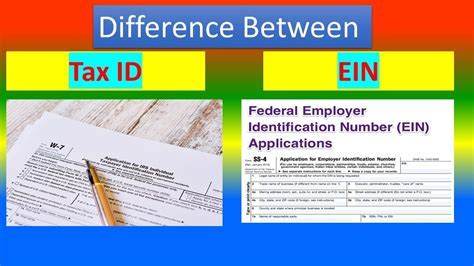

Federal Id Vs Tax Id

The distinction between a Federal ID and a Tax ID is a crucial topic for businesses, especially when it comes to tax obligations and legal compliance. These identifiers play a significant role in the administrative and financial operations of any organization, and understanding their differences is essential for effective management.

Unraveling the Federal ID and Tax ID Enigma

In the realm of business and taxation, two key identifiers often come into play: the Federal ID and the Tax ID. While they might seem interchangeable at first glance, they serve distinct purposes and have unique implications for businesses. Let’s delve into the specifics of each to unravel their differences and importance.

Federal ID: The Backbone of Business Identification

The Federal ID, officially known as the Employer Identification Number (EIN), is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to businesses for tax purposes. It serves as a vital identifier for companies and is used for a myriad of financial and administrative tasks. Here’s a closer look at its role and significance:

- Tax Obligations: An EIN is essential for businesses to fulfill their tax responsibilities. It is used to file tax returns, including income, employment, and excise taxes. Without an EIN, a business would find it challenging to comply with these obligations.

- Business Operations: The Federal ID is crucial for day-to-day operations. It is used for opening business bank accounts, applying for loans or grants, and even for certain licensing and permitting processes. In essence, it provides a unique identity for the business in the eyes of the law.

- Employment: If a business has employees, an EIN is necessary to report wages and salaries to the IRS. It is also used for payroll tax obligations, such as Social Security and Medicare taxes.

- Legal Compliance: In many cases, an EIN is required for businesses to comply with various regulations and laws. For instance, it is often a prerequisite for registering with state agencies, especially when it comes to taxes and employment laws.

The Federal ID, therefore, is the backbone of a business's identity, enabling it to operate legally and efficiently within the framework of the tax system.

Tax ID: A Specific Tax Identifier

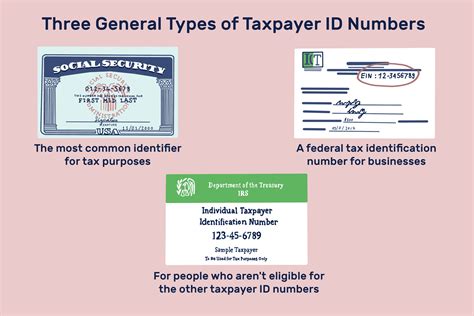

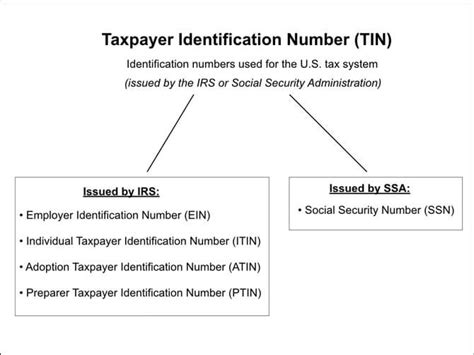

On the other hand, a Tax ID, or Taxpayer Identification Number (TIN), is a broader term that encompasses various types of identification numbers used for tax purposes. While an EIN is a type of TIN, there are other forms of TINs as well. Let’s explore the nuances of Tax IDs:

- Individual Taxpayers: For individuals, the most common TIN is the Social Security Number (SSN). This number is used for tax filing, reporting income, and claiming tax refunds. It is a unique identifier for individuals in the tax system.

- Business Entities: Businesses, as mentioned, use the EIN as their TIN. However, there are other business entities, such as sole proprietorships, that might use their owner's SSN as their TIN for tax purposes.

- Specific Tax Purposes: In certain situations, the IRS might assign a specific TIN for a particular tax obligation. For instance, if a business needs to report taxes for a specific activity or transaction, the IRS might assign a unique TIN for that purpose.

In essence, a Tax ID is a broader term that covers various identifiers used for tax purposes, whereas the Federal ID (EIN) is a specific type of TIN designed for businesses.

Key Differences and Implications

While both Federal ID and Tax ID are integral to the tax system, their differences are significant and impact how businesses operate and comply with tax laws. Here’s a concise summary of their key distinctions:

| Aspect | Federal ID (EIN) | Tax ID (TIN) |

|---|---|---|

| Purpose | Assigned to businesses for tax and operational purposes | Used by individuals and businesses for specific tax obligations |

| Scope | Primarily for business entities | Covers individuals, businesses, and specific tax transactions |

| Usage | For tax filing, payroll, and business operations | Depends on the type of taxpayer and tax obligation |

| Assignment | Issued by the IRS | Can be an SSN, EIN, or other IRS-assigned number |

Understanding these differences is crucial for businesses to ensure they are compliant with tax laws and can effectively manage their financial and administrative processes.

Practical Considerations and Real-World Examples

To illustrate the practical implications of Federal ID and Tax ID, let’s consider a few scenarios:

- Business Startup: When starting a business, applying for an EIN is often the first step. This unique identifier allows the business to open a bank account, apply for loans, and comply with tax obligations from day one.

- Sole Proprietorship: A sole proprietor might use their SSN as their TIN for tax purposes. However, if they hire employees or need to comply with specific regulations, they would need to obtain an EIN to fulfill those obligations.

- Specific Tax Transactions: Imagine a business engages in a complex international transaction that has specific tax implications. The IRS might assign a unique TIN for that transaction, ensuring proper reporting and compliance.

These examples highlight how Federal ID and Tax ID are integral to the tax system and how businesses must navigate these identifiers to ensure compliance and efficient operations.

FAQ

Can a business have multiple Federal IDs (EINs)?

+In some cases, a business might need multiple EINs, especially if it operates in multiple states or has distinct business entities. However, this should be done with careful consideration and legal guidance to ensure compliance.

Do I need a Tax ID (TIN) if I’m a sole proprietor with no employees?

+As a sole proprietor, you can use your SSN as your TIN for tax purposes. However, if your business grows and you hire employees or need to comply with specific regulations, obtaining an EIN becomes necessary.

How do I apply for a Federal ID (EIN)?

+The IRS provides an online application process for obtaining an EIN. It’s a straightforward process, but businesses should ensure they have all the necessary information, such as the business’s legal name and structure, before applying.