Does Indiana Have A State Tax

Indiana, like many other states in the United States, has a comprehensive tax system that includes various types of taxes to generate revenue for state operations and services. One of the key components of Indiana's tax system is the state income tax, which plays a significant role in funding public infrastructure, education, and other essential state programs.

Understanding the specifics of Indiana's state tax system is crucial for both residents and businesses operating within the state. In this article, we will delve into the details of Indiana's state tax, exploring its structure, rates, and how it impacts individuals and entities.

The Structure of Indiana's State Tax

Indiana's state tax system is primarily based on a graduated income tax structure, meaning that the tax rate increases as taxable income rises. This progressive tax system aims to ensure that higher-income earners contribute a larger proportion of their income to state revenue.

The state tax in Indiana is calculated based on the taxpayer's adjusted gross income (AGI) and is subject to certain deductions, exemptions, and credits. The AGI is derived from the federal AGI reported on the taxpayer's federal income tax return, with specific adjustments made for Indiana state purposes.

Indiana's tax year follows the federal tax year, which runs from January 1st to December 31st. Taxpayers are required to file their state income tax returns by April 15th, aligning with the federal tax filing deadline.

Tax Rates and Brackets

Indiana's state income tax is divided into five tax brackets, each with its own tax rate. As of my last update in January 2023, the tax brackets and corresponding rates are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| 0 - $2,400 | 2.4% |

| $2,401 - $10,800 | 3.2% |

| $10,801 - $27,000 | 3.3% |

| $27,001 - $92,000 | 3.4% |

| $92,001 and above | 3.23% |

It's important to note that these tax brackets and rates are subject to periodic review and may change over time due to legislative actions or economic factors. Taxpayers should refer to the most recent guidelines provided by the Indiana Department of Revenue for the most accurate and up-to-date information.

Taxable Income and Deductions

When calculating their state income tax liability, Indiana residents and businesses consider various deductions and exemptions. These deductions can significantly impact the final taxable income and, consequently, the amount of tax owed.

Some common deductions available to Indiana taxpayers include:

- Standard Deduction: All taxpayers are entitled to a standard deduction, which reduces taxable income. The standard deduction amount varies based on filing status.

- Itemized Deductions: Taxpayers can choose to itemize their deductions instead of taking the standard deduction. This option is beneficial for those with substantial qualifying expenses, such as medical costs, state and local taxes, charitable contributions, and mortgage interest.

- Personal Exemptions: Indiana allows personal exemptions for each taxpayer and dependent, further reducing taxable income.

- Business Deductions: Businesses operating in Indiana can deduct various business-related expenses, such as operating costs, depreciation, and employee benefits.

It's crucial for taxpayers to understand the specific rules and eligibility criteria for each deduction to maximize their tax savings.

Impact on Individuals and Businesses

Indiana's state tax system has a direct impact on both individuals and businesses operating within the state. For individuals, the state income tax is a significant consideration when evaluating their overall tax liability and financial planning.

The graduated tax rates ensure that individuals with higher incomes contribute a larger portion of their income to state revenue. This progressive tax structure aims to promote economic fairness and provide a more equitable distribution of the tax burden.

Businesses, on the other hand, must consider the state tax implications when making strategic decisions. Indiana's tax system can impact business profitability, especially for entities with substantial income or those operating in multiple states. Understanding the state's tax laws and potential deductions is essential for effective tax planning and compliance.

Tax Incentives and Credits

Indiana offers various tax incentives and credits to attract businesses and promote economic growth within the state. These incentives can significantly reduce a business's tax liability and make Indiana an attractive location for investments and operations.

Some notable tax incentives and credits in Indiana include:

- Economic Development for a Growing Economy (EDGE) Credit: This credit is designed to encourage businesses to locate or expand in Indiana. It provides a refundable tax credit based on the number of jobs created and the amount of investment made.

- Research and Development (R&D) Tax Credit: Indiana offers a tax credit for qualified research expenses, incentivizing businesses to invest in research and innovation.

