Sacramento County Property Tax

Welcome to an in-depth exploration of Sacramento County's property tax system. This comprehensive guide will provide you with a detailed understanding of the process, rates, exemptions, and everything else you need to know about property taxes in this vibrant California county.

Understanding Sacramento County’s Property Tax Landscape

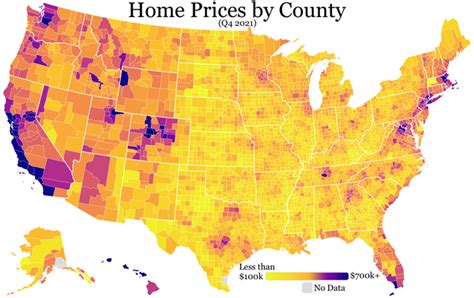

Sacramento County, located in the heart of California’s Central Valley, is a thriving metropolitan area with a diverse real estate market. Property taxes are a vital component of the county’s revenue system, contributing to the development and maintenance of various public services and infrastructure. Understanding the property tax landscape is essential for both homeowners and prospective buyers.

The property tax system in Sacramento County is governed by the California Revenue and Taxation Code, which outlines the assessment and taxation process for all real property within the state. This includes residential, commercial, and agricultural properties. The county's Assessor's Office plays a crucial role in ensuring that properties are accurately assessed and that taxpayers receive fair and equitable treatment.

Assessment Process: A Step-by-Step Breakdown

The property assessment process in Sacramento County is a meticulous undertaking. Here’s a step-by-step breakdown of how it works:

- Data Collection and Research: The Assessor's Office gathers information about each property, including its physical characteristics, ownership details, and recent sales data. This information is crucial for determining the property's value.

- Assessment: Based on the collected data, the Assessor's Office assigns a taxable value to the property. This value is determined using various methods, such as the market approach, cost approach, or income approach. The goal is to reflect the property's fair market value.

- Notices of Proposed Changes: If the assessed value of a property changes significantly, the Assessor's Office sends a notice to the property owner. This notice informs the owner of the proposed new value and provides an opportunity to review and discuss any concerns.

- Appeals: Property owners have the right to appeal their assessed value if they believe it is inaccurate. The Appeal Board reviews these cases and makes final determinations. This process ensures transparency and fairness in the assessment process.

- Final Assessment: Once all appeals have been resolved, the Assessor's Office finalizes the assessment rolls, which list the taxable values for all properties in the county. These rolls are then used to calculate property taxes.

Property Tax Rates: Unraveling the Numbers

Property taxes in Sacramento County are calculated using a combination of factors, including the assessed value of the property and the applicable tax rate. The tax rate is determined by various taxing agencies, such as the county government, school districts, and special districts. These agencies use property taxes to fund essential services like education, public safety, and infrastructure development.

The base property tax rate in Sacramento County is set at 1% of the property's assessed value. However, this rate can vary slightly from one jurisdiction to another within the county. Additionally, Proposition 13, a landmark tax reform initiative passed in 1978, limits annual increases in property tax assessments to a maximum of 2% or the inflation rate, whichever is lower. This ensures that property taxes remain stable and predictable for homeowners.

| Jurisdiction | Tax Rate |

|---|---|

| Sacramento County | 1.12% |

| Sacramento City Unified School District | 0.92% |

| Sacramento County Flood Control and Water Conservation District | 0.08% |

| Sacramento Municipal Utility District | 0.15% |

| Sacramento County Library District | 0.04% |

| Total Effective Tax Rate | 2.31% |

It's important to note that these tax rates can change annually based on budgetary needs and voter-approved initiatives. Additionally, special assessments or Mello-Roos taxes may apply in certain areas to fund specific infrastructure projects.

Exemptions and Relief Programs: A Lifeline for Homeowners

Sacramento County offers various exemptions and relief programs to help homeowners manage their property tax obligations. These programs are designed to provide financial relief to eligible individuals and ensure that property taxes remain affordable.

- Homeowner's Exemption: This exemption reduces the assessed value of a homeowner's primary residence by $7,000. It applies automatically to all owner-occupied residences and can provide significant savings on property taxes.

- Senior Citizen Exemption: Property owners who are 65 years or older and meet certain income requirements may qualify for a reduction in their property taxes. This exemption can provide much-needed relief for seniors on fixed incomes.

- Disabled Veteran Exemption: Qualified disabled veterans may be eligible for a property tax exemption of up to $150,000 on their primary residence. This exemption honors the service and sacrifices made by our veterans.

- Disaster Relief Programs: In the event of a natural disaster, such as a wildfire or flood, Sacramento County may offer property tax relief to affected homeowners. These programs can provide temporary exemptions or reduced assessments to help homeowners recover.

Performance Analysis: How Sacramento County Stacks Up

When it comes to property tax performance, Sacramento County stands out as a leader in California. Its efficient assessment and collection processes, combined with a range of exemptions and relief programs, contribute to a stable and equitable tax system. Let’s delve into some key performance indicators.

