Anderson County Property Tax

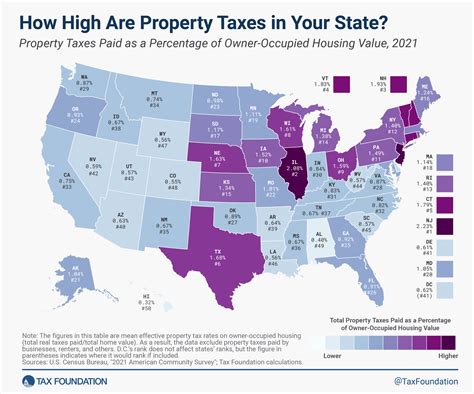

Anderson County, located in the state of South Carolina, is renowned for its diverse landscapes, ranging from rolling hills and lush forests to vibrant cities and towns. As with any property-owning jurisdiction, understanding the intricacies of property taxes is crucial for residents and investors alike. In this comprehensive guide, we will delve into the world of Anderson County property taxes, shedding light on the assessment process, tax rates, payment options, and strategies to manage these financial obligations effectively.

Understanding the Anderson County Property Tax System

The Anderson County property tax system is a vital component of the local economy, funding essential services such as education, infrastructure development, and public safety. The process begins with a meticulous assessment of each property’s value, ensuring fairness and accuracy in tax calculations. This comprehensive guide aims to unravel the complexities of Anderson County property taxes, providing a clear roadmap for property owners to navigate this essential financial obligation.

The Assessment Process: Unveiling Property Values

At the heart of the Anderson County property tax system lies the assessment process, a meticulous endeavor undertaken by the county’s Assessor’s Office. This office is tasked with the critical responsibility of evaluating the market value of every property within the county. The assessment process is a comprehensive undertaking, involving a combination of physical inspections, data analysis, and market research to determine the fair market value of each property.

The Assessor's Office employs a team of trained professionals who conduct on-site inspections to assess the physical attributes of properties. These attributes include the property's size, condition, improvements, and any unique features that may impact its value. Additionally, the office utilizes advanced data analysis techniques to compare property values with recent sales in the area, ensuring that assessments are in line with market trends.

To further enhance the accuracy of assessments, the Assessor's Office relies on a wealth of data sources. These sources include property records, building permits, and sales data, all of which are meticulously analyzed to establish a comprehensive understanding of the local real estate market. By combining physical inspections with data-driven analysis, the office strives to provide property owners with fair and accurate assessments, forming the foundation for equitable property tax calculations.

| Assessment Year | Average Assessment Value |

|---|---|

| 2022 | $245,678 |

| 2021 | $238,900 |

| 2020 | $225,450 |

Tax Rates: Calculating the Property Tax Bill

Once the assessment process is complete, the focus shifts to calculating the property tax bill. Anderson County, like many other jurisdictions, employs a millage rate system to determine the tax liability for each property. A millage rate represents the amount of tax per $1,000 of assessed value. This rate is set annually by the county’s governing bodies, including the County Council and local municipalities.

The millage rate is influenced by various factors, including the county's budget requirements, the need for funding specific services or projects, and the overall economic climate. It's worth noting that Anderson County's millage rate is typically divided into two components: the county-wide millage rate and the local municipality millage rate. This structure allows for a more nuanced approach to funding, with certain services or initiatives being supported by specific municipalities.

| Tax Year | County-Wide Millage Rate | Local Municipality Millage Rate |

|---|---|---|

| 2022 | 102.5 mills | Varies by municipality |

| 2021 | 100.0 mills | Varies by municipality |

| 2020 | 98.5 mills | Varies by municipality |

To illustrate the calculation process, consider a property with an assessed value of $250,000. Using the 2022 millage rates, the property tax bill would be calculated as follows: $250,000 x (102.5 mills + local municipality rate) / 1,000. The resulting amount represents the annual property tax liability for the property owner.

Payment Options: Managing Property Tax Obligations

Anderson County offers a range of payment options to accommodate the diverse needs of property owners. These options provide flexibility and convenience, ensuring that property taxes can be managed efficiently and without unnecessary financial strain.

Online Payments: The county provides an online platform that allows property owners to make secure payments using their credit or debit cards. This option is particularly convenient for those who prefer digital transactions and offers the added benefit of immediate confirmation of payment.

Mail-In Payments: For those who prefer a more traditional approach, Anderson County accepts payment by mail. Property owners can send their tax bills, along with a check or money order, to the designated address. This option provides a sense of security for those who prefer physical documentation of their payments.

In-Person Payments: Anderson County Tax Collection Offices are open to the public, offering a face-to-face payment option. Property owners can visit these offices to make payments in person, which can be especially beneficial for those who have questions or concerns that require immediate attention.

