Pension Income On Tax Return It 201

For individuals planning their retirement, understanding how pension income is treated on tax returns is crucial. In this comprehensive guide, we will delve into the intricacies of pension income and its implications on your 201 tax return. Whether you're a retiree, nearing retirement, or simply curious about the tax landscape, this article will provide you with valuable insights and expert advice.

The Importance of Pension Income Reporting

Pension income plays a significant role in an individual’s financial journey, especially during retirement. As such, it is essential to comprehend how this income is taxed and reported to the relevant tax authorities. Proper reporting ensures compliance with tax laws and helps individuals optimize their financial strategies.

Understanding Pension Income

Pension income encompasses various streams, including:

- Defined Benefit Plans: These plans provide a predetermined pension amount based on factors like years of service and final salary.

- Defined Contribution Plans: Here, the pension depends on the contributions made and investment returns, offering more flexibility.

- Annuities: A popular option where individuals purchase an annuity contract, receiving regular payments during retirement.

Each type of pension income has unique tax considerations, which we will explore further.

Tax Treatment of Pension Income

The tax treatment of pension income varies depending on the type of pension and the jurisdiction. In most cases, pension income is taxable, but the amount and method of taxation can differ.

For instance, in the United States, pension income is generally taxed as ordinary income, meaning it is subject to federal and state income taxes. However, some pension plans offer tax-deferred growth, providing tax benefits during the accumulation phase.

Let's consider a hypothetical scenario: Mr. Johnson, a retiree, receives a monthly pension of $2,500 from his defined benefit plan. This income is subject to federal tax at a rate of 22% and state tax at 5%. His pension income is thus taxed at $550 (22% of $2,500) for federal tax and $125 (5% of $2,500) for state tax. This leaves Mr. Johnson with a net pension income of $1,825 ($2,500 - $550 - $125) for the month.

| Tax Category | Rate | Amount |

|---|---|---|

| Federal Tax | 22% | $550 |

| State Tax | 5% | $125 |

Reporting Pension Income on Tax Returns

Reporting pension income accurately on your tax return is crucial for several reasons. Firstly, it ensures compliance with tax laws and regulations, avoiding potential penalties. Secondly, it allows individuals to claim eligible deductions and credits, reducing their overall tax liability.

Common Reporting Mistakes to Avoid

When reporting pension income, it’s important to avoid common mistakes that can lead to errors and potential audits. Some of these mistakes include:

- Failing to report all sources of pension income.

- Miscalculating the taxable amount of pension income.

- Not understanding the tax treatment of specific pension plans.

- Forgetting to include relevant tax forms and documentation.

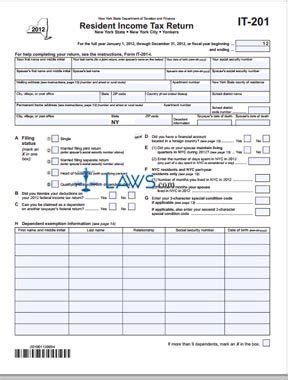

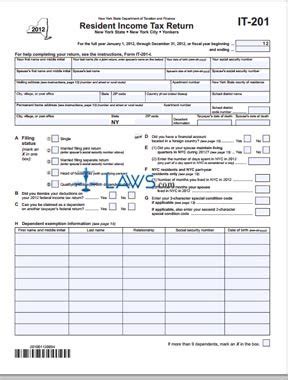

Step-by-Step Guide to Reporting Pension Income

To report pension income accurately, follow these steps:

- Gather all relevant pension income documents, including annual statements and tax forms.

- Determine the taxable amount of each pension income stream. This may involve calculating the taxable portion of defined benefit plans or including the full amount of defined contribution plans.

- Fill out the appropriate tax forms. In the United States, this typically involves Form 1040 and Schedule 1 for additional income.

- Report pension income under the “Pensions and Annuities” section of your tax return.

- Calculate and include any applicable deductions or credits related to pension income.

- Review your tax return carefully before submission to ensure accuracy.

