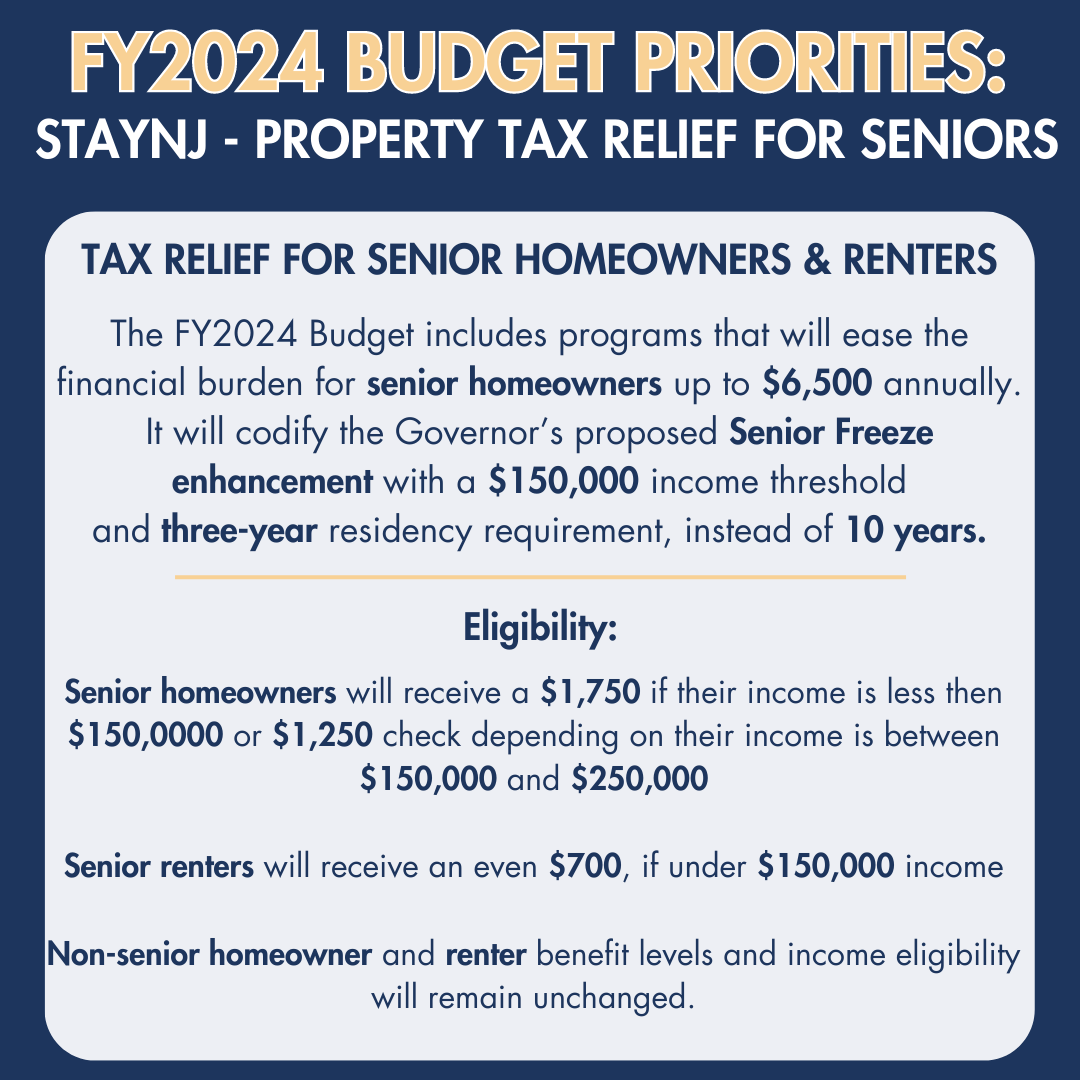

Nj Property Tax Relief For Seniors

In New Jersey, property taxes are a significant concern for many residents, especially for seniors on fixed incomes. To address this issue, the state has implemented various programs aimed at providing property tax relief for senior citizens. These initiatives aim to ease the financial burden and ensure a more comfortable retirement for older adults. This article delves into the specifics of these tax relief programs, offering a comprehensive guide for seniors in New Jersey to navigate and understand their options.

