Ohio Tax Exemption Form

The Ohio Tax Exemption Form is an essential document for businesses and individuals residing in the state of Ohio, as it allows them to claim tax exemptions and reduce their taxable obligations. This form plays a crucial role in the state's tax system, impacting the financial landscape for both taxpayers and the government. In this comprehensive article, we will delve into the intricacies of the Ohio Tax Exemption Form, exploring its purpose, eligibility criteria, the application process, and its broader implications for the Ohio economy.

Understanding the Ohio Tax Exemption Form

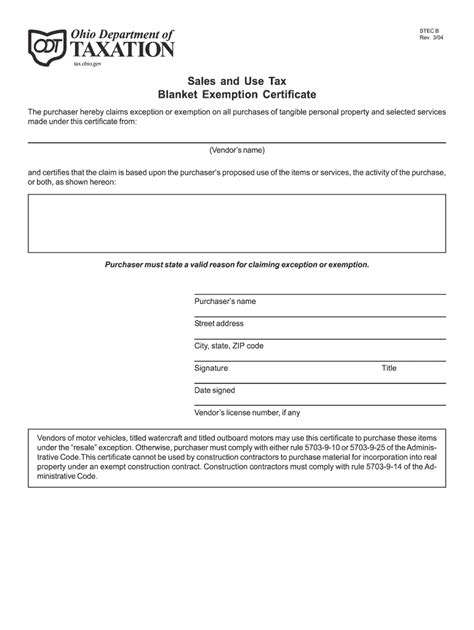

The Ohio Tax Exemption Form, officially known as Form ST-105, is a legal document that enables eligible taxpayers to claim specific exemptions from Ohio’s sales and use taxes. These exemptions can significantly impact a business’s or individual’s financial standing, making it a vital aspect of tax planning and compliance.

Ohio's tax system is designed to generate revenue for the state, supporting various public services and infrastructure projects. However, the state recognizes the need to provide relief to certain sectors or individuals, leading to the introduction of tax exemptions. These exemptions are carefully crafted to encourage economic growth, support specific industries, and provide assistance to vulnerable populations.

Eligibility Criteria and Types of Exemptions

Eligibility for the Ohio Tax Exemption Form varies depending on the type of exemption being claimed. Here are some of the common categories of exemptions and their eligibility requirements:

- Sales Tax Exemptions for Businesses: Businesses involved in manufacturing, research and development, or certain wholesale activities may qualify for sales tax exemptions. To be eligible, businesses must demonstrate that their operations fall within the defined criteria and adhere to specific guidelines outlined by the Ohio Department of Taxation.

- Use Tax Exemptions for Non-Profits: Non-profit organizations, including charities, educational institutions, and religious groups, can claim use tax exemptions for qualified purchases. These exemptions ensure that non-profits can dedicate more resources to their missions rather than paying taxes on essential equipment and supplies.

- Sales and Use Tax Exemptions for Government Entities: State and local government agencies, as well as certain political subdivisions, are entitled to sales and use tax exemptions. This allows government bodies to manage public funds more efficiently and ensure that taxpayer dollars are allocated effectively.

- Resale Exemptions: Businesses engaged in reselling goods, such as retailers and wholesalers, are exempt from sales tax on their purchases. This exemption encourages economic activity by reducing the tax burden on businesses involved in the supply chain.

- Agricultural Exemptions: Ohio's agricultural sector benefits from specific exemptions, including sales tax exemptions on agricultural equipment, feed, and other essential supplies. These exemptions support the state's agricultural industry and help farmers manage their costs.

It's important to note that each exemption category has its own set of rules and requirements. Taxpayers must thoroughly understand these guidelines to ensure they meet the criteria and correctly apply for the appropriate exemptions.

The Application Process

Applying for the Ohio Tax Exemption Form involves a series of steps to ensure a smooth and accurate process. Here’s an overview of the typical application journey:

Step 1: Determining Eligibility

The first step is to carefully review the eligibility criteria for the desired exemption. Taxpayers should refer to official guidelines provided by the Ohio Department of Taxation, which offer detailed explanations of each exemption category and the necessary qualifications.

Step 2: Completing the Form

Once eligibility is confirmed, taxpayers can access the Ohio Tax Exemption Form, either through the official Ohio government website or by requesting a physical copy. The form requires detailed information about the taxpayer, including business details, tax identification numbers, and specific details related to the claimed exemption.

