Adp Tax Forms

Welcome to this comprehensive guide on the essential ADp Tax Forms, a crucial aspect of payroll processing and tax compliance for businesses. In today's complex tax landscape, understanding and accurately completing these forms is vital to ensure compliance with the law and maintain a positive relationship with your employees and the IRS. This article will delve into the specifics of ADp Tax Forms, exploring their purpose, different types, and the key information they require. We'll also discuss best practices for completion and the potential consequences of errors, providing you with the knowledge and tools to navigate this critical process with confidence.

Unraveling the ADp Tax Forms: A Comprehensive Guide

The ADp Tax Forms, a series of documents issued by the Internal Revenue Service (IRS), play a pivotal role in the payroll process, serving as a crucial link between employers, employees, and the government. These forms are not just paperwork; they are the foundation of accurate tax reporting and compliance. In this section, we will delve into the intricacies of these forms, exploring their purpose, the information they require, and the potential consequences of errors or omissions.

Understanding the Purpose of ADp Tax Forms

At their core, ADp Tax Forms are designed to facilitate the accurate reporting of wages, salaries, and other compensation paid to employees. They are a critical component of the payroll process, ensuring that the correct amount of tax is withheld from employee earnings and that this information is correctly reported to the IRS. These forms also play a vital role in calculating and reporting payroll taxes, including Federal Income Tax, Social Security, and Medicare taxes.

One of the key purposes of these forms is to provide employees with a record of their earnings and the taxes withheld. This information is crucial for employees when filing their annual tax returns. Additionally, ADp Tax Forms are essential for employers to maintain accurate payroll records and ensure compliance with tax laws. They serve as a critical audit trail, providing evidence of tax compliance and helping to resolve any discrepancies or disputes that may arise.

Types of ADp Tax Forms and Their Specifics

The ADp suite of forms encompasses several different documents, each serving a unique purpose in the payroll and tax reporting process. Here’s a breakdown of some of the most common ADp Tax Forms and their specific functions:

-

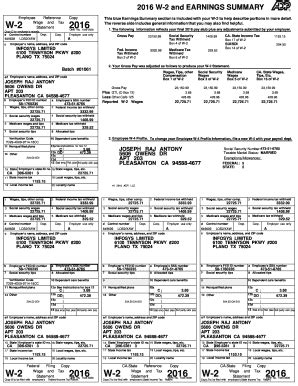

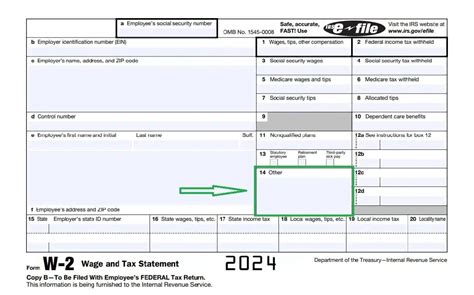

ADp Form W-2 (Wage and Tax Statement): This is one of the most well-known ADp forms, required for every employee. It reports the employee's wages, tips, and other compensation earned during the year, as well as the federal income tax, Social Security tax, Medicare tax, and any additional taxes withheld. The W-2 is crucial for employees to complete their personal tax returns accurately.

-

ADp Form W-4 (Employee's Withholding Allowance Certificate): This form is completed by employees to indicate their tax situation and withholding preferences. It includes information such as filing status, number of allowances, and any additional amounts to be withheld. The W-4 guides the employer on the correct amount of tax to withhold from each paycheck.

-

ADp Form 941 (Employer's Quarterly Federal Tax Return): This form is used by employers to report and pay federal income tax, Social Security tax, and Medicare tax withheld from employees' paychecks. It is filed quarterly and is a critical document for the IRS to monitor tax compliance.

-

ADp Form 1099-MISC (Miscellaneous Income): While not directly related to payroll, this form is often associated with the ADp suite. It is used to report various types of income other than wages, such as freelance work, prizes, awards, or rental income. The 1099-MISC is important for both the recipient of the income and the IRS to ensure proper tax reporting.

Each of these forms plays a critical role in the tax reporting process, and accurate completion is essential to avoid penalties and ensure compliance. Let's now delve into the key information required on these forms and best practices for completion.

