York County Sc Property Tax

York County, located in the state of South Carolina, has a robust property tax system that contributes significantly to its local economy and plays a crucial role in funding essential public services. This article aims to delve into the intricacies of York County's property tax, shedding light on its assessment process, tax rates, exemptions, and the impact it has on residents and businesses alike. By exploring these aspects, we can gain a comprehensive understanding of the role property taxes play in shaping the financial landscape of this vibrant county.

Understanding York County’s Property Tax Landscape

York County, with its picturesque landscapes and thriving communities, relies on property taxes as a primary source of revenue to support various public initiatives. These taxes are essential for funding critical services such as education, infrastructure development, public safety, and community programs. The property tax system in York County is designed to ensure fairness and transparency, with clear guidelines and assessment processes in place.

Property Assessment Process

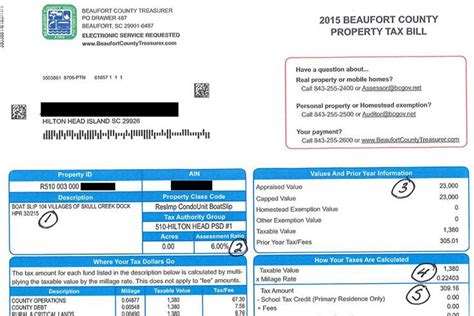

The first step in understanding York County’s property tax is to examine how properties are assessed. The county employs a team of skilled assessors who are responsible for evaluating the value of each property within the county’s boundaries. This process typically involves physical inspections, market analysis, and the consideration of various factors such as location, size, condition, and recent sales data.

Assessors utilize standardized methods to ensure consistency and accuracy in their valuations. They take into account the property’s unique features, such as the number of bedrooms, bathrooms, and any recent improvements or renovations. This meticulous approach helps in determining the fair market value of each property, which serves as the basis for calculating the property tax.

Tax Rates and Calculations

York County’s property tax rates are determined by the local government and can vary based on the type of property and its location within the county. These rates are expressed as millage rates, where one mill represents one dollar of tax for every 1,000 of assessed property value. The millage rate is then applied to the assessed value of the property to calculate the annual tax amount.</p> <p>For instance, if a residential property in York County has an assessed value of 200,000 and the millage rate is set at 200 mills, the annual property tax due would be calculated as follows:

| Assessed Value | Millage Rate | Annual Property Tax |

|---|---|---|

| 200,000</td> <td>200 mills</td> <td>4,000 |

It’s important to note that the millage rate can fluctuate annually, influenced by factors such as the county’s budget requirements and the need to maintain essential services. Residents and property owners can stay informed about the current tax rates by referring to official county websites or contacting the local tax assessor’s office.

Exemptions and Discounts

York County offers various exemptions and discounts to eligible property owners, aiming to alleviate the financial burden of property taxes for certain groups. These exemptions are designed to support homeowners, veterans, seniors, and individuals with specific circumstances.

- Homestead Exemption: York County provides a homestead exemption for primary residences. This exemption reduces the assessed value of the property, resulting in lower property taxes. To qualify, homeowners must meet specific residency and income criteria.

- Veteran’s Exemption: Veterans who meet certain criteria, such as having a service-connected disability or being honorably discharged, may be eligible for a property tax exemption. This exemption recognizes the service and sacrifice of our veterans and helps ease their financial obligations.

- Senior Citizen Discount: York County offers a discounted tax rate for senior citizens aged 65 and above. This discount aims to provide financial relief to seniors who have contributed significantly to the community throughout their lives.

- Other Exemptions: Additionally, York County may offer exemptions for properties used for agricultural purposes, historical preservation, or for individuals with disabilities. These exemptions encourage the preservation of heritage and support the local agricultural industry.

Impact on Residents and Businesses

Property taxes in York County have a direct impact on both residents and businesses. For homeowners, property taxes contribute to the overall cost of homeownership. While these taxes can be a significant expense, they also provide the necessary funds to maintain and improve public services, ensuring a high quality of life for residents.

Businesses operating within York County also bear the responsibility of paying property taxes on their commercial properties. These taxes contribute to the economic development of the county, supporting infrastructure, education, and other initiatives that benefit the business community. Additionally, the county’s competitive tax rates can attract new businesses and promote economic growth.

Managing Property Taxes: Tips and Strategies

Understanding and managing property taxes is essential for both homeowners and business owners in York County. Here are some tips and strategies to help navigate the property tax landscape effectively:

Stay Informed and Communicate

Keep yourself updated on the latest tax rates, assessment processes, and any changes or initiatives introduced by the county. Attend local government meetings, subscribe to official newsletters, and utilize online resources provided by the tax assessor’s office. Clear communication with the tax authorities can help address any concerns or queries you may have.

Understand Assessment Notices

When you receive an assessment notice, take the time to review it carefully. Ensure that the information, including the property’s assessed value and any applicable exemptions, is accurate. If you have any questions or believe there may be an error, reach out to the assessor’s office to seek clarification or request a review.

Appeal Assessment Values

If you feel that your property’s assessed value is unfair or inaccurate, you have the right to appeal. The assessment appeal process in York County provides a mechanism for property owners to challenge the assessed value and potentially reduce their tax liability. Gather evidence, such as recent sales data of similar properties, to support your case. Consult with a tax professional or attorney if needed.

Explore Tax Relief Programs

York County offers various tax relief programs and exemptions to eligible individuals and businesses. Research and understand the criteria for these programs to determine if you qualify. For instance, homeowners can explore the Homestead Exemption or the Senior Citizen Discount, while businesses may benefit from tax incentives for specific industries or economic development initiatives.

Consider Tax Planning Strategies

Engage with tax professionals or financial advisors to explore tax planning strategies that align with your goals and circumstances. They can provide insights into maximizing deductions, optimizing property ownership structures, and taking advantage of available tax credits or incentives. Effective tax planning can help minimize your overall tax burden and improve your financial position.

Conclusion: York County’s Property Tax System

York County’s property tax system is a vital component of its financial framework, ensuring the provision of essential services and contributing to the overall prosperity of the county. By understanding the assessment process, tax rates, exemptions, and their impact, residents and businesses can actively participate in the local economy and contribute to the community’s growth and development.

Stay informed, engage with local authorities, and explore the available resources to navigate the property tax landscape effectively. Together, we can foster a thriving community that benefits from a fair and transparent tax system.

What is the average property tax rate in York County, SC?

+The average property tax rate in York County varies depending on the municipality and the type of property. As of my last update in January 2023, the millage rate ranged from approximately 200 to 300 mills for residential properties and around 300 to 400 mills for commercial properties. It’s important to note that these rates can change annually, so it’s advisable to check with the York County Assessor’s Office for the most current information.

Are there any exemptions or discounts available for property taxes in York County?

+Yes, York County offers various exemptions and discounts to eligible property owners. These include the Homestead Exemption for primary residences, which reduces the assessed value of the property, and discounts for senior citizens and veterans. Additionally, the county may provide exemptions for agricultural properties and historical preservation initiatives. It’s recommended to consult the York County Assessor’s Office or a tax professional to determine your eligibility and understand the specific requirements.

How often are properties reassessed for tax purposes in York County?

+Properties in York County are typically reassessed every five years. However, certain circumstances, such as significant improvements or changes to the property, may trigger an earlier reassessment. It’s essential to stay informed about the assessment schedule and keep track of any changes that could impact your property’s valuation.