Understanding Property Tax Relief Programs for Seniors in New Jersey

New Jersey's property tax system is renowned for being one of the highest in the nation, which is why the state offers a range of tax relief programs specifically tailored for senior citizens. These programs are designed to reduce the property tax burden for individuals aged 65 and above who meet certain income and residency requirements.

The Senior Freeze (Property Tax Reimbursement) Program

The Senior Freeze, officially known as the Property Tax Reimbursement program, is a significant initiative aimed at providing relief to senior homeowners. This program reimburses eligible seniors for property tax increases, ensuring that they pay no more than their base-year tax amount. Here's a detailed look at the program:

- Eligibility Criteria: To qualify, seniors must be New Jersey residents, at least 65 years old, and their total household income (including spouse's income) must not exceed $150,000. They must also have owned and lived in their home for the entire tax year for which they are applying.

- Application Process: Applications for the Senior Freeze are typically accepted in the spring, with a deadline usually set for early summer. The application requires documentation of income and property tax bills. Late applications are not accepted, so it's essential to stay updated with the application window.

- Reimbursement Process: If approved, seniors will receive a reimbursement for any increase in their property taxes above the base-year amount. The reimbursement is typically paid out as a single lump sum, usually in the fall.

It's important to note that the Senior Freeze program does not provide an immediate reduction in property taxes. Instead, it offers a reimbursement for the difference between the base-year tax and the current tax, ensuring that seniors are not financially burdened by tax increases.

Homestead Benefit Program

The Homestead Benefit Program is another critical tax relief initiative for New Jersey seniors. This program provides a direct credit on property tax bills for eligible homeowners and renters. Here's an overview:

- Eligibility Criteria: To qualify, seniors must be New Jersey residents, at least 65 years old, and their total household income (including spouse's income) must not exceed $150,000. They must also have owned and lived in their home or rented their residence for at least six months of the tax year.

- Application Process: The Homestead Benefit Program applications are generally available in the fall, with a deadline typically set for late winter. The application process requires documentation of income and property tax bills. Late applications are not accepted, so staying informed about the application window is crucial.

- Credit Amount: The credit amount varies each year and is determined by the state's budget. It is directly applied to the recipient's property tax bill, reducing the amount they owe.

The Homestead Benefit Program is a more immediate form of tax relief compared to the Senior Freeze, as it provides a direct reduction on the property tax bill. This program ensures that eligible seniors can better manage their property tax expenses on an annual basis.

Senior Citizens Deduction

The Senior Citizens Deduction is a tax deduction that can be claimed on New Jersey income tax returns. This deduction is designed to reduce the state income tax liability for eligible seniors. Here are the key details:

- Eligibility Criteria: To qualify, seniors must be New Jersey residents, at least 62 years old, and their total household income (including spouse's income) must not exceed $100,000. They must also have owned and lived in their home for the entire tax year.

- Deduction Amount: The deduction amount varies each year and is subject to change based on legislative decisions. It is claimed on the recipient's New Jersey income tax return, reducing their taxable income.

The Senior Citizens Deduction is a valuable tool for seniors to reduce their state income tax burden, complementing the property tax relief provided by the Senior Freeze and Homestead Benefit programs.

Senior Housing Complex Tax Abatement

For seniors living in specific housing complexes designated for senior citizens, there may be additional property tax relief available. The Senior Housing Complex Tax Abatement program offers a reduced tax rate for eligible properties. Here's an overview:

- Eligibility Criteria: To qualify, the property must be designated as a senior housing complex, and the residents must meet certain age and income requirements. The specifics of these requirements can vary by municipality and should be confirmed with local tax authorities.

- Tax Abatement: Eligible properties receive a reduced tax rate, which is typically lower than the standard property tax rate. This abatement is applied to the property's tax assessment, resulting in a lower tax bill for residents.

