Tax Planning Services

Tax planning is a crucial aspect of financial management, impacting individuals and businesses alike. With the complex nature of tax laws and regulations, many seek professional assistance to navigate the intricacies and optimize their financial strategies. In this comprehensive guide, we delve into the world of tax planning services, exploring their importance, the benefits they offer, and how they can be a valuable asset in achieving financial goals.

Understanding Tax Planning Services

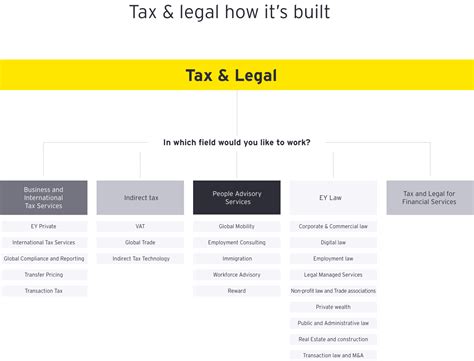

Tax planning services encompass a range of strategies and advisory services aimed at minimizing an individual’s or business’s tax liability while ensuring compliance with applicable tax laws. These services are typically provided by tax professionals, such as certified public accountants (CPAs) or tax attorneys, who possess in-depth knowledge of tax regulations and can offer tailored advice based on specific financial circumstances.

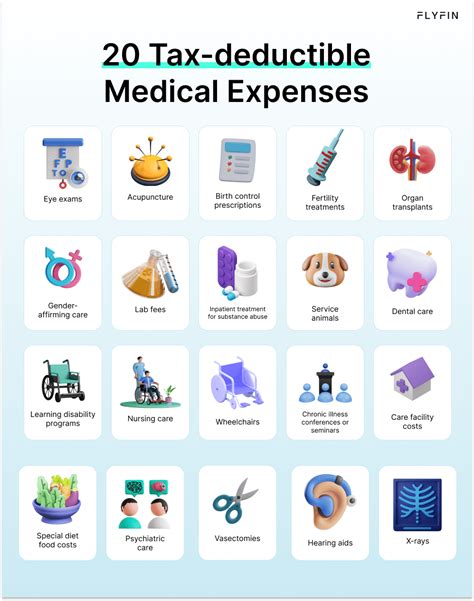

The primary objective of tax planning is to identify and implement legal strategies that reduce the overall tax burden. This involves a thorough analysis of an individual's or entity's financial situation, including income sources, investments, deductions, credits, and potential tax-saving opportunities. By proactively planning, tax professionals can help clients make informed decisions to maximize tax efficiency and minimize the risk of audits or penalties.

The Benefits of Engaging Tax Planning Services

Engaging tax planning services offers a multitude of benefits, ensuring that individuals and businesses can make the most of their financial resources while adhering to tax regulations.

Expertise and Knowledge

Tax laws are intricate and constantly evolving. Tax planning professionals possess the expertise to navigate these complexities, ensuring that clients remain compliant with the latest regulations. Their in-depth knowledge of tax codes, deductions, and credits allows them to provide accurate and tailored advice, optimizing financial strategies to achieve the best possible tax outcomes.

Strategic Tax Planning

Tax planning services involve a proactive approach to managing taxes. By analyzing a client’s financial situation in advance, tax professionals can identify potential tax-saving opportunities and develop strategies to take advantage of them. This may include optimizing investment strategies, structuring business transactions, or utilizing specific tax-saving provisions to minimize tax liability.

For instance, a tax planner might suggest deferring income to a later tax year when tax rates are expected to be lower or recommend investing in tax-efficient assets to reduce the overall tax burden. These strategic decisions can have a significant impact on an individual's or business's financial health and long-term financial goals.

Compliance and Risk Management

Tax compliance is a critical aspect of financial management. Non-compliance can lead to severe penalties, fines, and even legal consequences. Tax planning services ensure that individuals and businesses remain compliant with tax laws, reducing the risk of audits and potential financial penalties. Tax professionals can guide clients through the complex web of tax regulations, helping them understand their obligations and navigate potential pitfalls.

Personalized Advice

Every individual and business has unique financial circumstances and goals. Tax planning services offer personalized advice tailored to these specific needs. Whether it’s maximizing deductions for a high-income individual, optimizing tax strategies for a small business, or planning for retirement, tax professionals can provide customized solutions to achieve the desired financial outcomes.

Time and Resource Efficiency

Engaging tax planning services can save individuals and businesses valuable time and resources. Tax professionals handle the complex tasks of analyzing financial data, researching tax laws, and preparing tax returns, freeing up clients to focus on their core activities or personal lives. This efficiency can be particularly beneficial for busy professionals or business owners who may not have the expertise or time to dedicate to tax matters.