Taxpayers should ensure that all information provided is accurate and complete. Incomplete or incorrect applications may lead to delays or rejection, impacting the taxpayer's ability to benefit from the exemption.

Step 3: Supporting Documentation

Depending on the exemption type, taxpayers may need to provide supporting documentation to validate their eligibility. This could include business licenses, certificates of incorporation, or other official documents that demonstrate compliance with the exemption criteria.

Step 4: Submission and Processing

After completing the form and gathering all necessary documentation, taxpayers must submit their application to the Ohio Department of Taxation. This can be done electronically or by mail, depending on the taxpayer’s preference and the specific exemption requirements.

The processing time for tax exemption applications varies. Taxpayers should anticipate a waiting period while their application is reviewed and approved. During this time, it's crucial to maintain accurate records and be prepared to provide additional information if requested by the department.

Step 5: Renewal and Updates

Most tax exemptions in Ohio are not permanent and require periodic renewal. Taxpayers should stay informed about renewal deadlines and update their information as needed to maintain their exemption status. Failure to renew or provide accurate updates may result in the loss of the exemption.

Impact and Benefits of Tax Exemptions

The Ohio Tax Exemption Form and the exemptions it facilitates have a significant impact on the state’s economy and individual taxpayers. Here are some key benefits and implications:

Economic Growth and Development

Tax exemptions play a crucial role in stimulating economic growth. By reducing the tax burden on specific sectors, Ohio encourages investment, job creation, and innovation. This, in turn, attracts businesses and investors, fostering a vibrant and competitive business environment.

Support for Vulnerable Populations

Exemptions for non-profits and government entities ensure that essential services, such as education, healthcare, and social welfare, receive the necessary funding. This support helps vulnerable communities access critical resources and improves overall quality of life.

Efficient Tax Administration

The exemption system simplifies tax administration by categorizing taxpayers and providing clear guidelines for compliance. This reduces the complexity of tax filing, allowing taxpayers to focus on their core activities and ensuring a more efficient tax collection process.

Potential Challenges and Considerations

While tax exemptions offer numerous benefits, there are also considerations and challenges to be aware of. Some potential issues include:

- Complexity: Navigating the exemption system can be complex, especially for small businesses or individuals unfamiliar with tax regulations. Taxpayers may need assistance from tax professionals to ensure they claim the right exemptions.

- Administrative Burden: Managing exemption applications and renewals can be time-consuming for both taxpayers and tax authorities. Streamlining the process and providing clear guidance can help alleviate this burden.

- Equity Concerns: The distribution of tax exemptions may raise equity concerns if certain sectors or populations receive more benefits than others. Policymakers must carefully balance the distribution of exemptions to ensure fairness.

Looking Ahead: The Future of Ohio’s Tax Exemptions

As Ohio’s economy continues to evolve, so too will its tax exemption system. Here are some potential future developments and trends to consider:

Digital Transformation

The Ohio Department of Taxation is likely to embrace digital technologies to streamline the application and renewal process. This could include online portals for real-time tracking, electronic document submission, and improved data security.

Policy Updates

Tax policies are subject to change, and Ohio may introduce new exemptions or modify existing ones to align with economic priorities. Taxpayers should stay informed about any policy updates to ensure they can maximize their benefits.

Community Engagement

Engaging with taxpayers and community stakeholders can help identify areas where exemptions could be improved or expanded. This collaborative approach ensures that tax policies remain responsive to the needs of Ohio’s diverse population.

In Conclusion

The Ohio Tax Exemption Form is a powerful tool for businesses and individuals to navigate Ohio’s tax landscape. By understanding the eligibility criteria, application process, and the broader implications of tax exemptions, taxpayers can make informed decisions to optimize their financial strategies. As Ohio continues to evolve, its tax exemption system will play a pivotal role in shaping the state’s economic future.

How often should I renew my tax exemptions in Ohio?

+Renewal periods vary depending on the type of exemption. Some exemptions require annual renewal, while others may have longer periods. It’s essential to check the specific guidelines for your exemption to ensure timely renewal.

Can I apply for multiple tax exemptions simultaneously?

+Yes, you can apply for multiple exemptions as long as you meet the eligibility criteria for each. However, it’s important to carefully review the application requirements and ensure you provide all necessary documentation for each exemption.

Are there any penalties for claiming incorrect exemptions?

+Claiming incorrect exemptions can result in penalties and interest charges. It’s crucial to thoroughly understand the eligibility criteria and seek professional advice if needed to avoid potential issues.