Status Of Pa Tax Return

The status of a Pennsylvania tax return is a crucial aspect for taxpayers, as it provides insight into the progress of their filing and potential refund timelines. This article delves into the intricacies of the Pennsylvania Department of Revenue's processes, offering an in-depth guide to understanding the status of a PA tax return and the factors that influence it.

Understanding the Pennsylvania Tax Return Process

The Pennsylvania Department of Revenue manages the state’s tax collection and administration, including income tax returns. This process involves several stages, from filing to processing and, ultimately, refund issuance.

Filing Options and Deadlines

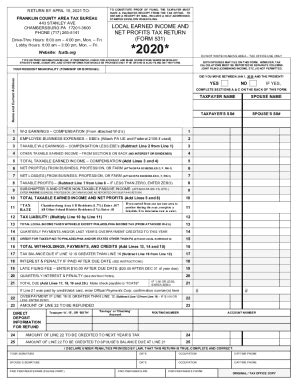

Taxpayers have various methods to file their Pennsylvania tax returns, including online filing through the Pennsylvania Department of Revenue’s website, traditional paper filing, or utilizing tax preparation software. The deadline for filing is typically April 15th, but this can be extended under certain circumstances.

Processing Times

Once a tax return is filed, the Department of Revenue’s processing times come into play. These times can vary depending on the filing method and the complexity of the return. On average, electronic returns are processed faster than paper returns. The department aims to process returns within 4 to 6 weeks from the filing date.

| Filing Method | Average Processing Time |

|---|---|

| Electronic Filing | 2-4 weeks |

| Paper Filing | 4-6 weeks |

Factors Affecting Processing Times

Several factors can impact the processing time of a PA tax return. These include:

- Return Complexity: Returns with complex transactions or errors may require additional review, slowing down the process.

- Errors or Inconsistencies: Inaccurate information or missing forms can delay processing until the issue is resolved.

- Audit Selection: In some cases, returns may be selected for an audit, which can extend the processing time.

Checking the Status of Your PA Tax Return

Taxpayers can check the status of their PA tax return online through the Pennsylvania Department of Revenue’s website. This service provides real-time updates on the progress of your return, from filing to processing and refund issuance.

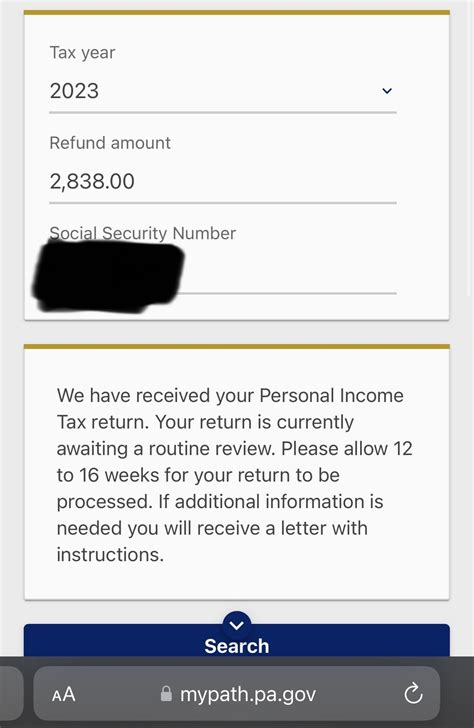

Online Status Check

To check the status of your PA tax return online, follow these steps:

- Visit the Pennsylvania Department of Revenue’s website and navigate to the “Check Your Refund Status” section.

- Enter your Social Security Number, Date of Birth, and Tax Year for which you’re checking the status.

- Click on the “Submit” button to view the current status of your return.

Interpreting the Status Message

The status message you receive can provide valuable insights into the progress of your return. Here are some common status messages and their meanings:

- “Return Received”: Your tax return has been successfully filed and is now being processed.

- “Return Being Processed”: Your return is currently undergoing review and processing by the Department of Revenue.

- “Return Accepted”: Your return has been accepted, and a refund (if applicable) will be issued shortly.

- “Refund Issued”: Your refund has been processed and is on its way. You can expect to receive it within a few business days.

Contacting the Department of Revenue

If you have specific questions or concerns about your PA tax return status, you can contact the Pennsylvania Department of Revenue for assistance. Their customer service representatives can provide more detailed information and guidance.

Common Issues and Resolutions

Despite the efficiency of the online status check, some taxpayers may encounter issues or delays. Here are some common problems and potential solutions:

Missing or Incorrect Information

If your tax return status shows “Return Not Found” or “Return Under Review”, it could indicate missing or incorrect information. Review your return and ensure all required details are accurate and complete. If necessary, amend your return and refile it.

Extended Processing Times

In some cases, returns may take longer than expected to process. This could be due to high volumes during tax season or specific issues with your return. If your return is taking longer than the average processing time, consider contacting the Department of Revenue for an update.

Refund Delays

Refund delays can occur for various reasons, such as errors in the return or additional reviews. If your status shows “Refund Sent” but you haven’t received your refund, check with your financial institution to ensure there are no issues with your account. If the issue persists, contact the Department of Revenue for further assistance.

Future Implications and Changes

The Pennsylvania Department of Revenue is continuously working to improve its tax return processing and refund issuance systems. Here are some potential future developments and their impact:

Enhanced Online Services

The Department of Revenue is likely to continue enhancing its online services, making it easier and faster for taxpayers to file and check the status of their returns. This could include improved user interfaces, additional features, and faster processing times.

Expanded Payment Options

To accommodate various taxpayer preferences, the Department may introduce new payment options, such as direct deposit or payment plans. This could provide greater flexibility and convenience for taxpayers when it comes to settling their tax liabilities.

Increased Use of Data Analytics

By leveraging data analytics, the Department can identify trends, detect errors, and streamline processes more efficiently. This could result in faster processing times and improved accuracy, ultimately benefiting taxpayers.

Conclusion

Understanding the status of your PA tax return is essential for effective tax management. By staying informed about the processing timeline, checking your return status regularly, and being aware of potential issues and solutions, taxpayers can ensure a smoother experience. The Pennsylvania Department of Revenue’s commitment to continuous improvement and its focus on taxpayer convenience are positive indicators for the future of the state’s tax system.

Frequently Asked Questions

How long does it typically take to receive a PA tax refund after filing electronically?

+On average, it takes approximately 2-4 weeks to receive a PA tax refund after filing electronically. However, processing times can vary depending on the complexity of the return and the time of year.

What should I do if my PA tax return status shows “Return Under Review” for an extended period?

+If your return status shows “Return Under Review” for more than 6 weeks, it’s advisable to contact the Pennsylvania Department of Revenue for an update. They can provide more specific information about the review process and any potential issues with your return.

Can I check my PA tax return status by phone or email instead of online?

+Yes, you can contact the Pennsylvania Department of Revenue by phone or email to inquire about your tax return status. However, the online status check is the fastest and most efficient way to receive real-time updates.

What happens if I make a mistake on my PA tax return after it has been filed?

+If you discover a mistake on your PA tax return after filing, you can amend your return by filing a Form PA-100X for individual returns or a Form PA-40X for business returns. This form should be filed within 3 years from the original filing date or 2 years from the date the tax was paid, whichever is later.

Are there any penalties for filing my PA tax return late?

+Yes, late filing of your PA tax return can result in penalties and interest charges. The penalty for late filing is 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25%. Interest on the unpaid tax is also charged at a rate of 0.5% per month or part of a month until the tax is paid in full.