Johnson County Property Tax

Welcome to our comprehensive guide on Johnson County Property Taxes, a topic that affects every homeowner and investor in the region. Understanding property taxes is crucial for financial planning and maintaining a healthy relationship with local authorities. In this article, we will delve deep into the world of Johnson County Property Taxes, covering everything from assessment processes to payment options, and provide you with the expertise you need to navigate this essential aspect of homeownership.

Unraveling the Johnson County Property Tax System

Johnson County, located in the vibrant state of Kansas, employs a systematic approach to property taxation, ensuring fairness and transparency for all property owners. The county’s tax system is designed to generate revenue for essential public services while maintaining a competitive business environment.

Assessment Process: A Detailed Breakdown

The property assessment process in Johnson County is an annual affair, undertaken by the Johnson County Appraiser’s Office. This office is responsible for determining the market value of all properties within the county, including residential, commercial, and agricultural lands.

The appraisers use a combination of methods, including sales comparison, cost approach, and income approach, to arrive at a fair assessment. Here's a simplified breakdown of the assessment process:

-

Data Collection: Appraisers gather information about the property, including its size, location, age, and any recent improvements or additions.

-

Market Analysis: They research recent sales of similar properties in the area to determine the fair market value.

-

Property Inspection: In some cases, appraisers may conduct on-site inspections to verify the property's condition and features.

-

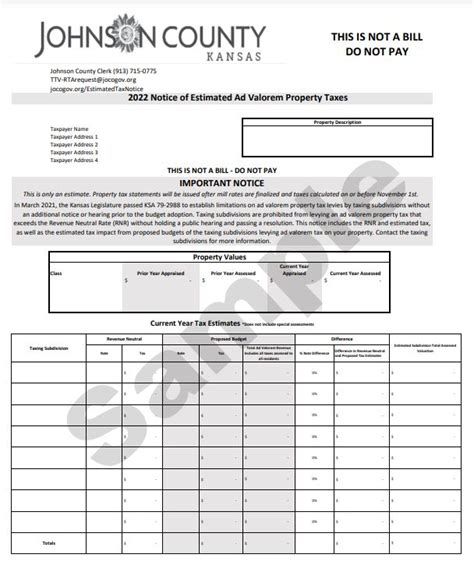

Assessment Notice: After the assessment is complete, property owners receive a notice detailing the new assessed value and any changes from the previous year.

-

Appeal Process: If a property owner disagrees with the assessed value, they have the right to appeal. The appeal process in Johnson County is designed to be fair and accessible, with guidelines available on the county's website.

It's important to note that property assessments are not final until approved by the Johnson County Board of Tax Appeals, ensuring an additional layer of oversight.

Tax Rates and Calculations: A Simple Guide

Once the assessed value of a property is determined, it’s time to calculate the property tax. In Johnson County, the tax rate is expressed as a mill levy, which is the amount of tax per $1,000 of assessed value.

The mill levy is determined by adding up the levies of all the taxing entities that provide services to the property, such as the county, city, school district, and special districts. These entities use the property taxes to fund essential services like education, law enforcement, and infrastructure development.

To calculate the property tax, simply multiply the assessed value of the property by the mill levy rate. For example, if a property has an assessed value of $200,000 and the mill levy rate is 100 mills, the property tax would be calculated as follows:

Property Tax = Assessed Value x Mill Levy Rate Property Tax = $200,000 x 0.100 = $2,000

It's worth noting that Johnson County offers various tax relief programs, such as the Senior Citizen Property Tax Refund and the Homestead Tax Exemption, to assist eligible residents.

Payment Options and Deadlines: A Comprehensive Overview

Johnson County offers a range of convenient payment options to ensure that property owners can settle their tax liabilities with ease. The county accepts payments via check, money order, credit card, and even online payment systems.

Payment Deadlines and Penalties

Property taxes in Johnson County are due in two installments, with the first half due on December 20 and the second half due on May 20 of the following year. Failure to pay by the deadline may result in additional fees and penalties.

It's important to keep track of these deadlines to avoid late fees and potential interest charges. Johnson County provides reminders and notifications to taxpayers, but it's always a good idea to mark these dates on your calendar.

Payment Plans and Options

For taxpayers facing financial difficulties, Johnson County offers payment plans to help manage property tax liabilities. The Installment Payment Plan allows taxpayers to spread their payments over multiple months, making it easier to manage large tax bills.

