What Is Phantom Tax: 5 Key Facts You Need to Know

In the complex landscape of taxation, concepts that seem opaque or counterintuitive often pose significant challenges for taxpayers and financial planners alike. Among these, "phantom tax" has emerged as a perplexing phenomenon that catches many off guard—an insidious element that can stealthily erode wealth without apparent cause. Understanding what phantom tax is, why it occurs, and how to strategize against its impact is now a critical competency for anyone invested in managing their financial affairs effectively. As with all tax-related topics, dissecting its nuances demands clarity, precision, and a nuanced grasp of tax law intricacies, combined with practical insights gleaned from industry experience and scholarly analysis.

Unveiling the Nature of Phantom Tax

Phantom tax, sometimes referred to as “ghost tax,” describes a scenario where taxpayers incur tax liabilities seemingly without corresponding cash income or asset liquidations. This paradoxically occurs in situations where internal financial mechanisms, like depreciation recapture, unrealized gains, or certain types of income reclassification, trigger tax obligations that do not align with actual cash flow. Such cases typify the disconnect between accounting income and realized income—a divergence that often surprises taxpayers who only consider cash received or liquid assets when assessing tax liabilities. This phenomenon is especially prevalent in investments involving complex asset management strategies, such as real estate or certain financial derivatives, where tax law provisions interact with asset appreciation or depreciation over time.

The Evolutionary Roots of Phantom Tax

Deriving from the evolution of tax law designed to ensure fiscal fairness and revenue stability, phantom tax reflects how legislative efforts to tax unrealized gains or income have inadvertently created situations where taxable events occur prematurely. Historically, tax authorities have grappled with balancing revenue collection and economic growth, leading to provisions like depreciation recapture, capital gains tax, and alternative minimum tax (AMT). These rules, intended to prevent deferral of tax or abuse, often result in taxpayers paying taxes on paper gains that have yet to translate into tangible cash, thereby producing the “phantom” effect. As tax standards evolved to deter tax avoidance, they layered additional complexity onto asset valuation and recognition rules, intensifying the prevalence and importance of phantom tax scenarios.

| Relevant Category | Substantive Data |

|---|---|

| Estimated Impact | Approximately 1.5 million U.S. households face phantom income issues annually, translating into billions in unexpected tax liabilities |

Core Aspects of Phantom Tax: Key Facts

Key Points

- Nature of Phantom Income: Primarily arises from unrealized gains, depreciation recapture, or reclassification of income, leading to tax liabilities without liquid assets.

- Legal Foundations: Rooted in tax laws like the U.S. Internal Revenue Code, notably provisions on depreciation, capital gains, and recapture rules.

- Impact on Taxpayers: Can generate significant unexpected tax burdens, forcing strategic planning and often resulting in cash flow challenges during tax payments.

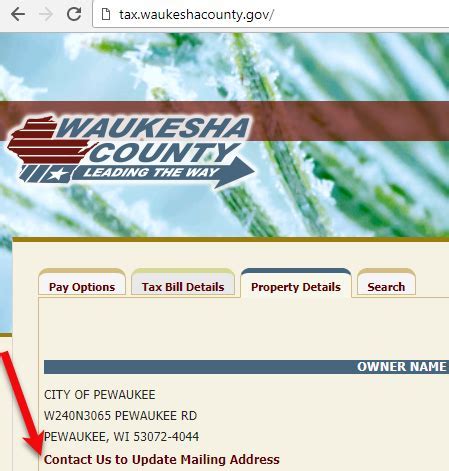

- Common Assets Affected: Real estate, stock options, certain derivatives, and high-value financial portfolios are most susceptible to phantom tax effects.

- Strategies to Mitigate: Use of tax deferral vehicles, timing of asset sales, and engagement with tax professionals for advanced planning are essential to reduce exposure.