Optimizing Your Tax Strategy with Pension Income

Pension income offers several opportunities to optimize your tax strategy and reduce your overall tax burden. Here are some strategies to consider:

Maximizing Deductions and Credits

Pension income can be used to maximize deductions and credits, reducing your taxable income. Some deductions and credits to consider include:

- Standard Deduction: This deduction reduces your taxable income by a set amount. Pension income can be used to maximize this deduction, especially if you have other sources of income.

- Itemized Deductions: If your pension income is substantial, you may benefit from itemizing deductions such as medical expenses, state and local taxes, and charitable contributions.

- Retirement Savings Credits: Certain pension plans, like defined contribution plans, may allow you to contribute to tax-advantaged retirement accounts, offering potential tax savings.

Strategic Pension Income Withdrawal

How you withdraw your pension income can impact your tax liability. Consider these strategies:

- Staggered Withdrawals: Instead of taking a large lump-sum distribution, consider spreading your withdrawals over multiple years. This can help you stay in a lower tax bracket and reduce your overall tax burden.

- Coordinate with Other Income Sources: Plan your pension income withdrawals to align with other income sources. This can help you optimize your tax bracket and potentially reduce your overall tax liability.

- Roth Conversions: If you have a traditional IRA or 401(k), consider converting a portion to a Roth IRA. This can provide tax-free growth and tax-free withdrawals in retirement, reducing your tax burden.

Pension Income and Social Security Benefits

For many retirees, pension income and Social Security benefits are key components of their retirement income. Understanding the interaction between these two income streams is crucial for optimal tax planning.

How Pension Income Affects Social Security Benefits

Pension income can impact your Social Security benefits in two ways:

- Taxability of Social Security Benefits: Pension income can increase the taxable portion of your Social Security benefits. If your combined income (pension income + half of Social Security benefits) exceeds certain thresholds, a portion of your Social Security benefits may become taxable.

- Social Security Benefit Calculation: Pension income can also affect the calculation of your Social Security benefits. If you start receiving pension income before reaching full retirement age, it can reduce your Social Security benefits. However, once you reach full retirement age, your benefits will be recalculated, taking into account your pension income.

Strategies for Managing Pension Income and Social Security

To optimize your tax strategy when dealing with pension income and Social Security benefits, consider the following:

- Delay Social Security Benefits: If possible, delay claiming your Social Security benefits until you reach full retirement age or later. This can increase your monthly benefit amount and reduce the impact of pension income on your Social Security benefits.

- Coordinate Withholding and Estimated Tax Payments: If your pension income is substantial, you may need to make estimated tax payments to avoid penalties. Coordinate these payments with your Social Security benefits to manage your tax liability effectively.

- Review Your Withholding Elections: Regularly review your tax withholding elections to ensure they align with your income and tax obligations. This can help you avoid surprises at tax time and manage your cash flow effectively.

Conclusion

Understanding how pension income is treated on your tax return is a crucial aspect of retirement planning. By reporting pension income accurately, optimizing your tax strategy, and considering the interaction with Social Security benefits, you can ensure compliance, reduce your tax burden, and maximize your retirement income. Remember, consulting a tax professional can provide personalized advice based on your unique circumstances.

FAQ

How do I know if my pension income is taxable?

+The taxability of pension income depends on the type of pension plan. Generally, defined benefit plans and annuities are taxable, while some defined contribution plans may offer tax-deferred growth. Consult a tax professional to determine the tax treatment of your specific pension plan.

Can I reduce my tax liability with pension income?

+Yes, pension income can be used to maximize deductions and credits, reducing your taxable income. Consider strategies like itemized deductions, standard deductions, and retirement savings credits to optimize your tax strategy.

How does pension income impact my Social Security benefits?

+Pension income can increase the taxable portion of your Social Security benefits and affect the calculation of your monthly benefit amount. By delaying Social Security benefits and coordinating withholding elections, you can manage the impact of pension income on your Social Security benefits effectively.

What are some common mistakes to avoid when reporting pension income?

+Avoid common mistakes like failing to report all sources of pension income, miscalculating taxable amounts, and not understanding the tax treatment of specific pension plans. Gather all relevant documents and consult a tax professional to ensure accurate reporting.