Illinois Sales Tax Calculator

Unveiling the Illinois Sales Tax Calculator: Navigating the Complexities with Precision

In the bustling state of Illinois, understanding the intricacies of sales tax is paramount for both businesses and consumers. With a diverse range of goods and services subject to taxation, the Illinois Sales Tax Calculator emerges as a powerful tool, offering precision and clarity amidst the complex landscape of tax regulations. This article delves into the depths of this calculator, exploring its functionalities, benefits, and the impact it has on the economic landscape of the state.

Illinois, known for its vibrant cities and diverse industries, boasts a dynamic economy, and with it, a complex sales tax system. From the bustling streets of Chicago to the serene countryside, businesses and individuals alike navigate a web of tax rates and regulations. This is where the Illinois Sales Tax Calculator steps in, providing an indispensable service by simplifying the tax calculation process, ensuring compliance, and fostering a better understanding of the state's fiscal policies.

The Evolution of Sales Tax Calculation in Illinois

Historically, calculating sales tax in Illinois has been a challenging task, often requiring manual computations and an in-depth knowledge of the state's tax laws. This was especially true for small businesses and entrepreneurs, who had to juggle multiple tax rates and regulations, often leading to errors and potential non-compliance.

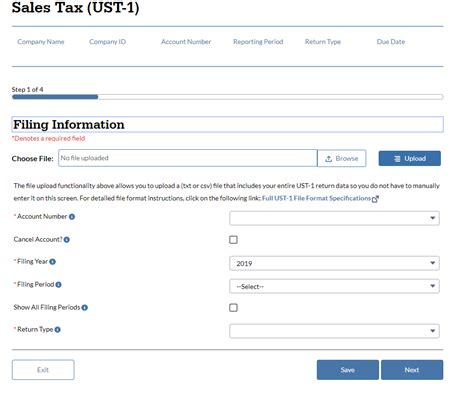

However, with the advent of technology and a growing emphasis on ease of doing business, the Illinois Department of Revenue introduced the Sales Tax Calculator. This innovative tool has revolutionized the way sales tax is calculated, making it accessible, accurate, and user-friendly. It has become an essential resource for businesses of all sizes, helping them streamline their tax obligations and focus on their core operations.

Unraveling the Features of the Illinois Sales Tax Calculator

The Illinois Sales Tax Calculator is a sophisticated online tool, designed to cater to the diverse needs of businesses and individuals. Here's a detailed look at its key features:

User-Friendly Interface

The calculator boasts a simple and intuitive interface, making it accessible to users with varying levels of technical expertise. With clear labels and straightforward input fields, users can quickly enter the necessary information, such as the type of goods or services, the sale price, and the applicable tax rate.

Real-Time Tax Calculation

One of the standout features of the calculator is its ability to provide real-time tax calculations. As users input the required data, the calculator instantly computes the applicable sales tax, displaying the result in a clear and concise manner. This instantaneous feedback ensures accuracy and efficiency, saving users valuable time and effort.

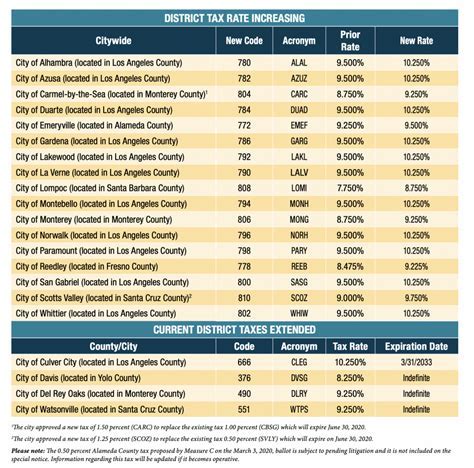

Comprehensive Tax Rate Database

The calculator is backed by a comprehensive database of tax rates, covering every county and municipality in Illinois. This ensures that users receive accurate tax calculations, taking into account the varying rates across the state. The database is regularly updated by the Illinois Department of Revenue, keeping the calculator in sync with the latest tax regulations.

| County/Municipality | Sales Tax Rate |

|---|---|

| Cook County | 10.25% |

| DuPage County | 7.00% |

| Lake County | 6.75% |

| McHenry County | 7.00% |

| Will County | 7.00% |

Tax Exemptions and Special Considerations

Understanding tax exemptions and special considerations is crucial for accurate sales tax calculation. The Illinois Sales Tax Calculator takes this into account, allowing users to input specific exemptions or apply special rates for certain goods or services. This feature ensures that businesses can comply with the state's complex tax regulations without compromising accuracy.

