Maui Property Tax

In the picturesque Hawaiian island of Maui, property ownership is a dream for many, but it comes with an important responsibility: property taxation. Understanding the nuances of Maui's property tax system is crucial for homeowners, investors, and those considering purchasing real estate in this tropical paradise. This article aims to provide an in-depth analysis of Maui's property tax landscape, offering a comprehensive guide to help navigate this essential aspect of island life.

Unraveling the Complexity of Maui’s Property Tax System

Maui, with its breathtaking landscapes and vibrant culture, attracts a diverse range of property owners. From lush rainforest estates to beachfront villas, each property contributes to the island’s unique charm and, subsequently, its tax revenue. The County of Maui, tasked with assessing and collecting these taxes, employs a system that is both intricate and tailored to the island’s specific needs.

At the heart of Maui's property tax system is the Real Property Tax Division, a department dedicated to evaluating and taxing all real property within the county. This division ensures that property owners pay their fair share, contributing to the maintenance and development of the island's infrastructure, education, and public services.

The property tax in Maui is based on the market value of the property and is calculated using a complex formula that takes into account various factors. These factors include the location, size, improvements made, and the overall real estate market conditions. The assessment process aims to ensure that each property is taxed equitably, considering its unique attributes and the broader market trends.

Key Aspects of Maui’s Property Tax Assessment

One of the distinctive features of Maui’s property tax system is its two-tiered assessment process. Properties are first assessed at their current market value, reflecting the property’s worth if it were sold on the open market. This value is then subjected to a capped valuation, which limits the annual increase in assessed value to a maximum of 3% or the percentage change in the Consumer Price Index (CPI), whichever is less.

This capped valuation, a unique feature of Hawaii's property tax law, provides stability for property owners, preventing sudden and drastic increases in tax liability. It ensures that homeowners are not disproportionately affected by rapid market fluctuations, fostering a more predictable and sustainable tax environment.

Additionally, Maui offers various exemptions and incentives to certain property owners. For instance, homeowners who occupy their properties as their primary residence may be eligible for a homestead exemption, reducing their taxable value. This exemption is designed to encourage homeownership and provide financial relief to Maui's residents.

Moreover, Maui promotes sustainable land use and environmental conservation through its conservation land tax rate. Properties designated as conservation lands, such as agricultural lands or environmentally sensitive areas, benefit from a reduced tax rate, incentivizing owners to maintain the land's natural state and contribute to the island's ecological balance.

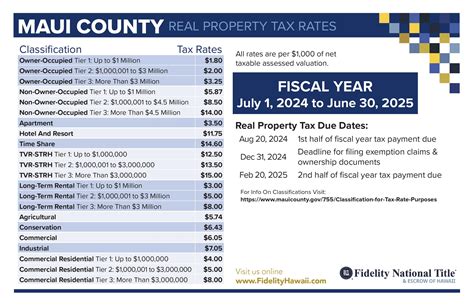

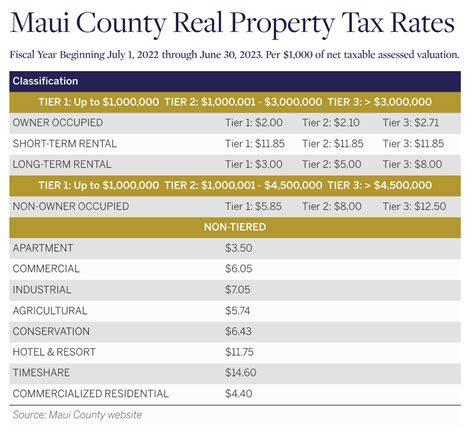

| Property Type | Tax Rate |

|---|---|

| Residential | 0.25% |

| Commercial | 0.35% |

| Vacant Land | 0.30% |

| Conservation Land | 0.20% |

The Lifecycle of a Maui Property Tax Bill

The journey of a Maui property tax bill begins with the assessment process and culminates in the property owner’s timely payment. This section will provide a detailed breakdown of each step, offering homeowners and investors a clear understanding of their obligations and the county’s procedures.

Assessment and Notification

Each year, the County of Maui’s Real Property Tax Division conducts a comprehensive assessment of all properties within the county. This assessment takes into account recent sales data, improvements made to the property, and market trends to determine the property’s current market value. Once the assessment is complete, property owners receive a Notice of Assessment, which details the assessed value of their property.

