Unlocking the Unique Features of Charlotte Sales Tax Explained

In the complex landscape of American taxation, sales tax remains one of the most intricate and often misunderstood components—especially when considering local variations like those found in Charlotte, North Carolina. Despite its seemingly straightforward premise—taxing retail transactions—Charlotte’s sales tax system embodies a nuanced blend of state, county, and municipal levies that can severely impact businesses and consumers alike. To navigate this labyrinth effectively, it’s essential to unpack the unique features of Charlotte sales tax, examining how its structure influences economic activity, compliance requirements, and local government revenue strategies.

Understanding the Problem: Navigating the Complexity of Charlotte Sales Tax

The primary challenge faced by business operators, financial professionals, and consumers in Charlotte is making sense of the layered sales tax rates and rules. Unlike many jurisdictions with a single, uniform sales tax rate, Charlotte’s revenue-generating mechanism involves multiple overlapping jurisdictions, each with its own rates and exemptions. This complexity leads to frequent confusion about applicable rates, product-specific exemptions, and reporting obligations. Furthermore, failure to comply accurately can result in penalties, audit complications, and financial loss, emphasizing the need for a comprehensive understanding of what makes Charlotte’s sales tax system distinct.

Deep Dive into the Features of Charlotte Sales Tax System

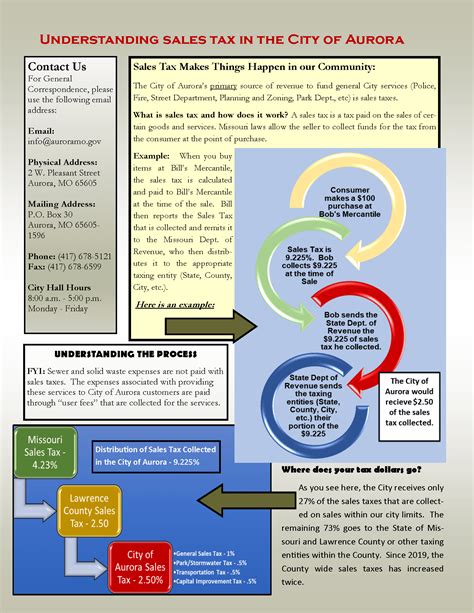

Charlotte’s sales tax system is emblematic of broader trends in U.S. local taxation, where devolution and local autonomy have led to varying tax structures. Its core features include a layered tax rate combining state, Mecklenburg County, and city levies, alongside specific exemptions and special district contributions, especially for infrastructure and public services.

Layered Tax Rates: Dissecting the Components of Charlotte Sales Tax

The total sales tax rate in Charlotte, North Carolina, typically hovers around 7.25%, but can fluctuate slightly due to specific district taxes or temporary surtaxes. This composite rate is constructed from segments:

- North Carolina State Sales Tax: 4.75% (as of October 2023), imposed uniformly across all jurisdictions.

- Mecklenburg County Sales Tax: 2.00%, dedicated to local infrastructure and public safety projects.

- Charlotte City Sales Tax: 0.50%, aimed at urban development and transportation improvements.

- Special Districts and Surtaxes: Occasional additional levies targeting specific projects, such as transit initiatives or environmental programs.

The combination creates a multifaceted rate structure that requires precise calculation for each transaction, especially in a retail environment with diverse product categories and multiple district considerations.

| Relevant Category | Substantive Data |

|---|---|

| Total Sales Tax Rate | Approximately 7.25%, variable with district-specific surtaxes and exemptions |

| State Base Rate | 4.75% |

| Mecklenburg County Component | 2.00% |

| Charlotte City Component | 0.50% |

Exemptions and Special Considerations in Charlotte

Besides the standard rates, Charlotte’s sales tax law accommodates numerous exemptions. Essential items like groceries, prescription medications, and certain educational materials often qualify for reduced or zero-rated transactions, aligning with social policy goals. However, specific exemptions depend on whether the sale is considered a wholesale or retail transaction, and whether the product falls under statutory exclusions.

Additionally, e-commerce sales or out-of-state shipments pose unique challenges. For example, Charlotte recognizes ‘economic nexus’ standards for remote sellers exceeding sales thresholds, compelling sellers outside North Carolina to collect and remit tax if their sales in the state cross specified limits.

The Impact of Charlotte’s Unique Features on Stakeholders

This intricate tax structure influences numerous stakeholders: local governments looking for sustainable revenue streams, businesses aiming to ensure compliance, and consumers managing disposable income. Understanding the interplay of these elements reveals strategic insights for economic planning and operational efficiency.

