Are Real Estate Taxes Deductible

Real estate taxes, also known as property taxes, are an essential aspect of homeownership, and many homeowners wonder if these taxes can be deducted from their federal income taxes. In this comprehensive guide, we will delve into the world of real estate tax deductions, exploring the factors that influence their deductibility, the benefits they offer, and the process of claiming them. By understanding the intricacies of this topic, homeowners can make informed decisions to maximize their tax savings.

Understanding Real Estate Taxes

Real estate taxes are levied by local governments on the value of properties within their jurisdiction. These taxes are typically calculated as a percentage of the property's assessed value and are used to fund various public services and infrastructure, such as schools, roads, and emergency services. The amount of real estate tax owed can vary significantly based on the property's location, size, and other factors.

The deductibility of real estate taxes depends on several key factors, including the taxpayer's filing status, income level, and the nature of the property. Let's explore these factors in more detail to gain a comprehensive understanding.

Factors Influencing Real Estate Tax Deductibility

Filing Status and Income Level

The Internal Revenue Service (IRS) sets guidelines on who can deduct real estate taxes. Generally, taxpayers who itemize their deductions on Schedule A of their federal income tax return can claim these taxes. Itemizing deductions involves listing out eligible expenses separately instead of taking the standard deduction.

However, the Tax Cuts and Jobs Act (TCJA) implemented significant changes to tax deductions, including real estate taxes. Under the TCJA, the standard deduction was nearly doubled, making it less advantageous for many taxpayers to itemize. As a result, fewer homeowners now qualify to deduct real estate taxes, as they may find it more beneficial to take the standard deduction.

For example, consider a married couple filing jointly. If their total itemized deductions, including real estate taxes, amount to less than the standard deduction for their filing status, they may opt for the standard deduction and forego the real estate tax deduction.

Property Type and Use

The deductibility of real estate taxes also depends on the nature of the property and its intended use. Generally, homeowners can deduct real estate taxes on their primary residence, as well as on a second home or rental property.

For instance, let's consider a homeowner who owns a vacation home that they rent out for part of the year. The real estate taxes paid on this property can be deducted as a rental property expense, provided the homeowner meets the necessary criteria for deducting rental property expenses.

On the other hand, real estate taxes on investment properties or commercial real estate may be treated differently. These properties often have unique tax considerations, and the deductibility of taxes may be subject to specific rules and limitations.

Assessed Value and Tax Rate

The assessed value of the property and the corresponding tax rate play a crucial role in determining the amount of real estate tax owed. Properties with higher assessed values generally face higher tax bills, as the tax rate is applied to this assessed value.

For example, if a homeowner's property is assessed at $500,000 and the local tax rate is 1.5%, the real estate tax owed would be $7,500. In contrast, a property with an assessed value of $300,000 and the same tax rate would result in a tax bill of $4,500.

Understanding the assessed value and tax rate is essential for homeowners to estimate their potential tax liability and evaluate the impact of real estate tax deductions.

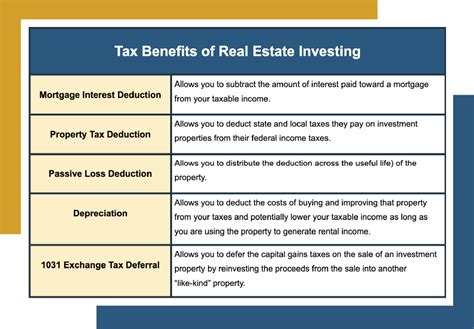

Benefits of Real Estate Tax Deductions

Reducing Taxable Income

One of the primary benefits of deducting real estate taxes is the potential to reduce taxable income. By itemizing deductions, including real estate taxes, homeowners can lower their taxable income, which, in turn, reduces their overall tax liability.

For instance, if a homeowner's taxable income before deductions is $100,000, and they have $15,000 in itemized deductions, including $7,000 in real estate taxes, their taxable income would be reduced to $85,000. This reduction can result in significant tax savings, especially for individuals in higher tax brackets.

Lowering Tax Burden

Real estate tax deductions can provide a substantial reduction in an individual’s tax burden. By claiming these deductions, homeowners can effectively lower the amount of taxes they owe to the government, resulting in more money in their pockets.

Imagine a homeowner with a taxable income of $150,000 who itemizes deductions, including $10,000 in real estate taxes. If their marginal tax rate is 24%, the real estate tax deduction alone would save them $2,400 in taxes.

Maximizing Refund or Reducing Tax Owed

For many taxpayers, claiming real estate tax deductions can lead to a larger tax refund or a reduced tax liability. By carefully evaluating their eligibility for itemized deductions, including real estate taxes, homeowners can optimize their tax returns and potentially receive a larger refund or owe less tax.

Consider a homeowner who expects a tax refund of $3,000 based on their standard deduction. By itemizing deductions and including real estate taxes, they might increase their refund to $4,500, providing them with a substantial financial benefit.

