Gambling Tax Calculator

The world of gambling and online gaming is an exciting and dynamic industry, offering players a chance to win big and experience the thrill of the game. However, it's essential to understand the financial implications, particularly when it comes to taxes. Tax regulations vary widely across jurisdictions, and it's crucial to have a comprehensive understanding of how taxes work in the context of gambling to ensure compliance and make informed financial decisions.

Unraveling the Complexities of Gambling Taxes

Gambling taxes are a unique aspect of the financial landscape, often posing challenges for both players and tax authorities. Unlike traditional income tax, which is relatively straightforward, gambling taxes can be intricate, with varying rules depending on the type of gambling activity, the jurisdiction, and the player’s residence.

The complexity arises from the diverse nature of gambling activities, from casino games like poker and roulette to sports betting and lottery. Each of these activities may have different tax implications, with some being taxable while others might be considered a form of entertainment and therefore tax-exempt. Moreover, the tax rate can vary significantly, from a flat rate to progressive scales, further complicating the matter.

Key Considerations for Gambling Tax Calculations

To navigate the complexities of gambling taxes, players and tax professionals need to consider several key factors. These include the player’s country of residence, the jurisdiction where the gambling activity takes place, the type of gambling involved, and the frequency and size of wins.

For instance, a professional poker player's income from tournaments and cash games might be treated differently from the winnings of an occasional slots enthusiast. The tax treatment could vary between different countries and even within a single country, depending on the specific tax laws and regulations.

Furthermore, the tax calculation process might involve deducting certain expenses related to the gambling activity, such as travel costs to and from the casino or online gaming platform, entry fees for tournaments, and even equipment costs for professional players. However, the deductibility of these expenses is subject to strict rules and conditions, and not all jurisdictions allow such deductions.

| Jurisdiction | Tax Rate | Deductible Expenses |

|---|---|---|

| Country A | 15% on winnings over $500 | Travel costs, entry fees |

| Country B | 20% flat rate | Not allowed |

| Country C | 10% on net profits | Equipment, travel |

The Impact of Tax Regulations on Gambling Industry

Tax regulations have a significant influence on the gambling industry, shaping the way operators conduct their business and affecting player behavior. For operators, tax obligations can be a substantial cost, impacting their profitability and growth strategies. They need to carefully consider tax implications when deciding on their business model, pricing strategies, and expansion plans.

On the player side, tax considerations can influence their gaming habits and decisions. For example, a high tax rate might deter players from participating in certain types of gambling activities, especially if they are not frequent or high-stakes players. Conversely, a favorable tax environment could attract more players, leading to a boost in the industry's revenue.

Strategies for Effective Tax Management in Gambling

Given the complexities involved, effective tax management is crucial for both players and operators in the gambling industry. Players should aim to understand the tax regulations applicable to their gambling activities and keep accurate records of their wins and losses. This can help them accurately calculate their tax obligations and also potentially take advantage of any allowable deductions.

For operators, tax planning is a critical aspect of their financial strategy. They need to carefully assess their tax obligations in different jurisdictions and consider the impact on their bottom line. This might involve seeking professional advice to ensure compliance and optimize their tax position.

Furthermore, both players and operators can benefit from staying updated on tax law changes and industry trends. This knowledge can help them anticipate and adapt to any shifts in tax regulations, ensuring they remain compliant and financially secure.

Future Trends and Implications for Gambling Taxes

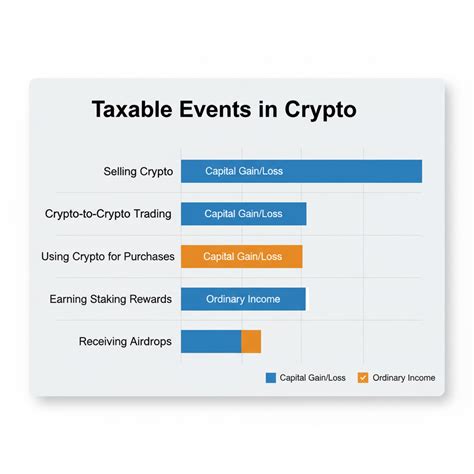

As the gambling industry continues to evolve, particularly with the rise of online gaming and the increasing popularity of cryptocurrency-based gambling, tax regulations are also expected to adapt. Tax authorities are likely to face new challenges in tracking and taxing gambling activities, especially those conducted online or using digital currencies.

One of the key trends is the increasing use of blockchain technology and cryptocurrencies in the gambling industry. While these technologies offer enhanced security and anonymity, they also present challenges for tax authorities in terms of tracking and auditing transactions. This could potentially lead to the development of new tax policies and regulatory frameworks to address these emerging trends.

The Role of Technology in Tax Compliance

Technology is set to play a significant role in facilitating tax compliance in the gambling industry. Advanced data analytics and AI can help tax authorities identify patterns and anomalies in gambling transactions, enabling them to detect potential tax evasion more effectively. For example, machine learning algorithms can analyze large datasets to identify suspicious activities or patterns that may indicate tax avoidance.

Moreover, the integration of blockchain technology in the gambling industry can provide a transparent and immutable record of transactions, making it easier for tax authorities to verify and audit gambling activities. This could potentially lead to more efficient tax collection processes and a reduction in tax evasion.

Implications for Players and Operators

The evolving tax landscape in the gambling industry will have implications for both players and operators. For players, it is essential to stay informed about the tax regulations applicable to their gambling activities, especially as the rules may change over time. They should also be aware of the potential tax implications of using cryptocurrencies for gambling, as the tax treatment of these transactions can vary significantly between jurisdictions.

For operators, the changing tax environment presents both challenges and opportunities. On the one hand, they need to stay abreast of the latest tax regulations and ensure compliance to avoid legal issues and penalties. On the other hand, they can leverage technological advancements to streamline their tax processes and potentially reduce costs. Additionally, by understanding the tax implications for players, operators can provide better guidance and support to their customers, enhancing the overall gaming experience.

How are gambling winnings taxed in different countries?

+Tax regulations on gambling winnings vary widely across countries. In some countries, gambling winnings are taxed as regular income, while in others, they are tax-exempt. It’s essential to understand the specific tax laws of your country and the jurisdiction where the gambling activity takes place.

Can I deduct gambling losses from my taxes?

+In many countries, gambling losses can be deducted from gambling winnings to determine taxable income. However, the deductibility of losses may be subject to certain conditions and limits. It’s advisable to consult with a tax professional to understand the specific rules in your jurisdiction.

What happens if I don’t report my gambling winnings to the tax authorities?

+Failing to report gambling winnings can have serious legal and financial consequences. Tax authorities can impose penalties and fines, and in some cases, you may face criminal charges. It’s important to accurately report your winnings and pay any applicable taxes to avoid these issues.

Are there any tax advantages for professional gamblers?

+Yes, professional gamblers may have certain tax advantages. They can deduct gambling-related expenses, such as travel costs and entry fees, from their taxable income. Additionally, they may be able to benefit from lower tax rates or specific tax treatments for professional gamblers. However, it’s crucial to consult with a tax professional to ensure compliance with the specific rules in your jurisdiction.