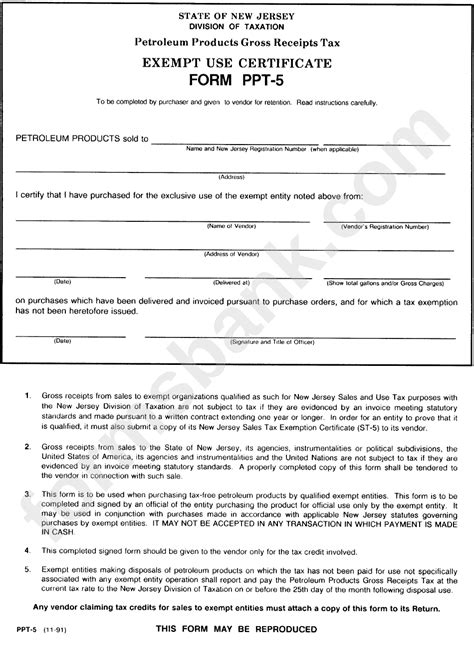

How to Complete and Submit the NJ Tax Exempt Form

For businesses, non-profits, and institutions operating within New Jersey, understanding the nuances of tax exemption procedures is vital for maximizing financial efficiency and compliance. Navigating the process of completing and submitting the NJ Tax Exempt Form (Form NJ-EX) isn't merely an administrative task—it reflects strategic planning, attentive compliance, and an intimate knowledge of state-specific tax law. As an expert in fiscal policy and tax regulations, I will unpack the intricacies of this process, providing a thorough guide grounded in current legal frameworks, practical steps, and common pitfalls—empowering you to handle this vital aspect of tax administration with confidence.

Understanding the Purpose and Scope of the NJ Tax Exempt Form

The NJ Tax Exempt Form serves as a formal declaration by eligible organizations acknowledging their exempt status under state law, specifically for sales tax and certain other taxes. It simplifies tax documentation processes, allowing qualified entities to purchase goods and services without paying sales tax at the point of sale, provided these purchases are intended for exempt purposes. Achieving this status involves adherence to specific legal criteria outlined by the New Jersey Division of Taxation, and failure to file correctly can lead to penalties, back taxes, or disqualification from exemption privileges.

The Legal Foundation and Eligibility Criteria

Under New Jersey law, organizations such as non-profit charities, religious institutions, educational entities, and certain government-related bodies may qualify for exemption. Eligibility hinges on the entity's nonprofit status, charitable purpose, or governmental function, all of which must be demonstrably documented. The exemption process is rooted in laws like the New Jersey Sales and Use Tax Act, which grants authorities authority to issue certificates of exemption to qualified entities.

| Category | Key Criterion |

|---|---|

| Non-profit organizations | Registered under 501(c)(3) or equivalent state law |

| Religious institutions | Verified religious operation with tax-exempt status |

| Educational entities | Accredited schools and universities |

| Government agencies | Official government functions |

The Step-by-Step Process to Complete and Submit the NJ Tax Exempt Form

1. Verify Organizational Eligibility

Before initiating the exemption application, thoroughly confirm that your organization satisfies all eligibility requirements. Review IRS determination letters, state registration status, and operational purposes. Maintaining comprehensive documentation at this stage facilitates smoother processing and supports your application during any audits or reviews.

2. Gather Necessary Documentation

Essential documentation includes:

- IRS determination letter confirming 501©(3) or equivalent status

- State registration certificates

- Proof of current organizational bylaws or purpose statements

- Identification numbers (FEIN, state registration numbers)

Having these ready streamlines the form-filling process and ensures accuracy.

3. Accessing the Correct Application Form

The NJ Division of Taxation offers the official form online, typically under the section for Sales and Use Tax exemption applications. The form’s current version can be downloaded directly from the official website, ensuring you’re utilizing the latest version aligned with current regulations.

4. Fill Out the Form Accurately

The form requires detailed information, including:

- Legal name and address of the organization

- Type and purpose of the organization

- Tax identification numbers

- Details about the specific exemption requested

- Authorized signatures from responsible officers

Pay close attention to ensure all entries are spot-on. Inaccuracies or omissions can delay processing or jeopardize your exemption status.

