Understand and Improve Your Tax Status Illinois Today

Navigating the complexities of tax compliance and optimization remains a challenge even for seasoned financial professionals. For residents and business owners in Illinois, understanding the nuances of state-specific tax laws and discovering effective strategies to enhance tax efficiency can elevate financial stability and ensure legal adherence. With the evolving landscape of tax legislation—driven by economic reforms, budget considerations, and federal-state coordination—Illinois taxpayers must stay informed and proactive. This deep-dive article examines key facets of Illinois tax status, providing actionable insights to help individuals and enterprises optimize their tax positions confidently and accurately.

1. Comprehending Illinois Tax Laws: The Foundation of Tax Strategy

A comprehensive grasp of Illinois tax statutes forms the cornerstone of any successful tax planning. Illinois maintains a distinctive blend of income, sales, property, and excise taxes, each with specific rules and thresholds that influence taxpayers’ obligations. The Illinois Income Tax Act mandates a flat rate of 4.95% on all net income derived from Illinois sources, but nuances such as deductions, credits, and exemptions can significantly alter tax responsibility. Similarly, the state’s sales tax rate of 6.25%, augmented by local taxes that can exceed 10%, creates a multi-layered landscape that demands meticulous attention.

Decoding these regulations requires familiarity with legislative amendments and administrative guidelines issued annually by the Illinois Department of Revenue (IDOR). Moreover, understanding the interaction between federal and state tax codes—particularly with regard to itemized deductions, credits like the Earned Income Tax Credit, and corporate apportionment—enables taxpayers to identify legal avenues to lower their taxable income legitimately. Additionally, Illinois’s property tax system, being largely administered locally, introduces variation that necessitates localized knowledge for effective planning.

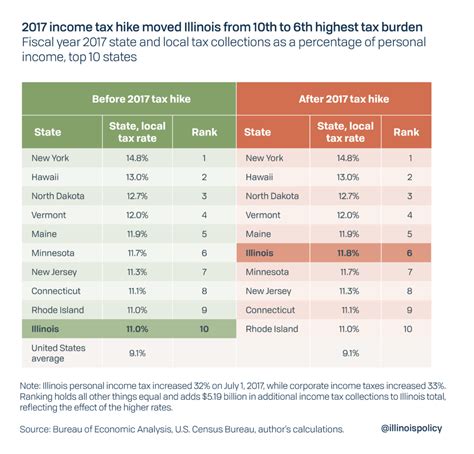

Historical context of Illinois tax legislation

Illinois’s tax framework historically reflects economic adjustments, often balancing budget requirements against taxpayer sustainability. For instance, the passage of the Illinois Income Tax Amendment of 1970 established the flat tax rate, which has persisted with minor modifications. Over subsequent decades, legislative efforts have targeted recalibrations—such as tax credits for low-income residents or incentives for business investment—aiming to promote economic growth while maintaining fiscal stability. Recognizing this history informs current strategies, emphasizing the importance of staying aligned with legislative trends and potential upcoming reforms.

| Relevant Category | Substantive Data |

|---|---|

| Illinois income tax rate | 4.95% flat rate since 2015 |

| Local sales tax rate | Up to 10.25%, depending on jurisdiction |

| Major tax credits | Earned Income Tax Credit (EITC), Property Tax Credit |

| Tax deadline | April 15 annually, with extensions available |

2. Evaluating Your Tax Filing Status: Individual and Business Perspectives

Determining the correct filing status is pivotal for accurate tax calculation and compliance. For individuals, Illinois recognizes federal filing statuses—such as single, married filing jointly, head of household—each impacted by specific deductions and credits. Choosing the appropriate status ensures taxpayers minimize liabilities while avoiding penalties for misclassification.

On the business front, Illinois classifies entities into several categories—S-corporations, LLCs, partnerships, and corporations—each facing distinct tax obligations. For instance, Illinois imposes a corporate net income tax at a rate of 7%, applied on net income apportioned to Illinois. Recognizing the difference between unitary and non-unitary business structures influences apportionment strategies, affecting overall tax liability.

Special considerations include non-resident filings, which require apportioning income based on Illinois-sourced activity; and those with multi-state operations, where interstate apportionment formulas become critical. Moreover, the emergence of gig economy income streams compels self-employed individuals to scrutinize their status—whether as independent contractors or small business owners—to optimize tax obligations.

Impacts of IRS and Illinois State Filing Divergences

The divergence between federal and Illinois filings can lead to discrepancies and audit triggers if not managed carefully. For example, federal allowances for certain deductions might not be available in Illinois, or vice versa. The effective strategy entails synchronizing both filings, leveraging Illinois-specific credits, and ensuring consistent reporting to minimize risks of penalties.