Key Information Required on ADp Tax Forms

ADp Tax Forms require a range of specific information to ensure accurate tax reporting. Here’s an overview of the critical data typically needed:

| Form | Required Information |

|---|---|

| W-2 | Employee's name, Social Security number, wages, federal income tax withheld, Social Security wages, tips, and other compensation. |

| W-4 | Employee's name, Social Security number, filing status, number of allowances, additional withholding amounts, and any applicable adjustments. |

| Form 941 | Employer's name, EIN, total wages, federal income tax withheld, Social Security and Medicare taxes withheld, and any adjustments or credits. |

| 1099-MISC | Recipient's name, TIN, amount of income, type of income, and any applicable state tax withholding. |

It's crucial to ensure that all information on these forms is accurate and up-to-date. Any errors or omissions can lead to significant tax issues and penalties. Let's now explore some best practices for completing ADp Tax Forms to minimize the risk of errors.

Best Practices for Completing ADp Tax Forms

Completing ADp Tax Forms accurately is essential to avoid penalties and ensure tax compliance. Here are some best practices to follow when working with these forms:

-

Use Electronic Filing: Many ADp Tax Forms can be filed electronically, which can reduce the risk of errors and speed up the process. Electronic filing also provides a record of submission and can be more secure than paper forms.

-

Double-Check Information: Always verify the accuracy of the information on the forms. This includes employee details, tax rates, and any calculations. A small error can have significant tax implications.

-

Stay Updated on Tax Laws: Tax laws and regulations can change frequently. Ensure that you are using the most recent versions of ADp Tax Forms and that you understand any new requirements or changes in tax rates.

-

Keep Records: Maintain accurate records of all ADp Tax Forms and supporting documentation. This will be crucial if there are any audits or disputes.

-

Seek Professional Help: If you are unsure about any aspect of completing ADp Tax Forms, consider seeking the assistance of a tax professional or accountant. They can provide guidance and ensure compliance.

Consequences of Errors or Omissions

Errors or omissions on ADp Tax Forms can have serious consequences for both employers and employees. Here are some potential issues that may arise:

-

Tax Penalties: The IRS imposes penalties for late or incorrect filing of tax forms. These penalties can be significant and may include fines, interest charges, or even criminal charges in extreme cases.

-

Employee Tax Issues: Inaccurate ADp Tax Forms can lead to employees paying the wrong amount of tax. This can result in employees owing money to the IRS at the end of the year or, conversely, not receiving the full refund they are entitled to.

-

Audits and Investigations: Errors on ADp Tax Forms can trigger IRS audits or investigations. This can be a time-consuming and stressful process for both employers and employees.

-

Reputational Damage: For businesses, errors on tax forms can damage their reputation and lead to negative public perception. This can impact future business opportunities and relationships.

By understanding the importance of accuracy and following best practices, you can minimize the risk of these consequences and ensure a smooth tax reporting process.

Future Implications and Industry Insights

The world of tax and payroll is constantly evolving, and ADp Tax Forms are no exception. Here are some future implications and industry insights to consider:

-

Digital Transformation: The IRS is increasingly moving towards digital solutions for tax filing and reporting. This includes online portals, electronic filing, and digital signatures. Staying updated with these digital tools can streamline the ADp Tax Forms process.

-

Tax Law Changes: Tax laws are subject to frequent changes and updates. It's essential to stay informed about any new legislation or amendments that may impact ADp Tax Forms. This includes changes in tax rates, deductions, and credits.

-

Data Security: With the increasing use of digital tools, data security becomes a critical concern. Employers must ensure that they have robust security measures in place to protect sensitive employee data on ADp Tax Forms.

-

Employee Empowerment: Many employers are now providing employees with more control over their tax withholding through digital tools. This allows employees to make real-time adjustments to their withholding based on their personal tax situation.

FAQ

What happens if I make a mistake on an ADp Tax Form?

+Mistakes on ADp Tax Forms can lead to penalties and other consequences. It’s important to correct any errors as soon as possible. If you discover a mistake after filing, you should contact the IRS and follow their guidelines for correcting the form.

Can I e-file ADp Tax Forms?

+Yes, many ADp Tax Forms can be e-filed through the IRS website or through authorized e-file providers. Electronic filing is often faster and more secure than paper filing.

What are the deadlines for filing ADp Tax Forms?

+Deadlines vary depending on the specific form. For example, ADp Form W-2 must be filed by January 31st, while ADp Form 941 has quarterly deadlines. It’s crucial to stay informed about the specific deadlines for each form to avoid late filing penalties.