2025 Estate Tax Exemption

As we navigate the complex landscape of financial planning and tax strategies, understanding the estate tax exemption is crucial, especially as we approach the year 2025. This article aims to provide a comprehensive guide to the 2025 Estate Tax Exemption, shedding light on its implications and how it may impact your financial future.

Unraveling the 2025 Estate Tax Exemption

The estate tax exemption, often referred to as the applicable exclusion amount, is a key component of the federal tax system in the United States. It determines the value of an estate that can be transferred tax-free upon an individual’s death. As we anticipate the year 2025, let’s delve into the specifics and implications of this exemption.

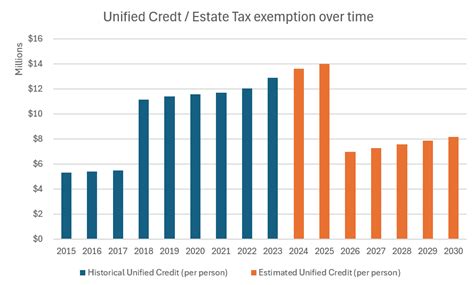

The Internal Revenue Service (IRS) periodically adjusts the estate tax exemption to account for inflation and ensure that it remains a practical tool for estate planning. For the year 2025, the proposed estate tax exemption stands at an impressive $12.06 million for individuals and $24.12 million for married couples filing jointly. This represents a significant increase from the $11.7 million individual exemption and $23.4 million joint exemption in 2023.

This upward trend in the exemption amount offers a substantial opportunity for individuals and families to pass on their wealth to their heirs without incurring substantial estate taxes. It is a testament to the government's commitment to supporting intergenerational wealth transfer and ensuring that estates are not unduly burdened by tax obligations.

The Impact on Estate Planning Strategies

The increased estate tax exemption for 2025 will likely prompt a reevaluation of existing estate planning strategies. High-net-worth individuals and families may find that their estates now fall below the exemption threshold, potentially eliminating the need for complex tax avoidance strategies.

For those with estates valued at or near the exemption amount, the 2025 exemption provides a unique opportunity to maximize tax-free transfers. By utilizing various estate planning tools such as trusts, gifting strategies, and charitable contributions, individuals can ensure that their wealth is distributed according to their wishes, while minimizing tax liabilities.

| Estate Tax Exemption for 2025 | Value |

|---|---|

| Individual Exemption | $12.06 million |

| Married Couple Joint Exemption | $24.12 million |

It is worth noting that while the 2025 exemption offers significant tax advantages, it is not a one-size-fits-all solution. The complexity of estate planning often requires a nuanced approach, taking into account individual circumstances, family dynamics, and future financial goals. As such, consulting with a qualified estate planning attorney or financial advisor is crucial to ensure that your strategy aligns with your unique needs and objectives.

Historical Context and Future Outlook

The estate tax exemption has undergone significant changes over the years, with the Tax Cuts and Jobs Act of 2017 playing a pivotal role in its evolution. The Act doubled the exemption amount, providing a temporary reprieve from estate tax obligations for many. However, the current proposal for 2025 represents a step towards a more permanent solution, offering long-term relief for estates.

Looking ahead, the future of the estate tax exemption remains uncertain. While the proposed exemption for 2025 is a positive development, there is always the possibility of legislative changes or economic shifts that could impact the exemption amount in the coming years. Staying informed and adaptable is key to effective estate planning.

In conclusion, the 2025 Estate Tax Exemption provides a significant opportunity for individuals and families to optimize their estate plans and minimize tax liabilities. By understanding the implications of this exemption and working with qualified professionals, you can ensure that your wealth is transferred efficiently and effectively, leaving a lasting legacy for future generations.

What is the purpose of the estate tax exemption?

+The estate tax exemption is designed to allow individuals to pass on a certain amount of their wealth to their heirs without incurring federal estate taxes. It aims to encourage the transfer of wealth across generations and reduce the tax burden on estates.

How often is the estate tax exemption adjusted?

+The estate tax exemption is typically adjusted annually to account for inflation. This ensures that the exemption amount remains relevant and provides a practical tool for estate planning.

Are there any potential risks associated with the 2025 exemption?

+While the 2025 exemption offers significant benefits, it is important to be aware of potential risks. Legislative changes or economic downturns could impact the exemption amount in the future. Staying informed and consulting with professionals can help mitigate these risks.