New York Transfer Tax

Welcome to our comprehensive guide on the New York Transfer Tax, a crucial aspect of real estate transactions within the state of New York. The transfer tax is an essential component of the state's revenue system, and understanding its intricacies is vital for both buyers and sellers in the New York real estate market. This article aims to provide an in-depth analysis of the New York Transfer Tax, covering its history, calculation methods, exemptions, and its impact on the property market.

The Origins and Purpose of New York Transfer Tax

The New York Transfer Tax has a long history dating back to the early 20th century. It was initially introduced as a means to generate revenue for the state government, with the tax being levied on the transfer of ownership of real property. Over the years, the tax has undergone various amendments and updates to adapt to the changing real estate landscape and the evolving needs of the state's economy.

The primary purpose of the New York Transfer Tax is to raise funds for essential public services and infrastructure projects. The revenue generated from this tax contributes significantly to the state's budget, allowing for investments in education, healthcare, transportation, and other vital sectors. By imposing a tax on real estate transactions, the state ensures that those benefiting from the property market also contribute to the overall well-being and development of the community.

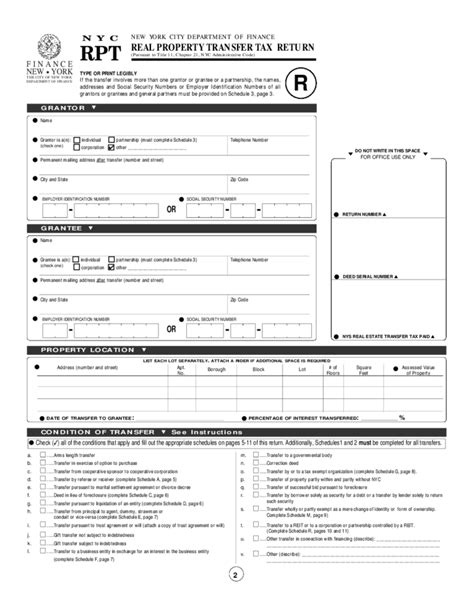

Understanding the Transfer Tax Calculation

The calculation of the New York Transfer Tax is a critical aspect that buyers and sellers must grasp to ensure accurate compliance. The tax is computed based on the value of the property being transferred and is imposed on both residential and commercial properties. Here's a breakdown of the calculation process:

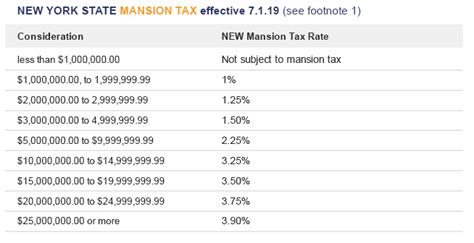

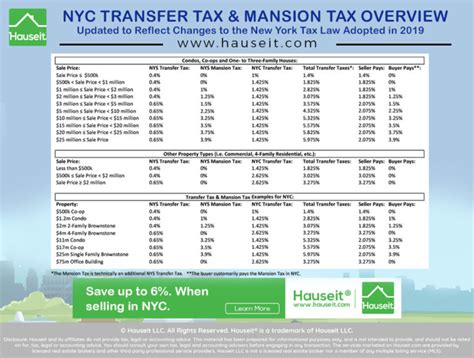

- Residential Properties: For residential real estate, the transfer tax is typically calculated as a percentage of the property's sale price. The rate varies depending on the county and can range from 0.4% to 0.65% of the sale value. For example, in Manhattan, the transfer tax rate is 1% for properties valued at $500,000 or less and increases to 1.425% for properties exceeding this value.

- Commercial Properties: The calculation for commercial properties differs slightly. The tax is assessed as a flat rate per $1,000 of the property's value. The rate varies by county and can range from $2.50 to $4.00 per $1,000. For instance, in Nassau County, the transfer tax for commercial properties is $3.00 per $1,000 of the property's value.

- Special Cases: It's important to note that there may be additional factors that influence the transfer tax calculation. For instance, properties transferred through a cooperative corporation or certain types of trusts may have specific tax rates or exemptions. It is crucial to consult with legal and tax professionals to ensure accurate calculations in such cases.

Impact of Transfer Tax on Property Prices

The New York Transfer Tax can have a significant impact on the overall cost of a real estate transaction. Buyers must factor in the transfer tax when calculating their budget for a property purchase. For instance, a buyer acquiring a $1 million residential property in Manhattan would need to budget for an additional $14,250 in transfer tax (at the 1.425% rate). This additional cost can affect the buyer's purchasing power and may influence their decision-making process.

Sellers, on the other hand, may consider the transfer tax as a negotiable expense, especially in a competitive market. In some cases, sellers might offer to pay a portion or all of the transfer tax to make their property more attractive to potential buyers. This strategy can help expedite the sale and ensure a quicker transaction, especially in a buyer's market.

Exemptions and Special Considerations

While the New York Transfer Tax is applicable to most real estate transactions, there are certain exemptions and special considerations that buyers and sellers should be aware of. These exemptions can significantly reduce or eliminate the tax burden, making it crucial to understand the eligibility criteria.

