Where My State Tax Refund Pa

Navigating the tax refund process can be a complex journey, especially when it comes to understanding where your state tax refund is and when to expect it. Each state in the United States has its own unique tax system and procedures, making it crucial to familiarize yourself with the specific rules and timelines of your state. In this comprehensive guide, we will delve into the world of state tax refunds, exploring the various factors that influence their processing and offering valuable insights to help you track your refund with precision.

Understanding State Tax Refunds

State tax refunds are a common occurrence for many taxpayers across the United States. When you overpay your state taxes throughout the year, either through withholding from your paycheck or estimated tax payments, you are eligible for a refund. These refunds can vary significantly based on factors such as your income, deductions, and the specific tax laws of your state.

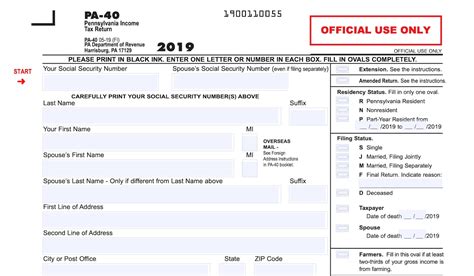

The process of receiving your state tax refund begins with the submission of your state tax return. Depending on your state's tax authority, you may have the option to file your return electronically or through traditional mail. Once your return is received and processed, the state tax agency will review your information and calculate the amount of refund you are entitled to.

Factors Influencing State Tax Refund Processing

Several factors can impact the processing time and outcome of your state tax refund. Understanding these factors is essential to managing your expectations and planning your financial affairs accordingly.

- State Tax Agency Capacity: The volume of tax returns received by state tax agencies can vary significantly, especially during peak filing seasons. A higher volume of returns may lead to longer processing times as agencies prioritize efficiency and accuracy.

- Complexity of Your Return: The complexity of your tax return can also affect processing time. Returns with multiple sources of income, deductions, or credits may require more time for review and calculation.

- Payment Method: The method you choose to receive your refund can impact the overall timeline. Opting for direct deposit typically results in faster refunds compared to receiving a paper check.

- Errors and Omissions: Mistakes or missing information on your tax return can cause delays. Tax agencies may need to contact you to resolve issues, which can prolong the refund process.

- Fraud Detection and Prevention: State tax agencies have robust systems in place to detect and prevent tax fraud. While these measures are necessary for security, they can sometimes lead to longer processing times as returns undergo additional scrutiny.

Tracking Your State Tax Refund

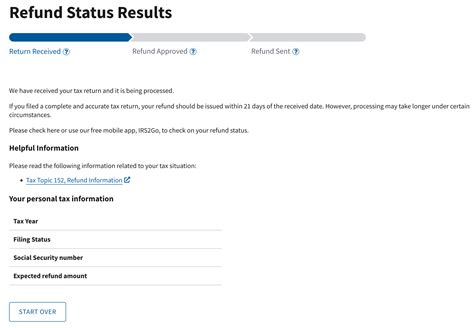

Staying informed about the status of your state tax refund is essential for effective financial planning. Most state tax agencies offer online tools and resources to help taxpayers track their refunds. Here are some steps to help you stay on top of the process:

- Check the Official Website: Start by visiting the official website of your state's tax agency. Many states provide dedicated sections or tools for refund tracking. You will typically need to enter personal information, such as your Social Security Number and date of birth, to access your refund status.

- Utilize Refund Hotlines: State tax agencies often maintain dedicated hotlines for refund inquiries. These hotlines can provide up-to-date information about your refund and answer any questions you may have about the process.

- Monitor Your Mail: In some cases, state tax agencies may send correspondence regarding your refund via mail. Keep an eye on your mailbox, especially if you have recently filed your tax return or if the expected refund date has passed.

- Set Up Email Notifications: If available, sign up for email notifications from your state tax agency. This way, you will receive real-time updates about the status of your refund directly in your inbox.

- Consider Using a Tax Preparation Software: Many tax preparation software providers offer refund tracking features. If you used such software to file your return, you may have the option to track your refund through the platform.

| State | Average Processing Time |

|---|---|

| California | 4-6 weeks |

| New York | 6-8 weeks |

| Texas | 2-3 weeks |

| Florida | 3-4 weeks |

| Illinois | 4-6 weeks |

Common Issues and Resolutions

Despite your best efforts, there may be instances where your state tax refund is delayed or faces other issues. Understanding common problems and their potential solutions can help you navigate these situations more effectively.

Delayed Refunds

If your refund is taking longer than expected, it’s essential to identify the reason for the delay. Common causes of delayed refunds include:

- Missing or Incomplete Information: Ensure that you have provided all the necessary documentation and information when filing your tax return. Incomplete or inaccurate data can lead to delays.

