401K Tax Calculator Withdrawal

Welcome to our comprehensive guide on the 401K Tax Calculator for Withdrawals, an essential tool for anyone looking to navigate the complex world of retirement savings and taxes. As an experienced financial planner, I understand the importance of having accurate information and resources to make informed decisions about your financial future. In this article, we will delve into the intricacies of 401K withdrawals, taxes, and how a tax calculator can be a powerful ally in optimizing your retirement planning.

Understanding 401K Withdrawals and Taxes

A 401K is a popular retirement savings plan offered by many employers in the United States. It allows employees to contribute a portion of their pre-tax income towards their retirement, with the potential for significant tax advantages. When it comes to withdrawing funds from your 401K, it’s crucial to understand the tax implications, as they can significantly impact your financial situation.

The tax treatment of 401K withdrawals depends on various factors, including the type of withdrawal, your age, and the length of time your funds have been in the account. Generally, withdrawals from a 401K are subject to ordinary income taxes, and you may also incur an additional 10% early withdrawal penalty if you're under the age of 59½. However, there are exceptions and strategies that can help minimize your tax liability, and this is where a 401K Tax Calculator becomes invaluable.

The Power of a 401K Tax Calculator

A 401K Tax Calculator is an online tool designed to provide you with an accurate estimate of the taxes you may owe on your 401K withdrawals. By inputting relevant details such as your age, the amount of the withdrawal, and your current tax bracket, the calculator can determine your potential tax liability. Here’s why a 401K Tax Calculator is an essential tool for any savvy investor:

Accurate Tax Estimation

The primary purpose of a 401K Tax Calculator is to give you an accurate picture of the taxes you’ll owe. This estimation is crucial for financial planning, as it allows you to budget accordingly and ensure you have sufficient funds to cover your tax obligations.

Understanding Tax Strategies

By using a 401K Tax Calculator, you can experiment with different withdrawal scenarios and tax strategies. For instance, you can compare the tax implications of a lump-sum withdrawal versus a series of smaller withdrawals over time. This analysis can help you optimize your tax liability and make informed decisions about when and how to withdraw funds.

Avoiding Surprises

Retirement planning is a long-term process, and unexpected tax bills can derail your financial goals. A 401K Tax Calculator helps you avoid these surprises by providing a clear estimate of your tax liability. With this knowledge, you can plan for any additional taxes and ensure your retirement savings remain on track.

Maximizing Tax Benefits

Certain 401K withdrawal strategies, such as the Roth conversion ladder, can help you maximize your tax benefits. A 401K Tax Calculator can assist in evaluating the potential tax savings of such strategies, ensuring you make the most of your retirement funds.

Key Features of a 401K Tax Calculator

A robust 401K Tax Calculator should offer the following features to provide a comprehensive analysis:

- Multiple Withdrawal Options: The calculator should allow you to input different types of withdrawals, such as regular withdrawals, early withdrawals, and Roth conversions.

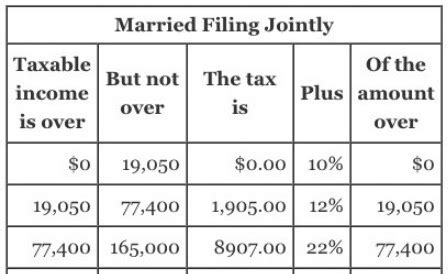

- Tax Bracket Selection: You should be able to choose your current tax bracket to receive an accurate estimate of your tax liability.

- Age and Withdrawal Amount Input: Input your age and the amount you plan to withdraw to see the potential tax consequences.

- Tax Penalty Calculation: The calculator should account for any applicable early withdrawal penalties, ensuring you understand the full financial impact.

- Tax Optimization Strategies: Some calculators offer advanced features to suggest tax-efficient withdrawal strategies, helping you make the most of your retirement savings.

Real-World Example: Optimizing Your 401K Withdrawals

Let’s consider a practical scenario to illustrate how a 401K Tax Calculator can be a valuable tool in optimizing your retirement savings.

Scenario: Early Retirement and 401K Withdrawals

Imagine you’re planning an early retirement at age 55 and have significant funds in your 401K. You’re considering a series of withdrawals to cover your living expenses. By using a 401K Tax Calculator, you can analyze the tax implications of different withdrawal strategies.

| Withdrawal Strategy | Amount Withdrawn | Estimated Taxes | Potential Savings |

|---|---|---|---|

| Lump-Sum Withdrawal | $50,000 | $12,500 (25% Tax Bracket) | $2,500 (Early Withdrawal Penalty) |

| Annual Withdrawals | $10,000/year for 5 years | $2,500/year (25% Tax Bracket) | No Early Withdrawal Penalty |

| Roth Conversion Ladder | $15,000/year for 3 years | $3,750/year (25% Tax Bracket) | No Early Withdrawal Penalty, Potential Tax-Free Growth |

In this scenario, the 401K Tax Calculator helps you compare the tax implications of different withdrawal strategies. By opting for annual withdrawals or utilizing a Roth conversion ladder, you can avoid the early withdrawal penalty and potentially reduce your overall tax liability.

FAQs

Are there any exceptions to the early withdrawal penalty for 401K withdrawals?

+

Yes, there are certain exceptions to the early withdrawal penalty. These include hardship withdrawals, such as medical expenses, higher education costs, or home purchases. Additionally, if you’ve reached the age of 59½, you’re no longer subject to the early withdrawal penalty. It’s crucial to understand these exceptions to optimize your withdrawal strategy.

Can I use a 401K Tax Calculator for Roth IRA conversions?

+

Yes, many 401K Tax Calculators also provide tools for estimating the tax implications of Roth IRA conversions. This feature is especially useful if you’re considering a Roth conversion ladder strategy to optimize your retirement savings.

What happens if I withdraw funds from my 401K and don’t have enough money to cover the taxes?

+

If you withdraw funds from your 401K and don’t have sufficient funds to cover the taxes, you may face penalties and interest charges. It’s crucial to plan your withdrawals carefully and ensure you have the necessary funds to cover your tax obligations. Consider using a 401K Tax Calculator to estimate your tax liability accurately.

Are there any tax advantages to leaving my 401K funds untouched until I reach a certain age?

+

Yes, by leaving your 401K funds untouched until you reach the age of 59½, you can avoid the early withdrawal penalty. Additionally, the longer your funds remain in the account, the more time they have to grow tax-deferred, potentially increasing your retirement savings.

How often should I use a 401K Tax Calculator to estimate my tax liability?

+

It’s recommended to use a 401K Tax Calculator regularly, especially when you’re considering major life changes or retirement planning. Tax laws and your financial situation may change over time, so staying informed and updating your calculations is essential for accurate tax planning.