Iowa Income Tax Calculator

Welcome to the ultimate guide to understanding and managing your Iowa income taxes. Whether you're a resident, a business owner, or a tax professional, this comprehensive article will provide you with all the essential information and tools to navigate the Iowa tax landscape with confidence. From calculating your tax liability to exploring deductions and credits, we've got you covered. So, let's dive into the world of Iowa income taxes and empower you to make informed financial decisions.

Understanding Iowa Income Tax Rates and Brackets

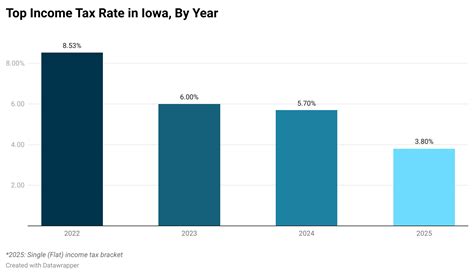

Iowa employs a progressive tax system, meaning that your tax rate increases as your income rises. This system ensures fairness and allows taxpayers to contribute proportionally to state revenue. The state has established several tax brackets, each with its own rate, to calculate the amount of tax you owe. As of 2023, these are the income tax brackets for Iowa residents:

| Tax Bracket | Tax Rate | Income Range |

|---|---|---|

| 0% | Up to $14,000 | |

| 3.38% | $14,001 - $23,000 | |

| 4.55% | $23,001 - $35,000 | |

| 6.1% | $35,001 - $70,000 | |

| 7.85% | $70,001 - $137,000 | |

| 8.53% | Over $137,000 |

These tax rates are applied to your taxable income, which is calculated after deducting various expenses and credits. Understanding these brackets is crucial for estimating your tax liability accurately.

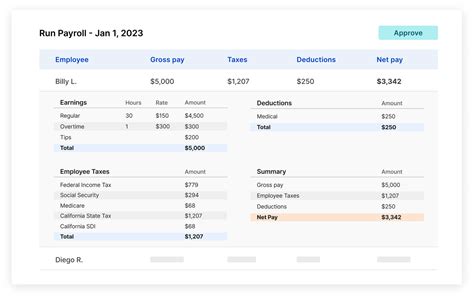

Calculating Your Iowa Income Tax Liability

Calculating your Iowa income tax liability involves a series of steps. Here’s a simplified breakdown:

- Determine Taxable Income: Start by calculating your total income from all sources, including wages, salaries, investments, and business income. From this amount, subtract any applicable deductions and exemptions to arrive at your taxable income.

- Apply Tax Rates: Refer to the tax brackets provided earlier and apply the corresponding tax rate to each portion of your taxable income that falls within a specific bracket.

- Sum Up Taxes: Add up the taxes calculated for each bracket to find your total tax liability.

- Subtract Credits: Iowa offers various tax credits that can reduce your tax burden. These include credits for dependent children, education, and property taxes. Subtract these credits from your total tax liability to determine your final tax amount.

It's important to note that the Iowa Department of Revenue provides tax calculators and worksheets to assist taxpayers in calculating their liability accurately. These tools consider various factors and ensure compliance with state tax regulations.

Exploring Iowa Income Tax Deductions and Credits

Iowa offers a range of deductions and credits to help taxpayers reduce their taxable income and overall tax liability. Let’s explore some of the most common ones:

Standard Deduction

All Iowa taxpayers are entitled to claim a standard deduction, which reduces their taxable income. As of 2023, the standard deduction for single filers is 2,500, while joint filers can claim a higher amount of 5,000. This deduction simplifies the tax filing process and ensures that a portion of your income remains tax-free.

Itemized Deductions

If your expenses exceed the standard deduction, you might consider itemizing your deductions. Common itemized deductions include:

- Medical and Dental Expenses: You can deduct qualified medical and dental expenses that exceed 10% of your adjusted gross income.

- State and Local Taxes: Iowa allows taxpayers to deduct state and local income taxes, as well as property taxes, paid during the tax year.

- Charitable Contributions: Donations to qualifying charitable organizations can be deducted.

- Mortgage Interest: Interest paid on your primary residence’s mortgage is deductible.

- Casualty and Theft Losses: Losses resulting from theft, fire, or other disasters may be deductible.

It's crucial to keep detailed records of these expenses to ensure accurate deductions.

Iowa Tax Credits

Iowa offers several tax credits to support various initiatives and provide relief to taxpayers. Some notable credits include:

- Child and Dependent Care Credit: This credit helps offset the cost of childcare expenses, providing a valuable benefit to working families.

