Rhode Island Income Tax

Rhode Island, the smallest state in the United States, has a robust economy and a diverse tax system. Understanding the intricacies of Rhode Island's income tax is essential for both residents and businesses operating within the state. This comprehensive guide aims to delve into the specifics of Rhode Island's income tax laws, rates, and their impact on the local economy.

The Basics of Rhode Island Income Tax

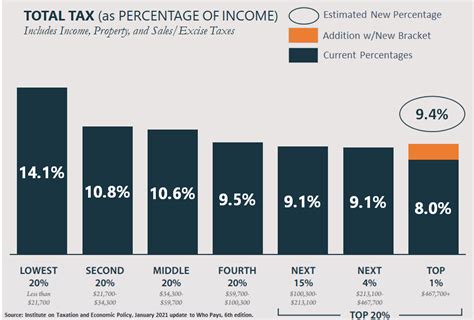

Rhode Island, like many other states, imposes an income tax on its residents and certain non-residents with income sources within the state. The state’s income tax system is progressive, meaning that higher income brackets are subject to higher tax rates. This structure aims to promote fairness and provide a balanced revenue stream for the state’s government.

Taxable Income Categories

Rhode Island’s income tax applies to various sources of income, including wages, salaries, bonuses, commissions, tips, and self-employment earnings. Additionally, income from investments, such as dividends, interest, and capital gains, is also taxable. However, certain types of income, like certain types of Social Security benefits, are exempt from state income tax.

For individuals, the state defines taxable income as the total income minus any applicable deductions and exemptions. This calculated taxable income then falls into specific brackets, each with its own tax rate.

| Income Bracket (Single Filers) | Tax Rate |

|---|---|

| $0 - $12,000 | 3.75% |

| $12,001 - $20,000 | 4.75% |

| $20,001 - $40,000 | 5.99% |

| $40,001 - $80,000 | 5.99% |

| Over $80,000 | 5.99% |

Filing Status and Deductions

Rhode Island recognizes various filing statuses, including single, married filing jointly, married filing separately, head of household, and qualifying widow(er). The choice of filing status can significantly impact an individual’s tax liability.

The state offers several deductions and exemptions to reduce taxable income. These include standard deductions, personal exemptions, and itemized deductions for eligible expenses like mortgage interest, medical costs, and charitable contributions.

Economic Impact and Tax Benefits

Rhode Island’s income tax system plays a crucial role in funding essential state services, including education, healthcare, infrastructure, and public safety. The progressive nature of the tax ensures that those with higher incomes contribute a larger share, supporting the overall well-being of the state’s residents.

Tax Incentives for Businesses

To attract and retain businesses, Rhode Island offers various tax incentives and credits. These include tax credits for research and development, job creation, and investment in certain industries. For example, the Qualified Targeted Industries Tax Credit provides a credit against state income tax for businesses investing in targeted industries like manufacturing and renewable energy.

Low-Income Tax Relief

Recognizing the financial strain on lower-income households, Rhode Island provides tax relief measures. The state offers a Low-Income Tax Credit, which can reduce the tax liability for qualifying individuals and families. Additionally, the Earned Income Tax Credit (EITC) provides a refundable tax credit for eligible low- and moderate-income workers, helping to offset the burden of income tax.

Compliance and Filing

Rhode Island requires all individuals earning income within the state to file an annual income tax return. The due date for filing typically aligns with the federal tax deadline, which is usually April 15th. However, extensions are available for those who need additional time.

Online Filing and Payment Options

The Rhode Island Division of Taxation provides a user-friendly online platform for taxpayers to file their returns and make payments. This platform offers a secure and efficient way to manage tax obligations, reducing the need for paper filing and physical visits to tax offices.

Taxpayer Assistance and Support

Rhode Island’s Division of Taxation offers resources and assistance to taxpayers. This includes tax guides, publications, and online tools to help individuals and businesses understand their tax obligations. Taxpayers can also seek assistance through local tax offices or by contacting the division directly for specific inquiries.

Conclusion: A Balanced Approach to Taxation

Rhode Island’s income tax system strikes a balance between promoting economic growth and ensuring fairness. The state’s progressive tax rates and targeted tax incentives create an environment that encourages investment and job creation while also providing essential services to its residents. By understanding the specifics of Rhode Island’s income tax, individuals and businesses can navigate their tax obligations with confidence, contributing to the state’s vibrant economy.

What is the current state income tax rate in Rhode Island?

+The state income tax rate in Rhode Island is currently set at 5.99% for all income brackets over $12,000. This rate applies to both single and joint filers.

Are there any tax incentives for starting a business in Rhode Island?

+Yes, Rhode Island offers a range of tax incentives to encourage business growth. These include tax credits for job creation, research and development, and investment in targeted industries.

How can I estimate my Rhode Island income tax liability before filing my return?

+You can use the Rhode Island Division of Taxation’s online tax estimator tool. This tool calculates your estimated tax based on your income, deductions, and filing status.

Are there any tax breaks for homeowners in Rhode Island?

+Yes, Rhode Island offers a Homestead Exemption, which reduces the assessed value of your primary residence for property tax purposes. Additionally, mortgage interest and property taxes are deductible on your state income tax return.