Tax Rate In San Jose Ca

Understanding the tax landscape is crucial for individuals and businesses alike, especially in dynamic metropolitan areas like San Jose, California. This comprehensive guide aims to delve into the specifics of the tax structure in San Jose, providing an in-depth analysis of the various tax rates, their implications, and how they compare to other major cities.

The San Jose Tax Ecosystem: A Comprehensive Overview

San Jose, being the economic powerhouse of Silicon Valley, boasts a diverse and thriving business environment. With a wide range of industries, from tech giants to innovative startups, the city’s tax structure plays a pivotal role in shaping its economic landscape.

Income Tax Rates: A Detailed Breakdown

Income taxes form a significant portion of San Jose’s revenue. The city operates within the state of California’s tax framework, which follows a progressive tax system. Here’s a breakdown of the income tax rates applicable to San Jose residents:

| Tax Bracket | Tax Rate |

|---|---|

| First $10,828 of taxable income | 1% |

| $10,828 - $37,964 | 2% |

| $37,964 - $62,874 | 4% |

| $62,874 - $264,528 | 6% |

| Income above $264,528 | 9.3% |

These rates are applicable for single filers, married couples filing jointly, and heads of households. It's important to note that San Jose, like many cities, also imposes a local income tax, which is separate from the state income tax. The local income tax rate in San Jose stands at 1%.

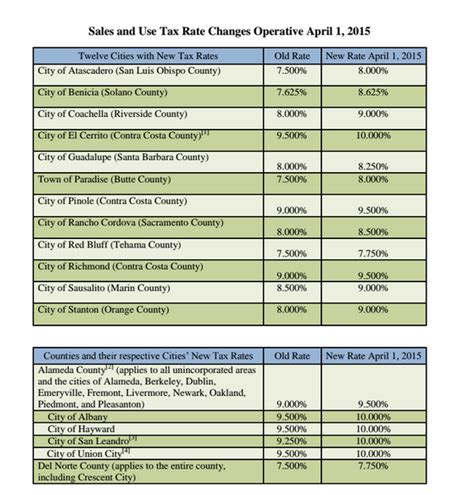

Sales and Use Tax: Understanding the Differences

Sales tax is a common levy across many states and cities in the U.S. In San Jose, the sales tax rate is currently set at 8.25%, which includes both the state and local sales tax. This rate can be broken down as follows:

| Tax Type | Rate |

|---|---|

| State Sales Tax | 7.25% |

| Local Sales Tax (San Jose) | 1% |

The use tax, on the other hand, is often overlooked but is equally important. Use tax applies to goods and services purchased from out-of-state vendors and brought into San Jose for use. The rate for use tax aligns with the sales tax rate, making it 8.25% in San Jose.

Property Tax: A Critical Component

Property taxes are a significant revenue source for many cities, and San Jose is no exception. The property tax rate in San Jose is set at 1%, which is applied to the assessed value of the property. However, it’s important to note that the assessed value is not the market value of the property. California has a Proposition 13 law, which limits the annual increase in the assessed value of real property to 2% or the inflation rate, whichever is lower.

Additionally, San Jose, like many other cities in California, has a transfer tax applicable to property transfers. This tax is typically a percentage of the property's selling price or assessed value, whichever is higher.

Comparative Analysis: San Jose vs. Other Major Cities

Understanding San Jose’s tax rates in isolation doesn’t provide the complete picture. Let’s explore how San Jose’s tax landscape compares to other major cities in the U.S.:

Income Tax Rates: A National Perspective

San Jose’s income tax rates, especially the top rate of 9.3%, might seem high when compared to cities like Houston (0% local income tax) or Seattle (2.25% local income tax). However, it’s important to consider the overall cost of living and the services provided by the city. San Jose’s high-tech industry and robust economy often attract high-income earners, making the progressive tax structure more sustainable.

Sales Tax: A Regional Comparison

Sales tax rates vary significantly across states and cities. San Jose’s combined sales tax rate of 8.25% is lower than cities like Chicago (10.25%) but higher than places like Austin, Texas (8.25%). However, it’s essential to consider the range of goods and services taxed, as some cities have additional taxes on specific items.

Property Taxes: A National Overview

Property taxes can vary widely, influenced by factors like property values, local services, and state laws. San Jose’s property tax rate of 1% is relatively lower when compared to cities like New York City (1.472%) or Boston (1.089%). However, the unique assessment system in California, as mentioned earlier, makes direct comparisons challenging.

The Impact of San Jose’s Tax Structure

The tax structure in San Jose has a profound impact on the city’s economy and its residents. Here are some key implications:

- Income taxes provide a stable revenue stream for the city, supporting essential services like education, infrastructure, and public safety.

- The sales tax rate can influence consumer behavior and business decisions. A higher sales tax might incentivize online purchases or shopping in neighboring cities with lower rates.

- Property taxes, despite the limitations imposed by Proposition 13, contribute significantly to the city's revenue. They fund vital services and infrastructure development.

Future Considerations and Challenges

As San Jose continues to evolve, its tax structure will need to adapt to changing economic landscapes and resident needs. Here are some potential future considerations:

- Exploring revenue-neutral tax reforms to ensure a balanced approach, especially with the progressive income tax system.

- Addressing the challenges posed by e-commerce and online sales, which can impact the city's sales tax revenue.

- Reevaluating the property tax system to ensure fairness and sustainability, especially with the unique assessment system in California.

Conclusion: Navigating the San Jose Tax Landscape

Understanding the tax rates in San Jose is crucial for individuals and businesses alike. From income taxes to sales and property taxes, each component plays a vital role in shaping the city’s economy and the services it provides. As San Jose continues to thrive, its tax structure will remain a key focus, ensuring a balanced and sustainable approach to revenue generation.

What is the current state sales tax rate in California?

+The current state sales tax rate in California is 7.25%.

Are there any tax incentives for businesses in San Jose?

+Yes, San Jose offers various tax incentives to attract and support businesses. These incentives can include tax credits, exemptions, and reduced tax rates for specific industries or initiatives.

How does San Jose’s tax structure compare to other major tech hubs?

+San Jose’s tax structure, especially its income tax rates, is relatively higher when compared to other major tech hubs like Seattle or Austin. However, the overall tax landscape is influenced by various factors, including cost of living and the city’s unique economic environment.