Unrealized Gains Tax Proposal

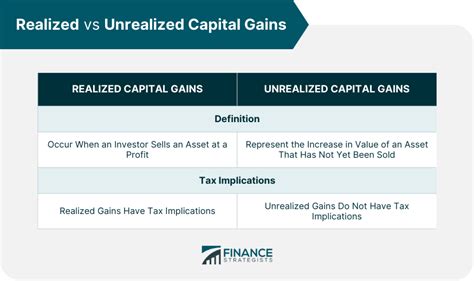

The concept of unrealized gains tax has been a topic of discussion and debate among policymakers, economists, and tax experts for years. It revolves around the idea of taxing capital gains not only when they are realized through the sale of an asset but also when the asset's value appreciates over time. This proposal aims to address perceived inequalities in the current tax system and could have significant implications for investors, businesses, and the economy as a whole.

Understanding Unrealized Gains Tax

At its core, unrealized gains tax (UGT) is a proposed mechanism to tax the increase in the value of an asset, even if the asset owner does not sell it. This concept is not new; it has been implemented in various forms in different countries and has been a subject of academic and policy research for decades. The primary objective of UGT is to ensure a more comprehensive and equitable taxation system, especially in an era where wealth accumulation through capital gains has become increasingly common.

The current tax system in most jurisdictions typically taxes capital gains only when the asset is sold. This means that if an individual holds an asset, such as stocks or real estate, and its value appreciates over time, the individual does not owe taxes on that appreciation until the asset is sold. This can lead to what is often referred to as the "lock-in effect," where individuals may defer selling an asset to avoid immediate tax liabilities.

How UGT Works

Under an unrealized gains tax regime, the tax authority would calculate the increase in the value of an asset held by an individual or entity over a specified period, typically a year. This increase in value, or the “unrealized gain,” would then be subject to taxation. For example, if an individual bought a stock for 100 and its value increased to 150 over the year, the unrealized gain of $50 would be taxed, regardless of whether the stock was sold.

| Asset | Initial Value | End-of-Year Value | Unrealized Gain |

|---|---|---|---|

| Stocks | $100 | $150 | $50 |

| Real Estate | $500,000 | $600,000 | $100,000 |

| Artwork | $20,000 | $25,000 | $5,000 |

To implement UGT, tax authorities would need to establish a system for tracking the value of various assets over time. This could involve working closely with financial institutions, brokers, and other intermediaries to obtain accurate data on asset values. Additionally, there would need to be provisions for accounting for factors like inflation and other economic variables that could impact asset values.

Pros and Cons of Unrealized Gains Tax

As with any significant tax reform, the proposal of UGT has its advantages and drawbacks. Understanding these can help stakeholders make informed decisions about the potential implementation of such a system.

Advantages

- Increased Tax Revenue: One of the primary advantages of UGT is the potential for increased tax revenue. By taxing unrealized gains, governments could tap into a significant source of wealth that is currently not being taxed. This could be especially beneficial in times of economic hardship or when governments are looking to reduce budget deficits.

- Fairness and Equity: Proponents argue that UGT promotes fairness by ensuring that all capital gains, whether realized or not, are subject to taxation. This can help address concerns about wealth inequality, as those with substantial assets that appreciate in value would be taxed similarly to those who realize their gains through sales.

- Encouraging Responsible Investing: UGT could incentivize investors to make more thoughtful and long-term investment decisions. With a tax on unrealized gains, investors might be less inclined to engage in speculative activities and more likely to focus on sustainable, long-term growth strategies.

Potential Drawbacks

- Complexity and Administrative Burden: Implementing UGT would require a significant overhaul of the current tax system. This could lead to increased complexity for both taxpayers and tax authorities, potentially resulting in higher administrative costs and a more challenging tax filing process.

- Impact on Liquidity and Investment: Critics argue that UGT could discourage long-term investments and impact market liquidity. If investors face taxes on unrealized gains, they might be less willing to hold onto assets for extended periods, which could disrupt the market and potentially reduce investment in certain sectors.

- Difficulties in Asset Valuation: Accurately valuing assets for UGT purposes could be challenging, particularly for unique or illiquid assets. This could lead to disputes between taxpayers and tax authorities, potentially increasing litigation and reducing the efficiency of the tax system.

Global Perspectives on UGT

The concept of UGT is not exclusive to any one country or region. Various jurisdictions have experimented with, or are considering, different forms of UGT. Understanding these global perspectives can provide valuable insights into the potential implications and feasibility of such a tax system.

European Countries

In Europe, several countries have implemented variations of UGT. For instance, in France, a wealth tax called the Impôt de Solidarité sur la Fortune (ISF) was in place until 2018. While it was primarily a wealth tax, it also taxed unrealized gains on certain assets. Similarly, Switzerland has a wealth tax that applies to certain types of assets, including real estate, and taxes unrealized gains on these assets.

United States

In the United States, the discussion around UGT has primarily centered around the taxation of unrealized capital gains upon death, known as the “step-up in basis” rule. Under this rule, the cost basis of an asset is adjusted to its fair market value at the time of the owner’s death, effectively eliminating capital gains taxes for heirs. Critics argue that this rule allows for significant wealth accumulation without taxation, leading to calls for its reform or elimination.

Asia and Beyond

In Asia, the concept of UGT has been less prevalent, but there are some notable exceptions. Singapore, for instance, has a partial UGT system for certain types of real estate investments. Meanwhile, in Australia, the taxation of unrealized gains is limited to certain situations, such as the sale of a business or the disposal of an asset in a managed fund.

Future Implications and Considerations

The future of unrealized gains tax is uncertain but warrants careful consideration. As wealth accumulation through capital gains continues to be a significant factor in global economies, the potential for UGT to provide a more equitable and stable tax system remains a compelling argument.

Policy Recommendations

For policymakers considering UGT, several key recommendations emerge from the analysis of this proposal:

- Ensure a Balanced Approach: While UGT can provide additional revenue and promote fairness, it should be implemented with caution to avoid discouraging investment and disrupting markets.

- Address Administrative Challenges: Invest in the necessary infrastructure and resources to ensure an efficient and accurate implementation of UGT, including robust systems for asset valuation and taxpayer education.

- Consider Exemptions and Thresholds: Exemptions for certain asset classes or unrealized gains below a certain threshold could help mitigate the potential negative impacts on investment and market liquidity.

Potential Impacts on Investors

For investors, the introduction of UGT could significantly alter investment strategies. It may encourage a shift towards more stable, long-term investment approaches and could impact the attractiveness of certain asset classes. Investors would need to carefully consider the tax implications of their holdings and potentially adjust their portfolios accordingly.

How would UGT impact investors' decision-making processes?

+UGT could lead investors to focus more on long-term, stable investments rather than short-term speculative activities. It might also encourage investors to diversify their portfolios to mitigate the impact of UGT on specific asset classes.

What are some potential challenges in implementing UGT globally?

+Implementing UGT globally would require coordination among different countries, especially regarding asset valuation and tax rates. Ensuring consistency and preventing tax evasion would be significant challenges.

Could UGT lead to double taxation for certain assets?

+The risk of double taxation exists if UGT is not carefully designed. To mitigate this, policymakers should consider exemptions or adjustments for assets that are already subject to other forms of taxation.

The proposal of unrealized gains tax presents an intriguing opportunity to enhance the fairness and stability of tax systems worldwide. However, it also comes with a host of complexities and potential drawbacks that require careful consideration. As the global economy evolves, the debate around UGT is likely to continue, with policymakers, economists, and investors closely monitoring its potential implications.