Gallatin County Property Tax

Understanding property taxes is crucial for homeowners and prospective buyers alike, as these taxes significantly impact an individual's financial planning and overall cost of living. In Gallatin County, Montana, property taxes play a pivotal role in funding essential services and local infrastructure. This comprehensive guide aims to demystify the intricacies of Gallatin County Property Tax, offering an in-depth analysis of its assessment process, tax rates, exemptions, and the impact on local residents.

The Gallatin County Property Tax Assessment Process

Gallatin County, nestled in the heart of Montana, boasts a unique blend of natural beauty and vibrant communities. The property tax assessment process in this county is a meticulous procedure designed to ensure fair and equitable taxation for all property owners. The county’s Assessor’s Office plays a central role in this process, tasked with the responsibility of determining the value of each property within the county.

The assessment process typically occurs every two years, with the Assessor's Office conducting an extensive review of property values. This review considers various factors, including recent sales of similar properties, construction costs, and the overall condition of the property. The aim is to establish a fair market value for each property, which forms the basis for the subsequent tax calculation.

One notable aspect of Gallatin County's assessment process is its commitment to transparency. The Assessor's Office maintains a detailed database of property records, which are made accessible to the public. This transparency allows property owners to review the assessed value of their properties and understand the factors that contribute to their tax liability.

Appealing Property Assessments

In cases where property owners disagree with the assessed value, Gallatin County provides a well-defined appeals process. Property owners can submit a formal appeal to the County Board of Equalization, outlining their reasons for contesting the assessment. The board reviews these appeals and makes decisions based on the evidence presented.

To assist property owners in navigating the appeals process, the Assessor's Office provides guidance and resources. This support ensures that property owners have the necessary tools to advocate for fair assessments, fostering a sense of trust and confidence in the county's tax system.

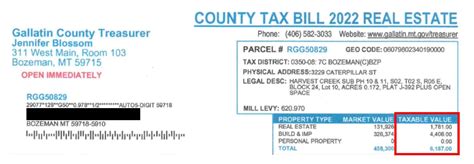

Understanding Gallatin County Property Tax Rates

The property tax rate in Gallatin County is determined by a combination of factors, including the assessed value of the property and the mill levy set by various taxing jurisdictions within the county. The mill levy represents the number of mills, or thousandths of a dollar, that are applied to each dollar of assessed property value.

Gallatin County's tax rates are influenced by the needs and priorities of different government entities, such as the county government, school districts, and special districts. These entities rely on property taxes to fund essential services like education, public safety, and infrastructure maintenance.

For instance, consider the Gallatin County School District. The district's mill levy is determined by the cost of providing quality education to students across the county. This levy directly impacts the property taxes paid by residents, highlighting the direct link between local taxes and the quality of community services.

The Impact of Tax Rates on Residents

The tax rates in Gallatin County can vary significantly depending on the specific location of a property and the services it receives. Properties located within city limits, for example, may have higher tax rates due to the additional services and amenities provided by municipal governments.

To illustrate, a homeowner in the city of Bozeman might pay a higher property tax rate compared to a homeowner in a rural area of the county. This difference is attributed to the extra services and infrastructure that city residents enjoy, such as access to public transportation, municipal parks, and expanded public safety services.

Understanding these variations in tax rates is crucial for prospective homebuyers. It allows them to make informed decisions about where to purchase a property, taking into account not just the purchase price but also the long-term costs associated with property ownership.

Exemptions and Relief for Gallatin County Property Owners

Gallatin County recognizes the diverse needs of its residents and offers a range of exemptions and relief programs to ease the tax burden on certain property owners. These exemptions and relief measures are designed to provide financial assistance to eligible individuals and promote equity within the community.

Homestead Exemption

One notable exemption is the Homestead Exemption, which provides a tax relief benefit to homeowners who use their property as their primary residence. This exemption reduces the assessed value of the property for tax purposes, resulting in lower property taxes. To qualify for the Homestead Exemption, property owners must meet specific residency and ownership criteria.

For example, a senior citizen who has lived in Gallatin County for many years and owns their home outright may be eligible for the Homestead Exemption. This exemption not only provides financial relief but also encourages long-term residency and community stability.

Veterans’ Exemptions

Gallatin County extends special consideration to its veteran community through various property tax exemptions. These exemptions recognize the sacrifices made by veterans and aim to alleviate their financial burdens. Eligible veterans can receive reductions in their property tax assessments, providing much-needed support for those who have served our country.

Consider a veteran who has returned to Gallatin County after serving overseas. By applying for and qualifying for veterans' exemptions, this individual can reduce their property tax liability, making it more affordable to own a home in the county.

Low-Income Relief Programs

Gallatin County also prioritizes supporting its low-income residents through targeted relief programs. These programs offer assistance to eligible homeowners who may struggle to meet their property tax obligations due to financial constraints.

One such program is the Property Tax Assistance Program, which provides grants to qualifying low-income homeowners. These grants help cover a portion of their property taxes, ensuring that financial challenges do not lead to loss of ownership or displacement.