Export and Save Options

For businesses that require record-keeping or further analysis, the calculator offers export and save options. Users can download the calculated tax amounts in various formats, such as CSV or Excel, for easy integration into their accounting systems. This feature promotes transparency and facilitates better financial management.

The Impact of the Illinois Sales Tax Calculator on Businesses

The introduction of the Illinois Sales Tax Calculator has had a profound impact on businesses operating within the state. Here's how it has transformed the tax calculation landscape:

Enhanced Compliance

By providing an accurate and reliable tool, the calculator has significantly improved tax compliance among businesses. With real-time calculations and a comprehensive tax rate database, businesses can confidently report and remit the correct tax amounts, reducing the risk of penalties and legal issues.

Streamlined Operations

The calculator's efficiency has streamlined the tax calculation process, freeing up valuable time for businesses. This time can be redirected towards core business activities, such as customer engagement, product development, or strategic planning. As a result, businesses can operate more efficiently and focus on their growth.

Improved Customer Experience

For businesses selling goods or services directly to consumers, the calculator has indirectly enhanced the customer experience. By accurately calculating sales tax, businesses can provide transparent pricing, building trust and confidence among their clientele. This, in turn, can lead to increased customer satisfaction and loyalty.

Data-Driven Insights

The export and save options of the calculator provide businesses with valuable data. This data can be analyzed to gain insights into sales trends, tax obligations, and potential areas for cost optimization. By leveraging this information, businesses can make informed decisions, improve their financial planning, and enhance their overall performance.

Future Implications and Potential Developments

As technology continues to evolve, so too will the Illinois Sales Tax Calculator. Here are some potential future developments and implications:

Integration with Accounting Software

One of the most significant potential developments is the integration of the calculator with popular accounting software. This would allow businesses to seamlessly transfer tax calculation data into their financial systems, further streamlining their operations and reducing manual errors.

Real-Time Rate Updates

Currently, the calculator relies on regular updates from the Illinois Department of Revenue to maintain its accuracy. However, future iterations could incorporate real-time rate updates, ensuring that businesses have access to the most up-to-date tax rates without any delay.

Advanced Reporting Features

The calculator could be enhanced with advanced reporting features, providing businesses with detailed analyses of their tax obligations. These reports could offer insights into tax trends, potential savings opportunities, and areas where tax compliance could be improved. Such features would empower businesses to make more strategic decisions regarding their tax strategies.

Mobile Accessibility

In today's mobile-first world, a dedicated mobile app for the Illinois Sales Tax Calculator could be a game-changer. This would make the tool even more accessible, allowing businesses and individuals to calculate sales tax on the go, whether they're at a trade show, a pop-up store, or simply out and about.

Conclusion

The Illinois Sales Tax Calculator is a testament to the state's commitment to ease of doing business and transparency in taxation. By providing a user-friendly, accurate, and reliable tool, the calculator has transformed the way businesses and individuals approach sales tax calculations. As the tool continues to evolve, it will undoubtedly play a pivotal role in shaping the economic landscape of Illinois, fostering growth, compliance, and a better understanding of the state's fiscal policies.

What is the sales tax rate in Illinois?

+

The sales tax rate in Illinois varies depending on the location of the sale. It is comprised of a state sales tax rate and additional local taxes. The state sales tax rate is 6.25%, and local taxes can range from 0% to 3.75%, resulting in a combined rate of up to 10% in some areas.

Are there any tax exemptions in Illinois?

+

Yes, Illinois offers various tax exemptions. For example, certain food items, prescription drugs, and medical devices are exempt from sales tax. Additionally, there are specific exemptions for agricultural equipment, manufacturing machinery, and certain services. It’s important to consult the Illinois Department of Revenue for a comprehensive list of exemptions.

How often are sales tax rates updated in Illinois?

+

Sales tax rates in Illinois are subject to periodic updates. The Illinois Department of Revenue regularly reviews and adjusts tax rates based on various factors. While there is no set schedule for these updates, it is recommended to check for any changes before calculating sales tax to ensure accuracy.

Can the Illinois Sales Tax Calculator be used for business registration purposes?

+

No, the Illinois Sales Tax Calculator is primarily designed for calculating sales tax on goods and services. It does not provide business registration services. For business registration, you will need to visit the Illinois Secretary of State’s website or contact their office directly.

Are there any special considerations for online sales in Illinois?

+

Yes, Illinois has specific regulations for online sales. If you’re selling goods online to Illinois residents, you may be required to collect and remit sales tax, even if your business is located outside the state. It’s important to understand the Nexus laws and comply with the applicable tax regulations to avoid penalties.