The Senior Housing Complex Tax Abatement program is a more localized form of tax relief, providing benefits to seniors living in specific housing developments. It is essential for seniors to inquire with their local tax authorities or property management to understand if their residence qualifies for this abatement.

Understanding the Income Limits

All of the tax relief programs mentioned above have income limits. These limits are in place to ensure that the programs benefit those who need it most. While the specific income limits can vary slightly between programs, they generally range from $100,000 to $150,000 for total household income. It's crucial for seniors to stay informed about these limits, as they can impact eligibility for multiple programs.

| Program | Income Limit |

|---|---|

| Senior Freeze | $150,000 |

| Homestead Benefit | $150,000 |

| Senior Citizens Deduction | $100,000 |

It's important to note that these income limits are subject to change, and seniors should consult the official program guidelines or seek advice from tax professionals for the most up-to-date information.

Maximizing Tax Relief Benefits: Tips and Strategies

While New Jersey's property tax relief programs provide significant benefits for seniors, there are strategies that can further maximize these savings. Here are some tips to consider:

Stay Informed About Program Changes

Tax relief programs can undergo changes from year to year, whether it's in the application process, eligibility criteria, or the amount of relief provided. Staying informed about these changes is crucial to ensure you don't miss out on any benefits. Follow the official websites and news outlets for updates, and consider setting reminders for application deadlines.

Consider All Eligible Programs

New Jersey offers a range of tax relief programs, each with its own set of criteria. It's important to review all the programs to determine which ones you qualify for. Some seniors may be eligible for multiple programs, and combining these benefits can lead to significant savings. Make sure to thoroughly research and understand the eligibility criteria for each program.

Keep Accurate Records

When applying for tax relief programs, accurate documentation is key. Keep organized records of your income, property tax bills, and any other relevant documents. This will streamline the application process and make it easier to provide the necessary information. Additionally, having accurate records can help you quickly address any discrepancies or issues that may arise during the application process.

Seek Professional Advice

Tax laws and regulations can be complex, and it's understandable if you have questions or need guidance. Consider consulting with a tax professional or financial advisor who specializes in senior tax planning. They can provide personalized advice based on your specific circumstances and help you navigate the various tax relief programs effectively. Their expertise can ensure you maximize your savings while staying compliant with the law.

Explore Local Programs

In addition to state-level tax relief programs, some counties and municipalities in New Jersey offer their own initiatives to assist seniors with property taxes. These local programs can provide additional benefits or be more tailored to your specific region. Reach out to your local tax authorities or government offices to inquire about any such programs and understand the eligibility criteria and application process.

Stay Engaged with Community Resources

Community organizations, senior centers, and local advocacy groups can be valuable resources for information and support. They often provide guidance and assistance with tax relief programs, and some may even offer workshops or seminars to help seniors understand and navigate the application process. Staying connected with these resources can ensure you stay informed and receive the support you need.

The Impact of Property Tax Relief on Senior Financial Planning

Property tax relief programs have a significant impact on the financial well-being of seniors in New Jersey. By reducing the property tax burden, these initiatives provide seniors with more financial flexibility and security during their retirement years. Here's a deeper look at how these programs can influence senior financial planning:

Improved Cash Flow and Budgeting

For seniors living on fixed incomes, every dollar counts. Property tax relief programs, such as the Senior Freeze and Homestead Benefit, provide direct financial assistance by reducing or reimbursing property taxes. This can lead to improved cash flow, making it easier for seniors to manage their day-to-day expenses and plan for the future. With reduced tax obligations, seniors can allocate more of their income towards essential needs, discretionary spending, or even savings for unexpected expenses.

Enhanced Financial Security

Property taxes are a significant expense for homeowners, and for seniors, these taxes can be a significant source of financial stress. By offering relief through programs like the Senior Housing Complex Tax Abatement, New Jersey helps alleviate this burden. This relief can lead to enhanced financial security, reducing the risk of seniors having to downsize or move due to unaffordable property taxes. With their financial obligations reduced, seniors can maintain their current standard of living and feel more secure in their retirement years.

