Union County Nc Property Tax

In Union County, North Carolina, property taxes play a significant role in the local economy and are a key component of the community's financial structure. Understanding how property taxes work and their impact on residents and businesses is essential for anyone living or investing in this vibrant county. This comprehensive guide aims to delve into the intricacies of Union County's property tax system, providing an in-depth analysis of rates, assessments, and the overall impact on property owners.

Property Tax Structure in Union County

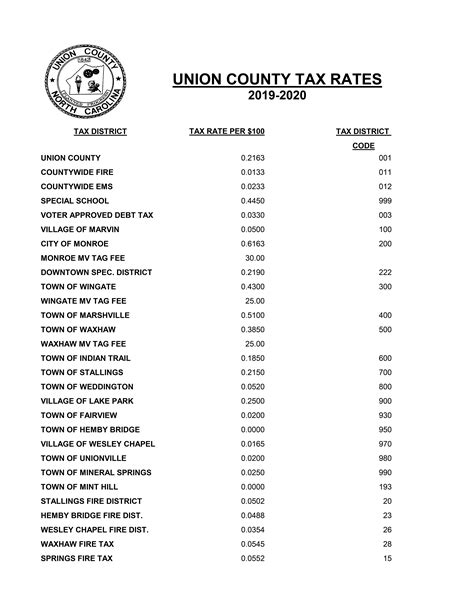

Union County’s property tax system is a crucial revenue source for the county government, schools, and various municipal services. The tax is levied on both real estate and personal property owned within the county. The tax rate is determined annually by the Union County Board of Commissioners, who set the overall rate based on the budget requirements and the assessed value of taxable properties.

The current property tax rate in Union County for the fiscal year 2024 is 0.6776 per $100 of assessed value. This rate is comprised of different components, including the county tax rate, city or town tax rate (if applicable), and special tax districts.

For instance, the tax rate for the City of Monroe, the county seat, is 0.4245 per $100 of assessed value for the 2024 fiscal year. This rate is lower than the overall county rate due to the city's additional sources of revenue, such as sales tax and other municipal fees.

| Taxing Authority | 2024 Tax Rate (per $100 of assessed value) |

|---|---|

| Union County | 0.6776 |

| City of Monroe | 0.4245 |

| Waxhaw | 0.6390 |

| Weddington | 0.3790 |

| Wingate | 0.6357 |

| Other Towns (e.g., Marvin, Stallings) | 0.6776 |

It's important to note that property tax rates can vary within Union County, as different municipalities have different budget requirements and sources of revenue. Towns like Waxhaw and Wingate have slightly higher tax rates compared to Weddington, which has a lower rate due to its specific revenue streams.

Assessed Value and Taxable Value

The assessed value of a property is determined by the Union County Tax Assessor’s Office. This office conducts periodic revaluations to ensure that property values are up-to-date and accurately reflect the market. The last full revaluation in Union County was conducted in 2021, and the next one is scheduled for 2026.

During a revaluation, the Tax Assessor's Office considers various factors, including recent sales data, construction costs, and property characteristics. This process ensures that properties are assessed fairly and that the tax burden is distributed equitably among property owners.

Once the assessed value is determined, a taxable value is calculated. The taxable value is typically a percentage of the assessed value and is used to calculate the actual tax amount. In Union County, the taxable value is set at 80% of the assessed value for residential properties and 100% for commercial and industrial properties.

For example, if a residential property has an assessed value of $300,000, its taxable value would be calculated as follows: $300,000 x 0.80 = $240,000. This taxable value is then used to compute the property tax due.

Tax Bill Calculation

The property tax bill is calculated by multiplying the taxable value of the property by the applicable tax rate. This calculation considers both the county tax rate and any additional rates for the specific municipality where the property is located.

Let's illustrate this with an example. Consider a residential property in the City of Monroe with an assessed value of $300,000. The taxable value, as calculated above, would be $240,000. The tax bill for this property would be:

$240,000 x (0.6776 Union County rate + 0.4245 Monroe rate) = $278.18 per $100,000 of assessed value.

For this property, the annual tax bill would amount to $719.67 (rounded to the nearest dollar). This calculation demonstrates how the property tax rate and the assessed value together determine the tax burden for property owners.

