Tennessee Property Taxes

Tennessee's property tax system plays a crucial role in the state's economy, impacting both residents and businesses. Understanding the intricacies of this tax system is essential for property owners, investors, and anyone interested in the financial landscape of the Volunteer State. In this comprehensive guide, we will delve into the specifics of Tennessee property taxes, exploring rates, assessments, exemptions, and more.

Understanding Tennessee’s Property Tax Landscape

Tennessee’s property tax system is a vital source of revenue for local governments, including counties, cities, and special districts. These taxes are used to fund essential services such as schools, fire protection, and infrastructure maintenance. The state’s unique tax structure, characterized by its lack of income tax, places a significant emphasis on property taxes to support public services.

The property tax system in Tennessee is primarily governed by local authorities, allowing for variations in tax rates and assessment practices across different counties and municipalities. This local control provides flexibility but also leads to a diverse landscape of property tax environments throughout the state.

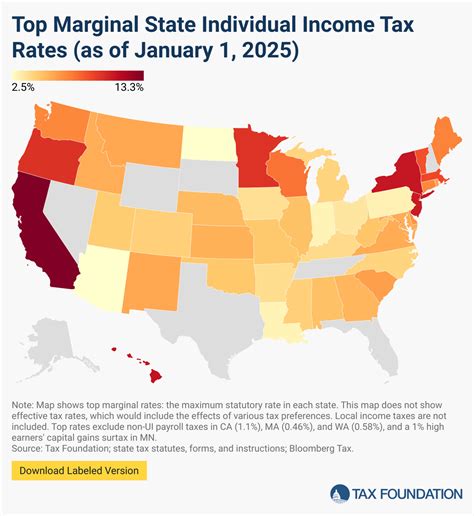

Property Tax Rates in Tennessee

Tennessee property tax rates are determined at the local level, with each county setting its own rate. These rates are typically expressed as “mills,” where one mill represents 1 of tax for every 1,000 of assessed property value. The specific millage rate can vary significantly from one county to another.

| County | Millage Rate (per $1,000) |

|---|---|

| Davidson County | 3.35 |

| Hamilton County | 2.68 |

| Shelby County | 3.85 |

| Knox County | 2.55 |

| Rutherford County | 2.80 |

For instance, a homeowner in Davidson County with a property assessed at $200,000 would pay an annual property tax of $670 (3.35 mills x $200,000 / 1,000). On the other hand, the same property in Hamilton County would result in a lower tax liability of $536 (2.68 mills x $200,000 / 1,000). These variations reflect the different budgetary needs and priorities of each county.

Property Assessment and Appraisal

Property assessment is a critical process in determining the taxable value of real estate in Tennessee. Local assessors are responsible for appraising properties, considering factors such as location, size, improvements, and market conditions. The assessed value is then used as the basis for calculating property taxes.

Tennessee follows a "mass appraisal" approach, where properties are valued collectively rather than individually. This method ensures uniformity in assessments and helps maintain fairness in the tax system. However, it also means that property owners have limited avenues for challenging individual assessments, as the focus is on overall market trends rather than specific property characteristics.

Property Tax Exemptions and Relief

Tennessee offers various exemptions and relief programs to alleviate the tax burden on certain property owners. These include:

- Homestead Exemption: This exemption reduces the taxable value of a homeowner's primary residence, providing a significant tax savings. The exact amount of the exemption varies by county but typically ranges from $4,000 to $15,000.

- Senior Citizen Exemption: Property owners aged 65 or older may qualify for a reduction in their property taxes if their income falls below a certain threshold. This exemption aims to assist older Tennesseans in maintaining their homes.

- Disabled Veteran Exemption: Qualified disabled veterans can receive a partial or full exemption from property taxes, depending on the extent of their disability.

- Agricultural and Forestland Exemptions: Property used for agricultural or forest purposes may be eligible for reduced assessments, encouraging the preservation of open spaces and natural resources.

These exemptions and relief programs play a crucial role in ensuring that property taxes remain manageable for a wide range of Tennesseans, from homeowners to veterans and farmers.

The Impact of Tennessee’s Property Tax System

Tennessee’s property tax system has a profound impact on the state’s economy and its residents’ financial well-being. The variations in tax rates and assessment practices across counties can influence real estate markets, attracting or deterring investors and homeowners.

For instance, counties with lower tax rates may be more appealing to buyers seeking lower long-term costs, while counties with higher rates may offer more robust public services funded by these taxes. This dynamic creates a complex relationship between property taxes, local economies, and the quality of life in different regions of Tennessee.

Real-World Examples of Property Tax Scenarios

Let’s explore a couple of hypothetical scenarios to illustrate the practical implications of Tennessee’s property tax system:

Imagine two homeowners, Jane and John, each owning a home in different counties. Jane's home is located in Davidson County, while John's home is in Hamilton County.

Both homes have an assessed value of $300,000. However, due to the difference in millage rates, Jane pays an annual property tax of $945 (3.35 mills x $300,000 / 1,000), while John pays $732 (2.68 mills x $300,000 / 1,000). This disparity in tax liability, despite identical property values, highlights the impact of local tax rates on individual financial responsibilities.

Furthermore, let's consider a business owner, Sarah, who is evaluating potential locations for her new manufacturing facility. She is considering two counties: Shelby County, with a higher tax rate, and Rutherford County, with a lower rate. While Shelby County may offer more comprehensive public services, Rutherford County's lower taxes could provide a more attractive financial environment for her business.

These real-world examples demonstrate how Tennessee's property tax system influences not only individual homeowners but also businesses and investors, shaping their decisions and the overall economic landscape of the state.

Future Outlook and Considerations

As Tennessee continues to evolve economically and demographically, its property tax system will likely face ongoing scrutiny and potential reforms. Here are some key considerations for the future:

- Revenue Adequacy and Equity: Ensuring that property taxes generate sufficient revenue to fund essential public services while maintaining fairness and equity among taxpayers is a continuous challenge. As the state's population and economy grow, striking the right balance between revenue generation and taxpayer burden will be crucial.

- Tax Reform Proposals: Proposals for tax reform, including changes to assessment practices and tax rates, may arise to address concerns about fairness and efficiency. These reforms could impact the way property taxes are calculated and collected, potentially affecting taxpayers across the state.

- Exemption and Relief Updates: The state and local governments may reevaluate existing exemptions and relief programs to ensure they align with current needs and demographics. This could involve expanding or modifying these programs to better support vulnerable populations or promote specific economic goals.

- Impact of Economic Shifts: Tennessee's economy is dynamic, with industries evolving and populations shifting. These changes can influence property values and tax bases, necessitating adjustments to tax policies to maintain stability and support local economies.

Staying informed about these developments and understanding their potential impact is essential for property owners, investors, and policymakers in Tennessee.

How often are property taxes assessed in Tennessee?

+

Property taxes in Tennessee are typically assessed annually. Local assessors conduct regular reappraisals to ensure property values remain up-to-date and accurately reflect the current market.

Are there any appeals processes for property tax assessments in Tennessee?

+

Yes, Tennessee provides avenues for property owners to appeal their assessments. The process involves submitting an appeal to the local Board of Equalization, which reviews and makes decisions on such cases. It’s essential to understand the timelines and requirements for these appeals.

How do property tax rates impact real estate investment in Tennessee?

+

Property tax rates can significantly influence investment decisions. Lower tax rates may attract investors seeking to minimize long-term expenses, while higher rates could impact the profitability of real estate ventures. It’s crucial for investors to consider tax implications alongside other factors when evaluating potential investments.