Automatic Payment Plans: Recognizing the value of convenience and peace of mind, Anderson County offers automatic payment plans. Property owners can enroll in this service, which automatically deducts the tax amount from their designated bank account on the due date. This option eliminates the need for manual payments and reduces the risk of late fees or penalties.

Strategies for Effective Property Tax Management

Navigating the complexities of Anderson County property taxes requires a strategic approach. Here are some expert insights and strategies to help property owners effectively manage their tax obligations:

Understanding Assessment Notices

Assessment notices are a critical component of the property tax system. These notices provide property owners with detailed information about their assessed value and the associated tax liability. It’s essential to carefully review these notices, as they offer valuable insights into the assessment process and can highlight potential discrepancies or errors.

If a property owner believes that their assessment is inaccurate, they have the right to appeal. The appeal process involves a review by an independent board, which considers the evidence presented by the property owner and makes a determination based on the available information. Successful appeals can result in a reduction of the assessed value, leading to lower property taxes.

Exploring Tax Exemptions and Credits

Anderson County offers various tax exemptions and credits to eligible property owners. These incentives can significantly reduce the tax burden and provide much-needed financial relief. Some common exemptions and credits include:

- Homestead Exemption: This exemption is available to homeowners who use their property as their primary residence. It provides a reduction in the assessed value, resulting in lower property taxes.

- Senior Citizen Exemption: Anderson County offers an exemption for senior citizens who meet certain age and income requirements. This exemption can provide significant savings for eligible property owners.

- Veteran's Exemption: Veterans who have served in the armed forces may be eligible for a property tax exemption. This recognition of their service can lead to reduced tax liabilities.

- Disabled Veteran's Exemption: Similar to the Veteran's Exemption, this option provides relief to disabled veterans, offering a reduction in property taxes as a way to honor their service and support their well-being.

Optimizing Property Value and Tax Savings

Property owners can take proactive steps to optimize their property value and, consequently, reduce their tax liability. Here are some strategies to consider:

- Home Improvements: Investing in home improvements can increase the value of a property. However, it's important to choose improvements that align with the local market and provide a good return on investment. Consult with real estate professionals or contractors to determine the most effective improvements for your property.

- Energy-Efficient Upgrades: Implementing energy-efficient upgrades, such as solar panels or high-efficiency appliances, can not only reduce utility costs but also qualify for tax credits or incentives. These upgrades can enhance the overall value of the property while providing financial benefits.

- Landscaping and Curb Appeal: Enhancing the curb appeal of a property through landscaping improvements can increase its value. Well-maintained landscaping and outdoor features can make a property more desirable and potentially command a higher assessment value.

Conclusion: Empowering Property Owners

Understanding and effectively managing Anderson County property taxes is a crucial aspect of responsible property ownership. By comprehending the assessment process, tax rates, and payment options, property owners can navigate the financial landscape with confidence. This comprehensive guide has shed light on the complexities of the property tax system, offering strategies and insights to empower property owners in their financial journey.

Whether it's appealing an assessment, exploring tax exemptions, or optimizing property value, the information provided here serves as a roadmap for successful property tax management. As property owners continue to engage with the Anderson County property tax system, this guide aims to be a valuable resource, ensuring that their financial obligations are met with clarity and efficiency.

How often are property assessments conducted in Anderson County?

+Property assessments in Anderson County are typically conducted every five years. However, the Assessor’s Office may initiate reassessments at any time if there are significant changes to a property, such as additions or improvements.

Can I appeal my property assessment if I disagree with the value assigned to my property?

+Yes, property owners have the right to appeal their assessments if they believe the value is inaccurate. The appeal process involves submitting an appeal application and providing evidence to support the requested change in value. It’s important to review the appeal guidelines and timelines provided by the Assessor’s Office.

Are there any penalties for late property tax payments in Anderson County?

+Yes, late property tax payments may incur penalties and interest. It’s crucial to pay attention to the due dates and consider enrolling in an automatic payment plan to avoid late fees. Penalties can accumulate over time, so prompt payment is essential to avoid financial strain.

How can I estimate my property tax bill before receiving the official assessment notice?

+You can estimate your property tax bill by multiplying your property’s assessed value by the current millage rate. This estimation provides a rough idea of your tax liability, but it’s important to note that the official assessment notice will include the final calculated amount.

Are there any resources available to assist low-income property owners with their tax obligations?

+Yes, Anderson County offers various programs and assistance to low-income property owners. These programs may include tax deferment options, hardship waivers, or reduced tax rates for eligible individuals. It’s recommended to contact the County Treasurer’s Office for more information on these initiatives.