Continuous Support and Updates

Tax laws are subject to frequent changes and updates. Tax planning services provide ongoing support and guidance to ensure that clients stay informed and adapt their strategies accordingly. Tax professionals monitor legislative changes, tax court rulings, and other developments that may impact tax obligations, keeping their clients ahead of the curve and ensuring their financial plans remain compliant and optimized.

The Role of Tax Planners in Different Scenarios

Tax planning services cater to a wide range of individuals and entities, each with unique financial circumstances and goals. Let’s explore some specific scenarios where tax planning can make a significant difference.

Individuals and Families

For individuals and families, tax planning can help maximize deductions, credits, and exemptions to reduce tax liability. Tax planners can assist with strategies such as optimizing charitable contributions, utilizing education credits, or planning for retirement to minimize taxes on investment income. Additionally, tax planning can be crucial for high-net-worth individuals who face unique tax challenges and opportunities.

Small Businesses and Startups

Small businesses and startups often face complex tax considerations, from choosing the right business structure to managing payroll taxes and deductions. Tax planning services can guide business owners through these complexities, ensuring compliance and providing strategies to minimize tax obligations. Tax planners can also assist with tax-efficient business transactions, such as acquisitions or expansions, to optimize financial outcomes.

Large Corporations

Large corporations operate in a highly regulated tax environment, with numerous tax considerations and potential exposures. Tax planning services for corporations involve sophisticated strategies, including transfer pricing, international tax planning, and tax-efficient structuring of business operations. Tax planners work closely with corporate finance teams to ensure tax efficiency and compliance on a global scale.

Nonprofit Organizations

Nonprofit organizations have unique tax obligations and benefits. Tax planning services for nonprofits focus on ensuring compliance with tax-exempt status requirements, managing unrelated business income, and optimizing fundraising and donation strategies from a tax perspective. Tax planners can help nonprofits maximize their financial resources while adhering to tax regulations.

Real Estate Investors

Real estate investors face specific tax considerations, including capital gains taxes, depreciation, and tax implications of rental income. Tax planning services for real estate investors involve strategies to minimize tax liability on investment properties, such as utilizing 1031 exchanges to defer taxes or implementing cost segregation studies to accelerate depreciation deductions.

The Tax Planning Process: A Step-by-Step Guide

Engaging tax planning services typically involves a structured process to ensure a comprehensive and tailored approach. Here’s a step-by-step guide to understanding how tax planning works.

Initial Consultation

The tax planning process begins with an initial consultation, where the tax planner meets with the client to understand their financial situation, goals, and concerns. This consultation allows the tax planner to assess the client’s needs and determine the scope of the engagement.

Data Collection and Analysis

Once the engagement is established, the tax planner will collect relevant financial data, including income statements, expense records, investment portfolios, and tax returns from previous years. This data is analyzed to gain a comprehensive understanding of the client’s financial position and identify potential tax-saving opportunities.

Strategy Development

Based on the analysis, the tax planner develops a tailored tax strategy that aligns with the client’s goals and financial circumstances. This strategy may involve optimizing deductions, credits, or tax-efficient investments. The tax planner considers the client’s short-term and long-term financial objectives to create a comprehensive plan.

Implementation and Compliance

The tax planner works closely with the client to implement the developed tax strategy. This may involve making adjustments to investment portfolios, structuring business transactions, or filing specific tax forms. Throughout the process, the tax planner ensures compliance with tax laws and regulations, providing guidance and support to the client.

Monitoring and Adjustments

Tax planning is an ongoing process, and tax laws may change or client circumstances may evolve. The tax planner continuously monitors the client’s financial situation and tax environment, making necessary adjustments to the tax strategy. This ensures that the client’s tax obligations remain optimized and compliant with the latest regulations.

Performance Analysis and Review

Periodically, the tax planner conducts a performance analysis to evaluate the effectiveness of the tax strategy. This analysis considers the client’s financial goals, tax obligations, and overall financial health. The tax planner reviews the strategy’s success and makes recommendations for further optimization, ensuring that the client’s tax planning remains aligned with their evolving needs.

Choosing the Right Tax Planning Service Provider

Selecting the right tax planning service provider is crucial to ensuring effective tax management and achieving financial goals. Here are some key considerations when choosing a tax planning professional.

Experience and Expertise

Look for tax planning professionals with extensive experience in the specific area of tax planning you require. Whether it’s individual tax planning, business tax strategies, or international tax considerations, choose a provider with a proven track record in that domain. Ensure they possess the necessary certifications and credentials, such as being a CPA or tax attorney.

Personalized Approach

Tax planning is highly individualized. Seek a provider who takes the time to understand your unique financial situation, goals, and concerns. A personalized approach ensures that the tax planner can develop a tailored strategy that aligns with your specific needs, whether you’re an individual investor, a small business owner, or a large corporation.

