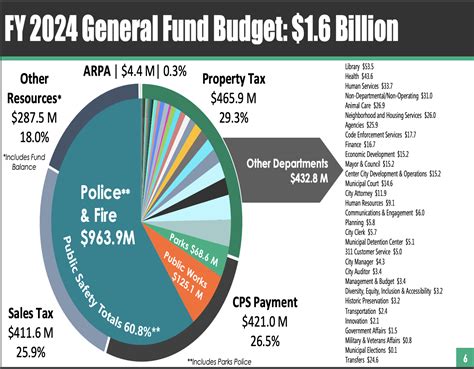

San Antonio City Sales Tax

Welcome to a comprehensive guide on the sales tax landscape of San Antonio, Texas. This article aims to provide an in-depth understanding of the city's sales tax structure, its impact on businesses and consumers, and the unique considerations for those navigating the vibrant economy of this vibrant city. With a diverse economy and a growing population, San Antonio's sales tax system is an essential component of its financial framework, influencing everything from local business strategies to consumer spending habits.

Understanding San Antonio's Sales Tax

San Antonio, like many other cities in Texas, operates within a complex sales tax system that includes various tax rates and jurisdictions. The sales tax in San Antonio is a cumulative tax, meaning that it is applied at each level of sale, from the manufacturer to the retailer, and finally to the consumer. This structure ensures that the tax burden is distributed across the supply chain.

The sales tax rate in San Antonio is composed of several components. The state of Texas imposes a 6.25% sales tax rate, which serves as the base rate. On top of this, San Antonio adds a 1.125% municipal tax, bringing the total city-level sales tax to 7.375%. However, it's essential to note that sales tax rates can vary within the city limits due to the presence of special taxing districts and additional local taxes.

For instance, the Bexar County, in which San Antonio is located, applies an additional 0.25% sales tax, taking the total county-level sales tax to 7.625%. Furthermore, certain areas within the city may have Municipal Utility Districts (MUDs) or Special Improvement Districts (SIDs), which can levy their own sales taxes, resulting in slightly higher rates in specific locations.

| Taxing Jurisdiction | Sales Tax Rate |

|---|---|

| State of Texas | 6.25% |

| San Antonio City | 1.125% |

| Bexar County | 0.25% |

| Special Districts (MUDs/SIDs) | Varies |

Taxable Goods and Services

The sales tax in San Antonio applies to a wide range of goods and services. This includes tangible personal property, such as clothing, electronics, and furniture, as well as certain services like repair work, entertainment, and even admission fees to events. However, there are some notable exceptions, such as groceries, prescription drugs, and certain agricultural products, which are exempt from sales tax in Texas.

The taxability of specific items can be complex, and it's crucial for businesses and consumers alike to stay informed about the latest regulations. For instance, while most food items are exempt, certain prepared foods or meals served in restaurants are subject to sales tax. Understanding these nuances is vital for accurate tax compliance.

Registration and Remittance Process

Businesses operating within San Antonio must register with the Texas Comptroller of Public Accounts to obtain a sales tax permit. This permit allows them to collect and remit sales tax on behalf of the state and local jurisdictions. The registration process typically involves providing business details, such as the nature of operations, estimated sales volume, and the location of sales.

Once registered, businesses are required to collect the appropriate sales tax from customers at the point of sale. The tax collected is then remitted to the state and local authorities on a periodic basis, usually monthly or quarterly, depending on the business's sales volume and tax liability. Late or non-compliance with these remittance requirements can result in penalties and interest charges.

Impact on Businesses and Consumers

The sales tax in San Antonio has a significant impact on both businesses and consumers. For businesses, it represents a critical revenue stream for the city and county, providing funding for various public services and infrastructure projects. However, it also adds to the cost of doing business, especially for retailers and service providers, who must factor in the tax when pricing their goods and services.

From a consumer perspective, the sales tax directly affects purchasing power and spending habits. While San Antonio's sales tax rate is relatively competitive compared to other major cities in Texas, it still represents a considerable portion of the total cost for higher-value items. Consumers often factor in the sales tax when making purchasing decisions, especially for big-ticket items, and may choose to shop in areas with lower tax rates if the savings are significant.

