Florida Free Tax Day

Florida Free Tax Day is an annual event that offers residents a convenient and cost-effective way to file their state and federal tax returns. This initiative, often organized by community organizations and tax professionals, provides a valuable service to Floridians, especially those with limited financial means or who may face challenges in navigating the complex world of tax filing.

Empowering Floridians with Free Tax Services

Florida Free Tax Day has become a vital resource for many residents, offering a range of benefits and services to ensure a smooth and stress-free tax filing process. The event typically takes place at designated locations across the state, where trained volunteers and tax experts provide assistance to individuals and families.

One of the key advantages of Florida Free Tax Day is its accessibility. Many of the sites are set up in community centers, libraries, or even churches, making it convenient for residents to access these services without having to travel long distances or incur additional costs. This initiative ensures that even those in rural or underserved areas have the opportunity to take advantage of this important financial service.

The event also provides a comprehensive range of tax services. Volunteers and professionals help residents with a variety of tax-related tasks, including preparing and filing federal and state income tax returns, calculating deductions and credits, and even offering advice on tax planning strategies. This level of assistance is particularly beneficial for individuals who may not have a strong understanding of tax laws or who are filing for the first time.

A Community-Driven Initiative with Lasting Impact

Florida Free Tax Day is not just a one-time event; it is a community-driven initiative that has a lasting impact on the financial well-being of Floridians. By offering free tax services, the event empowers residents to take control of their financial future and make informed decisions about their tax obligations.

The event organizers and volunteers play a crucial role in ensuring the success of Florida Free Tax Day. Many of them are trained tax professionals who donate their time and expertise to help their communities. Their dedication and commitment to serving others make a significant difference in the lives of those they assist. In addition to providing tax services, these volunteers often educate residents on the importance of tax compliance and the potential benefits of various tax credits and deductions.

The impact of Florida Free Tax Day extends beyond the immediate tax filing process. By offering free services, the event helps to reduce the financial burden on low- and moderate-income families, allowing them to save money that can be allocated towards other essential needs. Additionally, the event contributes to the overall economic well-being of the state by ensuring that residents are aware of and utilize available tax credits and deductions, thus maximizing their financial resources.

Furthermore, Florida Free Tax Day serves as an excellent opportunity for community engagement and education. Many of the event sites host information sessions and workshops on various financial topics, such as budgeting, saving, and investing. These educational initiatives not only empower residents with the knowledge to manage their finances effectively but also foster a sense of community and collaboration.

| Event Name | Location | Date |

|---|---|---|

| Florida Free Tax Day - Miami | Various Community Centers | February 1st - April 15th |

| Orlando Tax Assistance Program | Orlando Public Library | February 15th - April 15th |

| Tampa Tax Help Day | Hillsborough County Tax Office | February 1st - April 15th |

Maximizing the Benefits of Florida Free Tax Day

To ensure a successful and stress-free experience during Florida Free Tax Day, here are some key tips and strategies for residents to consider:

- Plan Ahead: Mark the dates of Florida Free Tax Day in your calendar and be prepared with the necessary documents. Gather all your tax-related information, such as W-2 forms, 1099s, and any other relevant paperwork. Having your documents organized will streamline the tax filing process and ensure a more efficient experience.

- Research Locations: Find out the specific locations and dates of Florida Free Tax Day events in your area. Many communities have multiple sites, so choose the one that is most convenient for you. Consider factors such as proximity, accessibility, and the range of services offered at each location.

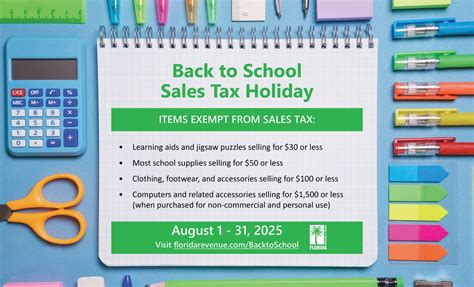

- Understand Eligibility: While Florida Free Tax Day aims to assist all residents, certain programs may have specific eligibility criteria. Familiarize yourself with the guidelines to ensure you qualify for the services offered. This can include income thresholds, age restrictions, or other requirements.

- Prepare Your Questions: Before attending the event, make a list of any questions or concerns you may have about your tax situation. This could include inquiries about specific deductions, credits, or tax-related issues. Having your questions prepared will help you make the most of your time with the tax professionals and volunteers.

- Bring a Support Person: If you feel more comfortable with a support person, such as a family member or friend, consider bringing them along. They can provide emotional support and help you navigate the process, especially if you have limited experience with tax filing.

- Utilize Online Resources: In addition to in-person assistance, many Florida Free Tax Day programs offer online resources and tools. Explore these resources to familiarize yourself with the process and gain a better understanding of the tax filing requirements. Online resources can also provide helpful tips and guidelines to make your experience smoother.

The Future of Financial Empowerment in Florida

Florida Free Tax Day is a shining example of community-driven initiatives that have a profound impact on the financial well-being of residents. As the event continues to evolve and grow, it is essential to recognize the role it plays in fostering financial literacy and empowerment across the state.

Looking ahead, there are several opportunities to further enhance the reach and impact of Florida Free Tax Day. One key area of focus could be expanding the scope of services offered. While the event currently provides assistance with tax preparation and filing, there is potential to include additional financial education and counseling services. This could involve offering workshops on topics such as budgeting, debt management, and investment strategies, empowering residents to make informed financial decisions beyond just tax season.

Another area of improvement could be in leveraging technology to enhance the efficiency and accessibility of the event. Developing user-friendly online platforms or mobile apps could allow residents to access tax-related information and resources more conveniently. These digital tools could also facilitate the pre-registration process, making it easier for individuals to schedule appointments and receive personalized support.

Furthermore, collaboration between different community organizations, tax professionals, and government agencies could strengthen the impact of Florida Free Tax Day. By working together, these entities can pool their resources and expertise to offer a more comprehensive range of services. This collaborative approach could also lead to the development of sustainable financial education programs that benefit residents throughout the year, not just during tax season.

In conclusion, Florida Free Tax Day is a valuable initiative that provides essential financial services to residents across the state. By offering free tax assistance, the event empowers individuals to take control of their financial future and make informed decisions about their tax obligations. With continued support and innovation, Florida Free Tax Day can continue to evolve, reaching more residents and making a lasting impact on their financial well-being.

What are the income eligibility criteria for Florida Free Tax Day services?

+The income eligibility criteria may vary depending on the specific program or organization offering the services. However, many programs are designed to assist low- and moderate-income individuals and families. Typically, those with an annual income below a certain threshold, such as $56,000 for federal tax filing, are eligible for free tax preparation and filing assistance.

Are there any age restrictions for Florida Free Tax Day services?

+Age restrictions may vary, but many programs are open to individuals of all ages. However, some services may prioritize assisting senior citizens or individuals with disabilities, ensuring they receive the necessary support and accommodations.

Can I receive assistance with both federal and state tax returns during Florida Free Tax Day?

+Absolutely! Florida Free Tax Day typically offers assistance with both federal and state tax returns. Volunteers and professionals are trained to help residents navigate the complexities of both tax systems, ensuring they maximize their eligible deductions and credits.