+

New Mexico provides tax incentives for renewable energy projects, including tax credits and exemptions. These incentives aim to encourage investment in solar, wind, and geothermal energy, contributing to the state’s clean energy goals.