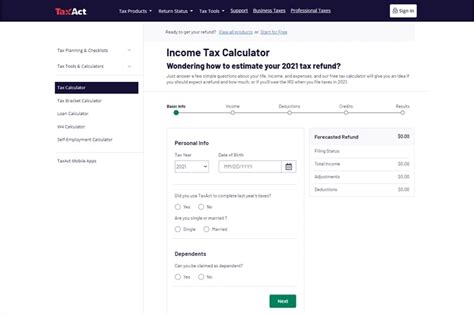

Taxact Tax Calculator

Welcome to an in-depth exploration of the TaxAct Tax Calculator, a powerful tool that revolutionizes the way individuals and businesses approach tax preparation. With a rich history dating back to the early 1990s, TaxAct has evolved into a trusted partner for millions of taxpayers seeking accurate and efficient tax solutions. In this comprehensive article, we delve into the intricacies of the TaxAct Tax Calculator, uncovering its features, benefits, and the transformative impact it has had on the tax landscape.

Unveiling the Power of TaxAct Tax Calculator

The TaxAct Tax Calculator stands as a testament to the company’s commitment to simplifying complex tax processes. Introduced as a groundbreaking innovation in the early 2000s, it quickly gained traction among taxpayers seeking a user-friendly and reliable tax preparation solution. This calculator has become an indispensable tool for taxpayers, offering a seamless and intuitive experience that guides users through the intricate world of tax regulations.

Key Features and Functionality

At its core, the TaxAct Tax Calculator boasts an array of features that cater to a diverse range of tax scenarios. Here’s an insight into some of its standout capabilities:

- Intuitive Interface: Designed with user experience in mind, the calculator boasts a clean and intuitive interface. Users can effortlessly navigate through various tax forms and schedules, making the tax preparation process less daunting.

- Comprehensive Tax Calculations: Whether it's calculating income tax, deductions, credits, or refunds, the TaxAct Tax Calculator handles it all. It leverages advanced algorithms to provide accurate results, ensuring taxpayers receive the refunds they're entitled to.

- Real-Time Updates: One of the calculator's standout features is its ability to provide real-time updates on tax law changes. This ensures users have access to the most current tax information, enabling them to make informed decisions.

- Personalized Recommendations: TaxAct's calculator goes beyond simple calculations. It offers personalized recommendations based on a user's unique tax situation. From identifying potential deductions to suggesting tax-saving strategies, it adds value to the tax preparation journey.

- Secure Data Encryption: Security is a top priority for TaxAct. The calculator employs advanced encryption protocols to safeguard users' sensitive information, providing peace of mind during the tax filing process.

A Transformative Impact on Tax Preparation

The introduction of the TaxAct Tax Calculator marked a significant turning point in the tax preparation industry. It democratized access to accurate tax calculations, empowering individuals and small businesses to take control of their financial obligations. Here’s how the calculator has transformed the tax landscape:

| Impact Area | Transformation |

|---|---|

| Accessibility | The calculator's user-friendly nature has made tax preparation accessible to a broader audience. No longer limited to professionals, individuals can now confidently navigate their tax responsibilities. |

| Efficiency | With automated calculations and streamlined processes, the TaxAct Tax Calculator has significantly reduced the time and effort required for tax preparation. This efficiency has freed up valuable time for taxpayers. |

| Accuracy | By leveraging advanced algorithms and real-time updates, the calculator minimizes errors and ensures accurate tax calculations. This precision has helped taxpayers avoid penalties and maximize their refunds. |

| Personalized Insights | The calculator's ability to offer personalized recommendations has added a new dimension to tax preparation. Users can now explore tailored strategies to optimize their tax outcomes, leading to better financial planning. |

Industry Recognition and Success Stories

The TaxAct Tax Calculator’s impact extends beyond its features and functionality. It has garnered widespread recognition and praise from industry experts and users alike. Here’s a glimpse into some of the accolades and success stories associated with this innovative tool:

- Industry Awards: Over the years, TaxAct has received numerous accolades for its tax preparation software, including accolades for innovation and user experience. These awards serve as a testament to the calculator's impact on the industry.

- User Testimonials: Countless users have shared their positive experiences with the TaxAct Tax Calculator. From simplified tax filing to impressive refund amounts, these testimonials highlight the calculator's role in transforming tax preparation into a seamless and rewarding process.

- Media Coverage: The calculator's success hasn't gone unnoticed by the media. Various publications have featured TaxAct and its innovative calculator, showcasing its ability to empower taxpayers and revolutionize the tax preparation landscape.

Future Prospects and Innovations

As the tax landscape continues to evolve, TaxAct remains committed to staying at the forefront of innovation. Here’s a glimpse into the future prospects and potential enhancements for the TaxAct Tax Calculator:

- AI Integration: TaxAct is exploring ways to integrate artificial intelligence into its calculator. This could further enhance accuracy and provide even more personalized recommendations, taking tax preparation to new heights.

- Mobile Optimization: With the rise of mobile devices, TaxAct aims to optimize its calculator for seamless mobile experiences. This will enable users to access tax calculations and recommendations on the go, further enhancing convenience.

- Enhanced Security Measures: As cybersecurity concerns grow, TaxAct is dedicated to fortifying its security protocols. This includes implementing advanced encryption techniques and multi-factor authentication, ensuring user data remains protected.

- Expanded Global Reach: TaxAct is eyeing expansion into international markets, aiming to bring its user-friendly tax calculator to a global audience. This expansion will enable taxpayers worldwide to benefit from accurate and efficient tax preparation.

FAQs

Is the TaxAct Tax Calculator suitable for businesses as well as individuals?

+Absolutely! TaxAct’s calculator is designed to cater to a wide range of tax scenarios, including both individuals and businesses. It provides comprehensive calculations and recommendations for various tax entities.

How does the TaxAct Tax Calculator ensure accuracy in its calculations?

+The calculator leverages advanced algorithms and real-time updates to ensure accuracy. It stays up-to-date with the latest tax regulations, minimizing the risk of errors and providing precise calculations.

Can I access the TaxAct Tax Calculator on my mobile device?

+While TaxAct offers a dedicated mobile app for tax preparation, the calculator itself is primarily designed for desktop and web use. However, TaxAct is actively working on optimizing the calculator for mobile devices, so stay tuned for future updates.

What sets TaxAct’s calculator apart from other tax preparation tools?

+TaxAct’s calculator stands out for its intuitive interface, real-time updates, and personalized recommendations. It offers a seamless and efficient tax preparation experience, ensuring accuracy and providing valuable insights.