Missouri State Tax Rate

Understanding state tax rates is crucial for individuals and businesses alike, as they directly impact financial planning and compliance. Missouri, a central state in the United States, has a unique tax system that offers a combination of state-level taxes and local taxes administered by counties and municipalities. This article delves into the intricacies of Missouri's tax landscape, providing a comprehensive guide to help navigate the state's tax obligations.

Missouri’s State Tax Structure

Missouri’s state tax system primarily consists of income tax, sales and use tax, and various other taxes, including franchise taxes, tobacco taxes, and excise taxes on specific goods and services.

Income Tax

Missouri imposes an income tax on both individuals and corporations. The state’s income tax system is progressive, with rates ranging from 1.5% to 6.0% for individuals and 4% for corporations. The tax rate depends on the taxpayer’s income bracket, with higher incomes subject to higher tax rates. Missouri allows taxpayers to claim deductions and credits to reduce their taxable income.

Here’s a breakdown of the income tax rates for individuals in Missouri:

| Income Bracket | Tax Rate |

|---|---|

| Up to 1,000</td> <td>1.5%</td> </tr> <tr> <td>1,001 - 2,000</td> <td>2.0%</td> </tr> <tr> <td>2,001 - 3,000</td> <td>2.5%</td> </tr> <tr> <td>3,001 - 4,000</td> <td>3.0%</td> </tr> <tr> <td>4,001 - 6,000</td> <td>3.5%</td> </tr> <tr> <td>Over 6,000 | 6.0% |

It’s important to note that Missouri offers several tax credits and deductions, such as the Low Income Housing Tax Credit and the Research and Development Tax Credit, which can reduce the overall tax liability for eligible individuals and businesses.

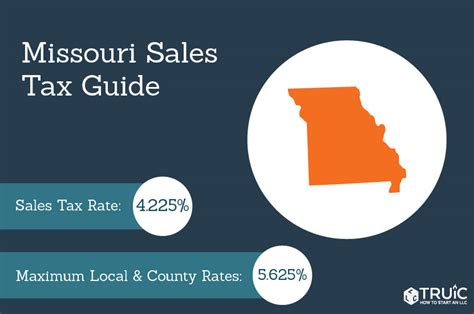

Sales and Use Tax

Missouri has a sales and use tax, which is a consumption tax applied to the sale of tangible personal property and certain services. The state’s base sales tax rate is 4.225%, but local taxing jurisdictions can impose additional sales taxes, resulting in varying rates across the state. These local rates can range from 0% to 3.75%, making the total sales tax rate anywhere from 4.225% to 8.775%.

For example, in the city of St. Louis, the sales tax rate is 9.225%, which includes the state base rate and the local city tax of 5%.

Missouri also has a use tax, which is applied to the storage, use, or consumption of tangible personal property purchased from out-of-state vendors. The use tax rate is the same as the sales tax rate and ensures that Missouri residents pay taxes on goods purchased online or from out-of-state retailers, even if sales tax was not collected at the time of purchase.

Other State Taxes in Missouri

In addition to income and sales taxes, Missouri levies various other taxes to fund specific programs and initiatives.

Franchise and Excise Taxes

Missouri imposes a franchise tax on certain corporations, limited liability companies, and limited liability partnerships. The tax rate varies based on the entity’s capital and surplus, with a minimum tax of $150. Missouri also levies excise taxes on specific activities and products, such as natural gas, electricity, and alcoholic beverages.

Tobacco and Fuel Taxes

Missouri has a tobacco tax of 0.17 per pack of cigarettes and a tax on other tobacco products, including cigars, chewing tobacco, and snuff. The state also imposes a fuel tax, which is a tax on the sale or use of motor fuels, including gasoline and diesel. The fuel tax rate is currently 0.184 per gallon for gasoline and $0.244 per gallon for diesel fuel.

Local Taxes in Missouri

Missouri allows local jurisdictions, such as counties and municipalities, to impose their own taxes in addition to state taxes. These local taxes can include property taxes, local income taxes, and local sales taxes. The specific rates and types of local taxes vary widely across the state, making it essential for individuals and businesses to understand the tax landscape in their particular area.

Property Taxes

Property taxes are a significant source of revenue for local governments in Missouri. The property tax rate is determined by the local taxing authority and can vary greatly from one county or municipality to another. Property taxes are based on the assessed value of the property and are used to fund local services such as schools, fire departments, and infrastructure.

