Trump Tax Bill Republican Pressure

In the tumultuous world of American politics, few issues have been as divisive and controversial as the Trump Tax Bill, officially known as the Tax Cuts and Jobs Act of 2017. This legislation, proposed and signed into law during the Trump administration, was a major undertaking that aimed to overhaul the US tax system. It sparked intense debates, not only within the political arena but also among economists, businesses, and the general public. The pressure from within the Republican party to pass this bill was immense, and it had significant implications for the nation's economic landscape.

The Birth of the Trump Tax Bill: A Republican Initiative

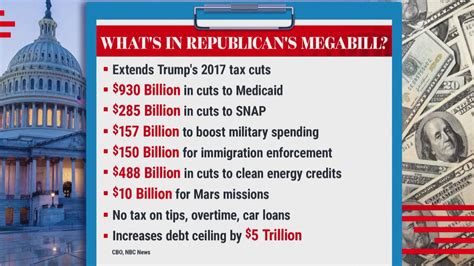

The Trump Tax Bill emerged as a key policy goal for the Republican Party, which held a majority in both the House of Representatives and the Senate during President Trump’s first two years in office. This bill was envisioned as a cornerstone of the Republican economic agenda, promising substantial tax cuts for individuals and businesses alike.

The Republican Party's desire to reduce taxes and simplify the tax code had been a longstanding principle, and the Trump administration saw an opportunity to make a bold move. The bill aimed to lower tax rates for individuals and corporations, reduce the number of tax brackets, and eliminate certain deductions and credits.

One of the most controversial aspects of the bill was its proposed changes to the Alternative Minimum Tax (AMT) and the State and Local Tax Deduction (SALT). The AMT was designed to ensure that high-income earners paid a minimum amount of tax, but the Trump bill sought to eliminate it, a move that critics argued would disproportionately benefit the wealthiest Americans.

Similarly, the SALT deduction, which allowed taxpayers to deduct state and local taxes from their federal taxable income, was limited in the new bill. This change particularly affected high-tax states like California and New York, sparking intense opposition from those states' representatives.

The Republican Strategy: A Focus on Growth and Investment

Republicans argued that the tax cuts would stimulate economic growth, increase investment, and create jobs. They believed that lowering tax rates would incentivize businesses to invest more, hire additional employees, and boost the overall economy. This theory, rooted in supply-side economics, was a cornerstone of the Republican economic philosophy.

| Tax Rate Changes under the Trump Tax Bill | Impact |

|---|---|

| Individual Income Tax Brackets Reduced from 7 to 3 | Simplified tax filing, but critics argue it widened income inequality |

| Corporate Tax Rate Reduced from 35% to 21% | Expected to boost corporate investment, but also reduced government revenue |

| Pass-Through Income Deduction | Benefited small businesses and real estate investors, but critics say it favored certain industries |

Furthermore, the bill included a provision for a one-time tax repatriation holiday, allowing US companies to bring back overseas profits at a significantly reduced tax rate. Republicans argued that this would encourage companies to reinvest in the US economy.

Despite the potential benefits, the bill faced significant opposition, not just from Democrats but also from some within the Republican party itself. Moderate Republicans, particularly those from high-tax states, expressed concerns about the impact on their constituents.

Republican Pressure and the Road to Passage

The pressure within the Republican party to pass the Trump Tax Bill was intense. President Trump and his administration, along with Republican leaders in Congress, launched an aggressive campaign to sell the bill to the public and to their own party members.

Uniting the Party: A Challenge for Republican Leadership

Uniting the diverse factions within the Republican party was a significant challenge. While the majority of Republicans supported the bill’s broad goals, there were differences in opinion on specific provisions. Some Republicans, especially those from high-tax states, were concerned about the bill’s impact on their constituents’ tax burdens.

The leadership, including House Speaker Paul Ryan and Senate Majority Leader Mitch McConnell, had to navigate these internal disagreements while maintaining party unity. They organized numerous meetings and hearings, attempting to address concerns and make adjustments to the bill to gain broader support.

One of the key strategies employed was emphasizing the potential economic benefits. The Republicans argued that the tax cuts would lead to increased wages, more jobs, and a stronger economy, benefits that would trickle down to all Americans.