Property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. The appeal process involves submitting evidence and arguments to the county's Board of Review, which reviews and makes decisions on these appeals.

Tax Rate Determination

After the assessment, the county calculates the tax rate applicable to each property. This rate is determined based on the property’s classification (residential, commercial, vacant land, etc.) and the county’s budgetary needs. The tax rate represents the percentage of the property’s assessed value that the owner will pay in taxes.

The county sets the tax rate annually, considering various factors such as the cost of providing public services, maintaining infrastructure, and funding education. The tax rate is a crucial component, as it directly influences the property tax bill for each owner.

Billing and Payment

Once the assessed value and tax rate are finalized, the county issues property tax bills to all property owners. These bills detail the property’s assessed value, the applicable tax rate, and the total amount due. Property owners typically receive their tax bills in the mail or through digital means, depending on their preferred communication method.

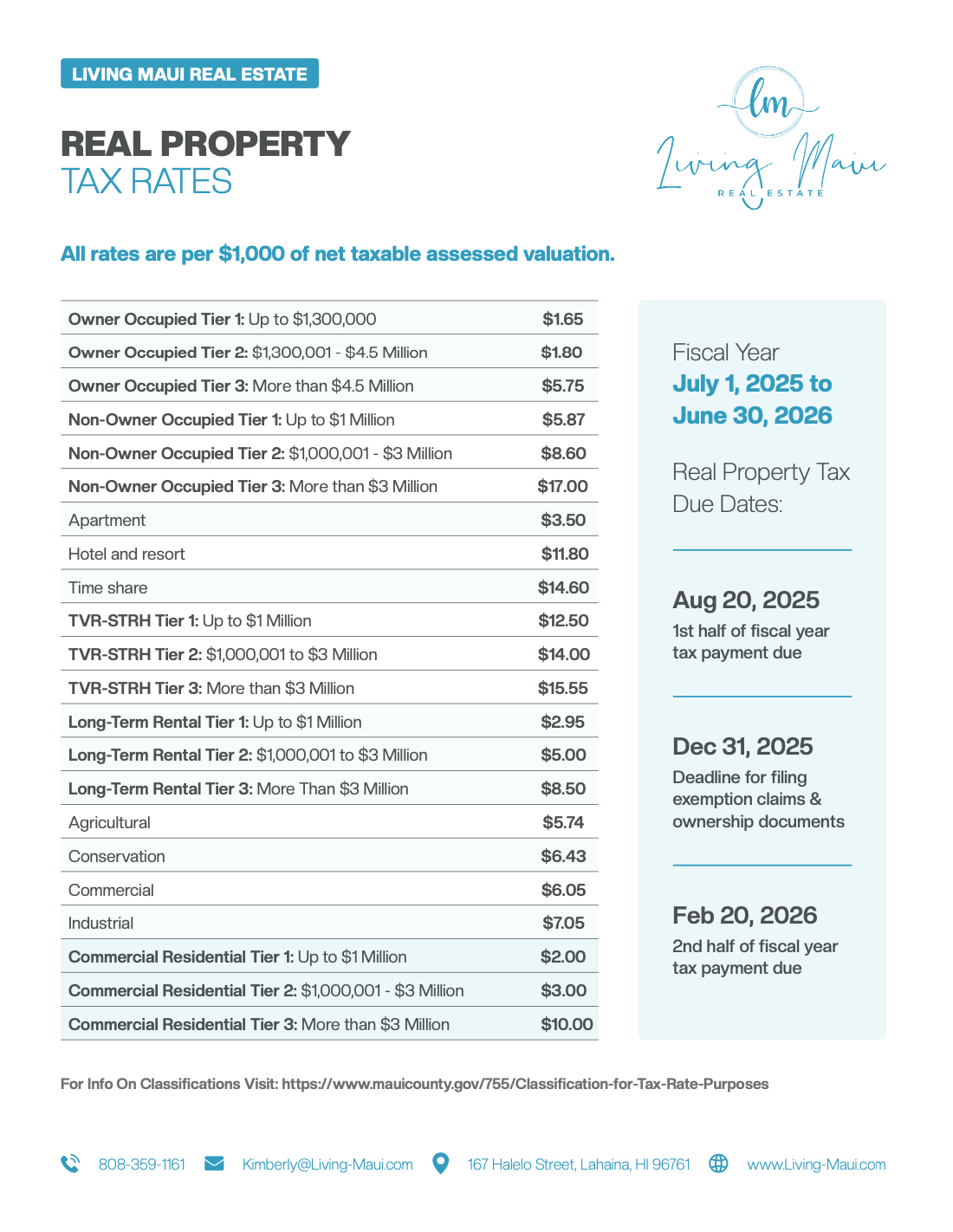

Property tax bills in Maui are due in two installments. The first installment is typically due in February, with the second installment due in July. Property owners are responsible for ensuring timely payments to avoid penalties and interest charges. The county provides various payment options, including online payment portals, direct bank transfers, and in-person payments at designated locations.

Late Payment Penalties and Interest

Failure to pay property taxes on time can result in late payment penalties and interest charges. The county imposes a penalty for late payments, which is a percentage of the outstanding tax amount. Additionally, interest accrues on the unpaid balance, further increasing the financial burden for delinquent taxpayers.

It's crucial for property owners to stay informed about their tax obligations and payment deadlines to avoid these additional charges. The county provides resources and reminders to assist homeowners in managing their property tax payments effectively.

Delinquency and Enforcement

If property taxes remain unpaid, the county may take enforcement actions to collect the outstanding amounts. These actions can include placing a tax lien on the property, which can impact the owner’s ability to sell or refinance the property. In extreme cases, the county may initiate foreclosure proceedings to recover the unpaid taxes.

The county aims to work collaboratively with property owners to resolve tax delinquency issues. It offers payment plans and other assistance programs to help taxpayers manage their obligations. However, property owners must take their tax responsibilities seriously to avoid legal complications and financial hardship.

The Impact of Maui’s Property Tax on the Local Economy

Maui’s property tax system plays a pivotal role in shaping the island’s economy. The revenue generated from property taxes contributes significantly to the county’s budget, funding essential services, infrastructure development, and community initiatives. This section will explore the economic implications of Maui’s property tax, highlighting its benefits and challenges.

