Nys Income Tax Refund Status

For residents of New York State, keeping track of tax refunds is a crucial part of financial management. The New York State Department of Taxation and Finance offers various tools and resources to help taxpayers check the status of their income tax refunds efficiently. This guide aims to provide an in-depth analysis of the process, offering insights and tips to navigate the system with ease.

Understanding the NYS Income Tax Refund Process

The journey of a New York State income tax refund begins with the submission of tax returns. Once the Department of Taxation and Finance receives your tax return, it undergoes a series of processing steps to ensure accuracy and compliance with state tax laws. This process can vary in duration, influenced by factors such as the complexity of the return and the volume of returns being processed.

During this period, taxpayers often find themselves eager to know the status of their refund. The Department offers multiple channels to check refund status, catering to different preferences and needs. These channels include online portals, telephone hotlines, and even traditional mail services.

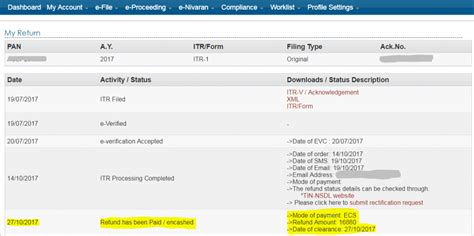

One of the most popular and efficient methods is the online refund status checker. This tool, accessible through the Department's official website, allows taxpayers to input specific details from their tax return to retrieve real-time information about their refund. The checker provides not only the current status but also estimated refund amounts and anticipated processing timelines.

Online Refund Status Checker: A Step-by-Step Guide

- Visit the Official Website: Begin by navigating to the New York State Department of Taxation and Finance’s official website. This is the trusted source for all tax-related information and services.

- Locate the Refund Status Tool: On the homepage, you’ll find a dedicated section for refund status inquiries. Click on the link or button labeled “Check Refund Status” or a similar variation.

- Enter Required Information: The status checker typically requires specific details from your tax return. This often includes your Social Security Number or Taxpayer Identification Number, as well as the exact amount of your refund as stated on your return.

- Submit and Retrieve Results: Once you’ve entered the required information, click the “Submit” or “Check Status” button. The tool will process your request and display the current status of your refund. It may also provide additional details, such as the date the refund was issued or any potential delays.

It's important to note that while the online status checker is an efficient tool, it's not the only option. For those who prefer a more personalized approach or encounter issues with the online tool, the Department offers a telephone hotline for refund status inquiries. Trained representatives are available to assist with any questions or concerns regarding refund status and can provide the same information as the online checker.

Furthermore, for taxpayers who prefer traditional methods or have limited access to digital tools, the Department also provides a refund status inquiry by mail. Taxpayers can send a written request to the Department, including their contact information and specific details about their tax return. While this method may take longer than digital options, it ensures that every taxpayer has access to the information they need.

Processing Times and Potential Delays

Understanding the typical processing times for New York State income tax refunds is essential for managing expectations. While the Department of Taxation and Finance strives to process refunds as quickly as possible, various factors can influence the timeline.

In general, refunds for simple tax returns with no errors or discrepancies are processed within 4 to 6 weeks from the date the return is received. However, more complex returns or those with errors may take longer. It's important to review your tax return carefully before submission to minimize potential delays.

The Department also prioritizes processing certain types of refunds, such as those for individuals with lower incomes or those who are experiencing financial hardship. These refunds may be processed more quickly to provide timely assistance to those in need.

Despite the Department's best efforts, unexpected delays can occur. These may be due to system upgrades, high volumes of tax returns during peak filing seasons, or issues with the accuracy or completeness of tax returns. In such cases, the Department communicates these delays through its website and social media channels to keep taxpayers informed.

Tips for Expediting Your Refund

- File Electronically: Filing your tax return electronically is not only faster and more secure but also reduces the chances of errors that could delay your refund.

- Choose Direct Deposit: Opting for direct deposit of your refund ensures it arrives faster and more securely than a paper check. It also reduces the risk of delays due to mailing issues.

- Review Your Return: Before submitting your tax return, carefully review it for accuracy. Double-check your personal information, income details, and any deductions or credits claimed. Errors or omissions can lead to delays or even additional scrutiny from the Department.

- Respond Promptly: If the Department of Taxation and Finance contacts you regarding your tax return, respond promptly with the requested information. This ensures that your refund processing can continue without unnecessary delays.

Staying Informed: The Role of Tax Notifications

To keep taxpayers informed about the status of their refunds, the New York State Department of Taxation and Finance employs various communication methods. One of the primary tools is tax notifications, which provide updates and important information about tax refunds and other tax-related matters.

Tax notifications can be sent via email, text message, or traditional mail, depending on the taxpayer's preferences. These notifications are designed to be clear and concise, providing essential details about the refund status, including whether the refund has been issued, is pending, or has been delayed.

For taxpayers who have provided their email addresses or mobile phone numbers, email and text notifications are the fastest way to receive updates. These notifications often include a direct link to the online refund status checker, allowing taxpayers to quickly access more detailed information about their refund.

Taxpayers who prefer traditional mail can still receive paper notifications. While these may take longer to arrive, they provide a physical record of the refund status, which can be useful for reference or for sharing with financial advisors or family members.

It's important for taxpayers to ensure that their contact information, especially email addresses and phone numbers, is up-to-date with the Department of Taxation and Finance. Outdated or incorrect information can lead to missed notifications and potential delays in receiving important refund updates.

Customizing Your Tax Notifications

The Department of Taxation and Finance recognizes that taxpayers have diverse preferences and needs when it comes to receiving tax notifications. To accommodate these preferences, the Department offers a customizable notification system.