5. Attaching Supporting Documentation

Some applications necessitate attaching copies of IRS determination letters, state registration proof, or organizational charters. Confirm whether the submission guidelines specify document formats, size limits, or additional authentication measures.

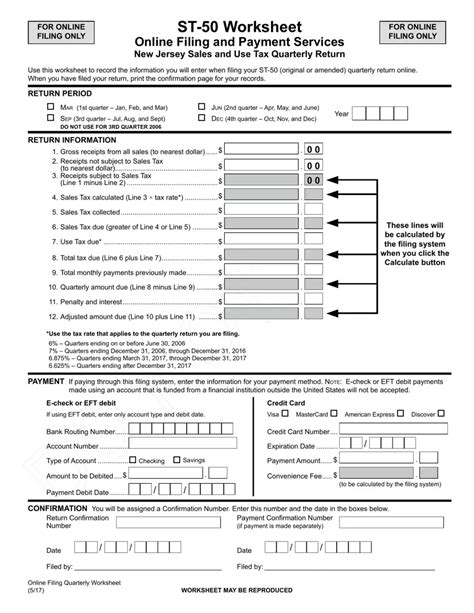

6. Submission Method

The NJ Division accepts applications via multiple channels:

- Online Submission: Via the official portal which guides you through electronic upload and submission

- Mail: Sending completed forms and attachments to the designated Department of Revenue address

- In-person: At designated state revenue offices, if applicable

Opt for the method that best fits your operational capacity, keeping in mind delays might occur with postal delivery or during peak processing times.

Post-Submission Procedures and Follow-Up

Once your application is submitted, the review period typically ranges from two to four weeks, depending on workload and completeness. During this window:

- Respond promptly to any request for additional information

- Maintain copies of submitted documents and correspondence

- Track your application status if an online portal is used

Upon approval, you’ll receive an exemption certificate—this must be presented at point of sale or used in your record-keeping to substantiate your exemption claim during audits.

Renewals and Maintaining Exemption

Exemption status isn’t perpetual; renewal processes generally involve resubmitting certain documentation or updating organizational details. Staying proactive in renewal ensures continued tax benefits and compliance with state laws.

Common Challenges and How to Address Them

Navigating tax exemption processes isn’t immune to hurdles. Common issues include incomplete forms, outdated documentation, or misinterpretation of eligibility criteria. To mitigate these:

- Verify organizational eligibility with a legal or tax professional

- Maintain up-to-date registration and exemption documents

- Use checklists prepared by the NJ Division of Taxation to ensure compliance

- Consult official guidance or directly contact the department for clarification

Addressing Potential Rejections

If your application is rejected, carefully review the department’s explanation, correct identified deficiencies, and consider resubmitting or appealing through the prescribed channels. Often, clarifying your organization’s purpose and providing additional proof resolves misunderstandings.

Implications of Non-Compliance and Best Practices

Failure to properly complete and submit the NJ Tax Exempt Form can trigger audits, fines, or disqualification. Maintaining rigorous internal controls—such as dedicated compliance personnel, routine training for staff, and periodic reviews—translates into sustained exemption legitimacy and financial efficiency.

Key Points

- Proper verificationOf eligibility is foundational to successful exemption application.

- Accurate, complete forms supported by current documentation accelerate processing.

- Utilize official channels for submission to avoid delays or errors.

- Regular updates and renewals protect ongoing exemption status.

- Meticulous record-keeping is essential for audit defenses and compliance.

What organizations qualify for NJ tax exemption?

+Qualifying organizations include non-profits with IRS 501©(3) status, religious institutions, educational entities, and certain government agencies that meet specific criteria under New Jersey law.

How long does it take to process the exemption application?

+Typically, processing takes between two and four weeks once all required information and documents are received and verified.

Can the exemption be revoked? If so, how?

+Yes, if an organization fails to maintain eligibility, misuses exemption privileges, or is found to have provided false information, the exemption can be revoked following an audit or review by the Department of Revenue.