- Identity Verification: In some cases, state tax agencies may require additional identity verification to prevent fraud. This process can add time to your refund's processing.

- Tax Audit: If your return is selected for an audit, it may result in a delay. Audits are a normal part of the tax process and are conducted to ensure accuracy and compliance.

Refund Denials and Adjustments

In certain situations, you may receive a notice of refund denial or adjustment. This could occur for various reasons, including:

- Errors in Your Return: Mistakes in your tax return, such as incorrect calculations or missing forms, can lead to adjustments or denials.

- Overpayment of Taxes: If you have overpaid your taxes, you may receive a refund for a smaller amount than expected. This is not necessarily a denial but rather an adjustment to reflect the correct amount.

- Underreporting Income: If you have underreported your income, the state tax agency may adjust your refund accordingly.

Addressing Refund Issues

If you encounter any issues with your state tax refund, it’s crucial to take prompt action. Here are some steps to consider:

- Review Your Return: Carefully review your tax return for any errors or omissions. Ensure that all forms and supporting documents are included and accurate.

- Contact the Tax Agency: Reach out to your state's tax agency to inquire about the status of your refund. They can provide specific information and guidance based on your situation.

- File an Amended Return: If necessary, you may need to file an amended return to correct any errors or provide additional information. Follow the instructions provided by your state's tax agency.

- Consider Professional Assistance: If you are unsure about the process or need further guidance, consider seeking help from a tax professional or accountant.

Maximizing Your State Tax Refund

While tracking and understanding the status of your state tax refund is crucial, it’s equally important to explore strategies to maximize your refund. Here are some tips to consider:

- Understand Tax Credits and Deductions: Familiarize yourself with the tax credits and deductions available in your state. These can significantly impact your tax liability and potential refund.

- Keep Good Records: Maintain organized records of your income, expenses, and deductions. This will not only help with the accuracy of your return but also make it easier to resolve any issues that may arise.

- Explore Tax Preparation Software: Utilizing tax preparation software can simplify the filing process and help you identify potential deductions and credits you may be eligible for.

- Consider Hiring a Tax Professional: If you have a complex tax situation or are unsure about maximizing your refund, consulting with a tax professional can provide valuable guidance and ensure compliance with state tax laws.

Future Outlook and Developments

The world of state tax refunds is constantly evolving, with ongoing developments aimed at improving the process for taxpayers. Here are some trends and potential future improvements to look out for:

- Digital Transformation: Many state tax agencies are investing in digital technologies to streamline the refund process. Expect to see more online tools, mobile apps, and electronic filing options in the future.

- Real-Time Tax Information Sharing: Some states are exploring real-time information sharing between taxpayers and tax agencies. This could lead to faster refund processing and improved accuracy.

- Enhanced Security Measures: As technology advances, state tax agencies are likely to enhance their security measures to protect taxpayers' information and prevent fraud.

- Simplification of Tax Laws: Efforts to simplify tax laws and regulations are ongoing. This could result in more straightforward tax processes and potentially quicker refund processing.

Conclusion

Understanding where your state tax refund is and how to navigate the refund process is an essential aspect of financial planning. By staying informed, utilizing available resources, and taking proactive steps, you can effectively track your refund and address any issues that may arise. Remember, each state has its unique tax system, so it’s crucial to familiarize yourself with the specific rules and timelines of your state. With the right knowledge and tools, you can ensure a smooth and efficient refund process.

How long does it typically take to receive a state tax refund?

+The processing time for state tax refunds can vary widely depending on factors such as the state’s tax agency capacity, the complexity of your return, and the payment method you choose. On average, refunds can take anywhere from a few weeks to several months. It’s essential to check with your state’s tax agency for specific processing times and updates.

What should I do if my state tax refund is delayed?

+If your refund is taking longer than expected, it’s recommended to contact your state’s tax agency to inquire about the status. They can provide specific information and guidance based on your situation. Ensure that your tax return is complete and accurate, and consider filing an amended return if necessary.

Can I track my state tax refund online?

+Yes, most state tax agencies offer online tools and resources to track your refund. Visit the official website of your state’s tax agency and look for a dedicated refund tracking section. You may need to provide personal information, such as your Social Security Number and date of birth, to access your refund status.

What if I receive a notice of refund denial or adjustment?

+If you receive a notice of refund denial or adjustment, carefully review the reasons provided. Common causes include errors in your tax return, overpayment of taxes, or underreporting of income. You may need to file an amended return or contact the tax agency for further guidance.

How can I maximize my state tax refund?

+To maximize your state tax refund, it’s important to understand the tax credits and deductions available in your state. Keep good records of your income, expenses, and deductions. Consider using tax preparation software or consulting with a tax professional to identify potential savings and ensure compliance with state tax laws.