Taxpayers can log into their online account with the Department and select their preferred method of communication for tax notifications. They can choose to receive notifications via email, text message, or mail, or a combination of these methods. This flexibility ensures that taxpayers can receive updates in a way that suits their lifestyle and preferences.

In addition to selecting the communication method, taxpayers can also choose the frequency of notifications. Some may prefer daily updates, while others may opt for weekly or monthly notifications. This level of customization ensures that taxpayers receive the right amount of information at a pace that works for them.

It's worth noting that while the customizable notification system offers convenience and flexibility, it's essential to strike a balance. Receiving too many notifications can lead to information overload, while too few notifications may result in missed updates. Taxpayers should find a frequency that allows them to stay informed without being overwhelmed.

Future Outlook: Enhancing the Tax Refund Experience

The New York State Department of Taxation and Finance is committed to continuously improving the tax refund process for its residents. As technology advances and taxpayer needs evolve, the Department is exploring innovative ways to enhance the refund experience.

One area of focus is digital transformation. The Department is investing in upgrading its online platforms and systems to provide a more seamless and user-friendly experience for taxpayers. This includes enhancing the online refund status checker with real-time updates and additional features, such as refund tracking and personalized refund estimates.

Additionally, the Department is exploring the use of artificial intelligence (AI) and machine learning technologies to streamline the refund process. AI-powered tools can analyze tax returns more efficiently, identify potential errors or discrepancies, and provide faster, more accurate refund calculations. This not only benefits taxpayers by reducing processing times but also helps the Department allocate resources more effectively.

Another area of improvement is taxpayer education. The Department aims to empower taxpayers with the knowledge and tools they need to navigate the tax system confidently. This includes providing comprehensive guides and resources on its website, hosting educational webinars and workshops, and offering personalized tax assistance through its helpline and in-person offices.

By combining technological advancements with a focus on taxpayer education, the New York State Department of Taxation and Finance is working towards a future where the tax refund process is not only faster and more efficient but also more transparent and accessible for all residents.

The Impact of Technological Advancements

Technological advancements have the potential to revolutionize the tax refund process in New York State. One key area where technology can make a significant impact is in data security. With the increasing sophistication of cyber threats, it’s crucial for the Department of Taxation and Finance to invest in robust data protection measures.

By leveraging cutting-edge encryption technologies and implementing advanced cybersecurity protocols, the Department can safeguard taxpayer information and ensure the integrity of the tax refund process. This not only protects sensitive data but also builds trust among taxpayers, encouraging them to embrace digital tax services with confidence.

Another area where technology can play a transformative role is in process automation. By automating repetitive and time-consuming tasks, such as data entry and document processing, the Department can significantly reduce the time it takes to process tax refunds. This not only benefits taxpayers by receiving their refunds faster but also allows the Department to allocate resources more efficiently, focusing on complex cases and providing enhanced taxpayer support.

Furthermore, technological advancements can enable the Department to offer a more personalized tax refund experience. Through the use of data analytics and AI, the Department can gain deeper insights into taxpayer behavior and preferences. This knowledge can be leveraged to develop tailored refund processing pathways, ensuring that each taxpayer's unique circumstances are considered and addressed.

In conclusion, the future of the NYS income tax refund process is bright, thanks to the continuous advancements in technology and the Department's commitment to innovation. By embracing these changes, the Department can enhance the tax refund experience, making it more secure, efficient, and personalized for all New York State residents.

Conclusion: A Brighter Future for Taxpayers

In conclusion, the New York State Department of Taxation and Finance is dedicated to ensuring a smooth and efficient tax refund process for its residents. Through a combination of online tools, telephone hotlines, and traditional mail services, taxpayers have multiple channels to check the status of their refunds.

By understanding the typical processing times and potential delays, taxpayers can manage their expectations and take proactive steps to expedite their refunds. Staying informed through tax notifications and customizing these notifications to their preferences further enhances the tax refund experience.

As the Department continues to innovate and embrace technological advancements, the future of the tax refund process looks promising. With digital transformation, AI integration, and a focus on taxpayer education, New York State is poised to offer a faster, more secure, and more accessible tax refund system.

For New Yorkers, keeping up-to-date with these advancements and taking advantage of the available resources can lead to a more seamless and stress-free tax refund journey. The Department of Taxation and Finance is committed to making this process as straightforward and beneficial as possible for all residents.

What is the average processing time for a NYS income tax refund?

+The average processing time for a simple NYS income tax refund is typically 4 to 6 weeks from the date the return is received. However, more complex returns or those with errors may take longer.

How can I check the status of my NYS income tax refund online?

+To check the status of your NYS income tax refund online, visit the New York State Department of Taxation and Finance’s official website and locate the “Check Refund Status” section. You’ll need to provide your Social Security Number or Taxpayer Identification Number, as well as the exact amount of your refund as stated on your return.

What should I do if I haven’t received my NYS income tax refund within the expected timeframe?

+If you haven’t received your NYS income tax refund within the expected timeframe, it’s recommended to first check the status of your refund using the online tool or by calling the Department’s telephone hotline. If the status indicates a delay or issue, you can follow the instructions provided to resolve the problem. If the status is unclear, contact the Department for further assistance.

Can I receive tax notifications via text message or email?

+Yes, the New York State Department of Taxation and Finance offers the option to receive tax notifications via text message or email. To set up these notifications, log into your online account with the Department and select your preferred communication method. This ensures you receive timely updates about your refund status.

How can I expedite the processing of my NYS income tax refund?

+To expedite the processing of your NYS income tax refund, file your return electronically and choose direct deposit for your refund. Also, review your tax return carefully before submission to minimize errors that could cause delays. Additionally, respond promptly to any communications from the Department of Taxation and Finance regarding your tax return.