- Investment Tax Credit: Businesses that make qualifying investments in certain types of equipment or machinery may be eligible for a tax credit.

- Historic Rehabilitation Tax Credit: This credit encourages the rehabilitation and preservation of historic buildings by providing a tax credit for eligible expenses incurred during the restoration process.

Businesses should carefully review the eligibility criteria and requirements for these incentives to determine if they qualify and how to maximize their benefits.

Compliance and Filing Requirements

Compliance with Indiana's state tax laws is crucial for both individuals and businesses to avoid penalties and maintain a good standing with the state. The Indiana Department of Revenue provides comprehensive guidelines and resources to assist taxpayers in understanding their obligations.

Individuals and businesses are required to file their state income tax returns annually, typically by April 15th. However, it's essential to note that certain entities, such as corporations and trusts, may have different filing deadlines. The Department of Revenue provides specific instructions and forms for each type of taxpayer.

Additionally, taxpayers must ensure that they report all relevant income, deductions, and credits accurately. Failure to comply with reporting requirements can result in penalties, interest charges, and potential audits.

Future Implications and Potential Changes

Indiana's state tax system is subject to ongoing review and potential legislative changes. The state's tax policies can be influenced by various factors, including economic conditions, political priorities, and the need to adapt to evolving business landscapes.

As of my last update, there were discussions and proposals for tax reform in Indiana. Some of the proposed changes include simplifying the tax code, reducing tax rates, and expanding tax incentives to support specific industries or economic development initiatives.

Staying informed about any proposed or enacted tax reforms is essential for taxpayers to understand how these changes may impact their tax liability and financial planning.

The Role of Technology in Tax Administration

Indiana, like many states, is leveraging technology to enhance its tax administration processes. The Indiana Department of Revenue has implemented online filing systems and electronic payment options, making it more convenient for taxpayers to fulfill their obligations.

Additionally, the use of data analytics and machine learning can help identify potential tax evasion or non-compliance, improving the efficiency of tax enforcement efforts. These technological advancements aim to streamline tax administration, reduce errors, and enhance taxpayer experience.

Conclusion

Indiana's state tax system plays a vital role in funding essential state services and infrastructure. The state's graduated income tax structure ensures a progressive tax burden, contributing to economic fairness and stability.

For individuals and businesses, understanding Indiana's state tax laws, rates, and incentives is crucial for effective tax planning and compliance. By staying informed and seeking professional advice when needed, taxpayers can navigate the state's tax landscape with confidence and optimize their tax strategies.

Frequently Asked Questions

How do I know which tax bracket I fall into in Indiana?

+Indiana’s tax brackets are determined by your taxable income. You can calculate your bracket by referring to the latest tax guidelines provided by the Indiana Department of Revenue. These guidelines outline the income ranges for each tax bracket and the corresponding tax rates.

Are there any tax incentives for businesses in Indiana?

+Yes, Indiana offers various tax incentives and credits to attract and support businesses. These incentives include the Economic Development for a Growing Economy (EDGE) Credit, Research and Development (R&D) Tax Credit, Investment Tax Credit, and Historic Rehabilitation Tax Credit. Each incentive has specific eligibility criteria and requirements.

What is the standard deduction in Indiana for the current tax year?

+The standard deduction in Indiana varies based on your filing status. For the current tax year, the standard deduction amounts are as follows: Single - 2,650, Married Filing Jointly - 5,300, and Head of Household - $4,000. These amounts may be subject to change, so it’s advisable to check the latest guidelines.