Local Income Taxes

A few cities in Missouri, including Kansas City and St. Louis, impose a local earnings tax on residents and businesses within their jurisdictions. The earnings tax rate is typically around 1%, but it can vary depending on the city. This tax is in addition to the state income tax and is used to fund city operations and services.

Tax Incentives and Credits in Missouri

Missouri offers a range of tax incentives and credits to attract businesses and support economic development. These incentives can take the form of tax credits, deductions, or exemptions and are designed to encourage investment, job creation, and innovation within the state.

Business Incentives

Missouri has several business incentives, including the Quality Jobs Program, which provides tax credits to businesses that create new jobs and invest in employee training. The Missouri Works Program offers tax incentives for businesses that make significant capital investments and create new jobs in targeted industries. Additionally, the Enhanced Enterprise Zone Program provides tax credits for businesses that locate or expand in designated economically distressed areas.

Personal Tax Credits

Missouri residents may be eligible for various personal tax credits, such as the Low Income Housing Tax Credit, which provides a credit for investing in affordable housing projects. The Earned Income Tax Credit is another example, offering a refundable tax credit to low- and moderate-income working individuals and families.

Compliance and Reporting Requirements

Understanding the tax obligations and compliance requirements is essential for both individuals and businesses operating in Missouri. The Missouri Department of Revenue provides resources and guidance to help taxpayers navigate the state’s tax system.

Tax Registration and Filing

Businesses and individuals must register with the Missouri Department of Revenue to obtain a tax registration number. This number is required for filing tax returns and making tax payments. The registration process involves providing basic information about the taxpayer, such as name, address, and business activities.

Tax Payment Methods

Missouri offers various methods for taxpayers to pay their state and local taxes. These include electronic funds transfer, credit card payments, and traditional paper checks. The Missouri Department of Revenue provides detailed instructions and guidelines for each payment method on its website.

Tax Return Due Dates

The due date for filing Missouri income tax returns for individuals is typically April 15th of each year, following the federal tax filing deadline. However, this date may be extended for certain taxpayers. Business tax return due dates vary depending on the type of business entity and the fiscal year-end.

Tax Planning and Strategies

Navigating Missouri’s tax system requires careful planning and consideration of the state’s unique tax landscape. Tax professionals and advisors can provide valuable guidance to individuals and businesses, helping them minimize their tax liability and maximize available tax incentives.

Maximizing Tax Benefits

Tax professionals can assist taxpayers in identifying and claiming all eligible deductions, credits, and exemptions. They can also provide strategies for structuring business activities and investments to take advantage of Missouri’s tax incentives and reduce the overall tax burden.

Minimizing Compliance Risks

Understanding and adhering to Missouri’s tax laws and regulations is crucial to avoid penalties and interest charges. Tax professionals can help ensure compliance by staying up-to-date with tax law changes, assisting with accurate tax return preparation, and providing guidance on tax planning strategies that align with the state’s requirements.

Conclusion

Missouri’s tax system offers a combination of state and local taxes, with varying rates and incentives across the state. Understanding the state’s tax landscape is essential for individuals and businesses to effectively plan their financial strategies and comply with tax obligations. By leveraging the state’s tax incentives and working with tax professionals, taxpayers can navigate Missouri’s tax system successfully and minimize their overall tax liability.

What is the current state sales tax rate in Missouri?

+The current state sales tax rate in Missouri is 4.225%. However, local jurisdictions can impose additional sales taxes, resulting in varying total sales tax rates across the state.

Are there any tax incentives for businesses in Missouri?

+Yes, Missouri offers several tax incentives for businesses, including the Quality Jobs Program, Missouri Works Program, and Enhanced Enterprise Zone Program. These incentives aim to attract investment and job creation in the state.

How do I register my business for tax purposes in Missouri?

+To register your business for tax purposes in Missouri, you need to obtain a tax registration number from the Missouri Department of Revenue. This involves providing basic information about your business and registering for the appropriate tax types, such as income tax, sales tax, or franchise tax.

Are there any tax deductions or credits available for individuals in Missouri?

+Yes, Missouri offers various tax deductions and credits for individuals, such as the Low Income Housing Tax Credit and the Earned Income Tax Credit. These incentives aim to support low- and moderate-income individuals and families.

What are the tax obligations for remote sellers in Missouri?

+Remote sellers in Missouri are required to collect and remit sales tax on transactions with Missouri customers if they meet certain economic nexus thresholds. The state has specific guidelines and registration requirements for remote sellers to comply with sales tax obligations.