- First-Time Homebuyer Exemption: New York State offers a significant exemption for first-time homebuyers. Qualified buyers purchasing a primary residence can receive a tax exemption of up to $400,000 on their property's value. This exemption can result in substantial savings, especially for those buying their first home in the state.

- Senior Citizen Exemption: Seniors aged 65 and above may be eligible for a partial exemption from the transfer tax. This exemption is based on the homeowner's income and the property's value. The exemption can reduce the tax liability, providing relief for seniors who are looking to downsize or sell their properties.

- Military Service Exemption: Active-duty military personnel and veterans may qualify for a transfer tax exemption when purchasing a primary residence in New York State. This exemption is a token of appreciation for their service and can provide significant savings, making homeownership more accessible for those who have served our country.

- Cooperative and Condominium Transfers: Transfers of cooperative apartments and condominiums have specific tax considerations. While the general transfer tax rates apply, there may be additional fees or exemptions based on the unique structure of these property types. It is essential to consult with a real estate attorney to navigate these complexities.

The Role of Title Insurance in Transfer Tax Compliance

Title insurance plays a crucial role in ensuring compliance with the New York Transfer Tax. When purchasing a property, buyers are often required to obtain a title insurance policy. This policy not only protects the buyer's interest in the property but also ensures that all applicable taxes, including the transfer tax, have been paid. Title insurance companies conduct thorough research to verify the accuracy of the transfer tax calculation and ensure that the necessary payments have been made.

Title insurance providers work closely with real estate professionals, attorneys, and government agencies to guarantee that the transfer tax process is handled correctly. By obtaining title insurance, buyers can have peace of mind knowing that their transaction is compliant with state regulations and that their interests are protected.

Future Implications and Market Trends

The New York Transfer Tax is a dynamic component of the state's real estate landscape, and its future implications are worth exploring. As the real estate market continues to evolve, the transfer tax may undergo further amendments to adapt to changing market conditions and government priorities.

One potential future trend is the expansion of transfer tax exemptions to encourage specific types of development or support targeted demographics. For instance, the state may consider additional exemptions for affordable housing initiatives or for properties that promote sustainability and environmental conservation. Such measures could shape the market by incentivizing certain types of investments and influencing buyer and seller behavior.

Additionally, the transfer tax rates themselves may be subject to adjustments based on economic conditions and government revenue needs. In times of economic prosperity, the state may consider increasing transfer tax rates to generate additional revenue for public projects. Conversely, during economic downturns, the state might reduce transfer tax rates to stimulate the real estate market and support homebuyers.

The Impact of Technological Advancements

Technological advancements are also likely to play a significant role in the future of the New York Transfer Tax. As the real estate industry embraces digital transformation, the process of calculating and paying transfer taxes may become more streamlined and efficient. Online platforms and digital tools could facilitate the submission of tax forms, payments, and record-keeping, making the entire process more accessible and transparent.

Furthermore, blockchain technology and smart contracts could revolutionize the way transfer taxes are handled. These innovative solutions could enhance security, reduce fraud, and automate certain aspects of the tax payment process. By leveraging these technologies, the state could ensure greater accuracy and efficiency in tax compliance, benefiting both taxpayers and government agencies.

Conclusion

In conclusion, the New York Transfer Tax is a multifaceted aspect of the state's real estate landscape. From its historical origins to its impact on property prices and market trends, this tax plays a crucial role in shaping the real estate market. By understanding the calculation methods, exemptions, and future implications, buyers and sellers can navigate the New York property market with confidence and make informed decisions.

As the real estate industry continues to evolve, staying updated on transfer tax regulations and market trends is essential. Whether you're a first-time homebuyer, a seasoned investor, or a real estate professional, a comprehensive understanding of the New York Transfer Tax will empower you to make strategic decisions and ensure compliance with state regulations.

Frequently Asked Questions

What is the purpose of the New York Transfer Tax?

+

The New York Transfer Tax is a revenue-generating measure imposed on the transfer of ownership of real property. The tax funds essential public services and infrastructure projects, contributing to the overall development of the state.

How is the transfer tax calculated for residential properties in New York?

+

The transfer tax for residential properties is calculated as a percentage of the property’s sale price. The rate varies by county and can range from 0.4% to 1.425% of the sale value. For instance, in Manhattan, the rate is 1% for properties up to 500,000 and increases to 1.425% for higher-value properties.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Are there any exemptions from the New York Transfer Tax?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, there are several exemptions available. First-time homebuyers can receive an exemption of up to 400,000 on their primary residence. Seniors aged 65 and above may qualify for a partial exemption based on their income and property value. Additionally, active-duty military personnel and veterans may be eligible for an exemption when purchasing a primary residence.

How does title insurance relate to the New York Transfer Tax?

+

Title insurance ensures that all applicable taxes, including the transfer tax, have been paid. When buying a property, obtaining a title insurance policy is often required, and it provides protection for the buyer’s interest in the property while verifying tax compliance.

What are some potential future trends for the New York Transfer Tax?

+

The New York Transfer Tax may undergo adjustments based on economic conditions and government priorities. Future trends may include expanded exemptions for affordable housing initiatives or properties promoting sustainability. Technological advancements, such as blockchain and smart contracts, could also revolutionize the tax payment process.