The Process of Claiming Real Estate Tax Deductions

Gathering Necessary Documentation

To claim real estate tax deductions accurately, homeowners must gather the necessary documentation. This typically includes receipts, bills, or statements showing the amount of real estate tax paid during the tax year. It is essential to retain these records for tax purposes.

Completing the Appropriate Tax Forms

Claiming real estate tax deductions requires completing the appropriate tax forms. For most taxpayers, this involves filing Schedule A along with their federal income tax return. Schedule A is used to itemize deductions, including real estate taxes, charitable contributions, and certain other expenses.

Additionally, homeowners may need to complete other forms or schedules specific to their situation, such as Schedule E for rental property income and expenses.

Consulting a Tax Professional

The process of claiming real estate tax deductions can be complex, especially for individuals with multiple properties or unique tax situations. Consulting a qualified tax professional, such as a Certified Public Accountant (CPA) or enrolled agent, can provide valuable guidance and ensure compliance with tax laws.

A tax professional can help homeowners navigate the intricacies of real estate tax deductions, optimize their tax strategy, and maximize their tax savings. They can also assist with filing the necessary forms and ensuring accurate reporting of real estate tax payments.

Real-World Examples and Case Studies

Case Study: Homeowner with a Primary Residence

Let’s consider the case of Sarah, a homeowner with a primary residence in a suburban area. Sarah’s property has an assessed value of 400,000, and the local tax rate is 1.2%. During the tax year, Sarah paid 4,800 in real estate taxes.

Sarah's taxable income before deductions is $80,000. By itemizing her deductions, including the $4,800 in real estate taxes, Sarah can reduce her taxable income to $75,200. This reduction in taxable income can result in substantial tax savings, especially if Sarah is in a higher tax bracket.

Case Study: Rental Property Owner

John is a rental property owner with two rental units. He paid a total of 8,000 in real estate taxes on these properties during the tax year. John's taxable income before deductions is 120,000.

By itemizing his deductions, including the $8,000 in real estate taxes, John can reduce his taxable income to $112,000. This deduction, combined with other rental property expenses, can significantly lower John's tax liability and maximize his tax savings.

Future Implications and Considerations

Tax Law Changes and Limitations

It is important to note that tax laws and regulations can change over time, and the deductibility of real estate taxes may be subject to future modifications. The TCJA, for example, introduced significant changes that impacted the deductibility of real estate taxes and other deductions.

Homeowners should stay informed about any changes in tax laws that may affect their eligibility for real estate tax deductions. Consulting a tax professional or keeping up with IRS updates can help individuals understand the latest rules and ensure compliance.

State and Local Variations

The deductibility of real estate taxes can vary across states and localities. Some states may allow for full deductibility, while others may impose limitations or restrictions. It is crucial for homeowners to understand the specific rules and regulations in their state and locality when claiming real estate tax deductions.

For instance, some states may offer a state-level deduction for real estate taxes, while others may only allow a partial deduction or none at all. Homeowners should consult their state's tax guidelines or seek professional advice to navigate these variations.

Impact of Property Value and Market Trends

The assessed value of a property, which determines the real estate tax owed, can fluctuate over time due to various factors, including market conditions and property improvements. As a result, the amount of real estate tax deductions can also vary from year to year.

Homeowners should monitor property value assessments and market trends to understand how these factors may impact their real estate tax liability and potential deductions. Staying informed about property values and market conditions can help individuals plan their tax strategy effectively.

Conclusion

Real estate tax deductions offer homeowners an opportunity to reduce their taxable income, lower their tax burden, and maximize their tax refunds or minimize their tax liability. By understanding the factors influencing deductibility, the benefits they provide, and the process of claiming these deductions, homeowners can make informed decisions to optimize their tax savings.

While the deductibility of real estate taxes may have been impacted by recent tax law changes, such as the TCJA, it remains a valuable consideration for many homeowners. By staying informed, consulting tax professionals when needed, and carefully evaluating their eligibility, homeowners can navigate the complexities of real estate tax deductions and make the most of their tax-saving opportunities.

Can I deduct real estate taxes on my primary residence only, or can I also deduct them for rental properties or second homes?

+

You can deduct real estate taxes on your primary residence, as well as on rental properties or second homes. However, there may be specific rules and limitations depending on the nature of the property and your intended use. It’s essential to understand the criteria for deducting real estate taxes on different types of properties.

What if I don’t itemize my deductions? Can I still deduct real estate taxes?

+

If you choose to take the standard deduction instead of itemizing your deductions, you generally cannot deduct real estate taxes. The standard deduction provides a fixed amount of deductions, and it is more advantageous for many taxpayers to take this deduction rather than itemizing. However, it’s always advisable to consult a tax professional to determine the most beneficial approach for your specific situation.

Are there any limitations on the amount of real estate taxes I can deduct?

+

Yes, there are limitations on the amount of real estate taxes you can deduct. The Tax Cuts and Jobs Act (TCJA) imposed a cap on the amount of state and local taxes (including real estate taxes) that can be deducted. The cap is currently set at 10,000 for individual taxpayers (5,000 for married filing separately). It’s important to understand these limitations and how they may affect your tax deductions.