Ct Tax Rate

The state of Connecticut, often referred to as "The Constitution State," boasts a vibrant economy and a unique tax landscape. Understanding the Connecticut tax rate is essential for residents, businesses, and investors alike. In this comprehensive guide, we delve into the intricacies of Connecticut's tax system, shedding light on the rates, structures, and implications for various taxpayers.

Understanding the Connecticut Tax Landscape

Connecticut’s tax system is a multifaceted framework designed to support the state’s infrastructure, education, and social services. It encompasses a range of taxes, including income tax, sales tax, property tax, and various other levies. While some aspects of Connecticut’s tax structure are similar to those of other states, there are distinct features that set it apart.

One notable characteristic of Connecticut's tax system is its progressive income tax rates, which means that higher-income earners pay a higher proportion of their income in taxes. This approach aims to ensure a fair distribution of the tax burden among residents. Additionally, the state's sales tax rate, while not the highest in the nation, contributes significantly to revenue generation.

Income Tax: A Progressive Approach

Connecticut’s income tax is a key component of its revenue stream. As of my last update in January 2023, the state operates on a graduated income tax system, which means that the tax rate increases as income levels rise. This progressive structure is designed to maintain tax fairness and provide a balanced approach to revenue collection.

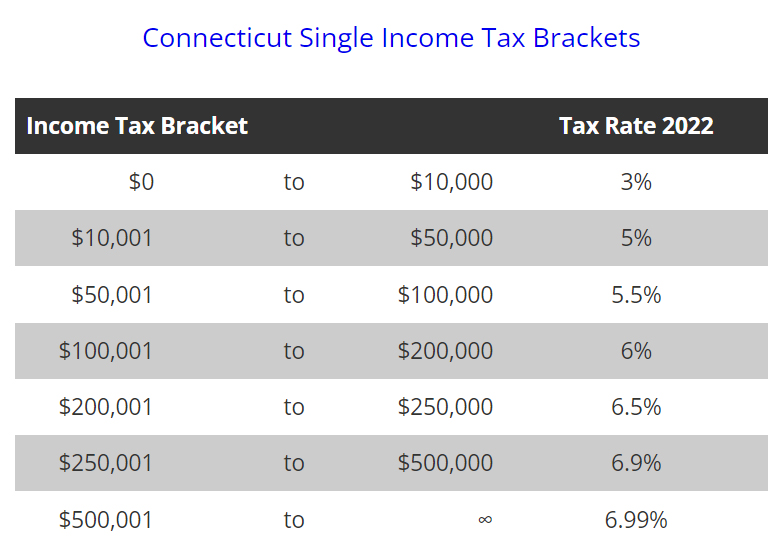

For individual taxpayers, Connecticut offers several tax brackets with corresponding rates. As of my knowledge cutoff, these brackets and rates were as follows:

| Income Bracket | Tax Rate |

|---|---|

| Up to $10,000 | 3.07% |

| $10,001 - $50,000 | 5.00% |

| $50,001 - $100,000 | 5.50% |

| $100,001 - $200,000 | 6.70% |

| $200,001 - $250,000 | 6.90% |

| Over $250,000 | 6.99% |

These rates are applicable to both single filers and married couples filing jointly. It's important to note that these brackets and rates may have been subject to change since my last update, so it's advisable to refer to official Connecticut tax resources for the most current information.

Sales Tax: A Statewide Levy

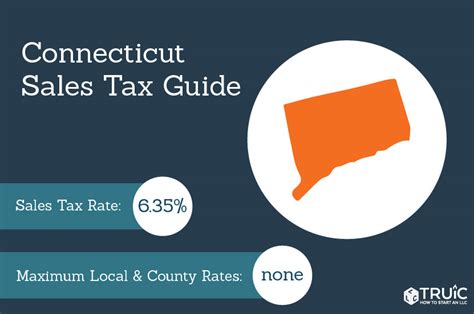

Connecticut imposes a statewide sales and use tax on most tangible personal property and certain services. As of my knowledge cutoff, the general sales tax rate in Connecticut was 6.35%. This rate applies to various goods and services, including clothing, electronics, and groceries. However, certain essential items like prescription drugs and residential energy are exempt from sales tax.

It's worth noting that Connecticut's sales tax rate is not uniform across the state. Some municipalities impose additional local sales taxes, which can vary from one town to another. These local add-ons are known as "special purpose taxes" and are typically dedicated to funding specific initiatives or infrastructure projects.