Impact of Property Taxes on Union County Residents

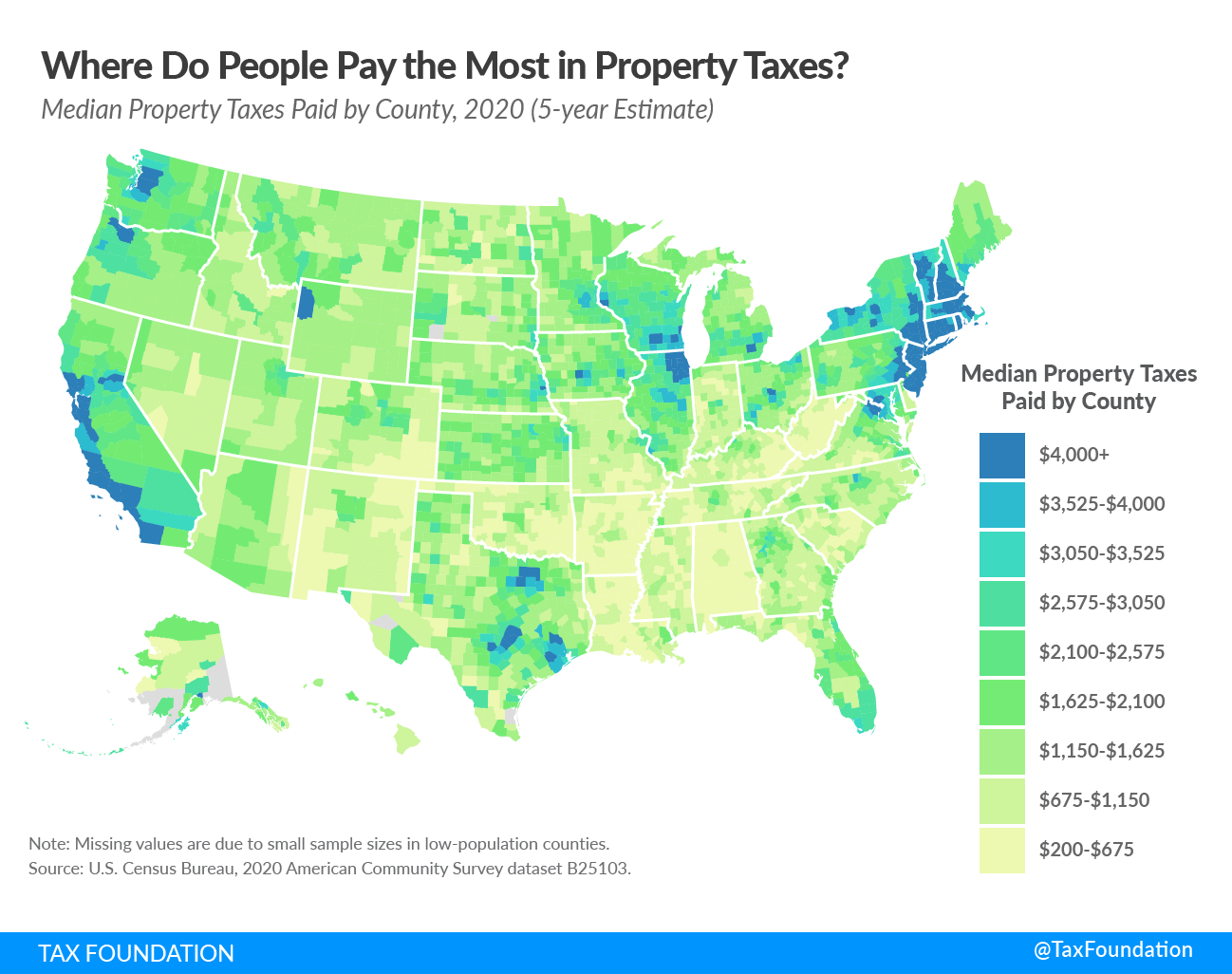

Property taxes in Union County have a significant impact on both residential and commercial property owners. These taxes fund essential services, including public education, emergency services, road maintenance, and various community programs.

Funding Education and Community Services

A substantial portion of the property tax revenue is allocated to the Union County Public Schools system. This funding ensures that the county’s schools have the resources needed to provide quality education to students. It covers operational costs, teacher salaries, and infrastructure maintenance.

Additionally, property taxes support a range of community services, such as parks and recreation programs, libraries, and cultural centers. These services enhance the quality of life for residents and contribute to the overall well-being of the community.

Impact on Homeowners

For homeowners in Union County, property taxes are a significant expense that must be considered when budgeting. The tax burden can vary widely depending on the location and value of the property. Homes in areas with higher assessed values or in municipalities with higher tax rates will generally have higher tax bills.

