Florida Broward County Sales Tax

The topic of sales tax is an important consideration for businesses and consumers alike, especially in regions like Broward County, Florida, where a unique blend of tourism, commerce, and diverse population dynamics come into play. Understanding the intricacies of sales tax regulations can significantly impact business operations and consumer experiences. This article aims to provide an in-depth analysis of Florida Broward County's sales tax structure, exploring its implications, benefits, and challenges.

Unraveling Broward County’s Sales Tax Landscape

In the vibrant county of Broward, nestled along the southeastern coast of Florida, a nuanced sales tax system operates. This system is a critical component of the state’s overall taxation framework, contributing significantly to the county’s economic health and infrastructure development.

Broward County, with its diverse communities and bustling tourism industry, is subject to a sales tax rate that is unique to the state of Florida. This rate, though relatively straightforward in its application, can have profound effects on local businesses and their pricing strategies. Furthermore, it influences the spending habits of residents and visitors, shaping the county's economic landscape.

A Deeper Dive into Broward’s Sales Tax Rates

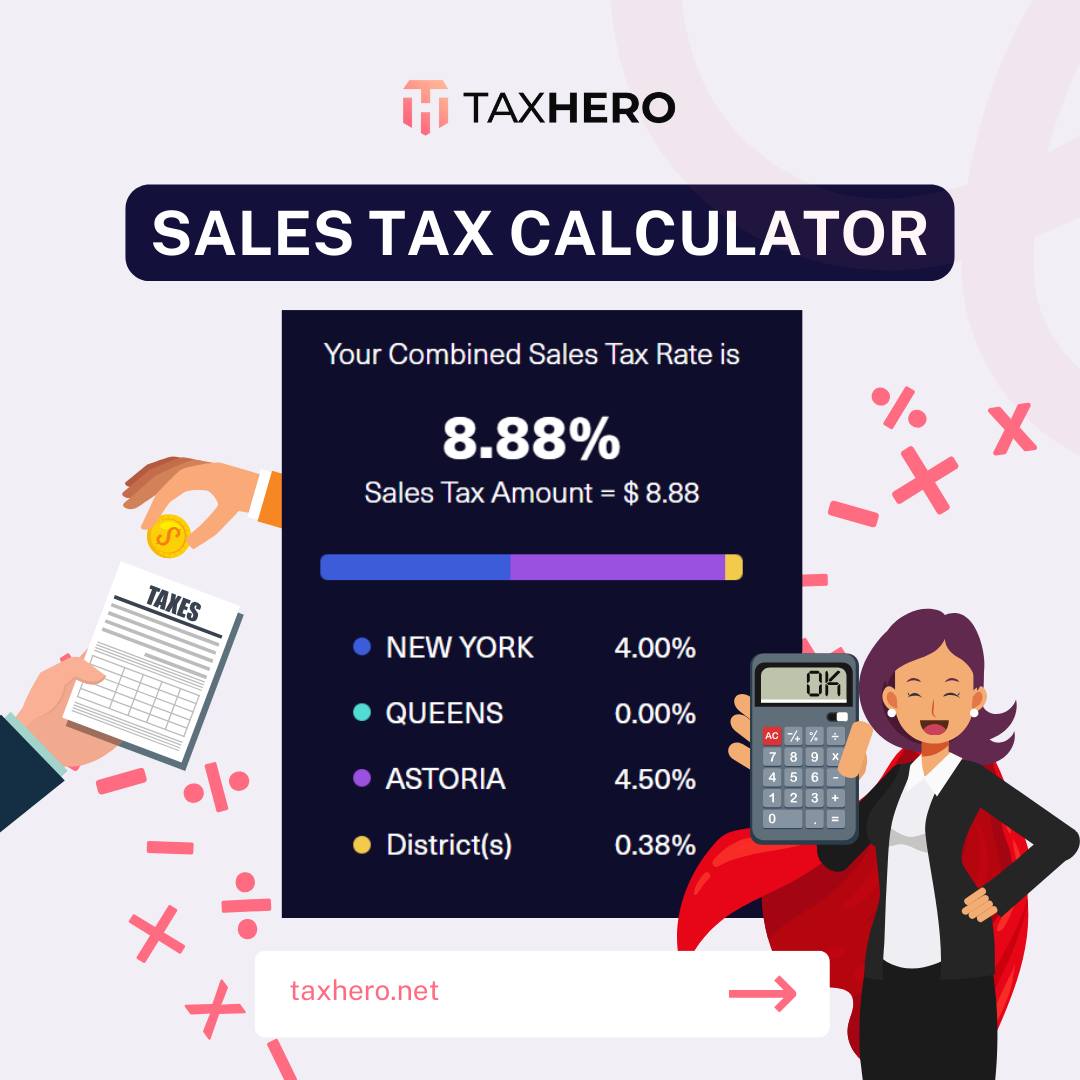

At its core, Broward County’s sales tax rate is composed of a state base rate and a local rate, which varies depending on the specific county. The current state sales tax rate stands at 6%, a figure that has remained consistent for several years. This base rate is then augmented by a local rate of 1.5%, bringing the total sales tax applicable in Broward County to 7.5%.

This local rate is not a one-size-fits-all figure but is tailored to the unique needs and characteristics of the county. It is allocated towards specific projects and initiatives that benefit the community, such as infrastructure improvements, education funding, and social services. This targeted allocation ensures that the additional tax burden is channeled back into the community, enhancing its overall quality of life.

| Component | Rate |

|---|---|

| State Base Rate | 6% |

| Broward County Local Rate | 1.5% |

| Total Sales Tax in Broward County | 7.5% |

The sales tax structure in Broward County is not without its complexities. It involves a careful balance between providing essential public services and maintaining a competitive business environment. The county's tourism-centric economy further adds a layer of complexity, as sales tax revenues from visitors play a significant role in funding local projects.

Impact on Businesses and Consumers

For businesses operating in Broward County, the sales tax rate can be a critical factor in pricing strategies and overall profitability. The 7.5% sales tax rate means that businesses must carefully consider their pricing to remain competitive while also ensuring they can cover their costs and generate a reasonable profit margin. This delicate balance is further complicated by the fact that sales tax is not a static cost but can fluctuate based on the varying tax rates in different jurisdictions.