Long-Term Financial Planning

Property tax relief programs can also influence long-term financial planning for seniors. With reduced property taxes, seniors may have more disposable income to contribute to savings or investments. This can be particularly beneficial for those who are planning for future healthcare costs, potential home renovations, or even legacy planning. By maximizing tax relief benefits, seniors can ensure they have the financial resources to address their unique needs and goals over the long term.

Peace of Mind and Quality of Life

Financial security is a cornerstone of peace of mind, and property tax relief programs can significantly contribute to this peace of mind for seniors. By easing the financial burden of property taxes, these programs allow seniors to focus on their well-being and quality of life. They can allocate more resources towards activities, travel, hobbies, or simply enjoying their retirement years without the stress of financial worries. The peace of mind that comes with financial security can lead to improved mental health and overall satisfaction during this stage of life.

Navigating the Application Process: A Step-by-Step Guide

Applying for property tax relief programs in New Jersey can seem daunting, but with a clear understanding of the process, it becomes more manageable. Here's a step-by-step guide to help seniors navigate the application journey:

Step 1: Determine Eligibility

Before applying, it's crucial to understand which programs you are eligible for. Review the eligibility criteria for each program, taking into account your age, income, and residency status. Ensure you meet all the requirements before proceeding to the next step.

Step 2: Gather Necessary Documents

Once you've identified the programs you qualify for, it's time to gather the necessary documents. This typically includes proof of income (such as tax returns or pay stubs), property tax bills, and any other relevant documentation. Having these documents organized and readily available will streamline the application process.

Step 3: Understand Application Deadlines

Each tax relief program has specific application deadlines. It's essential to mark these deadlines on your calendar and ensure you don't miss the window. Late applications are generally not accepted, so staying on top of these deadlines is crucial.

Step 4: Complete and Submit Applications

With your eligibility confirmed and documents gathered, it's time to complete the applications. Carefully review the instructions and ensure all required information is provided. Double-check for accuracy and completeness before submitting. Applications can typically be submitted online or by mail, depending on the program.

Step 5: Follow Up and Track Application Status

After submitting your applications, it's important to follow up and track their status. This ensures you stay informed about any updates or changes to your application. Many programs provide online portals or customer service lines where you can check the status of your application. Regularly checking in can help you address any issues or delays promptly.

Step 6: Receive and Understand Your Benefits

Once your applications are approved, you will receive information about your benefits. This could be in the form of a reimbursement check, a credit on your property tax bill, or a reduction in your state income tax liability. Carefully review the details of your benefits to understand how they will impact your finances. If you have any questions or concerns, don't hesitate to reach out to the program administrators for clarification.

Step 7: Stay Informed and Renew Benefits

Property tax relief programs often require annual renewal. It's crucial to stay informed about the renewal process and deadlines to ensure your benefits continue. Mark these deadlines on your calendar and ensure you have the necessary documents and information ready. By staying proactive, you can maintain your eligibility and continue to benefit from these programs year after year.

FAQs

What is the maximum income limit for the Senior Freeze program in New Jersey?

+

The maximum income limit for the Senior Freeze program is currently set at $150,000 for total household income, including the income of the spouse.

Can I apply for both the Senior Freeze and the Homestead Benefit programs simultaneously?

+

Yes, seniors who meet the eligibility criteria for both programs can apply for both simultaneously. These programs offer different types of tax relief, so combining them can provide significant benefits.

How often do the application deadlines for tax relief programs change in New Jersey?

+

Application deadlines can vary slightly from year to year, but they generally remain consistent within a given program. It’s recommended to check the official program websites or contact the program administrators for the most up-to-date information on application deadlines.

Are there any income tax implications for receiving tax relief benefits in New Jersey?

+

No, receiving tax relief benefits in New Jersey does not typically have income tax implications. These programs are designed to provide direct financial assistance without impacting your taxable income.

Can I still apply for tax relief programs if I missed the application deadline?

+

Unfortunately, late applications are generally not accepted for tax relief programs in New Jersey. It’s crucial to stay informed about the application deadlines and plan accordingly to ensure you don’t miss out on the benefits.