Nc Car Sales Tax

The North Carolina car sales tax is a crucial aspect of purchasing a vehicle in the state, as it directly impacts the overall cost of ownership. Understanding how this tax works and its implications can help potential car buyers make informed decisions and budget effectively. In this comprehensive guide, we will delve into the intricacies of the NC car sales tax, providing a detailed analysis of its structure, calculation methods, and potential exemptions. We will also explore the broader implications of this tax on the automotive market and the economy of North Carolina.

Understanding the NC Car Sales Tax

The car sales tax in North Carolina is a percentage-based tax imposed on the purchase price of a vehicle. This tax is an essential revenue source for the state, contributing to various public services and infrastructure development. The NC Department of Revenue oversees the collection and distribution of this tax, ensuring compliance and accurate calculations.

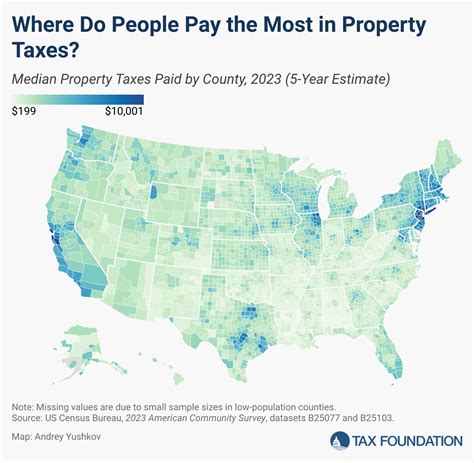

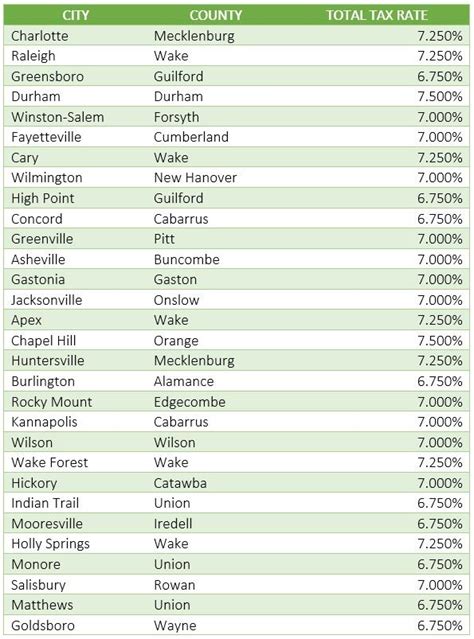

The sales tax rate in North Carolina varies depending on the county in which the vehicle is registered. This county-specific tax structure allows for a certain level of flexibility and customization in tax rates across the state. As of the latest data, the average sales tax rate for car purchases in North Carolina stands at 6.75%, but it's important to note that this can fluctuate based on local ordinances and special tax districts.

How is the NC Car Sales Tax Calculated?

The calculation of the NC car sales tax involves a straightforward process. The tax is applied to the purchase price of the vehicle, which includes the base price, any additional features or options, and any dealer-added accessories. This total purchase price is then multiplied by the applicable sales tax rate for the specific county where the vehicle is being registered.

For example, if you purchase a car with a total price of $30,000 in a county with a sales tax rate of 7%, the sales tax due would be calculated as follows: $30,000 x 0.07 = $2,100. This amount would be added to the purchase price, resulting in a total cost of $32,100 for the vehicle.

It's worth noting that the sales tax is not the only additional cost associated with buying a car. Other fees and charges, such as title and registration fees, may also apply, adding to the overall expense of vehicle ownership in North Carolina.

Exemptions and Special Considerations

While the NC car sales tax applies to most vehicle purchases, there are certain exemptions and special cases that buyers should be aware of. These exemptions can significantly impact the overall cost of a vehicle purchase, making it crucial to understand the specific scenarios where they apply.

- Vehicle Trade-Ins: When trading in an old vehicle as part of a new purchase, the sales tax may be calculated based on the difference in value between the old and new vehicles. This trade-in allowance can reduce the taxable amount, resulting in a lower sales tax obligation.

- Disabled Individuals: North Carolina offers a sales tax exemption for the purchase of a vehicle by a disabled individual. This exemption applies to vehicles specially equipped or modified to accommodate the individual's disability. The exemption is granted through a disability certificate issued by the NC Division of Motor Vehicles.

- Military Personnel: Active-duty military personnel stationed in North Carolina may be eligible for a sales tax exemption when purchasing a vehicle. This exemption is designed to support military families and is subject to specific conditions and documentation.

- Electric and Hybrid Vehicles: The state promotes the adoption of environmentally friendly vehicles by offering a sales tax exemption for the purchase of electric or hybrid cars. This incentive is part of North Carolina's efforts to reduce carbon emissions and promote sustainable transportation.

It's important for potential car buyers to thoroughly research and understand these exemptions, as they can provide significant savings and make the purchase more affordable. Additionally, staying informed about any changes or updates to these regulations is crucial to ensure compliance and maximize potential benefits.

