2022 Tax Table

The 2022 Tax Table is a vital tool for individuals and businesses alike, offering a comprehensive overview of the federal income tax rates and brackets applicable for the tax year 2022. As we navigate the complexities of the U.S. tax system, understanding these tables is crucial for accurate tax planning and compliance. In this article, we will delve into the intricacies of the 2022 Tax Table, exploring its structure, key changes, and implications for taxpayers.

Understanding the 2022 Tax Table Structure

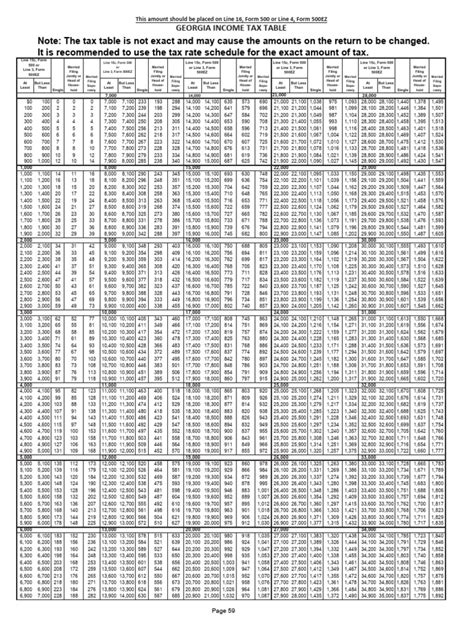

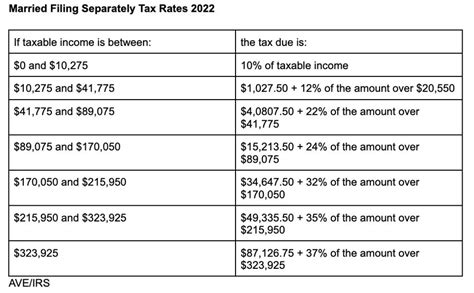

The 2022 Tax Table is a comprehensive resource provided by the Internal Revenue Service (IRS) to assist taxpayers in calculating their federal income tax liability. It consists of a series of tables, each designed for a specific filing status: Single, Married Filing Jointly, Married Filing Separately, and Head of Household. These tables are further subdivided into income brackets, with corresponding tax rates and amounts.

For instance, the Single filer's table starts with an income range of $0 to $10,275, with a tax rate of 10%. As income increases, the brackets widen, and tax rates progress from 12%, 22%, 24%, 32%, 35%, and finally, 37% for the highest income bracket of $209,426 and above. Similar structures exist for the other filing statuses, each with its own set of brackets and rates.

Within these tables, taxpayers can find the tax amount corresponding to their taxable income. It's important to note that these tables only provide the tax amount; additional calculations are required to determine the total tax liability, including deductions, credits, and other adjustments.

Key Changes in the 2022 Tax Table

The 2022 Tax Table reflects several significant changes from the previous year. One notable adjustment is the expansion of tax brackets for higher income levels, which is a result of the annual inflation adjustments mandated by the Tax Cuts and Jobs Act (TCJA). This expansion ensures that taxpayers with higher incomes are not disproportionately affected by bracket creep, which occurs when inflation pushes taxpayers into higher tax brackets without a corresponding increase in real income.

Additionally, the TCJA also introduced a new bracket for single filers with taxable income exceeding $518,401, subjecting them to a tax rate of 37%. This bracket was not present in the 2021 Tax Table, highlighting the evolving nature of the U.S. tax system.

Furthermore, the 2022 Tax Table also incorporates adjustments to standard deductions and personal exemptions. The standard deduction for Single filers has increased to $12,950, while the deduction for Married Filing Jointly has risen to $25,900. These adjustments aim to simplify tax filing for individuals who do not itemize their deductions.

Tax Bracket Analysis for 2022

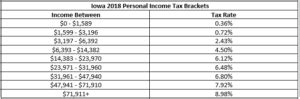

Let’s take a closer look at the tax brackets for the 2022 Tax Table. For Single filers, the first bracket starts at 0 and goes up to 10,275, with a tax rate of 10%. The subsequent brackets are as follows: 12% for income between 10,276 and 41,775; 22% for 41,776 to 89,075; 24% for 89,076 to 170,050; 32% for 170,051 to 215,950; 35% for 215,951 to 539,900; and finally, 37% for incomes above $539,900.