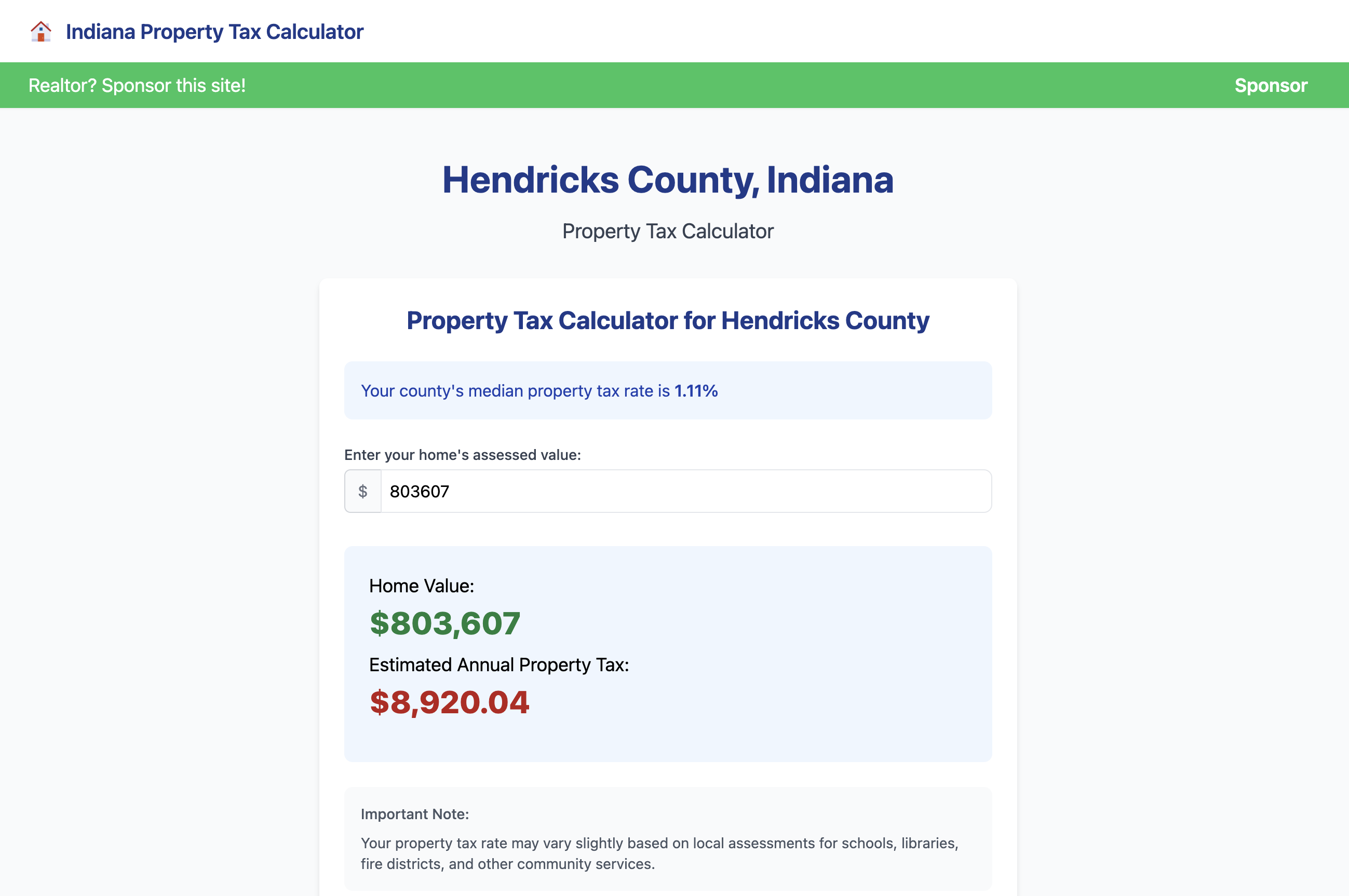

Are there any tax benefits for homeowners in Indiana?

+Yes, Indiana offers tax benefits for homeowners. The state provides a homestead credit, which reduces property tax liability for homeowners who meet certain eligibility criteria. Additionally, there are tax deductions for mortgage interest and property taxes, which can be claimed on your state income tax return.

When is the deadline to file state income taxes in Indiana?

+The deadline to file state income taxes in Indiana is typically April 15th, aligning with the federal tax filing deadline. However, it’s important to note that certain entities, such as corporations and trusts, may have different filing deadlines. It’s advisable to check the specific guidelines for your situation.