For example, the city of Bridgeport levies an additional 0.5% sales tax to support public transportation, while other towns may have different local taxes for various purposes. These local taxes can impact the overall sales tax rate a consumer pays, making it essential for businesses and residents to stay informed about these variations.

Property Tax: A Localized Approach

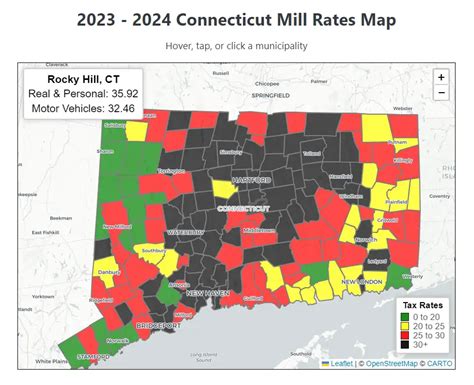

Unlike income and sales taxes, property taxes in Connecticut are administered at the local level. Each municipality sets its own property tax rates, resulting in a wide range of rates across the state. This localized approach allows communities to tailor their tax policies to meet specific needs and priorities.

Property taxes in Connecticut are calculated based on the assessed value of the property and the tax rate set by the local government. The assessed value is determined through a process that varies by town, often involving a physical inspection of the property and an assessment of its market value. Once the assessed value is established, the tax rate is applied to determine the annual property tax liability.

For instance, let's consider the city of New Haven, which had a tax rate of 45.59 mills (or $45.59 per $1,000 of assessed value) as of my knowledge cutoff. This means that for a property with an assessed value of $200,000, the annual property tax would be calculated as follows:

$200,000 (assessed value) x 0.04559 (tax rate) = $9,118 in annual property taxes.

It's important to note that property tax rates can change annually, and it's the responsibility of property owners to stay informed about their local tax rates. Additionally, Connecticut offers various property tax exemptions and credits to eligible residents, such as the Elderly Tax Abatement Program, which provides relief to qualifying seniors.

Other Taxes and Levies

In addition to income, sales, and property taxes, Connecticut levies various other taxes and fees to generate revenue. These include:

- Estate and Gift Taxes: Connecticut imposes taxes on the transfer of assets upon death (estate tax) and on certain gifts (gift tax). These taxes contribute to the state's revenue and help fund various programs.

- Corporate Income Tax: Corporations doing business in Connecticut are subject to a corporate income tax, which is separate from the individual income tax. The corporate tax rate is currently 7.5%.

- Motor Vehicle Taxes: Vehicle owners in Connecticut are required to pay an annual property tax on their vehicles. The tax is based on the vehicle's value and is collected by the Department of Motor Vehicles.

- Fuel Taxes: Connecticut levies taxes on gasoline and diesel fuel to fund transportation infrastructure. These taxes contribute to road maintenance and improvements.

The Impact of Connecticut’s Tax System

Connecticut’s tax system plays a crucial role in shaping the state’s economy and the lives of its residents. The progressive income tax structure ensures that higher-income earners contribute a larger share of their income to the state’s revenue, promoting tax fairness. This approach can help fund essential services and infrastructure projects that benefit all residents.

The sales tax, while providing a steady stream of revenue, also influences consumer behavior. A higher sales tax rate can discourage certain purchases, especially for non-essential items. On the other hand, essential items that are exempt from sales tax can make daily living more affordable for residents.

The localized nature of property taxes allows towns and cities to address their unique needs and priorities. This flexibility can lead to diverse communities with varying tax burdens, which can impact the real estate market and overall cost of living.

Conclusion

Understanding the Connecticut tax rate is a complex but essential task for anyone residing or doing business in the state. The state’s tax system, with its progressive income tax, statewide sales tax, and localized property taxes, forms a critical part of Connecticut’s economic landscape. By comprehending these taxes and their implications, individuals and businesses can make informed decisions about their financial strategies and contributions to the state.

As with any tax system, it's important to stay updated with the latest regulations and rates. For the most accurate and current information, consult official Connecticut tax resources and seek professional advice when needed.

How often are Connecticut’s tax rates updated?

+Connecticut’s tax rates can be subject to changes annually or at the discretion of the state legislature. It’s important to check for updates each year to ensure compliance with the latest regulations.

Are there any tax incentives or credits available in Connecticut?

+Yes, Connecticut offers various tax incentives and credits to encourage economic growth and support specific industries. These can include tax credits for research and development, job creation, and renewable energy initiatives.

How does Connecticut’s tax system compare to other states?

+Connecticut’s tax system is unique in its progressive income tax rates and localized property taxes. While some states have higher sales tax rates, Connecticut’s approach to income and property taxation sets it apart.