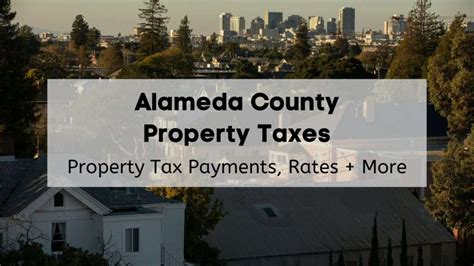

Alameda Property Tax Lookup

Welcome to this comprehensive guide on understanding and navigating the Alameda County Property Tax Lookup system. This resource aims to provide you with an in-depth analysis of the property tax landscape in Alameda County, California. By delving into the intricacies of the tax assessment process, property tax rates, and the various tools available for taxpayers, we aim to empower residents and property owners with the knowledge they need to effectively manage their property tax obligations.

Unveiling the Alameda County Property Tax System

Alameda County, situated in the San Francisco Bay Area, boasts a diverse range of residential, commercial, and industrial properties. The property tax system in this county plays a vital role in funding essential public services, including schools, fire departments, and local infrastructure. Understanding this system is crucial for property owners to stay informed about their tax liabilities and explore potential avenues for savings.

The Assessment Process: A Step-by-Step Guide

The property tax assessment process in Alameda County is a meticulous journey that begins with the annual assessment cycle. Let’s break down the key stages:

- Property Identification: Each property in the county is assigned a unique Assessor’s Parcel Number (APN), serving as a vital identifier throughout the assessment process.

- Data Collection: The Alameda County Assessor’s Office gathers extensive data on properties, including physical characteristics, ownership changes, and any improvements made.

- Valuation: Assessing the fair market value of a property is a complex task. The Assessor’s Office employs various valuation methods, such as the comparable sales approach and income capitalization, to determine an accurate value.

- Notice of Proposed Assessment: Property owners receive a Notice of Proposed Assessment detailing the Assessor’s preliminary valuation. This notice serves as a crucial opportunity for taxpayers to review and provide feedback.

- Final Assessment: Following a period of review and potential protests, the Assessor’s Office finalizes the assessments, and property owners receive their Notice of Assessment, outlining their property’s taxable value.

Exploring Property Tax Rates and Calculations

Understanding how property taxes are calculated is essential for effective financial planning. In Alameda County, property taxes are determined based on the taxable value of a property and the applicable tax rates set by various taxing authorities.

The taxable value of a property is often different from its market value due to the Proposition 13 limitations in California. This proposition, enacted in 1978, limits the annual increase in a property’s taxable value to a maximum of 2% or the percentage change in the Consumer Price Index (CPI), whichever is lower.

The tax rates applied to the taxable value are determined by the Ad Valorem system, which allocates a specific tax rate for each taxing authority. These authorities include the county, city, school districts, special districts, and various other entities. The combined tax rate for a property is the sum of these individual rates.

| Taxing Authority | Tax Rate (%) |

|---|---|

| Alameda County | 0.8418 |

| Oakland Unified School District | 2.2088 |

| City of Oakland | 0.6664 |

| East Bay Regional Park District | 0.2078 |

| Total Tax Rate | 3.9248% |

In the example above, a property with a taxable value of $500,000 would be subject to a total property tax bill of $19,624 based on the combined tax rate.

Leveraging Online Tools: The Alameda County Property Tax Lookup

The Alameda County Assessor’s Office has developed an intuitive online platform, the Property Tax Lookup Tool, to assist taxpayers in accessing essential information about their property taxes. This tool empowers users to:

- Quickly locate their property using the APN or street address.

- View current and historical tax assessments, including the taxable value and tax rates applied.

- Access tax bill payment information and explore options for online payments.

- Review property ownership records and track changes over time.

- Obtain contact details for the Assessor’s Office, facilitating easy communication for inquiries or protests.

Optimizing Your Property Tax Strategy: Tips and Insights

Navigating the property tax landscape can be complex, but with the right strategies, property owners can optimize their tax obligations. Here are some expert tips:

- Stay Informed: Regularly monitor your property’s assessment and tax rates. Changes in ownership, improvements, or exemptions can impact your tax liability.

- Understand Exemptions: Explore potential exemptions, such as the Homeowner’s Property Tax Exemption or Veterans’ Property Tax Exemption, which can reduce your taxable value.

- Consider Appeals: If you believe your property’s assessment is inaccurate, you have the right to protest. The Assessor’s Office provides a detailed guide on the appeal process.

- Explore Payment Plans: For those facing financial challenges, the Alameda County Treasurer-Tax Collector offers payment plans to help manage property tax payments.

FAQs: Common Questions about Property Taxes in Alameda County

How often are property taxes assessed in Alameda County?

+Property taxes in Alameda County are assessed annually. The assessment cycle begins with the Notice of Proposed Assessment, typically sent out in March, followed by the Notice of Assessment in July.

Can I dispute my property’s assessment if I believe it is incorrect?

+Absolutely! If you have concerns about your property’s assessment, you have the right to protest. The Assessor’s Office provides a Protest Application and guidelines on the appeal process. It’s important to act promptly, as there are deadlines for submitting protests.

What are the payment options for property taxes in Alameda County?

+Property taxes in Alameda County can be paid online through the Treasurer-Tax Collector’s Office website. Alternatively, taxpayers can pay by mail, phone, or in person at designated locations. The Treasurer-Tax Collector also offers payment plans for those facing financial difficulties.

Are there any exemptions available to reduce my property tax burden?

+Yes, Alameda County offers various exemptions to eligible property owners. These include the Homeowner’s Property Tax Exemption, which reduces the taxable value of a primary residence, and the Veterans’ Property Tax Exemption for qualifying veterans. It’s advisable to explore these options to potentially lower your tax liability.