Strategies for Businesses

Businesses operating in San Antonio can employ various strategies to navigate the sales tax landscape effectively. One common approach is to build the sales tax into the retail price, making it a transparent cost for consumers. This strategy simplifies pricing and can help businesses maintain competitive pricing without sacrificing profitability.

Another strategy is to offer sales tax incentives or promotions, especially during slower sales periods. For instance, businesses could absorb the sales tax on certain items or offer discounts that offset the tax, encouraging consumers to make purchases. Such strategies can boost sales and customer loyalty, particularly during competitive retail seasons.

Additionally, businesses should stay informed about any changes in sales tax rates or regulations. This includes keeping track of special taxing districts and their rates, as well as any legislative changes at the state or local level. Being proactive about tax compliance not only avoids penalties but also ensures a positive relationship with tax authorities.

Consumer Awareness and Planning

For consumers, understanding the sales tax is crucial for making informed purchasing decisions. While the sales tax may seem like a minor consideration for everyday purchases, it can significantly impact larger purchases, such as vehicles, appliances, or home renovations. Consumers can plan their purchases strategically by comparing prices across retailers and considering the impact of the sales tax on the total cost.

Furthermore, consumers can benefit from being aware of sales tax holidays, which are designated periods when certain items are exempt from sales tax. These holidays, often coinciding with back-to-school or holiday shopping seasons, can provide significant savings on essential items. Staying informed about these tax-free periods can help consumers make the most of their purchasing power.

Future Considerations and Trends

As San Antonio's economy continues to evolve, several factors could influence the future of its sales tax system. One key consideration is the potential for e-commerce and online sales to grow further. With an increasing number of transactions occurring online, the city and state will need to adapt their sales tax regulations to capture revenue from these sales effectively.

Additionally, the ongoing debate around sales tax fairness and the potential for a wayfair decision at the state level could impact San Antonio's sales tax landscape. This could involve changes to the taxability of certain online sales or the implementation of new tax collection mechanisms for out-of-state sellers. Businesses and consumers alike should stay informed about these potential changes, as they could significantly affect the sales tax environment.

Another factor to consider is the impact of economic growth and development on San Antonio's sales tax revenue. As the city continues to attract new businesses and residents, the sales tax base could expand, providing additional revenue for public services and infrastructure projects. However, this growth also brings challenges, such as managing increased traffic and ensuring that the city's services can keep pace with its expanding population.

Frequently Asked Questions

What is the total sales tax rate in San Antonio, including all applicable taxes and districts?

+The total sales tax rate in San Antonio can vary slightly depending on the specific location within the city. However, the base rate is 6.25% for the state of Texas, plus 1.125% for the city of San Antonio, and 0.25% for Bexar County, bringing the total to 7.625%. Additional taxes from special districts (MUDs/SIDs) may apply, increasing the rate further.

<div class="faq-item">

<div class="faq-question">

<h3>Are there any items or services that are exempt from sales tax in San Antonio?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, there are several items and services that are exempt from sales tax in San Antonio. This includes most groceries, prescription drugs, and certain agricultural products. Additionally, some services, such as medical services and educational courses, are also exempt. It's important to consult the Texas Comptroller's website for a comprehensive list of exempt items and services.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How often do businesses need to remit sales tax in San Antonio?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The frequency of sales tax remittance depends on the business's sales volume and tax liability. Most businesses are required to remit sales tax on a monthly basis, while others with lower sales volumes may remit quarterly. It's important for businesses to accurately calculate their tax liability and remit taxes in a timely manner to avoid penalties.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any sales tax holidays in San Antonio, and what items are typically included?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, San Antonio, along with the rest of Texas, observes certain sales tax holidays. These holidays typically occur around back-to-school and holiday shopping seasons. During these periods, specific items, such as clothing, school supplies, and energy-efficient appliances, are exempt from sales tax. Consumers can take advantage of these tax-free periods to save on essential purchases.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can businesses stay updated on changes to San Antonio's sales tax regulations?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Businesses can stay informed about changes to San Antonio's sales tax regulations by regularly checking the Texas Comptroller's website and subscribing to their email updates. Additionally, businesses can consult with tax professionals or industry associations to ensure they are aware of any upcoming changes or legislative developments that may impact their sales tax obligations.</p>

</div>

</div>