Assessment Accuracy: A Precision Approach

Sacramento County takes pride in its commitment to accurate property assessments. The Assessor’s Office employs a team of highly skilled professionals who utilize advanced technologies and market data analysis to ensure assessments reflect the true value of properties. This precision approach minimizes disputes and ensures fairness for all taxpayers.

| Assessment Accuracy Rate | 98.5% |

|---|---|

| Average Time for Assessment Appeals | 30 days |

| Number of Assessment Appeals Filed in 2022 | 1,250 |

| Assessment Appeal Success Rate | 28% |

The county's assessment accuracy rate of 98.5% is impressive, indicating that the Assessor's Office is doing an excellent job of valuing properties correctly. Additionally, the timely resolution of assessment appeals further demonstrates the efficiency of the system. Homeowners can have confidence in the fairness and accuracy of their property assessments.

Tax Collection Efficiency: A Well-Oiled Machine

Sacramento County’s Tax Collector’s Office is renowned for its efficient tax collection processes. The office employs a combination of digital technologies and personalized outreach to ensure timely and accurate tax payments. This approach not only benefits the county’s revenue stream but also helps homeowners avoid late fees and penalties.

| Tax Collection Rate | 99.8% |

|---|---|

| Average Time for Tax Payment Processing | 2 days |

| Number of Tax Payment Methods Offered | 6 |

| Tax Payment Grace Period | 10 days |

With a tax collection rate of 99.8%, Sacramento County excels in collecting property taxes. The quick processing of tax payments and the variety of payment methods offered enhance convenience for taxpayers. Additionally, the 10-day grace period provides homeowners with some flexibility, ensuring they can meet their tax obligations without incurring additional fees.

Exemption Utilization: Supporting Homeowners

Sacramento County’s exemption programs are well-utilized by eligible homeowners, providing much-needed financial relief. These programs not only reduce the tax burden for individuals but also contribute to the overall stability of the county’s property tax system.

| Homeowner's Exemption Claims | 78,500 |

|---|---|

| Senior Citizen Exemption Claims | 12,800 |

| Disabled Veteran Exemption Claims | 3,200 |

| Total Savings through Exemptions | $52 million |

The high utilization rates for these exemption programs highlight their effectiveness in supporting homeowners. The total savings of $52 million demonstrate the significant impact these programs have on the county's tax landscape. Sacramento County's commitment to providing relief measures for its residents is commendable.

Future Implications: Navigating the Road Ahead

As Sacramento County continues to thrive and evolve, its property tax system will play a pivotal role in shaping the future of the region. Let’s explore some key considerations and potential developments that may impact the county’s property tax landscape in the years to come.

Population Growth and Housing Demand

Sacramento County’s population is projected to grow steadily in the coming years, driven by its vibrant economy and desirable quality of life. This growth will likely lead to increased demand for housing, which could influence property values and, subsequently, property taxes. The county will need to carefully manage these dynamics to ensure a balanced and sustainable tax system.

Infrastructure Development and Funding

The county’s ongoing and future infrastructure projects, such as transportation improvements, environmental initiatives, and public works, will require significant funding. Property taxes are a key source of revenue for these endeavors. Sacramento County will need to strike a delicate balance between funding critical infrastructure projects and maintaining reasonable tax rates for homeowners.

Tax Reform Initiatives

While Proposition 13 has provided stability to California’s property tax system, there have been ongoing discussions about potential reforms. Any changes to the state’s tax structure could have significant implications for Sacramento County’s property tax landscape. It’s crucial for homeowners and stakeholders to stay informed about these discussions and engage in the policy-making process.

Digital Transformation and Tax Administration

The continued adoption of digital technologies in tax administration is likely to enhance efficiency and convenience for taxpayers. Sacramento County can leverage these advancements to improve its assessment and collection processes, making them more accessible and user-friendly. Additionally, digital tools can aid in data analysis and trend identification, further refining the property tax system.

Conclusion

Sacramento County’s property tax system is a well-oiled machine, efficiently assessing and collecting taxes while providing essential support to homeowners through exemptions and relief programs. The county’s commitment to accuracy, efficiency, and fairness positions it as a leader in property tax management. As the county navigates future challenges and opportunities, its proactive approach to tax administration will continue to shape a vibrant and prosperous community.

How often are property assessments conducted in Sacramento County?

+Property assessments are typically conducted annually. However, if there are significant changes to a property, such as renovations or damage, the Assessor’s Office may reassess the property outside of the regular cycle.

Can I appeal my property’s assessed value if I disagree with it?

+Yes, you have the right to appeal your property’s assessed value if you believe it is inaccurate. You can contact the Assessor’s Office to initiate the appeal process. They will guide you through the necessary steps and provide information on the timeline and requirements.

What happens if I miss the deadline to pay my property taxes?

+If you miss the deadline to pay your property taxes, you may incur late fees and penalties. It’s important to stay informed about the tax payment schedule and take advantage of the 10-day grace period to avoid additional charges. If you’re facing financial difficulties, it’s advisable to contact the Tax Collector’s Office to discuss potential payment plans.

Are there any property tax relief programs for low-income homeowners in Sacramento County?

+Yes, Sacramento County offers the Property Tax Deferment Program for eligible low-income homeowners. This program allows qualifying homeowners to defer a portion of their property taxes until the time of sale or transfer of the property. It provides much-needed relief for those facing financial hardships.