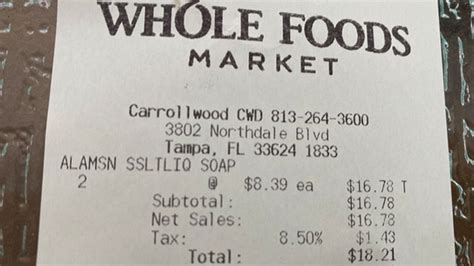

Tampa Sales Tax

Welcome to the comprehensive guide on Tampa's sales tax! This article aims to provide an in-depth understanding of the sales tax landscape in Tampa, Florida. Sales tax is an essential component of doing business in any city, and it's crucial to stay informed about the regulations and rates to ensure compliance and make informed financial decisions. Tampa, with its vibrant economy and diverse industries, presents a unique sales tax environment that we will explore in detail.

Understanding Tampa’s Sales Tax Structure

Sales tax in Tampa, like in many other cities in Florida, is a combination of state, county, and city taxes. This means that when you make a purchase in Tampa, you are subject to a cumulative tax rate that includes these three components. Let’s delve into each of these tax layers to gain a clearer picture.

State Sales Tax

Florida is known for its relatively low sales tax rate compared to many other states. As of [current year], the state sales tax rate in Florida is 6%. This base rate is applied to most tangible goods and certain services across the state. However, it’s important to note that there are some exceptions and variations based on the type of product or service being sold.

For instance, certain items like groceries, prescription drugs, and non-prepared foods are exempt from the state sales tax. On the other hand, luxury items, such as yachts and jewelry, often have an additional discretionary sales surtax applied. These nuances can significantly impact the final sales tax amount for consumers and businesses.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 6% |

County Sales Tax: Hillsborough County

Tampa, being the largest city in Hillsborough County, is subject to the county’s sales tax rate. As of [current year], the Hillsborough County sales tax rate is 1.5%, which is added to the state sales tax. This additional county tax is used to fund various county-wide initiatives and services, including infrastructure development and maintenance.

It's worth noting that Hillsborough County also has a discretionary sales surtax, which is a supplemental tax applied to certain luxury items. This surtax is levied on top of the standard county sales tax and varies depending on the type of product. For example, the surtax on yachts and certain luxury vehicles can be as high as 6%, bringing the total sales tax for these items to a significant 13.5% in Hillsborough County.

| Tax Type | Rate |

|---|---|

| Hillsborough County Sales Tax | 1.5% |

| Discretionary Sales Surtax (Luxury Items) | Varies (up to 6%) |

City Sales Tax: Tampa

In addition to the state and county sales taxes, Tampa imposes its own city sales tax of 2% as of [current year]. This tax is applied to most tangible personal property and certain services sold within the city limits. The revenue generated from this tax goes towards funding essential city services, such as public safety, infrastructure, and community development.

It's important to note that while Tampa's city sales tax rate is 2%, there are certain items that may have different tax rates within the city. For instance, prepared foods and restaurant meals often have a lower sales tax rate, typically around 1%. This variation is designed to encourage economic activity in specific sectors while still generating revenue for the city.

| Tax Type | Rate |

|---|---|

| Tampa City Sales Tax | 2% |

| Special Rate for Prepared Foods/Meals | 1% |

Sales Tax Compliance and Registration

For businesses operating in Tampa, sales tax compliance is a critical aspect of financial management. Here’s an overview of the registration and compliance process:

Registering for Sales Tax

Businesses in Tampa are required to register for sales tax with the Florida Department of Revenue. This process involves obtaining a Sales and Use Tax Permit, which allows businesses to collect and remit sales tax on behalf of the state, county, and city.

The registration process typically involves providing basic business information, such as the legal name, address, and contact details. Businesses may also need to provide additional documentation, such as a federal tax ID number or a business license. Once registered, businesses receive a unique permit number that must be displayed at their place of business.

Sales Tax Collection and Remittance

After registering for sales tax, businesses are responsible for collecting the appropriate sales tax from customers at the point of sale. This includes calculating the total sales tax based on the combined state, county, and city rates, as well as any applicable surtaxes.