It's important for homeowners to stay informed about property tax changes and revaluations. Regular reviews of tax bills and assessments can help identify any discrepancies or potential overvaluations, allowing homeowners to take appropriate action, such as appealing their assessment if necessary.

Commercial Property Owners and Economic Development

Commercial property owners in Union County also contribute significantly to the local tax base. These taxes fund vital infrastructure and services that support business operations and economic growth.

The county's competitive tax rates, along with its strategic location and growing economy, have attracted numerous businesses. This influx of commercial activity has led to increased job opportunities and a thriving local economy. As a result, commercial property owners play a pivotal role in the county's economic development and prosperity.

Union County’s Property Tax Incentives and Exemptions

Union County offers various property tax incentives and exemptions to eligible property owners. These programs aim to encourage economic development, support local businesses, and provide relief to specific segments of the population.

Business Incentives

The county provides several incentives for businesses, including tax abatements and tax increment financing (TIF). These incentives are often offered to attract new businesses or support existing ones, especially in designated economic development areas.

For instance, a business that invests in a designated industrial park may be eligible for a tax abatement, which reduces the tax burden for a set period. This incentive encourages businesses to locate in these areas, fostering economic growth and job creation.

Senior Citizen and Veteran Exemptions

Union County offers property tax exemptions for senior citizens and veterans. These exemptions provide relief to eligible individuals, reducing their tax burden and helping them maintain financial stability.

The Senior Citizen Exemption is available to residents who are 65 years or older and meet certain income and residency requirements. This exemption reduces the taxable value of their property, resulting in lower tax bills. The specific amount of the exemption depends on the individual's income and assessed property value.

Similarly, the Veteran Exemption provides property tax relief to honorably discharged veterans who have served in a time of war. This exemption reduces the taxable value of their property, benefiting those who have served our country.

Agricultural and Forestland Exemptions

Union County also offers exemptions for agricultural and forestland properties. These exemptions encourage the preservation of farmland and forestland, which are vital to the county’s natural resources and rural character.

The Agricultural Exemption allows eligible agricultural land to be taxed at a lower rate, based on its agricultural value rather than its fair market value. This exemption helps farmers and agricultural businesses maintain their operations and ensures the continued availability of farmland.

The Forestland Exemption, also known as the Current Use Value Taxation (CUVA) program, taxes forestland at its current use value rather than its potential development value. This exemption encourages the preservation of forestland, which provides environmental benefits and contributes to the county's natural beauty.

Conclusion: Union County’s Property Tax System

Union County’s property tax system is a complex yet essential component of the local economy. It funds vital services, supports education, and contributes to the overall well-being of the community. The tax rates and assessments are determined through a careful process, ensuring fairness and equity for all property owners.

Property taxes in Union County are a significant responsibility for both residential and commercial property owners. However, the county's competitive tax rates and various incentives and exemptions make it an attractive place to live and do business. The revenue generated from these taxes is invested back into the community, fostering economic growth, and enhancing the quality of life for all residents.

As Union County continues to thrive and develop, its property tax system will remain a crucial tool for funding essential services and driving economic progress. Understanding this system and staying informed about tax rates and incentives is key to navigating the financial responsibilities of property ownership in Union County.

How often are property values reevaluated in Union County?

+Property values in Union County are reevaluated every four years, with the last full revaluation occurring in 2021. The next revaluation is scheduled for 2026.

Can I appeal my property assessment if I believe it is inaccurate?

+Yes, property owners have the right to appeal their assessments if they believe the assessed value is incorrect. The Union County Tax Assessor’s Office provides guidelines and a formal process for filing appeals.

Are there any property tax relief programs for low-income homeowners in Union County?

+Yes, Union County offers the Property Tax Deferral Program for eligible low-income homeowners aged 65 and older. This program allows qualified homeowners to defer a portion of their property taxes until they sell their home or no longer meet the eligibility requirements.

How can I stay informed about changes in property tax rates and assessments in Union County?

+You can stay informed by regularly checking the Union County Tax Assessor’s website, attending public meetings, and subscribing to local news sources. The Tax Assessor’s Office also provides notifications and updates through their official website and social media channels.

Are there any tax incentives for renewable energy installations on properties in Union County?

+Yes, Union County offers a Renewable Energy Property Tax Exemption for eligible renewable energy systems, such as solar panels and wind turbines. This exemption allows for a reduced tax assessment on the value of the renewable energy system, encouraging the adoption of clean energy technologies.