Overcoming Political Obstacles

The road to passage was not without its hurdles. The bill faced multiple challenges, including procedural issues and a lack of support from some Republican senators.

One of the most significant obstacles was the need for every Republican senator to vote in favor of the bill, as the party held a narrow majority. This meant that even a single dissenting vote could prevent the bill from passing. Several senators, including Bob Corker and Jeff Flake, expressed reservations about the bill's impact on the national debt.

To overcome these challenges, the Republican leadership employed various strategies, including negotiating with individual senators to address their concerns and making last-minute amendments to the bill. They also utilized the reconciliation process, a procedural tool that allowed them to pass the bill with a simple majority, rather than the 60-vote filibuster-proof majority typically required in the Senate.

Public Perception and Political Risks

The Republicans also had to consider public perception. While the bill was popular among certain segments of the population, particularly those who stood to benefit from the tax cuts, it was not without its critics. Polls showed a divided public, with many expressing concerns about the bill’s impact on the national debt and potential benefits to the wealthy.

Despite these risks, the Republican leadership pushed forward, confident that the potential economic benefits would outweigh the short-term political risks. They believed that a strong economy would bolster their chances in future elections, justifying the political gamble.

Impact and Legacy of the Trump Tax Bill

The Trump Tax Bill had far-reaching implications for the US economy and the lives of American citizens. Its impact is still being felt and studied, with economists and policymakers debating its effectiveness and long-term consequences.

Immediate Economic Effects

In the immediate aftermath of the bill’s passage, there were some positive signs. Corporations announced plans to reinvest profits, and some companies even provided one-time bonuses to their employees. The stock market soared, with the Dow Jones Industrial Average hitting record highs. Additionally, the US economy experienced a growth spurt, with GDP growth rates exceeding expectations.

However, these effects were not universally positive. Critics pointed out that much of the corporate windfall was used for stock buybacks and increased dividends rather than increased investment and job creation. Moreover, the bill's impact on wage growth was less significant than anticipated, with most of the benefits going to higher-income earners.

Long-Term Implications

The long-term implications of the Trump Tax Bill are still being analyzed. One of the most significant concerns is its impact on the national debt. The bill is estimated to add over $1 trillion to the national debt over a decade, a substantial increase that could constrain future fiscal policy options.

Additionally, the bill's impact on income inequality is a topic of ongoing debate. While the tax cuts did provide some benefits to middle- and lower-income earners, the majority of the benefits went to the top earners and corporations. This has led to increased calls for a more progressive tax system and a reevaluation of the role of taxes in reducing inequality.

The Trump Tax Bill’s Legacy: A Divisive Policy

The Trump Tax Bill remains a highly divisive policy. While it achieved its primary goal of cutting taxes, the debate over its effectiveness and fairness continues. Republicans argue that it has spurred economic growth and investment, while Democrats and many economists argue that it has exacerbated income inequality and added significantly to the national debt.

As the country moves forward, the legacy of the Trump Tax Bill will continue to shape economic policy discussions. Its impact on the tax system and the economy will be studied and debated for years to come, influencing future tax reform efforts.

What were the key provisions of the Trump Tax Bill?

+

The Trump Tax Bill included provisions such as lowering individual and corporate tax rates, reducing tax brackets, eliminating the Alternative Minimum Tax, limiting the State and Local Tax Deduction, and providing a one-time tax repatriation holiday.

How did the Trump Tax Bill impact the US economy in the short term?

+

In the short term, the Trump Tax Bill led to corporate reinvestment, stock market gains, and increased GDP growth rates. However, the impact on wage growth and job creation was less significant than anticipated, and much of the corporate windfall went towards stock buybacks and dividends.

What are the long-term implications of the Trump Tax Bill on the national debt and income inequality?

+

The Trump Tax Bill is estimated to add over $1 trillion to the national debt over a decade. Additionally, while the bill provided some benefits to middle- and lower-income earners, the majority of the benefits went to the top earners and corporations, exacerbating income inequality.

What is the legacy of the Trump Tax Bill in the context of economic policy and political strategy?

+

The Trump Tax Bill’s legacy is a highly divisive one. While it achieved its goal of cutting taxes, the debate over its effectiveness and fairness continues. It has shaped future economic policies and will continue to influence political strategies for years to come.