Businesses must then remit the collected sales tax to the Florida Department of Revenue on a regular basis. The frequency of remittance can vary based on the business's sales volume and revenue. Most businesses remit sales tax on a monthly or quarterly basis. Failure to collect and remit sales tax accurately can result in penalties and interest charges.

Sales Tax Returns

In addition to collecting and remitting sales tax, businesses in Tampa are required to file sales tax returns. These returns provide a detailed breakdown of the sales tax collected during a specific period. Businesses must report the total sales, the amount of sales tax collected, and any applicable exemptions or deductions.

Sales tax returns are typically due on the same schedule as the remittance payments. For example, if a business remits sales tax on a monthly basis, they would also file a monthly sales tax return. Accurate and timely filing of sales tax returns is essential to avoid penalties and maintain compliance with Florida's tax laws.

Sales Tax Exemptions and Special Considerations

While the sales tax structure in Tampa is relatively straightforward, there are certain exemptions and special considerations that businesses and consumers should be aware of. These exemptions can significantly impact the final sales tax amount and should be carefully understood.

Exemptions for Certain Goods and Services

Florida, including Tampa, offers sales tax exemptions for a variety of goods and services. Some of the most common exemptions include:

- Groceries and Non-Prepared Foods: Most grocery items, including produce, dairy, and non-prepared meats, are exempt from sales tax in Florida. This exemption aims to reduce the tax burden on essential food items for consumers.

- Prescription Drugs: Sales tax is not applied to prescription medications, ensuring that healthcare costs are kept as low as possible for residents.

- Educational Materials: Textbooks, educational supplies, and certain computer equipment used for educational purposes are exempt from sales tax.

- Residential Rentals: Sales tax is generally not applied to the rental of residential properties, including apartments and single-family homes.

- Agricultural Sales: Certain agricultural equipment, feed, and supplies are exempt from sales tax to support the state's agricultural industry.

It's important for businesses to stay updated on the specific exemptions and qualifications for each category, as there may be additional requirements or restrictions.

Special Considerations for Online Sales

With the rise of e-commerce, sales tax regulations for online sales have become increasingly complex. In Tampa, as in many other cities, online retailers must consider the destination-based sales tax rules. This means that the sales tax rate applied to an online purchase is based on the location where the goods are delivered or the services are performed, not the location of the seller.

For businesses selling goods online, this can require a complex system for calculating and collecting sales tax based on the buyer's location. Many businesses use sales tax automation software to ensure compliance with these rules. Additionally, businesses must register for sales tax in any state or jurisdiction where they have a significant economic presence or nexus, which can vary based on the state's laws.

Sales Tax Rates for Tampa’s Major Industries

Tampa’s economy is diverse, with a range of industries contributing to its economic growth. Let’s explore the sales tax rates and considerations for some of Tampa’s major industries:

Retail and E-commerce

The retail sector is a significant contributor to Tampa’s economy. Retail businesses in Tampa are subject to the combined state, county, and city sales tax rates, as outlined earlier. However, there are a few additional considerations for retailers to keep in mind:

- Point-of-Sale Systems: Retailers should ensure their point-of-sale systems are programmed to calculate the correct sales tax rates based on the customer's location. This is particularly important for businesses with multiple locations or those that sell to customers in other states.

- Taxable vs. Non-Taxable Items: Retailers must clearly distinguish between taxable and non-taxable items in their inventory. For example, clothing items may be exempt from sales tax up to a certain price point, while luxury clothing may be subject to additional surtaxes.

- Returns and Refunds: When processing returns or refunds, retailers should ensure they handle the sales tax portion correctly. This may involve refunding the full sales tax amount or adjusting it based on the current tax rates.

Hospitality and Tourism

Tampa’s vibrant tourism industry is a key driver of its economy. The city’s sales tax rates can have a significant impact on the hospitality sector, including hotels, restaurants, and entertainment venues. Here are some considerations for businesses in the hospitality industry:

- Lodging Tax: In addition to the standard sales tax, Tampa imposes a tourist development tax on short-term rentals, such as hotel stays. This tax, often referred to as a "bed tax," is typically around 6% and is added to the rental rate. Businesses must collect and remit this tax separately from the standard sales tax.