Additionally, the county accepts partial payments, which can be a helpful option for those who need more time to gather funds. However, it's important to note that partial payments may not stop interest and penalties from accruing.

Appealing Your Property Assessment: A Step-by-Step Guide

If you believe that your property’s assessed value is inaccurate, you have the right to appeal. The appeal process in Johnson County is designed to be fair and accessible, with clear guidelines available on the county’s website.

Step 1: Review Your Assessment Notice

When you receive your assessment notice, carefully review the details. Look for any discrepancies or errors in the property’s description, size, or improvements. It’s crucial to identify any issues early on to build a strong case for your appeal.

Step 2: Gather Supporting Evidence

To strengthen your appeal, gather evidence that supports your claim. This may include recent appraisals, comparable property sales data, or expert opinions. The more evidence you have, the better your chances of a successful appeal.

Step 3: Submit Your Appeal

Once you have gathered your evidence, it’s time to submit your appeal. Johnson County provides an Appeal Application Form, which can be filled out and submitted online or in person. Ensure that you meet the deadline for appeals, which is typically 30 days after the assessment notice is mailed.

Step 4: Attend the Appeal Hearing

After your appeal is received, you will be notified of the hearing date. The appeal hearing is an opportunity to present your case to the Johnson County Board of Tax Appeals. Be prepared to explain your reasoning and provide supporting evidence.

Understanding Property Tax Exemptions and Credits

Johnson County offers various tax exemptions and credits to eligible property owners, which can significantly reduce their tax liabilities. These exemptions and credits are designed to provide relief to specific groups and promote economic development.

Senior Citizen Property Tax Refund

Eligible senior citizens in Johnson County can apply for a property tax refund. To qualify, applicants must be at least 65 years old, own and occupy the property as their primary residence, and meet certain income guidelines.

Homestead Tax Exemption

The Homestead Tax Exemption is available to homeowners who use their property as their primary residence. This exemption reduces the taxable value of the property, providing a significant tax savings. To qualify, homeowners must occupy the property as their primary residence and apply for the exemption annually.

Other Exemptions and Credits

Johnson County offers additional exemptions and credits, such as the Disabled Veteran Exemption, Agricultural Exemption, and the Historic Preservation Tax Credit. Each exemption has its own set of eligibility criteria and application process.

Staying Informed: Resources and Support

Navigating the world of property taxes can be complex, but Johnson County provides a wealth of resources to help taxpayers understand their obligations and rights. The Johnson County Treasurer’s Office and the Appraiser’s Office are excellent sources of information and assistance.

Additionally, the county's website offers a wealth of resources, including tax calculators, payment options, and appeal guidelines. Taxpayers can also attend informational sessions and workshops to learn more about the tax process and their rights.

FAQs

What is the average property tax rate in Johnson County?

+The average property tax rate in Johnson County varies depending on the specific location and taxing entities. As of the last assessment, the average mill levy rate was approximately 100 mills, but this can change annually.

Can I pay my property taxes online?

+Yes, Johnson County offers an online payment system through its official website. You can pay your property taxes using a credit card or electronic check. The system is secure and provides a convenient way to settle your tax liabilities.

What happens if I miss the property tax deadline?

+Missing the property tax deadline can result in late fees and penalties. Johnson County charges a 1% interest per month on late payments. It’s important to stay informed about the payment deadlines and plan accordingly to avoid additional costs.

How can I appeal my property assessment if I disagree with the value?

+If you believe your property’s assessed value is inaccurate, you can appeal to the Johnson County Board of Tax Appeals. The appeal process involves submitting an application, gathering supporting evidence, and attending a hearing. It’s advisable to review the county’s guidelines and seek professional advice if needed.

Are there any property tax exemptions or credits available in Johnson County?

+Yes, Johnson County offers various tax exemptions and credits, such as the Senior Citizen Property Tax Refund, Homestead Tax Exemption, and others. These programs provide relief to eligible property owners, reducing their tax liabilities. It’s important to review the eligibility criteria and application process for each program.

Understanding Johnson County Property Taxes is an essential aspect of homeownership and investment. By staying informed and proactive, property owners can navigate the tax system with confidence and ensure they are treated fairly. Remember, resources are available to assist you, and it’s always a good idea to seek professional advice when needed.