Funding Essential Services and Infrastructure

Property taxes in Maui are a primary source of revenue for the county, enabling it to provide essential services to its residents and visitors. These services include public safety, education, healthcare, and the maintenance and improvement of infrastructure such as roads, bridges, and public facilities.

The stable and predictable nature of property tax revenue ensures that the county can plan and budget effectively, delivering consistent and high-quality services to the community. This revenue stream is particularly crucial in Maui, where tourism and real estate drive a significant portion of the local economy.

Encouraging Economic Growth and Development

Maui’s property tax system also incentivizes economic growth and development. The county’s approach to taxation, including the two-tiered assessment process and exemptions, encourages property ownership and investment. By providing stability and predictability in tax obligations, the county attracts homebuyers and investors, fostering a thriving real estate market.

The influx of property owners and investors contributes to the local economy through increased demand for goods and services, creating jobs and supporting local businesses. Additionally, the development of new properties and improvements to existing ones stimulates construction and related industries, further boosting economic growth.

Challenges and Opportunities for Equity

While Maui’s property tax system has many benefits, it also presents challenges related to equity and affordability. The rising property values on the island can lead to increased tax burdens for homeowners, especially those on fixed incomes or with limited financial means.

The county recognizes these challenges and has implemented various measures to promote equity. These include the homestead exemption, which provides relief to primary homeowners, and the conservation land tax rate, which encourages sustainable land use. Additionally, the county regularly reviews its tax policies and assesses the impact on different segments of the community, aiming to strike a balance between revenue generation and community well-being.

Furthermore, Maui's unique natural resources and cultural heritage attract visitors and residents alike. The property tax revenue helps fund initiatives to preserve and enhance these assets, ensuring the island's long-term sustainability and appeal.

Navigating Maui’s Property Tax Landscape: Strategies and Insights

For homeowners and investors in Maui, understanding the intricacies of the property tax system is essential for effective financial planning and compliance. This section offers practical strategies and insights to help navigate Maui’s unique tax landscape, ensuring a smoother experience for property owners.

Understanding Your Property’s Assessment

The first step in navigating Maui’s property tax system is to thoroughly understand your property’s assessment. The assessment, which determines the property’s taxable value, is based on a variety of factors, including its location, size, and recent sales data. Property owners should review their assessment notices carefully and compare them to recent sales of similar properties to ensure accuracy.