- Restaurant Meals: As mentioned earlier, prepared foods and restaurant meals often have a lower sales tax rate in Tampa. This can be a significant factor in pricing strategies for restaurants, as it allows them to offer more competitive pricing while still contributing to the city's tax revenue.

- Event Tickets: Sales tax may also apply to event tickets, such as concerts, sporting events, and theater performances. The tax rate for these tickets can vary depending on the specific event and its location within the city.

Construction and Real Estate

The construction and real estate industries play a vital role in Tampa’s economic growth and development. When it comes to sales tax, these industries have unique considerations:

- Building Materials: Sales tax is typically applied to the purchase of building materials and supplies. However, there may be exemptions for certain materials used in new construction or renovations. Businesses in the construction industry should stay informed about these exemptions to optimize their tax liabilities.

- Real Estate Sales: Sales tax does not generally apply to the sale of real estate properties. Instead, these transactions are subject to documentary stamp tax and intangible tax, which are levied on the deed and mortgage documents. The rates for these taxes vary based on the property's value and the type of transaction.

- Rental Properties: As mentioned earlier, sales tax is not applied to the rental of residential properties. However, businesses involved in the management and operation of rental properties must still collect and remit the appropriate sales tax on other services provided, such as cleaning fees or maintenance charges.

The Impact of Sales Tax on Tampa’s Economy

Sales tax is a critical component of Tampa’s revenue stream, funding essential city services and infrastructure projects. The city’s sales tax revenue contributes to a range of initiatives, including:

- Infrastructure Development: Sales tax revenue is used to finance the construction and maintenance of roads, bridges, and other critical infrastructure. This ensures that Tampa's transportation network remains efficient and safe for residents and businesses.

- Public Safety: A portion of the sales tax revenue is allocated to support the city's public safety services, including police, fire, and emergency medical services. This funding is crucial for maintaining a safe and secure environment for Tampa's residents and visitors.

- Community Development: Sales tax revenue also supports community development initiatives, such as affordable housing programs, economic development projects, and initiatives to improve the quality of life for residents.

- Cultural and Recreational Amenities: Tampa's sales tax revenue helps fund cultural institutions, such as museums and performing arts centers, as well as recreational facilities like parks and sports venues. These amenities enhance the city's quality of life and attract visitors.

Overall, Tampa's sales tax structure plays a vital role in the city's economic health and sustainability. By understanding and complying with the sales tax regulations, businesses can contribute to the city's growth and development while ensuring a fair and transparent tax system.

Frequently Asked Questions

What is the total sales tax rate in Tampa, Florida as of [current year]?

+As of [current year], the total sales tax rate in Tampa, Florida is 9.5%. This includes the state sales tax of 6%, the Hillsborough County sales tax of 1.5%, and the Tampa city sales tax of 2%.

Are there any items exempt from sales tax in Tampa?

+Yes, there are several items exempt from sales tax in Tampa and Florida in general. Common exemptions include groceries, prescription drugs, non-prepared foods, educational materials, and residential rentals. It’s important to stay updated on the specific exemptions and qualifications.

How often do businesses in Tampa need to remit sales tax?

+The frequency of sales tax remittance in Tampa depends on the business’s sales volume and revenue. Most businesses remit sales tax on a monthly or quarterly basis. However, businesses with high sales volumes may need to remit more frequently, such as weekly or bi-weekly.

What happens if a business fails to collect or remit sales tax accurately in Tampa?

+Failure to collect and remit sales tax accurately in Tampa can result in penalties and interest charges. The Florida Department of Revenue takes sales tax compliance seriously, and businesses may face significant financial consequences for non-compliance. It’s crucial for businesses to stay informed about their sales tax obligations and seek professional advice if needed.

How can businesses in Tampa stay updated on sales tax regulations and changes?

+Businesses in Tampa can stay updated on sales tax regulations and changes by regularly checking the Florida Department of Revenue’s website. They can also subscribe to the department’s email updates and notifications. Additionally, consulting with tax professionals or using sales tax automation software can help ensure compliance and stay informed about any changes.