Consumers, on the other hand, are directly impacted by the sales tax rate when they make purchases. The added tax can significantly affect their purchasing power, especially for high-value items or frequent purchases. For example, a $1,000 item would incur an additional tax burden of $75, a substantial amount that could influence a consumer's decision to make a purchase.

The sales tax rate also has implications for online businesses, particularly those that offer shipping services to Broward County residents. These businesses must ensure compliance with the county's sales tax regulations to avoid legal repercussions and maintain a positive relationship with their customers.

Broward County’s Sales Tax Administration

The administration and enforcement of sales tax in Broward County are handled by the Florida Department of Revenue (DOR). This state agency is responsible for collecting and distributing sales tax revenues, ensuring compliance with tax laws, and providing support and resources to taxpayers.

Registration and Compliance

All businesses operating in Broward County, whether brick-and-mortar or online, are required to register with the DOR to obtain a sales tax permit. This permit allows businesses to collect and remit sales tax on behalf of the state and county. The registration process involves completing an application form, providing business details, and understanding the obligations and responsibilities associated with sales tax collection.

Compliance with sales tax regulations is a legal obligation for all registered businesses. This includes accurately calculating and collecting sales tax on taxable items, maintaining proper records, and filing timely tax returns. The DOR provides resources and guidance to help businesses understand their obligations and ensure compliance. Non-compliance can result in penalties, interest, and legal consequences.

Filing and Payment Process

Sales tax returns in Broward County are typically due monthly or quarterly, depending on the business’s tax liability and volume of sales. The filing process involves submitting a detailed report of taxable sales and purchases, along with the calculated sales tax amount. This can be done electronically through the DOR’s online portal or by submitting a paper return.

Payment of sales tax is due concurrently with the filing of the tax return. Businesses have the option to pay online, by mail, or in person at a designated DOR office. Late payments or non-payment can result in penalties and interest, and in severe cases, the DOR may take legal action to recover the owed taxes.

Sales Tax Exemptions and Special Considerations

While the general sales tax rate in Broward County is 7.5%, there are certain items and transactions that are exempt from sales tax. These exemptions are outlined in Florida’s sales tax laws and regulations and are designed to provide relief to specific industries or to promote certain social or economic goals.