The Impact of Gallatin County Property Taxes on the Local Economy

Property taxes play a vital role in shaping the local economy of Gallatin County. The revenue generated from these taxes is a primary source of funding for essential services and infrastructure development, contributing to the overall prosperity and livability of the county.

Funding for Public Services

A significant portion of property tax revenue is allocated to fund public services, including education, public safety, and social services. These services are crucial for the well-being and development of the community, and property taxes ensure their continuous provision.

For instance, property taxes support the Gallatin County Library System, providing access to educational resources and promoting literacy across the county. Additionally, these taxes fund emergency services, ensuring that residents have access to timely and effective responses during crises.

Infrastructure Development and Maintenance

Property taxes are also instrumental in financing infrastructure projects and maintaining existing infrastructure. This includes the development of roads, bridges, and public transportation systems, as well as the upkeep of parks and recreational facilities.

By investing in infrastructure, Gallatin County enhances its economic competitiveness and attracts businesses and residents. Well-maintained infrastructure not only improves the quality of life but also contributes to the county's long-term economic growth and sustainability.

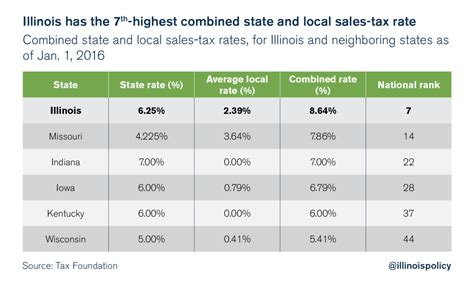

Comparative Analysis: Gallatin County Property Taxes vs. Other Counties

When assessing the fairness and competitiveness of Gallatin County’s property tax system, it is essential to compare it with other counties within Montana and across the nation. Such comparisons provide valuable insights into the county’s tax landscape and its position relative to other jurisdictions.

Montana Property Tax Rates

Montana, known for its diverse landscape and vibrant communities, has a varied property tax landscape. While some counties, like Gallatin, have relatively higher tax rates due to the services and amenities they offer, others have lower rates but may lack certain infrastructure and services.

Comparing Gallatin County's tax rates with those of neighboring counties provides a nuanced understanding of the county's tax environment. This analysis helps homeowners and prospective buyers make informed decisions about where to purchase property, considering both the tax burden and the quality of life offered.

National Property Tax Comparisons

Expanding the comparison to a national level offers an even broader perspective on Gallatin County’s property tax system. While Montana’s property tax rates are generally lower compared to many other states, Gallatin County’s rates may still be considered competitive within the state’s context.

By examining national property tax data, we can identify trends and patterns that influence tax rates across different regions. This analysis provides valuable context for understanding the factors that drive property tax rates and their potential impact on local economies.

Future Implications and Outlook for Gallatin County Property Taxes

As Gallatin County continues to grow and evolve, the property tax system will likely undergo changes to adapt to the changing needs and priorities of the community. These changes may include adjustments to tax rates, the introduction of new exemptions, or the implementation of innovative tax policies to promote economic development and equity.

Potential Tax Rate Adjustments

With the county’s growing population and expanding infrastructure needs, there may be a case for adjusting tax rates to ensure sufficient funding for essential services. However, any proposed rate adjustments will likely be met with careful consideration and public consultation to balance the need for revenue with the financial well-being of residents.

Promoting Economic Development through Tax Policies

Gallatin County could explore innovative tax policies to attract businesses and stimulate economic growth. For instance, offering tax incentives for new business establishments or implementing tax relief measures for certain industries could enhance the county’s economic competitiveness and create new opportunities for residents.

Equity and Fairness in Tax Policy

Ensuring equity and fairness in the tax system will remain a priority for Gallatin County. This may involve continued efforts to provide targeted relief for vulnerable populations, such as low-income individuals and seniors, and ensuring that the tax burden is distributed fairly across different income levels.

The Role of Technology in Tax Administration

As technology advances, Gallatin County’s tax administration processes may benefit from digital transformation. Implementing digital tools for tax assessment, collection, and citizen engagement could enhance efficiency, transparency, and overall citizen satisfaction with the tax system.

| Metric | Value |

|---|---|

| Average Property Tax Rate (2023) | 1.62% |

| Median Property Value | $500,000 |

| Homestead Exemption Savings | Up to $3,200 |

How often are property assessments conducted in Gallatin County?

+Property assessments in Gallatin County occur every two years. This biennial assessment ensures that property values are regularly updated and reflect current market conditions.

What is the role of the County Board of Equalization in property tax appeals?

+The County Board of Equalization is responsible for reviewing and deciding on property tax appeals. It provides an impartial body to ensure fair and consistent assessments across the county.

Are there any online resources available to help calculate my property taxes in Gallatin County?

+Yes, the Gallatin County Assessor’s Office provides an online property tax calculator. This tool allows homeowners to estimate their property taxes based on various scenarios and understand the impact of different factors.

How can I stay informed about changes to property tax rates and exemptions in Gallatin County?

+Staying informed is crucial. The Gallatin County Treasurer’s Office and Assessor’s Office websites often provide updates and announcements regarding tax rates, exemptions, and any changes to the tax system. Subscribing to their newsletters or following their social media channels can also ensure you receive timely information.