State Of Tn Property Tax

Welcome to an in-depth exploration of the State of Tennessee's Property Tax system, a critical aspect of the state's financial landscape. This article will provide a comprehensive overview, shedding light on the intricacies of this tax, its impact on residents, and its role in Tennessee's economy.

Understanding Tennessee’s Property Tax

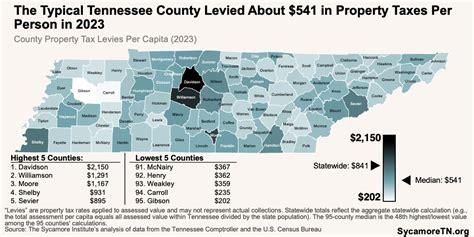

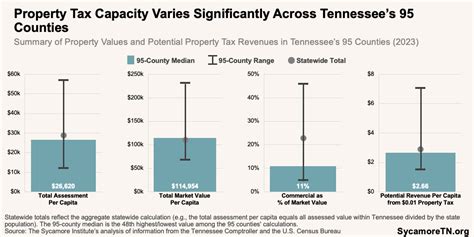

The Property Tax in Tennessee is a locally administered tax, meaning it is assessed and collected by individual counties, with each county having its own assessment practices and tax rates. This decentralized approach adds a layer of complexity but also allows for a more tailored and flexible tax system.

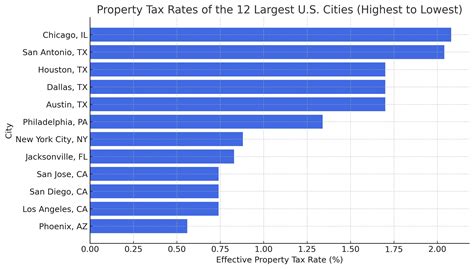

At its core, the Property Tax is a levy on real estate, including land, buildings, and certain improvements. It is a vital revenue stream for local governments, funding essential services like schools, fire departments, and road maintenance. The tax rate is typically expressed as a percentage and can vary significantly across counties.

Assessment Process

Property assessments in Tennessee occur at regular intervals, with the primary purpose of determining the taxable value of each property. These assessments consider factors such as:

- The property's market value, which reflects its current worth in the real estate market.

- Improvements made to the property, such as additions or renovations, which can increase its value.

- Local property tax rates, which are set by county governments and can change annually.

The assessed value of a property is then multiplied by the applicable tax rate to calculate the annual property tax liability. This process ensures that taxpayers pay their fair share based on the value of their property.

| County | Assessment Interval | Average Tax Rate (per $100) |

|---|---|---|

| Davidson | Every 4 years | 2.28 |

| Shelby | Annually | 1.96 |

| Knox | Every 3 years | 2.46 |

| Hamilton | Every 4 years | 2.02 |

| Williamson | Every 4 years | 2.18 |

Note: These rates are examples and may not reflect the current tax rates accurately. Always consult official sources for the most up-to-date information.

Exemptions and Relief Programs

Tennessee offers various property tax exemptions and relief programs to certain categories of taxpayers. These include:

- Homestead Exemption: This exemption reduces the taxable value of a homeowner's primary residence, providing some relief from rising property values.

- Senior Citizen Tax Relief: Elderly residents may qualify for a reduction in their property taxes based on income and age.

- Veteran's Exemption: Tennessee honors its veterans by offering property tax exemptions based on disability status and other criteria.

- Greenbelt Program: This program allows landowners to have their land assessed at its agricultural value, rather than its fair market value, if it is used for agricultural purposes.

These exemptions and programs aim to make property ownership more affordable and to support specific segments of the population.

The Impact on Tennessee’s Economy

The Property Tax system in Tennessee plays a pivotal role in the state’s economic landscape. It is a stable source of revenue for local governments, allowing them to provide essential services and infrastructure. This, in turn, contributes to the overall economic health and growth of the state.

Local Government Funding

Property taxes are the primary funding source for many local services and initiatives. These include:

- Public education, from primary schools to higher education institutions.

- Public safety services, such as police and fire departments.

- Maintenance and improvement of roads, bridges, and other transportation infrastructure.

- Funding for recreational facilities and community development projects.

By investing in these areas, Tennessee's Property Tax system helps create a robust and attractive environment for businesses and residents alike.

Economic Development and Growth

A well-managed Property Tax system can encourage economic growth and development. It provides a stable revenue base for counties to invest in infrastructure and initiatives that attract businesses and create jobs. This, in turn, can lead to increased property values and a more vibrant economy.

Furthermore, the Property Tax system can promote equitable development by ensuring that all property owners contribute to the growth and maintenance of their communities. This sense of shared responsibility can foster a stronger, more resilient local economy.

Challenges and Considerations

While the Property Tax system in Tennessee has many benefits, it also presents certain challenges and considerations for taxpayers and local governments alike.

Assessment Accuracy

Ensuring that property assessments are accurate and fair is a significant challenge. With a decentralized system, it can be difficult to maintain consistency across counties. This can lead to concerns about tax fairness, especially when properties with similar values are taxed at different rates.

Regular assessment reviews and appeals processes are in place to address these concerns, but they can be complex and time-consuming for taxpayers.

Impact on Homeownership

Rising property values, which often lead to higher property taxes, can impact homeownership rates. While exemptions and relief programs help mitigate this, they may not fully offset the increased tax burden for all homeowners.

This can disproportionately affect low- and middle-income households, making it more difficult for them to afford homeownership. It is a delicate balance for local governments to strike, as they want to encourage homeownership while also ensuring adequate funding for essential services.

Future Outlook and Potential Reforms

Tennessee’s Property Tax system is continually evolving, with ongoing discussions about potential reforms. Some proposed changes include:

- Increasing assessment frequency to more accurately reflect current property values.

- Standardizing assessment practices across counties to ensure greater fairness and consistency.

- Exploring alternative tax bases, such as a shift towards a land value tax, which could promote more efficient land use.

These reforms aim to make the Property Tax system more efficient, fair, and responsive to the needs of both taxpayers and local governments.

Conclusion

Tennessee’s Property Tax system is a critical component of the state’s financial framework, impacting both residents and local governments. While it presents certain challenges, it also offers opportunities for economic growth and community development. Understanding this system is essential for taxpayers to navigate their obligations and for local governments to manage their revenues effectively.

Stay informed, and don't hesitate to reach out to your local government or tax authorities for more detailed information and guidance.

How often are property assessments conducted in Tennessee?

+Property assessments occur at different intervals depending on the county. Some counties assess properties annually, while others do so every 3 or 4 years. It’s important to check with your local government for the assessment schedule in your area.

Are there any online resources to estimate my property tax liability in Tennessee?

+Yes, many counties in Tennessee provide online property tax estimators on their official websites. These tools allow you to input your property details and get an estimate of your potential tax liability. However, these are estimates and may not reflect the final assessed value.

What happens if I disagree with my property assessment?

+If you believe your property assessment is inaccurate, you have the right to appeal. The process varies by county, but typically involves filing an appeal with the local board of equalization. It’s important to gather evidence to support your case, such as recent sales of comparable properties.