For instance, some essential food items, prescription medications, and certain types of medical equipment are exempt from sales tax. Additionally, nonprofit organizations and government entities are often exempt from paying sales tax on their purchases. These exemptions can significantly impact the financial operations of these entities, providing much-needed relief and allowing them to allocate more resources towards their core missions.

| Sales Tax Exempt Items in Broward County |

|---|

| Essential food items |

| Prescription medications |

| Certain medical equipment |

| Purchases by nonprofit organizations |

| Government entity purchases |

It's important to note that the list of exempt items and transactions can be extensive and complex, and businesses should consult with tax professionals or refer to the DOR's guidelines to ensure they are aware of all applicable exemptions and special considerations.

The Future of Sales Tax in Broward County

As with any tax system, the sales tax structure in Broward County is subject to change and evolution. Proposed changes can stem from a variety of factors, including shifts in the county’s economic landscape, changes in state or federal tax policies, or public opinion and political will.

Potential Scenarios and Their Implications

One potential scenario for the future of sales tax in Broward County is an increase in the local rate to generate additional revenue for specific projects or to offset budget shortfalls. While this could provide much-needed funding for essential services and infrastructure, it would also place a higher tax burden on businesses and consumers, potentially impacting their financial stability and purchasing power.

On the other hand, there is also the possibility of a decrease in the sales tax rate, which could be seen as a way to stimulate economic growth and make the county more attractive to businesses and investors. A lower tax rate could boost consumer spending and business profitability, but it would also reduce the revenue available for public services and infrastructure development.

Another emerging trend in sales tax administration is the shift towards digital platforms and technologies. The DOR is likely to continue investing in digital tools and resources to streamline the sales tax registration, filing, and payment processes. This could include the development of mobile apps, online portals, and automated systems, making it easier and more efficient for businesses to comply with sales tax regulations.

Conclusion and Recommendations

In conclusion, the sales tax system in Broward County, Florida, is a complex and dynamic entity that plays a critical role in the county’s economic and social landscape. It impacts businesses and consumers alike, influencing pricing strategies, purchasing decisions, and overall financial health.

As Broward County continues to evolve and adapt to changing economic conditions and technological advancements, it is crucial for businesses and consumers to stay informed about sales tax regulations and their implications. This includes understanding the current tax rates, exemptions, and special considerations, as well as staying abreast of potential changes and their potential impact.

For businesses, staying compliant with sales tax regulations is not only a legal obligation but also a strategic imperative. By understanding their obligations and leveraging available resources, businesses can navigate the sales tax landscape effectively, minimize risks, and maximize their profitability.

For consumers, being aware of the sales tax rate and its impact on their purchases can help them make more informed spending decisions. By factoring in the sales tax, consumers can better manage their budgets and understand the true cost of goods and services in Broward County.

In a rapidly changing economic and technological environment, staying informed and proactive is key to navigating the complexities of sales tax in Broward County. By embracing digital tools, seeking professional guidance, and staying engaged with the latest developments, both businesses and consumers can thrive in this dynamic tax landscape.

What is the current sales tax rate in Broward County, Florida?

+

The current sales tax rate in Broward County, Florida is 7.5%, which includes a state base rate of 6% and a local rate of 1.5%.

How often do businesses need to file sales tax returns in Broward County?

+

Businesses typically file sales tax returns monthly or quarterly, depending on their tax liability and volume of sales. The filing frequency can be adjusted based on the business’s specific circumstances.

Are there any sales tax exemptions in Broward County?

+

Yes, there are certain items and transactions that are exempt from sales tax in Broward County. This includes essential food items, prescription medications, certain medical equipment, and purchases by nonprofit organizations and government entities.

How can businesses stay compliant with sales tax regulations in Broward County?

+

Businesses can stay compliant by registering with the Florida Department of Revenue (DOR), understanding their sales tax obligations, accurately calculating and collecting sales tax, maintaining proper records, and filing timely tax returns. It’s also beneficial to consult with tax professionals and stay informed about any changes or updates to sales tax regulations.

What are the potential implications of a sales tax rate increase or decrease in Broward County?

+

A sales tax rate increase could provide additional revenue for public services and infrastructure but may also place a higher tax burden on businesses and consumers. Conversely, a sales tax rate decrease could stimulate economic growth and make the county more attractive to businesses, but it would reduce revenue for public services.