Illinois Vehicle Tax

Illinois, a state known for its diverse landscape and vibrant cities, also has a unique approach to vehicle taxation. The Illinois Vehicle Tax, often referred to as the "Vehicle Registration Tax," is an essential component of the state's revenue system, contributing significantly to its infrastructure development and maintenance. This article delves into the intricacies of the Illinois Vehicle Tax, exploring its history, current structure, and implications for both residents and businesses within the state.

A Historical Perspective on Illinois Vehicle Taxation

The roots of the Illinois Vehicle Tax can be traced back to the early 20th century when the state began imposing taxes on motor vehicles to fund road construction and maintenance. This tax, initially a simple registration fee, has evolved over the years to become a crucial part of Illinois’ fiscal policy.

One of the key milestones in the history of Illinois vehicle taxation was the implementation of the Vehicle Registration and License Act in 1967. This act standardized the vehicle registration process and introduced a more comprehensive tax structure, ensuring a fair distribution of the tax burden among vehicle owners.

Evolution of Tax Rates

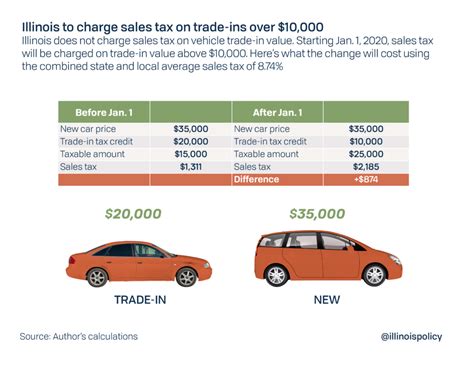

Over time, the tax rates have been subject to adjustments, reflecting the changing economic landscape and the state’s budgetary needs. For instance, in the early 2000s, Illinois experienced a significant shift in its tax policy, with the introduction of a graduated tax rate system based on the value of the vehicle.

The following table illustrates the historical progression of tax rates for vehicles valued at different amounts, as per the records from the Illinois Department of Revenue:

| Vehicle Value Range | Tax Rate (as % of Value) | Effective Date |

|---|---|---|

| $0 - $10,000 | 0.50% | January 1, 2003 |

| $10,001 - $20,000 | 0.62% | January 1, 2003 |

| $20,001 - $30,000 | 0.75% | January 1, 2003 |

| $30,001 and above | 0.85% | January 1, 2003 |

The Current Illinois Vehicle Tax Structure

In the present day, the Illinois Vehicle Tax is a complex system that takes into account various factors, ensuring fairness and adequacy in revenue collection.

Tax Calculation Methodology

The tax calculation for vehicles in Illinois is a multi-step process. It begins with determining the vehicle’s value, which is then subjected to a specific tax rate based on this value. Additionally, there are several other considerations, such as the vehicle’s age, its intended use (personal or commercial), and any applicable discounts or exemptions.

For instance, electric vehicles (EVs) in Illinois are eligible for a tax credit of up to $4,000, making them a more affordable option for environmentally conscious consumers.

Registration Fees and Penalties

Apart from the vehicle tax, Illinois residents must also pay registration fees, which cover the administrative costs associated with registering and maintaining vehicle records. Late registration or non-compliance with tax laws can result in penalties, which vary depending on the duration of the delay.

Implications and Impact on Residents and Businesses

The Illinois Vehicle Tax has wide-ranging implications for both individuals and businesses operating within the state.

Impact on Individual Vehicle Owners

For individual vehicle owners, the tax is a significant financial consideration when purchasing a new vehicle. The graduated tax rate system ensures that owners of high-value vehicles contribute more to the state’s revenue, which is essential for maintaining and improving the state’s infrastructure.

However, the tax also presents challenges for lower-income individuals who may struggle to afford the tax on top of the vehicle’s purchase price. To address this, Illinois offers various tax credits and exemptions, such as the Senior Citizens’ Motor Vehicle Tax Relief Program, which provides tax relief for eligible senior citizens.

Business Implications

Businesses, especially those involved in the transportation industry, are heavily impacted by the Illinois Vehicle Tax. For companies with large fleets, the tax can represent a substantial financial burden. To mitigate this, many businesses opt for tax-efficient strategies, such as leasing vehicles or utilizing tax credits available for commercial vehicles.

Moreover, the tax structure also influences business decisions regarding vehicle purchases and fleet management. For instance, the tax incentives for electric vehicles have encouraged some businesses to transition to eco-friendly fleets, reducing their environmental impact and potentially lowering their tax liabilities.

Future Outlook and Potential Reforms

As Illinois continues to evolve, so does its tax policy. The state’s ongoing commitment to infrastructure development and maintenance suggests that the vehicle tax will remain a crucial revenue stream.

Potential Reforms and Their Impact

There have been discussions among policymakers and industry experts about potential reforms to the Illinois Vehicle Tax. One proposed reform is the introduction of a flat tax rate for all vehicles, regardless of their value. This could simplify the tax system, making it more straightforward for taxpayers. However, it may also result in a revenue loss for the state, especially from high-value vehicle owners.

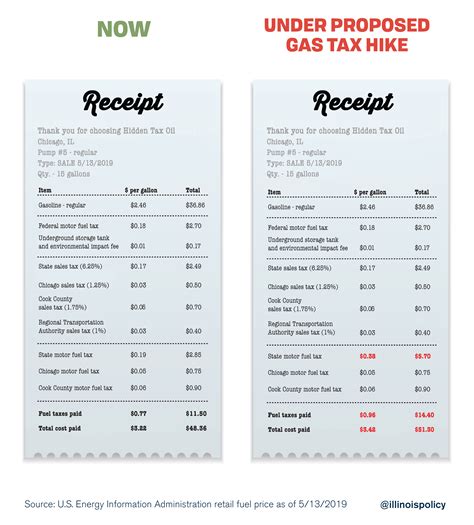

Another proposed reform is the implementation of a mileage-based tax system, which would tax vehicles based on the number of miles driven within the state. This system could encourage more efficient driving habits and potentially reduce congestion and emissions.

Infrastructure Development and Tax Revenue

The revenue generated from the Illinois Vehicle Tax plays a pivotal role in funding various infrastructure projects across the state. From road repairs and expansions to public transit initiatives, the tax ensures that Illinois’ transportation network remains robust and efficient.

Looking ahead, the state’s commitment to sustainable infrastructure development is likely to influence future tax policies. As the demand for eco-friendly transportation options grows, we can expect to see further incentives and tax benefits for electric and hybrid vehicles, encouraging a greener transportation landscape in Illinois.

How often do I need to pay the Illinois Vehicle Tax?

+The Illinois Vehicle Tax is due annually, typically coinciding with your vehicle’s registration renewal. It’s important to note that the tax is separate from your registration fees and must be paid before you can renew your registration.

Are there any exemptions or discounts available for the Illinois Vehicle Tax?

+Yes, Illinois offers various exemptions and discounts for certain vehicle types and owners. For instance, veterans, disabled individuals, and senior citizens may be eligible for tax exemptions or reduced rates. Additionally, electric and hybrid vehicles often qualify for tax credits, making them a more affordable option.

What happens if I don’t pay the Illinois Vehicle Tax on time?

+Late payment of the Illinois Vehicle Tax can result in penalties and interest charges. Additionally, your vehicle registration may be suspended until the tax is paid in full, which could impact your ability to legally drive your vehicle.

How can I calculate my Illinois Vehicle Tax liability?

+Calculating your Illinois Vehicle Tax liability involves determining your vehicle’s value and applying the appropriate tax rate. You can find online tax calculators or consult with a tax professional to ensure an accurate calculation.