Communication and Accessibility

Effective communication is essential in tax planning. Choose a provider who is responsive and accessible throughout the tax planning process. Ensure they provide regular updates and are available to address your questions or concerns promptly. Clear and open communication ensures that you remain informed and involved in the decision-making process.

Reputation and References

Research the reputation of the tax planning service provider. Look for reviews, testimonials, and references from their past clients. A reputable provider will have a positive track record and a history of satisfied clients. Don’t hesitate to ask for references and reach out to former clients to understand their experience working with the provider.

Fee Structure and Transparency

Understand the fee structure of the tax planning service provider. Ensure they provide a clear and transparent breakdown of their fees, including any potential additional costs or hidden charges. Discuss the scope of the engagement and the services included in the fee to ensure you’re aware of what you’re paying for and that it aligns with your budget and expectations.

The Future of Tax Planning: Emerging Trends and Technologies

The field of tax planning is evolving with advancements in technology and changing tax landscapes. Here are some emerging trends and technologies shaping the future of tax planning services.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are transforming tax planning by automating data analysis and providing insights. AI-powered tax planning tools can analyze vast amounts of data quickly, identifying potential tax-saving opportunities and optimizing tax strategies. These technologies enhance the efficiency and accuracy of tax planning, enabling tax professionals to provide even more tailored advice.

Blockchain and Cryptocurrency Taxation

The rise of blockchain technology and cryptocurrencies has introduced unique tax considerations. Tax planning services are adapting to address the complex taxation of digital assets. Tax planners are developing strategies to manage cryptocurrency transactions, calculate capital gains taxes, and ensure compliance with evolving regulations in this emerging field.

Remote Work and Global Tax Considerations

The shift to remote work and the increasing globalization of businesses have led to new tax challenges. Tax planning services are expanding their expertise to address global tax considerations, such as cross-border transactions, remote worker taxation, and international tax treaties. Tax planners are guiding clients through the complexities of operating across borders and ensuring compliance with diverse tax regimes.

Sustainable and Impact Investing

Sustainable and impact investing is gaining traction, with investors seeking opportunities that align with their values and have a positive social or environmental impact. Tax planning services are incorporating strategies to optimize tax efficiency for these types of investments. Tax planners are exploring tax-efficient structures and incentives to support sustainable investing while maximizing financial returns.

Data-Driven Tax Planning

Tax planning is becoming increasingly data-driven, with tax professionals leveraging advanced analytics to identify patterns and trends in tax data. By analyzing large datasets, tax planners can make more informed decisions and provide evidence-based recommendations. Data-driven tax planning enhances the accuracy and effectiveness of tax strategies, allowing for better financial planning and decision-making.

Conclusion: Navigating the Tax Landscape with Confidence

Tax planning services are an invaluable asset for individuals and businesses seeking to optimize their financial strategies and navigate the complex tax landscape. By engaging tax professionals, clients can benefit from expertise, strategic planning, and personalized advice to minimize tax obligations and achieve their financial goals.

As tax laws continue to evolve, staying ahead of the curve and adapting to emerging trends is crucial. Tax planning services provide ongoing support and guidance, ensuring compliance and financial efficiency in a dynamic tax environment. With the right tax planning strategies in place, individuals and businesses can confidently manage their taxes and focus on their core objectives.

How often should I engage tax planning services?

+The frequency of engaging tax planning services depends on your individual or business circumstances. For individuals, annual tax planning is recommended to review income, deductions, and credits and ensure compliance with the latest tax laws. Businesses may require more frequent tax planning, especially if they undergo significant changes, such as expansions or acquisitions.

Can tax planning services help me with international tax considerations?

+Absolutely! Tax planning services are well-equipped to handle international tax considerations. Tax planners with expertise in cross-border transactions and international tax laws can guide you through the complexities of operating globally, ensuring compliance and optimizing tax strategies across different jurisdictions.

What are some common tax-saving strategies for small businesses?

+Small businesses can benefit from various tax-saving strategies, including maximizing deductions for business expenses, utilizing tax-efficient business structures, and optimizing payroll tax strategies. Tax planning services can provide tailored advice to small businesses, helping them reduce tax liabilities and improve cash flow.

How do tax planning services handle tax audits and disputes?

+Tax planning services often include support during tax audits and disputes. Tax professionals can assist in preparing for audits, responding to tax authorities, and representing clients in tax court if necessary. Their expertise in tax law and regulations ensures a strategic approach to resolving tax-related issues.

Can tax planning services assist with estate planning and wealth preservation?

+Yes, tax planning services play a crucial role in estate planning and wealth preservation. Tax planners can help individuals structure their assets and estates to minimize tax liabilities upon inheritance or transfer. They can also provide guidance on gift-tax strategies and trust arrangements to ensure the efficient transfer of wealth to future generations.