How Does No Tax On Overtime Work

Welcome to a comprehensive exploration of the concept of "No Tax on Overtime," a system designed to incentivize and reward hard work, boost productivity, and provide financial benefits to employees who go the extra mile. This article will delve into the mechanics, advantages, potential challenges, and real-world implications of such a system.

The "No Tax on Overtime" System: Unlocking Productivity

The idea of a "No Tax on Overtime" system is a bold move to redefine the relationship between work and taxation. At its core, this system proposes that any income earned through overtime work should be exempt from certain taxes, thus offering a direct financial incentive to employees willing to put in extra hours.

In traditional tax systems, overtime pay is often taxed at the same rate as regular income, which can result in a significant portion of overtime earnings being deducted as taxes. The "No Tax on Overtime" system aims to change this dynamic by introducing a tax-free zone for overtime earnings, encouraging employees to embrace additional work opportunities without the fear of excessive tax deductions.

Understanding the Mechanics

The implementation of a "No Tax on Overtime" system involves a careful redesign of tax laws and regulations. Here's a simplified breakdown of how it might work:

- Overtime Definition: First, a clear definition of overtime work is established. This could include any work hours exceeding a standard 40-hour workweek or specific thresholds set by the employer or governing bodies.

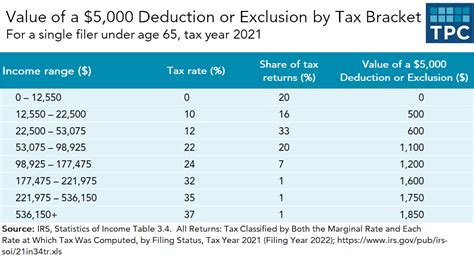

- Tax-Free Threshold: A threshold amount is set for overtime earnings. Any income earned beyond this threshold would be considered "overtime income" and eligible for tax exemption.

- Exemption Limits: To prevent abuse and maintain fiscal responsibility, there would likely be limits to the amount of overtime income that can be exempt from taxes each year.

- Reporting and Compliance: Employers would be responsible for accurately tracking and reporting overtime hours and earnings to ensure compliance with the tax-free system.

For instance, consider a scenario where the tax-free threshold is set at $1000 per month for overtime income. If an employee earns $1500 in overtime pay, they would be exempt from taxes on the first $1000, and only the remaining $500 would be subject to regular taxation.

| Overtime Income | Tax-Free Amount | Taxable Amount |

|---|---|---|

| $1500 | $1000 | $500 |

Real-World Examples

While a "No Tax on Overtime" system is not widely implemented, certain countries and industries have experimented with similar concepts. For example, in the United States, some states offer tax incentives for overtime work in specific sectors, such as the oil and gas industry in Texas.

In addition, certain professions, like truck drivers and sales representatives, often have variable income structures where earnings above a certain threshold are taxed at a lower rate. While not a complete exemption, these examples demonstrate the potential for tax systems to incentivize specific types of work.

Advantages of a "No Tax on Overtime" System

A "No Tax on Overtime" system has the potential to bring about several benefits for both employers and employees:

Incentivizing Productivity

By offering a direct financial reward for overtime work, this system encourages employees to increase their productivity and take on additional responsibilities. This can lead to higher output and efficiency, especially in industries where overtime is common.

Employee Retention and Morale

Employees who feel valued and rewarded for their hard work are more likely to stay with a company. A tax-free overtime system can boost employee morale, leading to reduced turnover rates and a more loyal workforce.

Economic Stimulus

Exempting overtime income from taxes can put more money into the pockets of workers, stimulating consumer spending and boosting the economy. This is particularly beneficial during economic downturns, as it can help sustain consumer demand.

Tax Efficiency

A well-designed "No Tax on Overtime" system could simplify tax calculations for both employees and employers. By clearly defining the tax-free threshold and exemption limits, tax compliance becomes more straightforward.

Potential Challenges and Considerations

While the concept is appealing, a "No Tax on Overtime" system also presents several challenges and considerations that need careful attention:

Revenue Loss for Governments

Exempting overtime income from taxes would result in a loss of revenue for governments. This loss could impact public services and infrastructure, requiring careful fiscal planning to mitigate potential negative effects.

Fairness and Equity

Implementing a "No Tax on Overtime" system may raise concerns about fairness, especially if certain professions or industries are excluded. Ensuring that the system is equitable and does not disproportionately benefit specific groups is crucial.

Potential Exploitation

Without proper regulations, a tax-free overtime system could be exploited by employers. It's essential to establish clear guidelines to prevent employers from abusing the system by encouraging excessive overtime or using it as a substitute for fair wage increases.

Impact on Regular Income

If overtime earnings become significantly more lucrative due to tax exemptions, employees may be incentivized to prioritize overtime work over regular duties, potentially disrupting workflow and team dynamics.

Future Implications and Alternative Approaches

As we look to the future, the "No Tax on Overtime" system could evolve in several directions:

Hybrid Models

A potential compromise could be a hybrid system where overtime income is taxed at a lower rate, rather than being completely exempt. This approach maintains revenue for governments while still offering a financial incentive to employees.

Industry-Specific Exemptions

Rather than a blanket exemption, governments could consider industry-specific exemptions where overtime is particularly common, such as healthcare or manufacturing.

Performance-Based Incentives

Shifting focus from hours worked to performance, some companies offer performance-based incentives or bonuses that are exempt from taxes. This approach rewards productivity and results rather than simply incentivizing longer work hours.

Work-Life Balance Considerations

In an era where work-life balance is a priority, it's essential to consider the potential impact of a "No Tax on Overtime" system on employees' well-being. Encouraging excessive overtime work may lead to burnout and negatively impact long-term health and productivity.

Conclusion

The concept of "No Tax on Overtime" presents an intriguing approach to incentivizing hard work and boosting productivity. While it offers several advantages, it also raises important questions and challenges that must be addressed to ensure a fair and effective system. As we continue to explore innovative ways to improve the relationship between work and taxation, the "No Tax on Overtime" system serves as a thought-provoking idea with the potential to shape future labor policies.

How would a “No Tax on Overtime” system impact employees’ take-home pay?

+

A “No Tax on Overtime” system would increase employees’ take-home pay for overtime work. For example, if an employee’s regular income is taxed at 25%, and they earn 500 in overtime pay, they would typically take home 375. With a tax-free system, they would receive the full $500, resulting in a higher net income.

Are there any countries that have successfully implemented a “No Tax on Overtime” system?

+

While no country has a complete “No Tax on Overtime” system, certain industries or professions in various countries have tax incentives for overtime work. For instance, some European countries offer tax breaks for overtime work in specific sectors, such as construction.

How can governments ensure a “No Tax on Overtime” system doesn’t lead to excessive overtime exploitation by employers?

+

To prevent exploitation, governments can implement regulations that limit the number of overtime hours an employee can work and require employers to provide sufficient rest periods. Additionally, collective bargaining and strong labor laws can protect employees’ rights and ensure fair practices.