In-Depth Explanation: How Phantom Tax Manifests in Practice

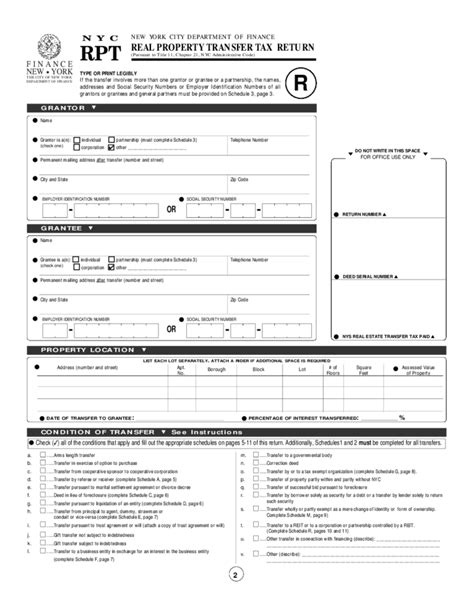

Imagine an investor holding appreciated real estate with significant depreciation deductions from prior years. When they sell the property, depreciation recapture taxes emerge—an IRS rule that taxes certain gains at ordinary income tax rates rather than capital gains rates. Until the sale occurs, these depreciation amounts create a paper loss on paper, but the tax law demands payment upon disposition, leading to a “phantom” tax liability. Similarly, in stock trading, when an asset has gone through an unfavorable valuation adjustment, the reclassification or sale of derivatives can trigger unrealized gains that are taxable without any corresponding cash inflow. Such complex interactions underscore the importance of understanding the specific tax code provisions and their economic effects.

Tax Law Provisions Underpinning Phantom Tax

The legislative framework that supports the phenomenon includes key elements such as:

- Depreciation Recapture: Taxed upon sale or disposition of depreciable assets, forcing recognition of accumulated depreciation as taxable income.

- Capital Gains Taxation: Imposes taxes on realized gains, but certain strategies may trigger taxes on unrealized gains due to reclassification or deemed dispositions.

- Alternative Minimum Tax (AMT): Limits deductions like depreciation, which can result in increased tax liabilities without liquidity equivalents.

| Relevant Category | Substantive Data |

|---|---|

| Depreciation Recapture Rate | up to 25% in the U.S., depending on asset class |

| Capital Gains Rate | Typically 15-20% for long-term assets, but can be higher for certain recaptured income |

Navigating Phantom Tax: Practical Strategies and Considerations

Effective management of phantom tax involves a blend of disciplined record-keeping, proactive planning, and sometimes the aid of sophisticated financial instruments. Taxpayers and advisors should focus on:

- Timing Asset Dispositions: Phasing sales to avoid spikes in unrealized gains within a single tax period can reduce sudden liabilities.

- Utilizing Tax-Deferred Exchanges: Instruments like 1031 exchanges or IRAs allow postponement of tax recognition on certain gains.

- Tracking Basis and Recapture: Maintaining detailed records of asset purchase price and improvements helps in accurately calculating tax liabilities and avoiding surprises.

- Employing Tax Credits and Deductions: Offset potential phantom income with available credits, deductions, or loss harvesting strategies.

The Role of Professional Guidance

Given the layered complexity, engaging knowledgeable tax professionals is often vital. Their expertise can pinpoint opportunities for deferral, identify potential liabilities early, and guide strategic asset management to minimize the impact of phantom taxation. This proactive approach can make the difference between manageable tax bills and debilitating financial strain.

Potential Limitations and Considerations

Despite best efforts, some aspects of phantom tax remain challenging due to legislative uncertainty or changes in law. For example, recent proposals in fiscal reforms could alter depreciation or capital gain rules, reshaping the landscape. Additionally, tax planning must consider individual circumstances, such as estate size, income level, and investment portfolio diversity, which influence the specific risks and opportunities associated with phantom tax.

What causes phantom tax in real estate investments?

+Phantom tax in real estate often stems from depreciation recapture when an asset is sold, requiring the taxpayer to pay taxes on depreciation taken previously, even if no cash has been received.

Can phantom tax be entirely avoided?

+Complete avoidance is challenging, but strategic planning—such as utilizing like-kind exchanges, timing sales, and employing tax deferral tools—can significantly reduce its impact.

What role do tax professionals play in managing phantom tax?

+Tax professionals provide critical guidance in understanding complex law interactions, developing tailored strategies, and implementing effective tax deferral or minimization techniques.