| Relevant Category | Substantive Data |

|---|---|

| Filing thresholds | Income above 2,300 (single) or 4,600 (married filing jointly) generally requires Illinois return |

| Business income tax forms | ILL-1120 for corporations, ILL-1065 for partnerships |

| Non-resident filing | Schedule NOL (Non-Resident) for income sourced outside Illinois |

| Net income tax rate | 4.95%, flat rate |

3. Strategic Tax Planning: Opportunities and Pitfalls

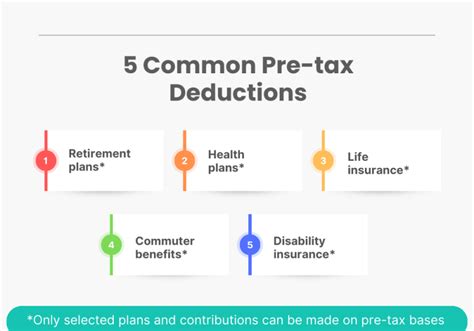

Effective tax planning in Illinois involves not merely compliance but proactive strategies aimed at increasing after-tax income. A critical first step is comprehensive income and expense analysis—identifying allowable deductions such as business expenses, property depreciation, and qualified retirement contributions. Capitalizing on Illinois-specific credits—like the Property Tax Credit or Illinois Earned Income Tax Credit—can significantly alter net liabilities.

Additionally, structuring transactions to facilitate income deferral or expense acceleration remains a time-tested approach. For example, timing capital investments or deferring income recognition until subsequent years can leverage fluctuations in state tax rates or legislative changes.

However, pitfalls abound: aggressive tax strategies that push legal boundaries may trigger audits, especially with heightened scrutiny on remote working arrangements and multi-state apportionment. Furthermore, the dynamic nature of tax legislation necessitates ongoing review—what was optimal last year might be suboptimal today. As such, leveraging professional tax advisors with specialized Illinois expertise often results in optimized outcomes and minimized risk.

Tax incentive programs as growth catalysts

Illinois offers several incentive programs designed to stimulate economic activity, including Enterprise Zone credits, Film Tax Credits, and Enterprise Zone Employment Credits. When properly harnessed, these incentives can dramatically reduce taxable income or provide direct cash benefits. For instance, companies investing in designated zones may claim significant credits proportional to their investment and job creation metrics.

| Relevant Category | Substantive Data |

|---|---|

| Enterprise Zone Credit | Up to 6% of qualified investment |

| Film Tax Credit | Up to 30% of qualifying expenditures |

| Investment thresholds | $2.5 million minimum for certain credits |

| Benefit period | Credits claimable over 5 years |

4. Leveraging Technology and Data Analytics for Tax Optimization

Technology plays an increasingly pivotal role in modern tax management. Cloud-based accounting software tailored for Illinois statutes—integrating local tax codes, deductions, and reporting formats—streamlines compliance and enhances decision-making. Data analytics tools enable detailed scenario modeling, helping taxpayers forecast tax impacts of various strategic moves with precision.

Furthermore, automation tools facilitate documentation of eligible expenses and deduction tracking, reducing manual errors. For businesses with complex multi-state operations, integrated software solutions can automate apportionment calculations aligned with Illinois regulations, ensuring accurate filings and diminished audit risk.

Adopting these technological strategies not only improves immediate compliance but also builds a sustainable tax planning framework adaptable to future legislative changes and economic shifts.

Emerging trends: AI and machine learning

Emerging innovations introduce AI algorithms capable of analyzing vast datasets to identify optimal deduction, credit, and investment strategies tailored to Illinois’s unique fiscal environment. These tools can also flag potential compliance risks before submission, minimizing penalties and audits, and fostering a proactive rather than reactive tax posture.

| Relevance | Data Point |

|---|---|

| Adoption rate of tax automation | Approximately 60% of mid-sized Illinois firms in 2023 |

| AI-driven analytics accuracy | Estimated 95% accuracy in identifying maximizable credits |

| Cost reduction | Average 20% reduction in compliance expenses with automation |

| Forecasting improvements | Enhanced predictive modeling leading to 15% higher tax savings |

5. Ensuring Long-Term Compliance and Adaptability

Tax positions are not static; they require ongoing vigilance. Periodic audits and reviews of filing procedures, financial records, and tax positions help detect discrepancies early. Moreover, cultivating relationships with Illinois tax professionals ensures access to latest legislative updates, compliance resources, and strategic advice tailored to evolving circumstances.

Adapting to legislative proposals, such as potential increases in the corporate tax rate or reforms to property tax assessments, demands flexible planning structures. Building reserve funds to cover potential liabilities or establishing contingency strategies can safeguard against legislative shocks. Additionally, maintaining meticulous documentation supports transparent audits and mitigates penalties.

This long-term approach integrates routine review, technological leverage, and professional guidance—empowering taxpayers to remain compliant, optimized, and resilient amidst Illinois’s fiscal landscape.

Forecasting future developments in Illinois taxation

Anticipated legislative initiatives include potential adjustments to marginal income rates, expansion of tax credits targeting renewable energy, and reforms in local property assessments, driven by economic incentives for sustainability and infrastructure development. Keeping a tactical eye on these trends allows proactive adaptation, avoiding reactive penalties or missed opportunities.

| Relevant Category | Projected Changes |

|---|---|

| Income tax rate | Possibility of incremental increases depending on fiscal needs |

| Tax credits | Potential expansion for green energy projects |

| Property tax assessments | Reforms to promote transparency and fairness |

| Legal environment | Enhanced enforcement and audit capabilities |