Florida State Auto Sales Tax

When purchasing a vehicle in Florida, one of the key considerations for buyers is the state's auto sales tax. Understanding the tax implications is crucial, as it can significantly impact the overall cost of owning a car in the Sunshine State. This article aims to provide an in-depth analysis of Florida's auto sales tax, exploring its rates, exemptions, and the potential savings strategies available to consumers.

Understanding Florida's Auto Sales Tax

Florida, like many other states, imposes a sales tax on the purchase of motor vehicles. This tax is levied on the total sale price of the vehicle and is typically paid by the buyer at the time of registration. The primary purpose of this tax is to generate revenue for the state, which is then allocated towards various public services and infrastructure development.

Florida's auto sales tax is unique in that it is not a flat rate across the state. Instead, the tax rate varies depending on the county where the vehicle is registered. This means that buyers in different counties may experience varying tax rates, adding an extra layer of complexity to the purchasing process.

Tax Rate Variations

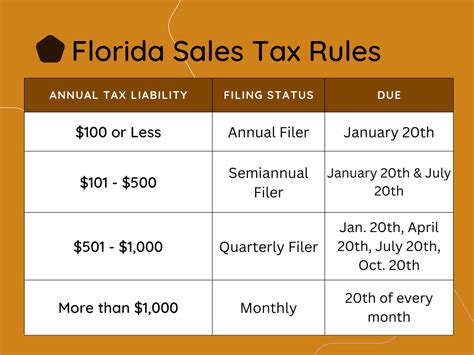

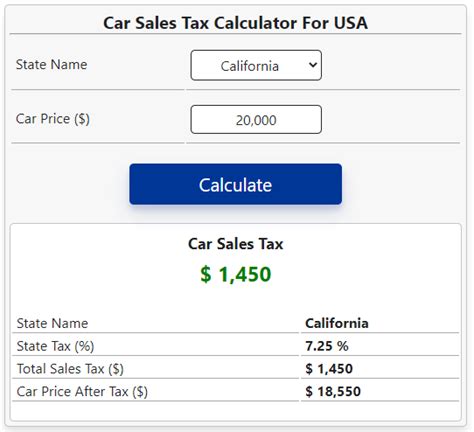

As of the latest data, the auto sales tax rate in Florida ranges from 6% to 7.5% depending on the county. For instance, counties like Miami-Dade and Broward have a higher tax rate of 7.5%, while other counties like Hillsborough and Orange have a slightly lower rate of 6.5%. This variation is primarily due to the additional local taxes imposed by individual counties to fund specific projects or services.

| County | Sales Tax Rate |

|---|---|

| Miami-Dade | 7.5% |

| Broward | 7.5% |

| Hillsborough | 6.5% |

| Orange | 6.5% |

It's important to note that these tax rates are subject to change, and buyers should always refer to the most up-to-date information provided by the Florida Department of Revenue. Additionally, certain counties may offer tax incentives or rebates for specific vehicle types, such as electric or hybrid cars, which can further reduce the overall tax burden.

Exemptions and Special Considerations

Florida provides several exemptions and special considerations for auto sales tax, allowing certain individuals or groups to benefit from reduced or waived taxes. Here are some notable exemptions:

- Active Military Personnel: Members of the military stationed in Florida are exempt from paying sales tax on vehicle purchases if they are permanent residents of another state.

- Disabled Individuals: Florida offers a sales tax exemption for disabled individuals who purchase vehicles equipped with specialized modifications to accommodate their disability.

- Low-Income Families: Certain low-income families may be eligible for reduced sales tax rates through specific programs or initiatives aimed at supporting financial accessibility.

- Electric Vehicles: To promote environmentally friendly transportation, Florida provides tax incentives for the purchase of electric vehicles, reducing the overall tax liability for buyers.

It is crucial for buyers to research and understand the specific exemptions and considerations that may apply to their situation. Consulting with a tax professional or the Florida Department of Revenue can provide clarity on eligibility and the necessary documentation required.

Strategies for Savings

Navigating Florida's auto sales tax landscape can be complex, but there are strategies that buyers can employ to minimize their tax liability. Here are some effective approaches:

Research County Tax Rates

Before finalizing a vehicle purchase, it is essential to research and compare the sales tax rates in different counties. Buyers can explore the option of purchasing a vehicle in a county with a lower tax rate, potentially saving a significant amount of money. However, it's important to consider the convenience and accessibility of the chosen county for future maintenance and services.

Consider Vehicle Type and Age

The type and age of the vehicle can also impact the sales tax. In Florida, certain vehicles, such as recreational vehicles (RVs) and mobile homes, are subject to different tax calculations. Additionally, purchasing a used vehicle may result in a lower tax liability compared to buying a brand new car, as the tax is typically calculated based on the vehicle's depreciated value.

Utilize Tax Incentives and Rebates

Florida offers various tax incentives and rebates to encourage the purchase of environmentally friendly vehicles. Buyers should explore these options, as they can significantly reduce the overall tax burden. For instance, the state provides tax credits for the purchase of electric vehicles, making them a more affordable and sustainable choice.

Negotiate with Dealers

When negotiating the purchase of a vehicle, buyers can discuss the sales tax with the dealer. In some cases, dealers may be willing to absorb a portion of the tax or offer other incentives to make the deal more attractive. It's always beneficial to have open conversations about tax considerations during the negotiation process.

The Future of Auto Sales Tax in Florida

As Florida continues to evolve and adapt to changing economic and environmental landscapes, the auto sales tax may undergo modifications. The state's focus on promoting sustainable transportation and supporting infrastructure development suggests potential shifts in tax policies.

One potential future implication is the expansion of tax incentives for electric and hybrid vehicles. With an increasing emphasis on reducing carbon emissions, Florida may further incentivize the adoption of these eco-friendly options. This could lead to a significant reduction in sales tax for buyers, making electric vehicles a more accessible and appealing choice.

Additionally, the state may consider implementing tax reforms to simplify the process and ensure fairness across counties. This could involve standardizing the tax rate or introducing a statewide tax rebate program to benefit all buyers, regardless of their county of residence. Such reforms would provide clarity and consistency for consumers.

Conclusion

Florida's auto sales tax is a critical consideration for anyone purchasing a vehicle in the state. By understanding the varying tax rates, exemptions, and savings strategies, buyers can make informed decisions to minimize their tax liability. As the state continues to evolve its tax policies, staying updated on potential changes will empower consumers to navigate the auto sales tax landscape with confidence.

What is the average auto sales tax rate in Florida?

+

The average auto sales tax rate in Florida is approximately 6.5%, but it varies by county. Some counties have rates as high as 7.5%, while others are slightly lower.

Are there any ways to reduce my auto sales tax liability in Florida?

+

Yes, there are strategies to reduce your tax liability. Researching county tax rates, considering vehicle type and age, utilizing tax incentives for eco-friendly vehicles, and negotiating with dealers are all effective approaches.

What are some common exemptions for auto sales tax in Florida?

+

Florida offers exemptions for active military personnel, disabled individuals, low-income families, and buyers of electric vehicles. These exemptions can significantly reduce or waive the sales tax liability.

Where can I find the most up-to-date information on Florida’s auto sales tax rates and exemptions?

+

The Florida Department of Revenue provides the most accurate and current information on auto sales tax rates and exemptions. Their website is a reliable resource for staying updated on any changes or new initiatives.