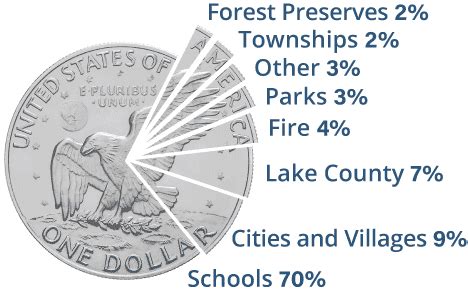

Local Government Revenue Strategies and Taxation

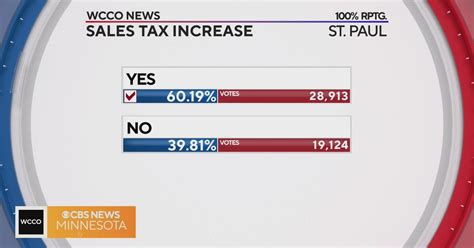

Charlotte relies heavily on layered sales taxes to fund urban infrastructure, transportation, and public safety. The strategic deployment of surtaxes and special district levies enables targeted investments but also creates periodic volatility, especially during economic downturns or political debates about tax rates.

For instance, temporary surtaxes introduced for transit expansion have provoked debates about balancing fiscal needs and economic impacts, prompting policymakers to consider long-term sustainability versus short-term revenue boosts.

Business Implications and Compliance Challenges

Retailers and service providers in Charlotte face mounting compliance burdens due to the multiplicity of rates and exemptions. Mistakes in rate application or misclassification of products can result in overpayment or underpayment, incurring penalties and audit risks. Advanced point-of-sale (POS) systems, coupled with geographic information systems (GIS), are increasingly necessary tools for accurate tax collection.

Moreover, the rise of e-commerce extends these challenges beyond traditional retail, necessitating robust tax automation and understanding of remote seller obligations under North Carolina’s marketplace facilitator laws.

Consumer Perspective and Economic Considerations

From the consumer standpoint, understanding Charlotte’s sales tax disclosures influences buying decisions. Transparency regarding tax-inclusive pricing or detailed receipts can empower consumers to evaluate cost implications accurately, especially when shopping in districts with varying surtax levels.

Economic implications also arise for cross-border shopping within Mecklenburg County, where proximity to neighboring jurisdictions with different tax rates can sway consumer behavior and retail patterns.

Strategies for Navigating the Charlotte Sales Tax Landscape

Effective navigation of Charlotte sales tax requires a multifaceted approach that integrates technological, legal, and educational components. Businesses benefit from implementing comprehensive tax compliance software tailored to these jurisdictional nuances, including automatic rate calculations, exemption flagging, and reporting tools.

Regular staff training and engagement with professional tax advisories help mitigate inadvertent errors, while active participation in local government consultations can provide insights into upcoming legislative changes. Moreover, leveraging third-party tax service providers specializing in North Carolina tax regulation can ensure ongoing compliance and minimize liabilities.

Leveraging Technology for Compliance

Advanced POS systems with integrated geolocation capabilities dynamically adjust for district-specific rates, reducing manual errors. Cloud-based solutions also facilitate real-time updates on changing surtax policies, aligning operational practices with current legal frameworks.

Supply chain transparency, including tracking product classification and exemption qualifications, forms a vital part of compliance strategies, especially for multi-channel retailers and online sellers.

Continual Education and Policy Monitoring

Proactive engagement through industry associations, local taxation seminars, and government portals enables stakeholders to anticipate legislative shifts and adapt swiftly. Staying close to policy evolutions ensures firms are not caught unprepared in an ever-changing tax landscape.

Key Points

- Layered tax structure: Combines state, county, city, and district levies, requiring meticulous calculation.

- Exemption intricacies: Significant variances based on product type and transaction nature.

- Technology integration: Essential for accurate rate application and compliance.

- Policy evolution: Regular updates demand active monitoring and adaptation.

- Stakeholder collaboration: Effective partnerships with expert advisors mitigate risks and optimize compliance.

Key Takeaways for Businesses and Consumers

Deciphering Charlotte’s sales tax features involves understanding its layered structure, exemption mechanisms, and regional specifics. For businesses, integration of sophisticated compliance tools is non-negotiable in managing operational risks effectively. Consumers benefit from transparency and awareness, empowering smarter purchase decisions. While the system’s complexity presents hurdles, strategic adaptation promises enhanced compliance, optimized costs, and sustained economic vitality.

How does Charlotte’s sales tax differ from other North Carolina municipalities?

+Charlotte’s sales tax features a layered structure with specific city surtax and district levies that vary from neighboring municipalities, influencing overall rates and compliance complexity.

What technological solutions are recommended for accurate sales tax collection in Charlotte?

+Employ POS systems with integrated geolocation, real-time rate updates, and exemption management capabilities to accurately apply the layered rates and exemptions specific to Charlotte.

How can businesses stay compliant amidst changing local sales tax policies in Charlotte?

+Regular training, active monitoring of legislative updates, and collaboration with specialized tax advisors or third-party providers form the cornerstone of ongoing compliance efforts.