- Iowa Property Tax Credit: Iowa residents can claim a credit for a portion of their property taxes, offering relief for homeowners.

- Education Credits: Iowa offers credits for college tuition and other educational expenses, making education more accessible.

- Research and Development Credit: Businesses engaged in research and development activities can claim this credit, encouraging innovation.

Iowa Tax Forms and Filing Process

Filing your Iowa income taxes involves completing the appropriate tax forms and submitting them to the Iowa Department of Revenue by the deadline. Here’s an overview of the key forms and the filing process:

Iowa Income Tax Forms

The primary form for Iowa income tax filing is the Iowa Individual Income Tax Return (Form IA 1040). This form is used by most Iowa residents to report their income and calculate their tax liability. It includes sections for income, deductions, credits, and tax calculations.

Additionally, you may need to complete other forms depending on your specific circumstances, such as:

- Schedule A: Used for itemizing deductions.

- Schedule C: For reporting income from self-employment or business activities.

- Schedule E: To report income from rentals, royalties, or partnerships.

- Form IA 1040-V: Payment voucher for any tax due.

Filing Methods

Iowa offers multiple filing methods to accommodate different preferences and needs:

- Online Filing: The Iowa Department of Revenue provides an online filing system, IowaTaxOnline, which allows taxpayers to file their returns securely and conveniently. This method is often preferred for its simplicity and speed.

- Paper Filing: If you prefer a traditional approach, you can download and print the necessary forms from the Iowa Department of Revenue website. Complete the forms, attach any required documentation, and mail them to the designated address.

Remember to keep records of your tax returns and any supporting documents for future reference and potential audits.

Iowa Tax Deadlines and Payment Options

Understanding tax deadlines and payment options is essential to ensure timely compliance with Iowa tax laws. Here’s what you need to know:

Tax Deadlines

The standard deadline for filing your Iowa income tax return is April 30th of the year following the tax year. For example, the deadline for filing taxes for the 2022 tax year is April 30, 2023. However, it’s important to note that this deadline may be extended in certain circumstances, such as during a natural disaster or if you are out of the country on the due date.

Additionally, Iowa requires estimated tax payments for taxpayers with income not subject to withholding. These payments are due on specific dates throughout the year, typically on the 15th of April, June, September, and January.

Payment Options

Iowa offers several payment options to accommodate different financial situations and preferences:

- Electronic Funds Transfer (EFT): You can pay your taxes electronically through the IowaTaxOnline system. This method is secure and ensures prompt payment.

- Credit or Debit Card: Iowa accepts payments made using major credit or debit cards. This option provides convenience and flexibility.

- Check or Money Order: Traditional payment methods involve sending a check or money order along with your tax return. Make sure to include your name, address, and Social Security Number on the payment.

- Installment Agreements: If you’re unable to pay your taxes in full, Iowa offers installment agreements to allow you to pay your tax liability over time. Contact the Iowa Department of Revenue for more information on this option.

It's important to make your tax payments on time to avoid penalties and interest charges.

Frequently Asked Questions (FAQ)

Are there any tax benefits for retirees in Iowa?

+Yes, Iowa offers a Retirement Income Deduction for certain types of retirement income. This deduction allows retirees to exclude a portion of their retirement income from taxable income. The specific eligibility criteria and deduction amounts vary, so it’s advisable to consult the Iowa Department of Revenue for detailed information.

Can I file my Iowa taxes jointly with my spouse if we live in different states?

+Filing jointly with a spouse who resides in a different state is generally not possible. Iowa tax laws require that both spouses be residents of Iowa to file jointly. However, you may be able to file separate returns and claim appropriate deductions and credits for your respective states.

What is the Iowa Earned Income Tax Credit (EITC), and who is eligible for it?

+The Iowa Earned Income Tax Credit (EITC) is a refundable tax credit designed to benefit low- to moderate-income working individuals and families. It helps offset the burden of social security taxes and provides financial relief. Eligibility is based on income and family size. The Iowa Department of Revenue provides detailed guidelines on who qualifies for the EITC.

How can I stay updated on changes to Iowa tax laws and regulations?

+Staying informed about tax law changes is crucial. The Iowa Department of Revenue’s website is an excellent resource for the latest tax news, updates, and publications. Additionally, you can subscribe to their email updates or follow their social media channels for timely notifications.

Iowa’s tax landscape is designed to be fair and accessible, offering a range of deductions, credits, and resources to assist taxpayers. By understanding the tax rates, brackets, and available benefits, you can make informed decisions and effectively manage your Iowa income taxes. Remember to stay updated on tax law changes and seek professional advice if needed.