Waukesha County Property Taxes

When it comes to understanding and managing property taxes, Waukesha County, Wisconsin, offers a unique landscape with its diverse range of residential and commercial properties. This comprehensive guide will delve into the intricacies of Waukesha County property taxes, providing an expert analysis to help property owners navigate this essential aspect of homeownership.

Understanding Waukesha County’s Property Tax System

Waukesha County’s property tax system is designed to generate revenue for local government bodies, including the county, municipalities, school districts, and special purpose districts. This revenue is crucial for funding essential services like education, infrastructure, and public safety.

The property tax system in Waukesha County operates on the principle of ad valorem taxation, which means that the tax liability is determined by the assessed value of the property. This value is influenced by various factors, including the property's location, size, condition, and recent sales of similar properties in the area.

Assessed Value vs. Fair Market Value

It’s important to distinguish between the assessed value and the fair market value of a property. The assessed value is the value determined by the county assessor for tax purposes, while the fair market value is the price at which a property would likely sell on the open market.

In Waukesha County, the assessed value is typically set at a percentage of the fair market value. This percentage, known as the assessment level, can vary depending on the property type and its location within the county.

| Property Type | Assessment Level |

|---|---|

| Residential Properties | 100% of Fair Market Value |

| Commercial Properties | 25% of Fair Market Value |

| Agricultural Properties | 50% of Fair Market Value |

For instance, if a residential property has a fair market value of $300,000, its assessed value for tax purposes would be $300,000, assuming the standard assessment level for residential properties in Waukesha County.

The Tax Levy and Mill Rate

Once the assessed values of all properties within a taxing district are determined, the local government sets a tax levy, which is the total amount of tax revenue required to fund its operations and services for the year.

The tax levy is then divided among the properties within the district based on their assessed values. This division is done using the mill rate, which is a tax rate expressed in mills. One mill represents a tax liability of $1 for every $1,000 of assessed value.

To calculate the property tax liability for a specific property, the assessed value is multiplied by the mill rate. For example, if the mill rate in a given district is 20 mills and a property has an assessed value of $200,000, the tax liability would be $4,000 ($200,000 x 0.020 = $4,000).

Property Tax Rates in Waukesha County

Waukesha County, like many other counties, has multiple taxing districts, each with its own tax rate. These districts include the county itself, various municipalities, school districts, and special purpose districts such as fire districts or sanitary districts.

The tax rates within Waukesha County can vary significantly depending on the specific district and the services provided. For instance, a property located within the city limits of Waukesha might have a higher tax rate compared to a property in a rural area of the county, as it benefits from additional municipal services.

Average Property Tax Rates

According to recent data, the average effective property tax rate in Waukesha County is approximately 1.86% of the property’s assessed value. This rate can be broken down into the following:

- County Tax Rate: Approximately 0.35% of assessed value.

- Municipal Tax Rate: Varies, but on average, around 0.75% of assessed value.

- School District Tax Rate: Typically the highest component, averaging around 0.76% of assessed value.

- Special Purpose District Tax Rate: Ranges from 0.05% to 0.20% of assessed value, depending on the specific district and services provided.

It's important to note that these rates are averages and can vary significantly from one property to another, depending on their location within the county and the specific taxing districts they fall under.

Comparison with Other Counties

When compared to other counties in Wisconsin, Waukesha County’s property tax rates are relatively competitive. For instance, neighboring Milwaukee County has an average effective property tax rate of around 2.05%, while Washington County’s rate is approximately 1.92%.

However, it's essential to consider that property values can also vary significantly between counties, which can influence the overall tax burden. Waukesha County's relatively lower tax rates might be offset by higher property values, making the effective tax burden more comparable to that of neighboring counties.

Property Tax Assessments and Appeals

Property owners in Waukesha County have the right to understand and question their property’s assessed value. The county’s Department of Taxation and Assessment is responsible for conducting property assessments, which are typically done every two years.

Understanding Your Property Assessment

When a property assessment is conducted, property owners will receive a notice of their property’s assessed value. This notice should include details such as the property’s legal description, its assessed value, and any changes made since the last assessment.

Property owners should carefully review these assessments to ensure accuracy. Discrepancies in the assessment can lead to an unfair tax burden, so it's crucial to address any concerns promptly.