If a property owner believes their assessment is inaccurate, they have the right to appeal. The appeal process involves submitting evidence and arguments to the county's Board of Review, which will review the case and make a decision. It's important to gather supporting documentation, such as recent appraisals or sales data, to strengthen your case.

Maximizing Exemptions and Incentives

Maui offers several exemptions and incentives to property owners, which can significantly reduce their tax liability. One of the most common exemptions is the homestead exemption, which reduces the taxable value of a property for homeowners who occupy it as their primary residence. Other incentives, such as the conservation land tax rate, provide reduced tax rates for properties designated for environmental conservation or agricultural use.

Property owners should explore these exemptions and incentives to determine their eligibility and maximize their tax savings. It's essential to stay informed about any changes or updates to these programs and consult with tax professionals or the county's tax office for guidance.

Managing Property Tax Payments

Property tax payments in Maui are due in two installments, typically in February and July. It’s crucial for property owners to budget and plan for these payments to avoid late fees and interest charges. The county offers various payment options, including online payments, direct bank transfers, and in-person payments at designated locations.

Property owners can also consider setting up automatic payments or payment plans to ensure timely payments. The county provides resources and reminders to assist homeowners in managing their property tax obligations effectively.

Seeking Professional Guidance

Navigating Maui’s property tax system can be complex, especially for new homeowners or investors. Seeking professional guidance from tax advisors, accountants, or real estate professionals can provide valuable insights and ensure compliance with the county’s tax regulations.

These professionals can assist with understanding assessment values, maximizing exemptions, and developing effective tax strategies. They can also provide guidance on tax planning and help property owners stay informed about any changes or updates to the tax system.

Staying Informed and Engaged

Maui’s property tax system is subject to periodic updates and revisions. Staying informed about these changes is crucial for property owners to adapt their strategies and ensure compliance. The county provides resources and updates through its official website and local media outlets.

Property owners can also engage with local community groups, attend public meetings, and participate in tax workshops to stay updated on tax-related matters. By staying informed and engaged, homeowners can actively contribute to the community's tax dialogue and influence policy decisions that impact their financial well-being.

Conclusion

Maui’s property tax system is a critical component of the island’s economic and community landscape. It funds essential services, promotes economic growth, and preserves the island’s unique natural and cultural heritage. Understanding this system is vital for homeowners and investors, ensuring compliance, maximizing benefits, and contributing to the vibrant community of Maui.

As Maui continues to thrive and evolve, its property tax system will play a pivotal role in shaping the island's future. By staying informed, engaged, and proactive, property owners can navigate this complex landscape with confidence, ensuring a bright and sustainable future for Maui and its residents.

How is Maui’s property tax calculated?

+

Maui’s property tax is calculated based on the property’s assessed value, which is determined by the Real Property Tax Division. The assessed value is then subjected to a capped valuation, limiting the annual increase to a maximum of 3% or the percentage change in the Consumer Price Index (CPI), whichever is less. The tax rate is applied to the assessed value to determine the final tax amount.

What are the tax rates for different property types in Maui?

+

The tax rates in Maui vary depending on the property type. Residential properties have a tax rate of 0.25%, commercial properties have a rate of 0.35%, vacant land has a rate of 0.30%, and conservation land has a reduced rate of 0.20%.

How can I appeal my property’s assessed value in Maui?

+

If you believe your property’s assessed value is inaccurate, you can appeal by submitting evidence and arguments to the county’s Board of Review. It’s important to gather supporting documentation, such as recent appraisals or sales data, to strengthen your case.

What happens if I don’t pay my property taxes on time in Maui?

+

Late payment of property taxes in Maui can result in penalties and interest charges. The county may also place a tax lien on the property, impacting the owner’s ability to sell or refinance. In extreme cases, the county may initiate foreclosure proceedings to recover the unpaid taxes.

Are there any exemptions or incentives available for property owners in Maui?

+

Yes, Maui offers several exemptions and incentives to property owners. The homestead exemption reduces the taxable value for homeowners who occupy their property as their primary residence. The conservation land tax rate provides a reduced tax rate for properties designated for environmental conservation or agricultural use. Property owners should explore these options to maximize their tax savings.