Similarly, for Married Filing Jointly, the first bracket starts at $0 and goes up to $20,550, with a 10% tax rate. The brackets then progress to 12% for income between $20,551 and $83,550; 22% for $83,551 to $178,150; 24% for $178,151 to $340,100; 32% for $340,101 to $431,900; 35% for $431,901 to $699,900; and 37% for incomes above $699,900.

The Married Filing Separately and Head of Household brackets follow similar structures, with their own unique income ranges and tax rates. It's crucial for taxpayers to refer to the specific table that aligns with their filing status to ensure accurate calculations.

| Filing Status | Tax Bracket | Tax Rate |

|---|---|---|

| Single | $0 - $10,275 | 10% |

| Single | $10,276 - $41,775 | 12% |

| Single | $41,776 - $89,075 | 22% |

| ... | ... | ... |

| Married Filing Jointly | $0 - $20,550 | 10% |

| Married Filing Jointly | $20,551 - $83,550 | 12% |

| Married Filing Jointly | $83,551 - $178,150 | 22% |

| ... | ... | ... |

These tables provide a glimpse into the complexity of the U.S. tax system and the varying rates at which different income levels are taxed. It's essential for taxpayers to stay informed about these brackets to make informed decisions regarding their financial planning and tax strategies.

Tax Planning Strategies for 2022

With a clear understanding of the 2022 Tax Table, taxpayers can now strategize their financial moves to optimize their tax liability. One common strategy is to maximize deductions and credits, which can reduce the taxable income and, consequently, the tax amount. This may involve contributions to tax-advantaged retirement accounts, such as 401(k)s or IRAs, which offer tax deductions on contributions.

Another strategy is to time income and expenses to fall within lower tax brackets. For instance, if a taxpayer expects a significant increase in income in the following year, they may consider deferring income to the current tax year, provided they can maintain a lower taxable income level. Similarly, accelerating deductions, such as charitable contributions or business expenses, can be beneficial in reducing taxable income for the current year.

For taxpayers with higher incomes, it's crucial to consider the impact of the Alternative Minimum Tax (AMT). The AMT is a parallel tax system that applies a flat tax rate to taxpayers with certain types of income or deductions. Understanding the AMT thresholds and potential AMT liability can help taxpayers make informed decisions to minimize their overall tax burden.

Conclusion: Navigating the 2022 Tax Landscape

The 2022 Tax Table serves as a vital guide for taxpayers, offering a structured overview of the federal income tax system. By understanding the brackets, rates, and key changes, individuals and businesses can make informed decisions to optimize their tax strategies. Whether it’s maximizing deductions, timing income and expenses, or considering the AMT, a proactive approach to tax planning can lead to significant savings and compliance with the complex U.S. tax system.

As we move forward into the tax year 2022, staying updated with tax laws and regulations is crucial. Taxpayers should consult with tax professionals or utilize reliable tax preparation software to ensure accurate calculations and compliance. By leveraging the insights from the 2022 Tax Table, taxpayers can navigate the tax landscape with confidence and make the most of their financial opportunities.

What is the difference between the 2021 and 2022 Tax Tables?

+

The 2022 Tax Table reflects several changes, including the expansion of tax brackets for higher incomes and the introduction of a new bracket for single filers with incomes exceeding $518,401. These adjustments are made annually to account for inflation and maintain tax bracket integrity.

How do I know which Tax Table to use for my filing status?

+

The Tax Table is divided into sections based on filing status: Single, Married Filing Jointly, Married Filing Separately, and Head of Household. You should refer to the table that aligns with your specific filing status to ensure accurate tax calculations.

Can I reduce my taxable income to stay in a lower tax bracket?

+

Yes, taxpayers can employ various strategies to reduce their taxable income, such as maximizing deductions, contributions to retirement accounts, or timing income and expenses. These strategies can help keep taxable income within lower tax brackets, resulting in potential tax savings.

What is the Alternative Minimum Tax (AMT) and how does it affect me?

+

The Alternative Minimum Tax is a parallel tax system that applies to certain types of income or deductions. If your income or deductions fall within the AMT thresholds, you may be subject to a flat tax rate, which can increase your overall tax liability. It’s important to consult a tax professional to understand your potential AMT liability.

Where can I find the most up-to-date Tax Tables and tax information?

+

The most reliable source for Tax Tables and tax information is the Internal Revenue Service (IRS) website. The IRS regularly updates its website with the latest tax forms, tables, and guidance. Additionally, tax professionals and reputable tax preparation software can provide accurate and up-to-date information.