The Appeal Process

If a property owner believes their property’s assessed value is inaccurate, they have the right to appeal. The appeal process in Waukesha County involves the following steps:

- Informal Review: Property owners can request an informal review with the assessor's office to discuss concerns and provide additional information about the property.

- Board of Review: If the informal review doesn't resolve the issue, property owners can file a formal objection with the Board of Review. This board is responsible for reviewing assessments and making adjustments if necessary.

- Circuit Court Appeal: If the Board of Review's decision is unsatisfactory, property owners have the option to appeal to the circuit court. This is a formal legal process that requires representation by an attorney.

It's important to note that the appeal process has specific timelines and requirements. Property owners should carefully review the assessment notice and relevant county guidelines to ensure they meet all deadlines and provide the necessary documentation.

Reducing Your Property Tax Burden

While property taxes are a necessary part of homeownership, there are strategies that property owners can employ to potentially reduce their tax burden. Here are some approaches that Waukesha County residents can consider:

Homeowner Exemptions

Waukesha County offers several homeowner exemptions that can reduce the assessed value of a property, thereby lowering the tax liability. These exemptions include:

- Homestead Exemption: Provides a $30,000 reduction in the assessed value for primary residences.

- Senior Citizen Exemption: Offers a reduction in assessed value for homeowners aged 65 or older.

- Veteran's Exemption: Provides a tax exemption for eligible veterans or their surviving spouses.

To claim these exemptions, property owners need to complete the necessary applications and provide the required documentation to the county assessor's office.

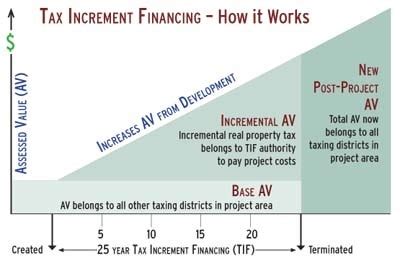

Tax Abatement Programs

Waukesha County, along with some of its municipalities, offers tax abatement programs to encourage economic development and attract new businesses. These programs provide temporary tax relief for eligible properties, such as those undergoing significant renovations or new construction.

Property owners interested in these programs should consult with the county's economic development office to understand the eligibility criteria and the application process.

Appealing Assessed Value

As mentioned earlier, property owners have the right to appeal their assessed value if they believe it is inaccurate. A successful appeal can lead to a reduced tax liability for the current and future tax years.

To increase the chances of a successful appeal, property owners should gather compelling evidence, such as recent sales of similar properties, appraisals, or professional assessments. It's also beneficial to seek guidance from tax professionals who are familiar with the appeal process in Waukesha County.

Conclusion

Navigating Waukesha County’s property tax system requires an understanding of the assessment process, tax rates, and available exemptions. By staying informed and proactive, property owners can ensure that their tax burden is fair and accurate.

Whether it's understanding the appeal process, claiming applicable exemptions, or exploring tax abatement programs, there are various strategies that can help Waukesha County residents manage their property taxes effectively. Staying informed and seeking professional guidance when needed can go a long way in optimizing one's financial position as a property owner.

How often are property assessments conducted in Waukesha County?

+Property assessments in Waukesha County are typically conducted every two years. However, the county can also conduct reassessments when there are significant changes to a property, such as new construction or renovations.

What happens if I miss the deadline for appealing my property assessment?

+Missing the deadline for appealing your property assessment can result in your appeal being denied. It’s important to carefully review the assessment notice and adhere to the timelines set by the county. If you have valid reasons for missing the deadline, such as illness or natural disasters, you may be able to request an extension, but this is not guaranteed.

Can I appeal my property taxes if I’ve recently purchased my home?

+Yes, you can appeal your property taxes even if you’ve recently purchased your home. The assessed value of a property is based on its fair market value, not the purchase price. If you believe the assessed value is inaccurate, you have the right to appeal.

Are there any online resources to help me estimate my property taxes in Waukesha County?

+Yes, the Waukesha County Treasurer’s Office provides an online Property Tax Estimator tool. This tool allows property owners to estimate their tax liability based on their property’s assessed value and the current tax rates. It’s a helpful resource for budgeting and financial planning.