Impact on the Automotive Market and Economy

The NC car sales tax has a profound impact on the automotive market and the overall economy of the state. As a revenue stream, it directly contributes to the funding of essential public services and infrastructure projects. The tax revenue collected helps maintain and improve roads, bridges, and other transportation networks, benefiting all North Carolina residents and businesses.

From an economic perspective, the car sales tax influences consumer behavior and purchasing decisions. The tax can impact the affordability of vehicles, particularly for those on a tight budget. It can also affect the resale value of used cars, as buyers may factor in the tax when negotiating prices. Additionally, the tax can encourage consumers to explore financing options, lease agreements, or even consider purchasing used vehicles to mitigate the tax burden.

Furthermore, the tax structure can impact the competitiveness of the automotive industry within North Carolina. Counties with lower tax rates may attract more vehicle sales, leading to economic growth and job creation in those areas. On the other hand, counties with higher tax rates may face challenges in retaining businesses and attracting new investments in the automotive sector.

The NC car sales tax is a dynamic and ever-evolving aspect of the state's economic landscape. It requires careful consideration and ongoing evaluation to ensure it remains fair, effective, and aligned with the needs of both consumers and the automotive industry.

Performance Analysis and Comparisons

To provide a comprehensive understanding of the NC car sales tax, let’s examine some real-world examples and compare it with other states:

| State | Average Sales Tax Rate | Vehicle Purchase ($50,000) |

|---|---|---|

| North Carolina | 6.75% | $3,375 |

| Virginia | 6.0% | $3,000 |

| South Carolina | 6.0% | $3,000 |

| Tennessee | 7.0% | $3,500 |

As the table illustrates, the NC car sales tax compares favorably with neighboring states. While the average sales tax rate in North Carolina is slightly higher than Virginia and South Carolina, it is still lower than Tennessee. This analysis highlights the competitive positioning of North Carolina in terms of sales tax rates, making it an attractive option for car buyers in the region.

Future Implications and Potential Changes

The NC car sales tax, like any tax policy, is subject to potential changes and reforms. As the state’s economy evolves and new priorities emerge, the tax structure may need adjustments to remain effective and equitable. Here are some key considerations and potential future developments:

- Revenue Allocation: The distribution of sales tax revenue could be reevaluated to address specific infrastructure needs or support emerging industries. For instance, allocating a portion of the tax revenue to fund electric vehicle charging stations or improve public transportation networks.

- Tax Rate Adjustments: The sales tax rate may be revised to align with economic trends and ensure competitiveness. This could involve lowering the rate to stimulate vehicle sales or increasing it to generate additional revenue for critical services.

- Exemption Expansions: As environmental concerns and social equity issues gain prominence, the state may consider expanding exemptions to encourage the adoption of electric and hybrid vehicles, support low-income families, or promote community development.

- Online Sales Taxation: With the growing trend of online vehicle purchases, the state may need to address the taxation of these transactions to ensure a level playing field for traditional dealerships and online retailers.

These potential changes highlight the dynamic nature of tax policies and their role in shaping the automotive market and the overall economy. Stay informed about any legislative updates and proposed reforms to make well-informed decisions when purchasing a vehicle in North Carolina.

Conclusion

The NC car sales tax is a critical component of vehicle ownership in North Carolina, impacting both buyers and the state’s economy. By understanding the tax structure, calculation methods, and potential exemptions, car buyers can make informed decisions and effectively manage their finances. Additionally, recognizing the broader implications of this tax on the automotive market and the state’s economic landscape highlights its significance as a revenue source and its role in shaping the future of transportation in North Carolina.

Frequently Asked Questions

Are there any hidden fees or additional charges besides the sales tax when buying a car in North Carolina?

+Yes, there are additional fees and charges associated with purchasing a car in North Carolina. These may include title fees, registration fees, documentation fees, and, in some cases, a title transfer fee. It’s important to research and understand these fees to have a comprehensive understanding of the total cost.

How can I calculate the sales tax for my specific county in North Carolina?

+You can calculate the sales tax for your specific county by visiting the North Carolina Department of Revenue website and searching for your county’s sales tax rate. Once you have the rate, you can multiply it by the purchase price of your vehicle to estimate the sales tax due.

Are there any ways to reduce the sales tax burden when purchasing a car in North Carolina?

+Yes, there are a few strategies to potentially reduce the sales tax burden. These include exploring trade-in allowances, researching and qualifying for specific exemptions (such as for disabled individuals or electric/hybrid vehicles), and timing your purchase to take advantage of any sales tax holidays or promotional offers.

How does the NC car sales tax compare to other states in the region?

+The NC car sales tax is generally competitive with neighboring states like Virginia and South Carolina, which have similar average sales tax rates. However, it’s important to note that tax rates can vary significantly within states, so researching specific county rates is crucial for accurate comparisons.